Individual Preferences In Art

advertisement

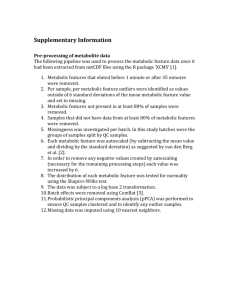

Metabolic State Alters Economic Decision Making under Risk in Humans (Symmonds et al, 2010) Created by: Chutikarn Techaboonako (Mild), Naomi Mwamba, and Samantha Hillock • What is it about? • A study to define whether a change in the state of our metabolism influences our attitude to risk, specifically in a financial decision. • This was based on the Prospect Theory. • Sample: • 19 males who were required to perform a gambling task. How? They performed this task three times; with a space of a week between each task. On the first occasion, they performed the task after a fourteen hours fast. On the second occasion, they did the task immediately after a 2000 kcal meal, …and the third occasion, one hour after they had eaten the meal. Figure 1. Example of the lottery cards used in the risk-preference task. Results: • Men with higher baseline levels of leptin (generally more risk averse) became less risk averse right after eating • Men with lower baseline levels of leptin (usually less risk averse) had increased levels of risk aversion. …is “when choosing between option yielding gains, humans are on average risk-averse, while when choosing between options yielding losses below a reference point, humans make riskier choices” (Symmonds et al., 2010: 1) Problem 1: In addition to what you own, you have been given $1000 Alternative (a): A 50 percent chance of gaining $1000 Alternative (b): A sure gain of $500 Problem 2: In addition to what you own, you have been given $2000 Alternative (c): A 50 percent chance of losing $1000 Alternative (d): A sure loss of $500 Source: Adapted from an experiment by Kahnerman and Tversky (1979) Figure 2: Prospect Theory Graph. • Loss Aversion! • With the same value, losses are felt more strongly than gain Applications: foraging behaviour in animals “…sensitivity to risk is systematically influenced by a metabolic reference point” (Symmonds el at., 2010: 1) Experiment Hypothesis: “Individuals making monetary decisions would become more risk-averse after feeding if the meal had a larger impact on metabolic state (Symmonds et al., 2010) “There might also be an immediate shift towards risk-neutrality due to satiation (a non-humoral, rapid effect), as ecological models predict a shift towards a risk neutral attitude with repletion” (ibid) What did they record? • • • Hormone levels, by taking blood samples. How hungry participants said they were during each metabolic state (using visual analogue scores). Percentage of risky decisions and less risky decisions taken by each participant at each metabolic state. What did they find? • • Significant fall in risk-aversion immediately after eating. However, the difference between fasting and an hour after eating was not significant. Participants with higher base levels of leptin took more risks immediately after eating. By contrast, participants with a lower base level of leptin took less risks immediately after eating. Figure 3 Metabolic sate and percentage of higher risk choices. Source: Symmonds et al. (2010) Metabolic State Alters Economic Decision Making under Risk in Humans. 5 (6). Figure 4 Leptin levels and changes in risk aversion. Source: Symmonds et al. (2010) Metabolic State Alters Economic Decision Making under Risk in Humans. 5 (6). Figure 5.1: Metabolic sate and change in risky choice. Source: Symmonds et al. (2010) Metabolic State Alters Economic Decision Making under Risk in Humans. 5 (6). Figure 5.2: Graph of ‘Metabolic sate and change in risky choice’ without the two last samples. Confirmatory Bias: Seeking to confirm the theory rather than spotting conflicting information Over-confidence bias and Optimism: o Over-estimate knowledge while under-estimate risk Gender differences: • Females are more risk averse in general (Byrnes et al, 1999) as well as in financial situations (Eckel & Grossman, 2002). • Therefore, cannot apply findings to females. Personality and Cultural differences: • A study across 37 nations – males are generally higher in Extraversion while females are generally higher in Neuroticism (Lynn and Martin, 1997 and Feingold, 1994). • People who are higher in Extraversion are prone to take risks (Soane and Chmiel, 2005). • Also, different cultural background different personality (Lynn and Martin, 1997) Emotion Sad participants were found to exhibit greater preference for the high-risk/high-reward option, whereas anxious participants tended to prefer the low-risk/lowreward option. (Raghunathan and Pham, 1999) Sad people spend more on shopping! (Cryder et al., 2008) Other Factors: • Citing many other pieces of research, Pesti and and Penz state that factors such as age, occupation, income and expectations all influence financial risks, therefore these findings can only be applied to 25 (±7) year old males. Our Sample Whole Population Plus points: • Did the method three times over a week to minimise order effects. • Randomised order lottery cards. No participants reported realising that the same cards were used for each task. • Didn’t rely on self-reported hunger (though this was recorded). They measured hormone levels. Negative Points: • System bias • Do men have more risk taking tendencies than women? If this is the case, then the study appears to suffer from system bias because only males were used • - The design of the task: Is it beneficial? Question of ecological validity Question of external validity • Suggested improvements to make it applicable to real financial situations: • • Dragon’s Den Casino/Poker scenario • Does this study have implications for businessmen or people in the financial world? • When operating in a different zones, manipulating eating patterns to ensure advantage! • • When dealing with someone in a different time zone, manipulate their (estimated) eating time if possible in order to get the best deal! Best times to make calculated financial decisions in terms of mortgages, investments etc • Catch the bank manager before his lunch! • Casinos: to sell food or not to sell food? (or perhaps just snacks) • Government policy to reduce excessive gambling: all licensed casinos should sell meals not just snacks [extreme, control issues etc] Are there any conflicts of interest? • There don’t appear to be any conflicts of interest and funding has been specified. Is study relevant? • Yes – expands on research done on non-human animals, though there appears to be a large jump between animal and human assumptions. It’s not just a replica for the sake of a replica – new methodology. Does the study add anything new? • Yes, it expands on previous research into financial risk taking and prospect theory, but uses brand new methodology. Was the study design appropriate for the research question? • Yes, to some extent, but the methodology is flawed in terms of external and ecological validity. Did the study methods address the most important potential sources of bias? • No. The sample causes more potential sources of bias than in counteracts. Were the statistical analyses performed correctly and does the data justify the conclusions? Though significant differences were found, they were small. Therefore, we think this is a good paper, which could influence further studies. However, we also feel that this paper could be improved through repetition with a larger data sample. • Byrnes, J. P., Miller, D. C., Schafer, w. D. (1999). Gender differences in risk taking: A meta-analysis. Psychological Bulletin, 125(3), 367-383. • Cryder, C. E., Lerner, J. S., Gross, J. J., & Dahl, R. E. (2008). Misery is not Miserly: Sad and Self-Focused Individuals Spend More. Psychological Science, 19 (6), 525-530. • Eckel, C. C., & Grossman, P. J. (2002). Sex differences and statistical seterotyping in attitudes towards financial risk. Evolution and Human Behavior, 23(4), 281-295. • Feingold A. (1994) Gender Differences in Personality: A Meta-Analysis. The American Psychological Association, Inc., 116 (3), 429-456 • Ginsburg, H. J., & Miller, S. M. (1982). Sex-differences in chidlrens risk- taking behavior. Child Development, 53(2), 426-428.Kahnerman, D., & Tversky, A. (1979). Prospect theory: An analysis of Decision under risk. Econometrica, 47(2), 263-291 • Lynn, R., & Martin, T. (1997). Gender Differences In Extraversion, Neuroticism, and Psychoticism in 37 nations. The Journal of Social Psychology, 137 (30), 369–373. • Plous, S. (1993) The Psychology of Judgement and Decision making. United Sates of America: McGraw-Hill, Inc. o Raghunathan, R., & Pham, M. T. (1999). All Negative Moods Are Not Equal: Motivational Influences of Anxiety and Sadness on Decision Making. Organizational Behavior and Human Decision Processes, 79 (1), 56–77. o Soane, E., & Chmiel, N. (2005). Are risk preferences consistent?: The influence of decision domain and personality. Personality and Individual Differences, 38 (8), 1781-1791. Symmonds, M., Emmanuel, J. J., Drew, M. E., Batterham, R. L., & Dolan, R. J. (2010). Metabolic State Alters Economic Decision Making under Risk in Humans. PLoS One, 5(6), e11090. Young, J. M., & Solomon, M. J. (2009). How to critically appraise an article. Nature Clinical Practice, 6(2), 82-91.