Evolution of E

advertisement

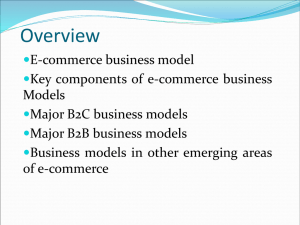

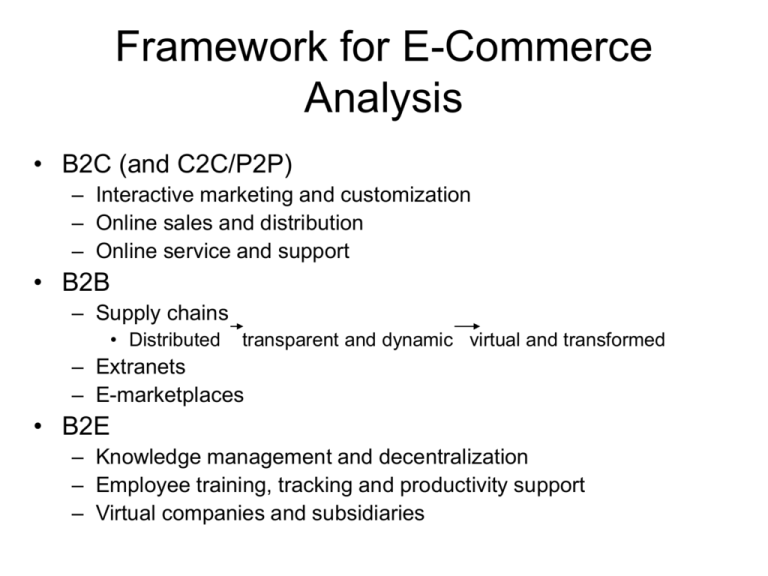

Framework for E-Commerce Analysis • B2C (and C2C/P2P) – Interactive marketing and customization – Online sales and distribution – Online service and support • B2B – Supply chains • Distributed transparent and dynamic virtual and transformed – Extranets – E-marketplaces • B2E – Knowledge management and decentralization – Employee training, tracking and productivity support – Virtual companies and subsidiaries B2C Business Models Model Examples Portal and Search Engines E-Tailer and “Clicks & Bricks” Content/Service Provider Transaction Broker Market Maker Community Revenues Yahoo, Google Ads, subscriptions, fees, transactions Amazon WalMart Sale of goods, web services CNN, WSJ Weather.com Ads, subscriptions, fees, sale of services/content PayPal EBay Match.com Transaction fees Transaction fees, subsidiary services Ads, subscriptions, referral fees B2C Trends Since 2000 • Consolidation and niche growth – The largest and the smallest ends of the spectrum are the most robust • Hybrid models for leadership – Multiple businesses, services and revenue sources through integration, acquisition, and strategic partnerships • Amazon’s new search engine • Yahoo’s wireless and media businesses • Google’s enterprise services • More acceptance of fee-based models – The Internet is no longer a “free for all” zone • Music, mobile and gaming set the pace (and always, sex) • Business services and personal gratification are core drivers • Continued expansion in online sales – BUT still seeing dismal browser conversion and transaction completion data across all B2C sites; what are the barriers to growth of E-Commerce? Consumer Drivers • • • • • • Convenience Comparison shopping Product research before purchase decision Greater selection Lower prices And….. Critical Role of Trust • Security is a prerequisite but not a substitute for online trust – “Security prevents bad things from happening.” – “Trust enables good things to happen.” • Online trust is an unnatural act – Internet lacks traditional “trust markers” • Personal acquaintance, geographical proximity, physical presence are how we once instinctively decided who to trust • Therefore B2C trust must be carefully built and maintained in every online interaction to maximize the value of the investment in E-Commerce Building Online Trust • Excellent and consistent performance at the Internet and Web presence technical and security level – Metrics: Web site speed and reliability; security best practices and policies • Excellent Web site design and functionality – Metrics: Web site best practices implementation • Business Reputation – Metrics: Perception and value of brand; responsiveness (answer your e-mail!) • Providing Tangible Value to the Customer along with Protection of Privacy and Personal Information – Metrics: Privacy policies; valued online services and features Digital Trust Hierarchy of Needs Shared Value Relationship Online Performance Reputation and Responsiveness Security and Privacy Typical B2C Approach Consumer Needs Web Features That Build Trust (From 1999 “E-Commerce Trust Study” by Sapient) • Brand Recognition • Navigational Consistency and Search Function • Reliable Fulfillment – Starting with ease of ordering, clear fulfillment process (explicit information about what happens once order is placed online, visible and easy-to-use customer support contacts • Professional Presentation of Content – Accurate, current information and links (no error messages) • Up to Date Technology Especially for Security • Seals of Approval--External Trust Insignia – But only if insignia group is recognized by user What Features Do Consumers Value Most? Which of the following features would make you visit/patronize/buy more from a certain site? Content Services Commerce Pages load quickly 54% 41% 37% Site was easy to navigate 52% 50% 48% Ease of registration/check-out/login 28% 44% 42% Pages are easy to read/not confusing 35% 37% 27% Search function works well 32% 17% 30% None 16% 22% 22% Ability to customize site to my needs 8% 11% 4% Personalized offers/recommendations 8% 7% 14% Source: Jupiter Research/Ipsos-Insight November 2003 Quantifying What Matters: Web Performance and Transaction Success The Keynote E-Commerce Transaction Performance Index shows the total (automated) web execution time and success rate for logging into an account, searching for an item, adding it to the shopping cart, and proceeding to check out on selected Internet retail sites. Success rate is aggregate ratio of attempts to successful completion of all steps. Available weekly on E-Commerce Times http://www.ecommercetimes.com/ectpi/ Execution Time Rankings 10/11/04 Success Rate in Transactions Seconds % Rank (& last 1 week) Office Depot 9.68 (2) 1 Office Depot 99.73 (2) 2 Eddie Bauer 9.75 (1) 2 Eddie Bauer 99.55 (1) 3 JC Penny 10.96 (3) 3 JC Penny 99.37 (7) 4 Wal-Mart 12.98 (5) 4 Best Buy 99.10 (4) 5 Amazon 13.18 (4) 5 Office Max 98.84 (5) 6 Costco 15.67 (6) 6 Costco 98.66 (3) 7 Best Buy 16.65 (7) 7 Target 98.46 (9) 8 Target 18.71 (8) 8 Wal-Mart 98.10 (6) 9 Office Max 21.62 (9) 9 Amazon 97.96 (10) 10 Sears 22.59 (10) 10 Sears 93.85 Who Do We Really Trust? • Survey (2004) by Ponemon Institute and TRUSTe asked 6,300 consumers to name 5 companies across all industries that they trusted the most to protect their privacy and the personal information provided online • Top 5 companies in order of rank – – – – – eBay American Express Proctor & Gamble (all brands) Amazon Hewlett Packard • Also in top 10 • US Post Office, IBM, Earthlink, Citibank, Dell What Do We Worry About Most? • The same survey asked respondents what worried them the most when buying or interacting online (including email, web browsing and general Internet activities) • Majority worried about: – Identity theft (76%) – SPAM (58% -- twice as high as in 2003 survey) • Some minority worries – – – – Legal problems, surveillance, loss of civil liberties Financial problems, stolen credit card or loss of payment made Public embarrassment Stalking or spying activities Quantifying the Value of Trust • DoubleClick 2004 consumer study – 81% of US consumers surveyed send and receive e-mail daily • Consumers consider an e-mail as SPAM when it comes from an unknown sender (93%) or comes too frequently from a known source (58%) • Despite irritation with SPAM, consumers continue to respond to permission-based e-mail and offers (which account for less than 8% of total e-mail) – Permission marketing drives sales (and requires trust) • 32% of respondents have made made immediate online purchase in response to e-mail offer • 30% have clicked for more info and made online purchase later • 12% have clicked for more info and made purchase offline • 79% have redeemed e-mailed coupons for online purchases • 59% have redeemed e-mailed coupons for offline purchases Potential B2C “Trust Dividend” • Raise browser-to-buyer conversion rate from under 10% to 50% – Estimated added sales revenue: • Increase the completion rate for transactions already at the shopping cart check out from 47% to 80% – Estimated added sales revenue: • Boost the online percentage of all US retail sales from under 10% to 50% – Estimated aggregate E-Commerce dollar increase: Best B2C Practice Overview • Go to the Buyers – Bring in traffic through effective online marketing (and affiliate programs) • Optimize Home Page Design – Provide clear navigation, site overview, search and support options – Content Partnerships – Keep content relevant and current – Supporting Images and Content – Product details • Persistent Shopping Cart – Let customers browse and then pick up cart as they left it when they come back to site • Promote Online and Offline Synergies – Offer in-store pick up and returns; provide store locator • Excellent Search Engine Capabilities – Most frequently used navigation tool • Clear Customer Support Options • Strong and Relevant Cross Selling - Solid product recommendation logic and tight inventory integration is critical One Persistent Worst Practice • 2004 study by BenchmarkPortal found that 41% of the largest US and Canadian companies on the Web are not responding promptly or personally to e-mails, even those that indicate a consumer interest in making a purchase – – – – 41% did not respond 39% send response within 24 hours 15% sent an immediate acknowledgement 17% responded with an accurate and complete answer – 6% of online companies don’t even provide an e-mail contact address Sign of Immaturity of B2C: Still More Focus on Finding Than Keeping Customers 2001 2002 Acquisition 63% 55% Retention 19% 28% Branding 18% 17% Overall retailer digital marketing spending Source: The State Of Retailing Online 5.0 Tracking cross-channel customers is elusive “Do you know how many of your Web site visitors come into your stores and make a purchase?” Yes 2% No 98% Courtesy of Forrester Research Most offline retailers have not integrated their channels Percent of retailers using Process to measure revenue and cost impact across channels 42% Costs allocated across channels 42% Offline channels get revenue credit for online sales 26% Online channel gets revenue for offline sales influenced by Web 9% Courtesy of Forrester Research Creating an Information Gap in All Channels About What Happens to the Dropouts Online researchers who buy in another channel Online buyers and researchers Dropouts? Courtesy of Forrester Research Best Buy: A basic cross channel best practice • What they did: implemented the ability to buy online and pick up offline • What they learned: the Web influences 19% of store purchases • Impact: higher budgets for new developments like online circulars, DVD rentals, etc. Sears.com: A multichannel best practice Sears.com influences $500 million of in-store appliance purchases a year WalMart Overview • End to end strategy starts with online management of all supplier relationships • Dynamic sales and inventory update reports via the web • Customer facing sales and support online, including new digital products and services – Music downloads, DVD rental services • Innovations with RFID tagging for enhanced inventory control Standardized Navigation Bars Detailed Content Online Service Offerings How does the world’s “big store” retail giant rate in end-to-end ebusiness practice? Two cross selling pitches for relevant items Detailed product descriptions Anticipating and responding to customer support questions Offering alternative contact options and multi-channel support Still cross-selling! WalMart in Europe: Extending the Brand With Localization Global branding and localized web presence WalMart International Web Sites Canada: www.walmartcanada.ca China: www.wal-martchina.com Germany: www.walmartgermany.de Mexico:www.walmartmexico.com.mx Korea: www.walmartkorea.com United Kingdom: www.asda.com Another Web Site for Outdoor Furniture How Many “Best Practices” Can You Spot? Well-known best practices mean that start-ups have a running start In fact, smaller companies reap proportionately more benefits from an exemplary web presence Evolution of B2B E-Commerce • • • • • • EDI ancestors Early appearance of supplier webs E-procurement software tools Net exchanges and marketplaces Value webs Private industry and VPN platforms B2B Business Models Model Examples E-Procurement Ariba E-Marketplace Provider Industry Consortia Exchanges Hosted Services E-Learning, E-CRM E-Accounting, etc Covisent RubberNetwork Web Services Fees, software licenses Fees and commissions on transactions Salesforce.com Supportforce.com Licenses, fees for hosted services Cisco Sale of goods, software licenses, fees Internet Enablers Hardware, software, payment systems, etc Revenues IBM Software, fees B2B Trends • Consolidation – Many start up business failures as well as acquisitions – E-Marketplace integration along with industry-specific survivors • Survival based on demonstrating ROI – Reach for higher-level management customers • Spend management focus by Ariba • Executive Dashboards from multiple vendors • Data integration and channel synchronization issues loom equally large in B2B • Security is relatively more robust • Critical component is the degree of information transparency