RomePresentation_Emp..

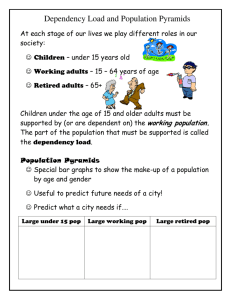

advertisement

Challenges for Europe in the World in 2030 Deliverable 4.3 WP#4 Global Development, Demography and Migration Accademia Lincei, Rome, ITALY AUGUR Introduction • Previous deliverables focused on inclusion of demographic variables into CAM model • In this deliverable we focus on concept of Economic Dependency • This includes not only demographic variables but also employment and activity • We test the impact of an employment-focused fiscal expansion for each European bloc in 2030 Conventional Approach to Ageing • Increasing and unsustainable ‘burden’ to society of ageing population • Reduce pensioner income; increase contributions from wages; reduce other social welfare spending; increase retirement age • Implicit assumption that the elderly are ‘inactive’ and the working-age population are ‘active’. Changes in working-age population… Working-Age Population (millions of persons) North Europe 1,800 1,750 1,700 1,650 1,600 1,550 1,500 90 Central Europe 9,600 12,400 9,200 12,000 00 10 20 11,600 8,800 11,200 8,400 10,800 30 90 00 East Europe 8,400 8,200 8,000 7,800 7,600 7,400 7,200 90 South Europe 00 10 20 10 20 30 8,000 90 00 10 UK 4,400 4,300 4,200 4,100 4,000 3,900 3,800 3,700 30 90 Reduced government China US intervention regionalisation multipolar governance 00 10 20 30 20 30 leads to rising demographic dependency Total age-based dependency ratio (persons aged 0-14 and 65 and over per working-age person) North Europe Central Europe South Europe .80 .80 .80 .70 .70 .70 .60 .60 .60 .50 .50 .50 .40 90 00 10 20 30 .40 90 00 East Europe .80 .70 .70 .60 .60 .50 .50 00 10 20 20 30 .40 90 00 10 UK .80 .40 90 10 30 .40 90 Reduced government China US intervention regionalisation multipolar governance 00 10 20 30 20 30 Dependency Reconsidered • Need to include employment and activity rates in our measure of dependency. • While demographic dependency rising, employment-related dependency is sensitive to policy changes. • Potential for increases in employment to offset changes in population structure. • Levels of employment among the young are very low, especially in South and East Europe Youth Employment and Activity Economic Dependency Ratio EDR = Unemployed Inactive Old Age Young Population Employed EDR = Demographic Dependency Ratio WorkingAge Dependency Ratio Demographic Dependency Ratio = Old Age Young Population Employed WorkingAge Dependency Ratio = Unemployed Inactive Employed EDR in CAM Blocs, 2009 CAM European Bloc Demographic Dependency Ratio Working-Age Dependency Ratio Economic Dependency Ratio Central 0.76 0.48 1.24 East 0.76 0.78 1.53 North 0.72 0.38 1.10 South 0.84 0.69 1.53 UK 0.74 0.44 1.18 Development, Demography and Migration SCENARIO PROJECTIONS: ECONOMIC DEPENDENCY RATIO EDR in Europe Economic Dependency Ratio North Europe Central Europe 2.0 1.8 1.6 1.4 1.2 1.0 90 2.0 1.8 1.6 1.4 1.2 1.0 00 10 20 30 90 2.0 1.8 1.6 1.4 1.2 1.0 00 East Europe 10 20 30 2.0 1.8 1.6 1.4 1.2 1.0 00 10 20 90 00 10 UK 2.0 1.8 1.6 1.4 1.2 1.0 90 South Europe 30 90 Reduced government China US intervention regionalisation multipolar governance 00 10 20 30 20 30 EDR in Japan, China, USA Economic Dependency Ratio Japan 2.0 1.8 1.6 1.4 1.2 1.0 90 00 10 USA China 20 30 .92 .88 .84 .80 .76 .72 .68 90 2.0 1.8 1.6 1.4 1.2 1.0 00 10 20 30 Reduced government China US intervention regionalisation multipolar governance 90 00 10 20 30 EDR in Central Europe Economic Dependency Ratio and its components Central Europe Economic Dependency Ratio 2.0 1.8 1.6 1.4 1.2 1.0 90 00 10 20 30 Demographic Dependency Ratio Working-Age Dependency Ratio 0.9 0.9 0.7 0.7 0.5 0.5 0.3 90 0.3 90 00 10 20 Reduced government China US Regionalisation Multipolar governance 30 00 10 20 30 EDR South Europe Economic Dependency Ratio and its components South Europe Economic Dependency Ratio 2.0 1.8 1.6 1.4 1.2 1.0 90 00 10 20 30 Demographic Dependency Ratio Working-Age Dependency Ratio 0.9 0.9 0.7 0.7 0.5 0.5 0.3 90 0.3 90 00 10 20 Reduced government China US Regionalisation Multipolar governance 30 00 10 20 30 Development, Demography and Migration REGIONAL FOCUS: WEST ASIA AND NORTH AFRICA EDR North Africa and West Asia Economic Dependency Ratio and its components North Africa Economic Dependency Ratio 3.2 3.0 2.8 2.6 2.4 2.2 2.0 90 00 10 20 30 Demographic Dependency Ratio 2.0 1.8 1.6 1.4 1.2 1.0 0.8 90 00 10 20 30 Working-Age Dependency Ratio 2.0 1.8 1.6 1.4 1.2 1.0 0.8 90 00 10 20 30 Reduced government China US Regionalisation Multipolar governance Economic Dependency Ratio and its components West Asia Economic Dependency Ratio 3.0 2.8 2.6 2.4 2.2 2.0 1.8 90 00 10 20 30 Demographic Dependency Ratio 2.0 1.8 1.6 1.4 1.2 1.0 0.8 90 00 10 20 30 Working-Age Dependency Ratio 2.0 1.8 1.6 1.4 1.2 1.0 0.8 90 00 10 20 30 Reduced government China US Regionalisation Multipolar governance Youth Unemployment in WA, NA Youth Unemployment Unemployment Activity and Inactivity Rate Rate Ratio Middle East Bahrain Iran, Islamic Republic of Iraq Jordan Kuwait Lebanon Oman Saudi Arabia Syrian Arab Republic Turkey Yemen North Africa Algeria Egypt Libyan Arab Jamahiriya Morocco Sudan Tunisia 32% 45% 68% 24% 17% 19% 31% 23% 32% 11% 24% 32% 26% 31% 29% 27% 35% 29% 40% 16% 30% 40% 37% 76% 83% 81% 69% 77% 68% 89% 76% 68% 74% 22% 25% 29% 30% 27% 23% 28% 34% 37% 36% 35% 33% 78% 75% 71% 70% 73% 77% AN INITIAL POLICY SCENARIO AN EMPLOYMENT-FOCUSED ECONOMIC RECOVERY FOR EUROPE Scenario Characteristics We construct a scenario that programs changes in macroeconomic policies that can stimulate an employment-focused economic recovery in Europe (as well as in the US); We compare this scenario’s results with those of a baseline scenario (note: we are using the past set of scenarios applicable in Fall 2011) We are in the process of comparing this scenario to AUGUR’s three European sub-variant scenarios Specific Policy Assumptions Main Policy Changes: An increase in government expenditures These expenditures are programmed to modestly stimulate private investment (ratio of 1 to 0.2) A modest stimulus is imparted to bank lending to reinforce the desired increased in private investment Note: public expenditures and private investment are marshalled explicitly to target an increase in the employment rate, not economic growth alone Employment Targets The Employment Target is based on a specific ratio of the number of employed to the number of people of working age Important Point: we calibrate the size of the fiscal stimulus needed to achieve a desirable, but also feasible, level of this ratio for each European bloc and the US The Specified Targets: North Europe, West Europe & the UK: 70 - 74% South Europe: 62% East Europe: 60% The US: 72% Note the lower, more ‘realistic’, targets for South and East Europe Supportive Policies: Government Revenue In order to contain future government deficits, we boost government revenue in conjunction with the projected increases in expenditures (based on reverting to past historical trends, before the crisis) Targeted Increases in Government Revenue (government income as a ratio to GDP): West Europe and the UK: 25% South Europe: 23% East Europe: 21% The US: 20% Supportive Policies: The Real Exchange Rate In order to contain the possible negative effects of the fiscal stimulus on each bloc’s current account, we set targets for each bloc’s Real Exchange Rate (calibrated to offset the projected effects on its current account) We set a ceiling ratio of 1 on the real exchange rate of the US dollar as a global reference point We assume a break-up of the Eurozone since the targets for the real exchange rate for the two major blocs differ: West Europe: 1.3 (appreciation) South Europe: 0.75 (depreciation) Targets outside the Eurozone also vary: North Europe: 1.7 (large appreciation) East Europe: 0.55 (large depreciation) UK: 0.9 Employment Growth Scenario: Results Summary Core results: Economic growth is more rapid across the board compared to that of the baseline scenario Growth of government expenditure is at first rapid but it markedly slows down in most blocs after 2015 Government deficits are eliminated or significantly improved Government net income as a ratio to GDP is increased in the majority of the blocs Government debt falls dramatically in all blocs Domestic price inflation remains relatively subdued across the blocs despite the fiscal stimulus Most importantly, employment markedly rises across the blocs Economic Growth Average growth jumps from 0.8% per year to 3.5% in South Europe, and from 2.1% to 5.5% in East Europe Moderate increases in North Europe, the UK and the US Modest increase in West Europe Average Growth Rate of GDP Employment Scenario Bloc North Europe West Europe UK South Europe East Europe USA Bloc Code eun euw uk eus eue us (2012-2030) 3.2 2.1 3.4 3.5 5.5 3.9 Baseline Scenario (2012-2030) 2.4 1.7 2.0 0.8 2.1 2.8 Employment Rate (%) Employment Rate results: In some blocs the employment outcomes by 2030 exceed our targets Migration contributed to these increases in North Europe, UK, and South Europe Workers return to East Europe, a region that had suffered from marked outmigration after the mid-1980s Employment Scenario: Employment Rate (%) Bloc North Europe West Europe Bloc code Employment Scenario: Net Migration as % of Employment 2009 2015 2030 Bloc North Europe West Europe 2000 2008 Eun 72.5 74.8 72.4 73.3 75.6 Euw 64.3 67.8 67.6 68.8 71.1 UK South Europe East Europe uk 70.8 71.4 69.5 70.7 73.6 eus 56.3 61.7 59.1 59.5 64.1 eue 56.2 57.0 56.2 57.2 62.4 UK South Europe East Europe US us 72.3 69.7 66.2 66.6 71.9 USA Bloc Code 2000 2008 2009 2015 2030 eun 0.33 1.04 0.98 0.94 1.43 euw 0.38 0.36 0.34 0.31 0.15 uk 0.55 0.68 0.72 0.85 1.33 eus 1.29 1.73 1.61 1.43 2.02 eue -0.24 0.09 0.08 0.15 0.42 us 1.20 0.65 0.68 0.61 0.60 Net Lending (% of GDP) Net Lending converges towards zero in all blocs Although this ratio dramatically improves in blocs such as South Europe and the US, it remains negative Government deficits are improved due to the eventual slowdown in government expenditure after an initial increase and an improvement in government net income. (Also helping is the acceleration in the growth of GDP, the numerator of the ratio) Employment Scenario: Government Net Lending as % of GDP Bloc Bloc Code 2000 2008 2009 2010 2011 2012 2015 2030 North Europe eun 6.7 7.7 1.3 -0.5 -0.3 0.1 -0.6 -2.9 West Europe euw 0.2 -0.9 -4.7 -5.2 -4.3 -3.6 -1.4 0.8 UK uk 1.3 -4.9 -11.3 -11.3 -9.4 -7.6 -3.6 0.9 South Europe eus -0.9 -3.9 -8.6 -10.3 -10.3 -9.9 -6.5 -2.4 East Europe eue -3.6 -3.2 -6.2 -6.5 -5.2 -3.6 -1.4 1.0 USA us 1.5 -6.1 -11.1 -11.4 -9.8 -8.3 -4.7 -2.2 Falling Debt: Two Examples Government Debt (% of GDP) falls dramatically in all blocs. South Europe’s debt burden is also reduced but not as substantially as one would hope. In these circumstances, some debt restructuring or relief is desirable (as is happening now) UK South Europe 160 110 140 100 120 90 132% 100 80 80 70 88% 60 60 50 40 20 1980 80% 1985 1990 1995 2000 2005 2010 2015 Employment Growth Scenario Baseline Scenario 2020 2025 2030 40 1980 1985 1990 1995 2000 2005 2010 2015 Employment Growth Scenario Baseline Scenario 2020 2025 50% 2030 Exchange-Rate Impact: 4 Blocs The current accounts of S. Europe, E. Europe and UK all progressively improve But the US continues to slide into deeper current-account deficits East Europe South Europe 4 2 2 0 0 -2 -2 -4 -4 -6 -8 -6 -10 -12 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 2030 -8 1980 1985 1990 1995 Employment Growth Scenario Baseline Scenario 2000 2005 2010 2015 2020 2025 2030 2020 2025 2030 Employment Growth Scenario Baseline Scenario UK USA 4 1 3 0 2 -1 1 -2 0 -3 -1 -4 -2 -5 -3 -4 1980 1985 1990 1995 2000 2005 2010 2015 Employment Growth Scenario Baseline Scenario 2020 2025 2030 -6 1980 1985 1990 1995 2000 2005 2010 2015 Employment Growth Scenario Baseline Scenario Domestic Price Inflation Despite the fiscal stimulus, domestic price inflation remains subdued across the European blocs and the USA (with the highest rates recorded in the UK and East Europe) Employment Growth Scenario: Domestic Prices (Expenditure Deflator) annual % change Bloc Bloc Code 2000-08 2008-09 2009-10 2010-11 2011-12 2012-15 2015-30 North Europe eun 2.3 1.7 1.8 2.9 1.6 1.5 0.6 West Europe euw 1.7 0.1 0.9 2.2 1.8 1.8 1.2 UK uk 2.6 1.8 3.4 4.3 3.0 3.4 2.8 South Europe eus 3.0 0.4 1.0 2.0 1.5 2.3 2.7 East Europe eue 5.2 2.1 1.9 3.0 3.2 4.1 3.9 USA us 2.8 0.2 1.7 2.7 1.3 0.9 1.7 Future Research and Modelling We will be re-running this scenario on the basis of the modified baseline (for Deliverable 4.1) and including the Economic Dependency Ratio as an outcome We will compare our results to those for the three European Sub-Variant Scenarios: EU Breakup, Federal Europe and Multi-Speed Europe (in some of which employment rates are also targeted) In the latter two scenarios, regionalisation is the underlying context so their results naturally differ from ours We will focus more in the future on such factors as youth unemployment and net migration flows We will also devote more attention to the policy implications of our findings, addressing the current debate on growth strategies and employment policies for Europe