Inventories: Additional Issues

advertisement

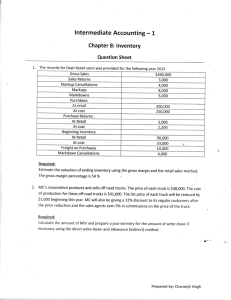

Intermediate Financial Accounting I Inventories: Additional Valuation Issues Objectives of this Chapter I. Introduce Inventory estimation methods: the gross profit method and the retail inventory method. II. Determine ending inventory cost by applying the gross profit method. III. Determine ending inventory cost by applying the retail inventory method. Inventories: Additional Issues 2 Objectives of this Chapter (contd.) IV. Compare the gross profit method and the retail inventory method. V. Explain dollar-value LIFO retail method. VI. Discuss accounting issues related to purchase commitments. Inventories: Additional Issues 3 I. Estimating Inventory: Gross Profit Method and Retail Inventory Method Reasons: For some companies, inventory information is needed between accounting periods . Companies cannot afford to do physical inventory count every quarter. Thus, either the gross profit method or the retail inventory method can be used to estimate value of ending inventory for interim reports. Inventories: Additional Issues 4 Estimating Inventory: Gross Profit Method and Retail Inventory Method (contd.) No physical count of inventory is needed for either method. The value of inventory is based on estimation. Neither method is acceptable for annual financial reporting purposes. Inventories: Additional Issues 5 Estimating Inventory: Gross Profit Method and Retail Inventory Method (contd.) Both methods are acceptable for interim reporting. The insurance adjusters may use the gross profit method to estimate the loss of inventory in case of fire or flood. Inventories: Additional Issues 6 II. The Gross Profit Method Data Required: Beginning Inventory (at cost) Purchase (net) (at Cost) Sales Price Gross Margin Ratio (Gross Margin/Sales Price) Inventories: Additional Issues 7 Example A Gross Profit Method Beginning Inv. = $60,000 Purchase (net) = $200,000 Sales = $280,000 Gross Margin Ratio 1= 30% 1. Gross margin ratio is obtained from past years’ experience (assuming the ratio is stable over years). Inventories: Additional Issues 8 Example A (contd.) Using gross profit method to estimate the cost of ending inventory Selling Price Beg. Inventory Purchase (net) Goods Available for Sale Sales 280,000 Less: gross margin1 (84,000) Sales (at cost) Estimated Inv. (at cost) Cost $60,000 200,000 260,000 196,0002 64,000 1. gross margin = 280,000x30% 2. also equals 280,000x(1-30%) = 196,000 Inventories: Additional Issues 9 Example B Gross Profit Method What if the gross margin ratio is based on cost of goods sold (CGS) rather than on sales price? Sales $100 CGS (80) Gross Margin $20 Gross profit ratio (based on Sales)= 20% Gross profit ratio (based on CGS) = 25% Deriving CGS using sales and gross profit ratio based on sales: $100 x (1 - 20%) = $80 Deriving CGS using sales and gross profit ratio based on CGS: $100 (1+25%) = $80 Inventories: Additional Issues 10 Example B (contd.) Sales = CGS + Gross Profit = CGS + 25% x CGS = CGS x (1+25%) CGS = Sales (1+25%) Inventories: Additional Issues 11 Comments on Gross Profit Method If the relationship between the gross profit and selling price has been changed, the ratio should be adjusted accordingly. A separate gross profit ratio should be applied to different inventory. Inventories: Additional Issues 12 III. Retail Inventory Method Terminology related to retail inventory method: Original retail price Additional markup Markup Cancellations Markdowns Markdown Cancellations Mark et $5 5 5 5 Retail Price $110 115 110 105 110 = Additional Markups - Markup Cancellations Net Markdowns = Markdowns - Markdown Cancellations Net Markups Inventories: Additional Issues 13 Retail Inventory Method (contd.) Data required to apply retail method: Beg. Inv. (both cost and retail price) Purchases (net) (cost and retail) Sales (subtracting sales returns only) Price adjustment data such as additional markups, markup cancellations, markdowns and markdown cancellations Inventories: Additional Issues 14 Retail Inventory Method Example (assuming no price adjustments) Beg. Inv. Purchases (net) Cost $14,000 63,0001 77,000 Retail $20,000 90,0002 110,000 85,0003 $25,000 Sales Estimated End. Inv. at retail Cost ratio = 77,000/110,000=70% Estimated cost of end. inv. = 25,000x70%=17,500 1. Purchases - Pur. R&A - Pur. Dis. + Freight-in 2. Purchases - Pur R&A 3. Gross sales-Sales Returns +Employee Discounts Inventories: Additional Issues 15 Retail Inventory Method Example (with price adjustments) Cost $14,000 63,000 77,000 Beg. Inv. Purchases (net) Goods Avail. Additional Markups Markup Cancel. Markdowns Markdowns Cancel. Sales Estimated End. Inv. at Retail Retail $20,000 90,000 110,000 5,000 (4,000) (1,500) 200 (85,000) $24,700 Question: What is the cost ratio? Inventories: Additional Issues 16 Retail Inventory Method Example (with price adjustments) Cost $14,000 63,000 77,000 Beg. Inv. Purchases (net) Goods Avail. Net Markups Goods Avail. after net MU Net Markdowns Goods Avail. after all price adj. Sales* End. Inv. at Retail Retail $20,000 90,000 110,000 1,000 111,000 (1,300) 109,700 (85,000) $24,700 *Sales = Sales - Sales R&A Inventories: Additional Issues 17 Cost Ratios for Retail Method 1) Average Method (consider all price adjust.) Cost Ratio = 77,000 109,700 = 70.19%. Esti. End. Inv. at cost = $24,700 x 70.19% = $17,336.93 2) LCM approach (conventional retail method) (consider only net markups) Cost Ratio = 77,000 111,000 = 69.37%. 24,700 x 69.37% = 17,134.39 Inventories: Additional Issues 18 Cost Ratios for Retail Method (contd.) 3) FIFO approximation (excluding the beg. inv. in the computation of cost ratio) Cost Ratio = (77,000-14,000)(109,700-20,000) =70.23%. Esti. Inv. at cost = $24,700 x 70.23%=17,346.81 Inventories: Additional Issues 19 Cost Ratios for Retail Method (contd.) 4) LIFO approximation (computing two ratios, one for the beg. inv. and one for others) Cost Ratio 1(for beg.inv.) =14,000/20,000=70% Cost Ratio 2(for other inv.) = (77,000-14,000)(109,700-20,000)=70.23% Esti. End. Inv. at cost = 1) 20,000 x 70% = 14,000 2) 4,700a x 70.23% = 3,301 17,301 a. 24,700-20,000=4,700 Inventories: Additional Issues 20 Comments for Retail Method A. Purchases Pur. Discounts Pur. R & A Freight-In Cost $$$$ $$$$ $$$$ $$$$ Retail $$$$ ------1 $$$$ ------1 1. Pur. Discounts and freight-in are already considered in the retail price of purchases. Inventories: Additional Issues 21 Comments for Retail Method (contd.) B. Sales in the retail column should be gross sales - sales returns. This is because the retail prices for beg. inv. and purchases are based on gross sales, not net sales. Also, if employee discounts have been subtracted from sales, they should be added back to sales. Inventories: Additional Issues 22 Comments for Retail Method (contd.) C. Spoilage Normal Spoilage1 Abnormal Spoilage2 Cost Retail ------ $$$$ $$$$ $$$$ 1. In computing cost ratios, the normal spoilage will not be considered. 2. In computing cost ratios, the abnormal spoilage will be considered. Inventories: Additional Issues 23 Retail Inventory Method – Special Items Included Cost $14,000 63,000 (1,400) 75,600 Goods Avail. after all price adj. Retail $20,000 90,000 (2,000) 108,000 1,000 109,000 (1,300) 107,700 Sales 85,000 Sales returns (2,000) Employee Discounts Normal Spoilage End. Inv. at Retail Inventories: Additional Issues (83,000) (2,000) (1,000) $21,700 Beg. Inv. Purchases (net) Abnormal Spoilage Goods Avail. Net Markups Goods Avail. after net MU Net Markdowns 24 Retail Inventory Method –Special Items Included(contd.) 1) Average Method (consider all price adjust.) Cost Ratio = 75,600 107,700 = 70.19%. Esti. End. Inv. at cost = $21,700 x 70.19% = $15,232.23 2) LCM approach (conventional retail method) (consider only net markups) Cost Ratio = 75,600 10,900 = 69.36%. 21,700 x 69.36% = $15,051.12 5Inventories: Additional Issues 25 Another Example of Conventional Retail Inventory Method – Special Items Included (Illustration 9-3, KWW, 14th e) Inventories: Additional Issues 26 IV. Comparison of Gross Profit Method and Retail Inventory Method Gross-Profit Method Retail Inventory Method 1. Data required: cost of beg. inv., purchases, sales and gross profit ratio. 2. Any company can use this method to estimate ending inventory. 1. Data required: Cost and retail price of beg. inv., purchases, sales price and price adjustments. 2. Only retail store can apply this method to estimate inventory. Inventories: Additional Issues 27 Comparison of Gross Profit Method and Retail Inventory Method (contd.) Gross-Profit Method Retail Inventory Method 3. Gross profit ratio is 3. Cost ratio can be estimated from past calculated at years’ experience different stage and (not updated with is updated with the price current year’s price adjustments of the adjustment data. current year). Inventories: Additional Issues 28 Comparison of Gross Profit Method and The Retail Method (contd.) Gross-Profit Method Retail Inventory Method 4. Not acceptable for 4. Not acceptable for the annual financial the annual financial reporting but reporting but acceptable for the acceptable for the interim report. interim report. 5. No physical count of 5. No physical count of inventory is needed. inventory is needed. Inventories: Additional Issues 29 V. Dollar-Value LIFO Retail Method Applying retail method to estimate cost of ending inventory and also considering price index when prices are fluctuating. Inventories: Additional Issues 30 Example Dollar-Value LIFO Retail Method Cost $14,000 63,000 77,000 Retail Beg. Inv. -20x1 $20,000 Purchases (net) 90,000 Goods Avail. 110,000 Net Markups 1,000 Goods Avail. after net MU 111,000 Net Markdowns (1,300) Goods Avail. after all price adj. 109,700 Sales (85,000) End. Inv. at Retail $24,700 Cost Ratio(CR) 1(for beg. inv.)=14,000/20,000=70% CR2 (for others)=(77,000-14,000)/(109,700-20,000) =70.23% Inventories: Additional Issues 31 Dollar-Value LIFO Retail Method Example (contd.) Assuming the price indices of 20x0 and 20x1 are 100% and 112%, respectively. Procedures of applying Dollar-Value LIFO concept to Retail method (LIFO approximation): Inventories: Additional Issues 32 Dollar-Value LIFO Retail Method Example (contd.) 1. Ending inventory at retail prices is deflated to base year’s price level: $24,700112% = $22,054 2. Forming Layers based on LIFO cost flows assumption: Beg. inv (retail) at base-year prices (L1) $20,000 Inv. increase (retail) from beg. inv. (L2) 2,054 Inventories: Additional Issues 33 Dollar-Value LIFO Retail Method Example (contd.) Ending Inv Layers Price Cost End. Inv. at Base-year at Base-year Index Ratio at LIFO Retail Prices Retail Prices (%) (%) Cost $22,054 $20,000 $2,054 100 70 $14,000 112 70.23 1,616 $15,615 Inventories: Additional Issues 34 Dollar-Value LIFO Retail Method Example (contd.) Subsequent years under Dollar-Value LIFO Retail The D-V LIFO retail method follows the same procedures in subsequent years as the traditional D-V LIFO method. That is when a real increase in inventory occurs, a new layer is added. Inventories: Additional Issues 35 Dollar-Value LIFO Retail Method Example (contd.) Using the information on page 27 and assuming the retail value of 20x2 ending inventory at current price is $42,960. The 20x2 price index is 120% (20x0 price index is 100%) and the cost ratio of 20x2 is 75%. In base-year’s dollars(20x0), the ending inventory of 20x2 is $42,960 120% = $35,800 Inventories: Additional Issues 36 Dollar-Value LIFO Retail Method Example (contd.) Ending Inv. Layers Price Cost End. Inv at Base-Year at Base-Year Index Ratio at LIFO Retail Prices Retail Prices (%) (%) Cost $35,8001 L1 L2 L3 $20,000 2,054 13,746 100 70 $14,000 112 70.23 1,616 120 75 12,371 $27,987 1.Current cost of ending Inv. of 20x2: $42,9601.12 = $35,800 L1(layer 1) = 20x0 L2 = 20x1 Inventories: Additional Issues L3 = 20x2 37 VI. Purchase Commitments Purchase contract may be signed a few months (or years) before the actual delivery date (i.e., George Pacific) to secure the supply of inventory. Losses are recognized for any purchase commitments outstanding at the end of a period when market price is less than contract price (i.e., applying a LCM rule in the valuation of purchase commitments). Inventories: Additional Issues 38 Example 1- Contract Period within Fiscal Year Geteway Co. signed a purchase commitment of $20,000 on 4/30/x5 to buy goods which would be delivered on 9/30/x5. 4/30/x5 No entry required. Disclosure of this firm commitment is required at the end of a reporting period if the amount is significant. Inventories: Additional Issues 39 Example 1 (contd.) Case 1: When the market price of these goods equal or greater than the contract price of $20,000 on 9/30/x5, the journal entry on 9/30/x5, the delivery date, would be: 9/30/x5 Purchases 20,000 Cash 20,000 Inventories: Additional Issues 40 Example 1 (contd.) Case 2: The market price is $18,000 on 9/30/x5. The journal entry would be: Purchases Loss on Pur. Commitment 18,000 2,000 Cash Inventories: Additional Issues 20,000 41 Purchase Commitments Example 2 - Contract Period Extends beyond Fiscal Year Geteway Co. signed a firm purchase commitment of $50,000 on 4/15/x5 for goods to be delivered on 10/2/x6. The market price of the contracted goods was $49,000 on 12/31/x5. The purchased commitment loss must be recognized in the year end when the loss first occurred (i.e., 12/31/x5). Inventories: Additional Issues 42 Example 2 (contd.) The following entry would be prepared on 12/31/x5 and disclosure is required when the amount is significant regardless whether a loss is expected or not: Estimated Loss on Purchase Commitments* 1,000 Estimated Liability on Purchase Commitments 1,000 * Reported in the income statement under “Other expenses and losses” Inventories: Additional Issues 43 Example 2 (contd.) At the delivery date (i.e., 10/2/x6): Case 1: The market price remained $1,000 below the contract price, the following journal entry would be prepared on 10/2/x6: Purchases Estimated Lia. on Pur. Commit. Cash 49,000 1,000 Inventories: Additional Issues 50,000 44 Example 2 (contd.) Case 2: The market price was $3,000 below the contract price on 10/2/x6: Purchases 47,000 Estimated Lia. on Pur. Commitments 1,000 Loss on Pur. Commit. 2,000 Cash Inventories: Additional Issues 50,000 45 Example 2 (contd.) Case 3: the market was only $600 below the contract price 0n 10/2/x6: Purchases* 49,000 Estimated Lia. on Pur. Commit. 1,000 Cash 50,000 *$49,000 became the new cost for the purchase commitment on 12/31/x5 Inventories: Additional Issues 46 Hedging of Purchase Commitments with Future Sales Contracts In order to offset the potential future loss on purchase commitments, a firm can enter a future sales contract at the same quantity of inventory purchased in a purchase commitment. Inventories: Additional Issues 47