Understanding Financial Statements

advertisement

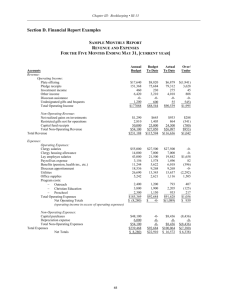

Understanding Financial Statements Prepared for Delaware Valley Grantmakers 11/2011 Katherine Reilly, CMA karegd@verizon.net Introduction • Why read financial reports? • What do they tell you? • Should they receive a grant? • Would you want to be on the Board? Agenda Financial Reports Statement of Financial Position Statement of Financial Activity Statement of Cashflow Statement of Functional Expenditure Ratios Audits vs 990 Operating Reserve Types of Financial Reports Statement of Financial Position Balance Sheet - Snapshot Statement of Financial Activity Income Statement – Period of time Statement of Cashflow Cash Statement of Functional Expenditure Uses of the income by program, fundraising, management. Types of Financial Systems • Cash Based – Income recorded when received – Expenses recorded when received – Advantages & disadvantages • Accrual Based – Income recorded when notified – Expenses recorded when bill is received – Advantages & disadvantages • Modified Accrual Statement of Financial Position Assets – What you own Liabilities – What you owe Net Assets-What you own minus what you owe Unrestricted – No donor imposed restrictions Designated – Board determines use Temporarily Restricted – Restricted as to time and/or purpose Permanently Restricted – Only interest or income can be used Assets = Liabilities + Net Assets Statement of Financial Activity Income – Contributions that arrive or is owed you Contributions – Money, some in-kind contributions Use of temporarily restricted funds Accounts Receivable = Income Expenses – Outflow Accounts Payable = Expenses Net Income – Income minus expenses ABC NONPROFIT ORGANIZATION STATEMENTS OF FINANCIAL POSITION JUNE 30, 2010 AND 2009 ASSETS 2010 CURRENT ASSETS Cash and cash equivalents Accounts receivable, Fee for Service contracts, net of allowance for doubtful accounts of $25,000 and $40,000 at June 30, 2010 and 2009, respectively Accounts receivable, other, net of allowance for doubtful accounts of $100,000 and $96,000 at June 30, 2010 and 2009, respectively Total current assets PROPERTY AND EQUIPMENT Furniture and equipment Leasehold improvements $ 850,000 $ 80,000 700,000 692,000 1,570,000 $ 1,645,000 $2,350,000 1,400,000 220,000 1,620,000 1,320,000 300,000 Less accumulated depreciation and amortization Total property and equipment Total Assets 103,000 2009 $ 1,945,000 1,180,000 220,000 1,400,000 1,240,000 160,000 $2,510,000 LIABILITIES AND NET ASSETS LIABILITIES Accounts payable Deferred Revenue Accrued salaries and vacation Line of credit Total current liabilities NET ASSETS Unrestricted Temporarily restricted Total net assets Total Liabilities and Net Assets $ 605,000 $ 400,000 45,000 947,000 750,000 100,000 250,000 $ 1,697,000 $1,400,000 $ $ 65,000 $ 650,000 160,000 460,000 225,000 $1,110,000 $ 1,922,000 $2,510,000 ABC NONPROFIT ORGANIZATION STATEMENTS OF FINANCIAL POSITION JUNE 30, 2010 AND 2009 ASSETS 2010 CURRENT ASSETS Cash and cash equivalents Accounts receivable, Fee for Service contracts, net of allowance for doubtful accounts of $25,000 and $40,000 at June 30, 2010 and 2009, respectively Accounts receivable, other, net of allowance for doubtful accounts of $100,000 and $96,000 at June 30, 2010 and 2009, respectively Total current assets CURRENT LIABILITIES Accounts payable Deferred Revenue Accrued salaries and vacation Line of credit Total current liabilities 2009 $ 103,000 $ 80,000 850,000 700,000 692,000 1,570,000 $ 1,645,000 $ 2,350,000 $ 628,000 $ 400,000 45,000 947,000 750,000 100,000 250,000 $ 1,720,000 $ 1,400,000 ABC NONPROFIT ORGANIZATION STATEMENTS OF FINANCIAL POSITION JUNE 30, 2010 AND 2009 ASSETS 2010 PROPERTY AND EQUIPMENT 1,400,000 Furniture and equipment 220,000 Leasehold improvements 1,620,000 1,320,000 Less accumulated depreciation and amortization 300,000 Total property and equipment 2009 1,180,000 220,000 1,400,000 1,240,000 160,000 ABC NONPROFIT ORGANIZATION STATEMENTS OF FINANCIAL POSITION JUNE 30, 2010 AND 2009 2010 2009 NET ASSETS Unrestricted Temporarily restricted Total net assets $ $ 65,000 $ 650,000 160,000 460,000 225,000 $ 1,110,000 ABC NONPROFIT ORGANIZATION STATEMENTS OF FINANCIAL POSITION JUNE 30, 2010 AND 2009 ASSETS 2010 CURRENT ASSETS Cash and cash equivalents Accounts receivable, Fee for Service contracts, net of allowance for doubtful accounts of $25,000 and $40,000 at June 30, 2010 and 2009, respectively Accounts receivable, other, net of allowance for doubtful accounts of $100,000 and $96,000 at June 30, 2010 and 2009, respectively Total current assets PROPERTY AND EQUIPMENT Furniture and equipment Leasehold improvements $ 850,000 $ 80,000 700,000 692,000 1,570,000 $ 1,645,000 $2,350,000 1,400,000 220,000 1,620,000 1,320,000 300,000 Less accumulated depreciation and amortization Total property and equipment Total Assets 103,000 2009 $ 1,945,000 1,180,000 220,000 1,400,000 1,240,000 160,000 $2,510,000 LIABILITIES AND NET ASSETS LIABILITIES Accounts payable Deferred Revenue Accrued salaries and vacation Line of credit Total current liabilities NET ASSETS Unrestricted Temporarily restricted Total net assets Total Liabilities and Net Assets $ 605,000 $ 400,000 45,000 947,000 750,000 100,000 250,000 $ 1,697,000 $1,400,000 $ $ 65,000 $ 650,000 160,000 460,000 225,000 $1,110,000 $ 1,922,000 $2,510,000 Statement of Financial Activity ABC NONPROFIT ORGANIZATION STATEMENT OF ACTIVITIES YEAR ENDED JUNE 30, 2010 with JUNE 39, 2009 Temporarily Unrestricted Restricted PUBLIC SUPPORT AND REVENUE Public support Contributions and grants $ 225,000 $ 20,000 $ Special fund raising events, net of $125,000 of related expenses 115,000 Contribution of facility space 120,000 Net assets released from restrictions 320,000 (320,000) Total public support $ 780,000 $ (300,000) $ Revenue Fee for Service $ 10,200,000 $ $ Governmental Contracts 4,400,000 Grants 650,000 Other 170,000 Interest 5,000 Total revenue 15,425,000 Total public support and revenue EXPENSES Program services Fund raising Management and general Total expenses CHANGES IN NET ASSETS Net assets, beginning of year Net assets, end of year $ 16,205,000 $ 13,830,000 280,000 2,680,000 16,790,000 (585,000) 650,000 65,000 2009 Total Total 245,000 115,000 120,000 480,000 $ 500,000 $ 150,000 120,000 770,000 10,200,000 4,400,000 650,000 170,000 5,000 15,425,000 $ 8,400,000 3,400,000 650,000 150,000 7,500 12,607,500 (300,000) $ 15,905,000 $ 13,377,500 - 13,830,000 280,000 2,680,000 16,790,000 10,700,000 190,000 2,750,000 13,640,000 (885,000) 1,110,000 225,000 (262,500) 1,372,500 1,110,000 (300,000) 460,000 160,000 Income 2009 & 2010 Contributions Fund raising events Contribution-space Fee for Service Governmental Contracts Grants Other Interest % 2010 2009 Change $ 245,000 $ 500,000 -51% 115,000 150,000 -23% 120,000 120,000 0% $ 10,200,000 $ 8,400,000 21% 4,400,000 3,400,000 650,000 650,000 170,000 150,000 5,000 7,500 15,905,000 13,377,500 29% 0% 13% -33% 19% $12,000,000 $10,000,000 $8,000,000 $6,000,000 $4,000,000 $2,000,000 $- 2010 2009 Income 2009 & 2010 Temporarily Restricted PUBLIC SUPPORT AND REVENUE Public support Contributions and grants Special fund raising events, net of $125,000 of related expenses Contribution of facility space Net assets released from restrictions Total public support Revenue Fee for Service Governmental Contracts Grants Other Interest Total revenue Total public support and revenue EXPENSES Program services Fund raising Management and general Total expenses CHANGES IN NET ASSETS Net assets, beginning of year Net assets, end of year $ 20,000 $ (320,000) (300,000) $ $ (300,000) (300,000) 460,000 160,000 Expenses EXPENSES Program services Fund raising Management and general Total expenses 2010 2009 % change 13,830,000 10,700,000 29% 280,000 190,000 47% 2,680,000 2,750,000 -3% 16,790,000 13,640,000 23% Why do you need a balance sheet & an income statement •Balance sheet • Cash position • Types of assets • Amount of liabilities • Net assets – Unrestricted vs restricted •Income Statement • Current income – type and amount • Current expenses – type and amount • This year compared to last year and to budget Linking Statements NET ASSETS (Statement of Financial Position) 2010 2009 Unrestricted $ 65,000 $ 650,000 Temporarily restricted 160,000 460,000 Total net assets $ 225,000 $ 1,110,000 Statement of Financial Activity Unrestricted CHANGES IN NET ASSETS (585,000) Net assets, beginning of year 650,000 Net assets, end of year 65,000 Temporarily Restricted (300,000) 460,000 160,000 2010 Total (885,000) 1,110,000 225,000 2009 Total (262,500) 1,372,500 1,110,000 Statement of Financial Position Statement of Financial Position - Master Inc. Assets Cash & Cash Equivalents Accounts Recievable Bequest Receivable Prepaid Expenses Inventory Investments Trusts Property, Plant, Equipment Total Assets Liabilities and Net Assets Liabilities Accounts Payable Other Payable Deferred Revenue Funds held for others Pension liability Total Liabilities Net Assets Unrestricted Temporarily Restricted Permanently Restricted Total Net Assets Total Liabilities and Net Assets 2009 997,387 616,346 500,000 29,181 63,831 19,796,636 19,356,658 7,427,156 48,787,195 2008 1,217,056 662,707 45,043 64,821 17,131,263 25,088,666 7,268,869 51,478,425 366,427 152,030 12,737 314,707 654,551 1,500,452 484,843 166,387 49,995 396,257 644,121 1,741,603 9,363,531 19,949,016 17,974,196 47,286,743 48,787,195 10,742,024 25,439,979 13,554,819 49,736,822 51,478,425 Statement of Financial Activity - Master Inc. For the years ended June 30, 2009 & 2008 Unrestricted Temporarily Restricted Permanently Restricted 2009 Total 2008 Total Support and Revenue Statement of Financial Activity Grants Contracts Contributions Bequest Board Support Fee income Investment income Net Assets released Total Support and Revenue 314,053 1,000,000 426,711 292,795 1,000,000 512,523 6,639,659 314,053 1,000,000 554,948 6,639,659 272,822 1,035,213 2,232,995 12,049,690 158,366 (5,649,329) 6,639,659 (2,220,282) 2,427,129 71,849 82,317 1,639,393 632,834 198,227 219,182 34,581 201,406 147,363 25,452 5,679,733 6,369,957 (8,820,036) 2,290,487 56,673 69,292 1,735,118 431,897 227,635 162,685 38,752 191,138 161,447 32,008 5,397,132 (185,857) (4,684,558) 25,439,979 19,949,016 13,554,819 17,974,196 49,736,822 47,286,743 54,607,237 49,736,822 128,237 6,639,659 272,822 1,035,213 1,780,430 422,436 5,251,665 452,565 (422,436) 158,366 254,657 787,002 2,364,298 5,211,275 Expenses Salaries & Benefits Training & travel Volunter expenses Event costs Contracted Services Communications Rent Insurance Repairs & Maintenance Depreciation Miscellaneous Change in net assets Unrealized gains (losses) Net Assets beginning Net Assets ending 2,427,129 71,849 82,317 1,639,393 632,834 198,227 219,182 34,581 201,406 147,363 25,452 5,679,733 (428,068) (950,425) 10,742,024 9,363,531 T r e n d s Support and Revenue Grants Contracts Contributions Board Support Fee income Investment income Total Support and Revenue Expenses Salaries & Benefits Training & travel Volunter expenses Event costs Contracted Services Communications Rent Insurance Repairs & Maintenance Depreciation Miscellaneous Bequest 2009 Total 2008 Total 314,053 1,000,000 554,948 272,822 1,035,213 2,232,995 5,410,031 292,795 1,000,000 512,523 254,657 787,002 2,364,298 5,211,275 7% 0% 8% 7% 32% -6% 4% 2,427,129 71,849 82,317 1,639,393 632,834 198,227 219,182 34,581 201,406 147,363 25,452 5,679,733 2,290,487 56,673 69,292 1,735,118 431,897 227,635 162,685 38,752 191,138 161,447 32,008 5,397,132 6% 27% 19% -6% 47% -13% 35% -11% 5% -9% -20% 5% 6,639,659 % Change Income Trends 2,500,000 2,000,000 1,500,000 1,000,000 500,000 - Grants 2009 2008 Contracts Contributions Board Support Fee income Investment income Expense Trends 3,000,000 2,500,000 2,000,000 1,500,000 1,000,000 500,000 - 2009 2008 Statement of Cashflow For the years ended June 30, 2009 & 2008 Operating Activities Cashflow Statement Change in net assets Depreciation Net realized/unrealized loss Changes in Property & investments values Accounts Receivable Prepaid Expenses Inventory Accounts Payable Other Payable Deferred revenue Funds held for others Pension Net cash utilized by operating activities 2009 (2,450,079) 147,363 3,382,628 2008 (4,870,415) 161,447 2,314,409 (1,202,251) 46,361 15,862 990 (118,416) (9,057) (37,258) (45,250) 10,430 (258,677) 2,370,149 (124,400) (1,390) (8,698) 191,422 (30,204) (30,720) (42,396) 17,464 (53,332) (6,048,002) (52,649) (6,100,651) 288,363 (113,215) 175,148 Investing activities Net proceeds from purchases (invest.) Purchase of property & equipment Net cash provided by (used for) investing Cash flows from financing Contributions restricted 6,139,659 Increase (decrease) in cash Cash and cash equivalents at beginning Cash and cash equivalents at end of year (219,669) 1,217,056 997,387 121,816 1,095,240 1,217,056 Statement of Functional Expenditures Statement of Functional Expenses - Master Inc. For the years ended June 30, 2009 & 2008 Program Services Salaries & Benefits Training & travel Volunter expenses Event costs Contracted Services Communications Rent Insurance Repairs & Maintenance Depreciation Miscellaneous 1,650,266 55,058 79,410 1,634,796 410,886 112,083 122,976 12,518 10,500 35,000 22,609 4,146,102 73% Management & General 526,477 11,483 1,725 1,521 207,291 52,250 85,164 21,496 190,295 112,363 201 1,210,266 Fundraising 250,386 5,308 1,182 3,076 14,657 33,894 11,042 567 611 2,642 323,365 32% 2009 2008 Total Total 2,427,129 71,849 82,317 1,639,393 632,834 198,227 219,182 34,581 201,406 147,363 25,452 5,679,733 2,290,487 56,673 69,292 1,735,118 431,897 227,635 162,685 38,752 191,138 161,447 32,008 5,397,132 Project budget Project Budget Income Your foundation Other grant applications Agency funds Total Income Expenses Salary & Benefits Event costs Contracted Services Program materials Office supplies Communications costs Rent Transportation Insurance Total Expenses Net $ 50,000 80,000 22,000 $ 152,000 60,000 30,000 18,000 15,000 8,000 8,000 8,000 3,500 1,500 $ 152,000 $ - Types of Reports Prepared by CPA firms Audit – Highest form of reliability, detailed analysis & transaction testing (on a sample basis), provides assurance that the statements present fairly the financial position Review – Limited to an analytical review with no detailed transaction testing, variation analysis performed to compare current year with prior years for reasonableness, provides limited assurance about the financial position Compilation – Involves converting raw financial information into a readable format, no opinion is expressed Independent Auditors Report To the Board of Directors of the Hope Agency We have audited the accompanying consolidated statement of financial position of Social Service Agency as of June 30, 2006, and the related consolidated statements of activities, functional expenses, and cash flows for the year then ended. These financial statements are the responsibility of the Organization's management. Our responsibility is to express an opinion on these financial statements based on our audit. The prior-year summarized comparative information has been derived from the Organization's 2005 financial statements and, in our report dated October 25, 2005, we expressed an unqualified opinion on those financial statements. We conducted our audit in accordance with U.S. generally accepted auditing standards. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion. In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Social Service Agency and Affiliates at June 30, 2006, and the changes in their net assets and their cash flows for the year then ended, in conformity with U.S. generally accepted accounting principles. Your Friendly Audit Firm Philadelphia, Pennsylvania October 27, 2006 Management Letters • Internal Controls – Auditor must evaluate control deficiencies and determine if they are significant deficiencies or material weaknesses • Preparation of reports – Auditor will determine if the client is capable of preparing the financial statements and if the client has the skills and competencies necessary to prevent, detect, and correct a material misstatement • Other matters Audit & 990 Audit Total Support and Revenue Rental Revenue Form 990 990 p.1 Total 1,617,242 Contributions & grants Program Service revenue Investment income 553,554 1,696,858 5,073 Other - 510 2,255,995 Participation Fees Contributions Miscellaneous Total Support and Revenue 79,616 188,889 510 1,886,257 Total Expenses 1,369,916 1,476,798 Contributions permanently restricted Investment income (loss) Change in beneficial interest Loss on disposition of assets Change in net assets Total difference 364,665 8,073 (3,000) (106,882) 1,632,772 779,197 779,197 (364,665) (79,616) (106,882) Financial Ratios Quick ratio – Cash divided by payables. Is it 1 or greater? Current ratio – Current Assets divided by Current Liabilities Is it 1 or greater? Debt to Equity - Long term debt divided by total net assets Is it less than .50? Increase in net assets (Current year’s net assets minus prior year’s net assets )divided by prior year’s net assets Is it greater than the rate of inflation? Fixed Ratio - Fixed Assets divided by total assets. The lower the number the more liquid the assets Overhead cost - Management & fundraising costs divided by total expenses Is it less than .30? (Could vary depending on type) Ratios Quick ratio Current Ratio Debt to Equity Increase in net assets Fixed ratio Overhead cost ABC Master 0.16 1.92 0.96 2.53 None 0.01 (0.80) (0.05) 0.15 0.15 0.18 0.27 Ratios Quick ratio Current Ratio Debt to Equity Increase in net assets Fixed ratio Overhead cost ABC Master 0.16 1.92 0.96 2.53 None 0.01 (0.80) (0.05) 0.15 0.15 0.18 0.27 Operating Reserve Information Operating Reserve Policy Toolkit for Nonprofit Organizations (September 2010 Sponsored by the National Center for Charitable Statistics, Center on Nonprofits and Philanthropy at the Urban Institute and United Way Worldwide (http://www.nccs2.org) Why does an organization need an operating reserve? Unexpected shortfall in revenue Unexpected demands on your resources Unanticipated opportunities Less than perfect judgment and foresight A change in direction that is needed Day to day fluctuations in income and expense Seasonal fluctuations Board Designated Operating Reserves Board designated operating reserves are that portion of unrestricted net assets that the Board establishes for the organization to use in case of an emergency or an unexpected event. According to the Nonprofit Operating Reserves Initiative Working Group the minimum operating reserve ratio should be 25% or three months of the annual expense budget.) Funding the operating reserve – the funds must come from unrestricted income and need to represent cash that is set aside. One method is to “fund depreciation”, another is to set aside a certain amount each year. Questions