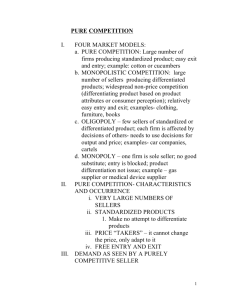

FIRMS IN COMPETITIVE MARKETS

advertisement

FIRMS IN COMPETITIVE MARKETS What Is A Competitive Market? A perfectly competitive market has the following characteristics: There are many buyers and sellers in the market. 2) The goods offered by the various sellers are the same (identical). 3) Firms can freely enter or exit the market. 4) Information is perfect. Buyers and sellers know all prices offered,... 1) What Is A Competitive Market? As a result of these characteristics, the perfectly competitive market has the following outcomes: The actions of any single buyer or seller in the market have no impact on the market price. Each buyer and seller takes the market price as given. Ex: Gasoline, fish, eggs, pencils, tomatoes, etc. What Is A Competitive Market? Buyers and sellers must accept the price determined by the market. No single seller has market power (the power to influence the market price). “Demand Faced By A Competitive Firm” versus “Market Demand” Price Price Pm QTY (millions) QTY (ones) Demand faced by one competitive firm Market Demand The Revenue of a Competitive Firm Total revenue for a firm is the market price times the quantity sold. TR = P Q Table 1 Total, Average, and Marginal Revenue for a Competitive Firm Copyright©2004 South-Western The Revenue of a Competitive Firm Marginal revenue is the change in total revenue when an additional unit is sold. MR =TR / Q The Revenue of a Competitive Firm 1. Only in a competitive market, marginal revenue equals the price of the good. This is because a firm in a competitive market can sell as much as it wants at the constant market price. 2. If a monopolist or oligopolist sells more, this causes the price of the good to fall. Ex1: Think of crude oil price and OPEC. Ex2: Consider a downward sloping demand curve. Profit Maximization and The Competitive Firm’s Supply Curve The goal of a competitive firm is to maximize profit. This means that the firm wants to produce the quantity that maximizes the difference between total revenue and total cost. Table 2 Profit Maximization: A Numerical Example Copyright©2004 South-Western Profit Maximization and The Competitive Firm’s Supply Curve Profit maximization occurs at the quantity where marginal revenue equals marginal cost. Profit Maximization And The Competitive Firm’s Supply Curve When MR > MC, profit is increasing, so must produce more. When MR < MC, profit is decreasing, so must produce less. When MR = MC, profit is constant, so this is the point where profit is maximized. Figure 1 Profit Maximization for a Competitive Firm Costs and Revenue The firm maximizes profit by producing the quantity at which marginal cost equals marginal revenue. MC MC2 P = MR1 = MR2 P = AR = MR MC1 0 Q1 QMAX Q2 Quantity Copyright © 2004 South-Western Figure 2 Marginal Cost as the Competitive Firm’s Supply Curve Price P2 This section of the firm’s MC curve is also the firm’s supply curve. MC ATC P1 AVC 0 Q1 Q2 Quantity Copyright © 2004 South-Western The Firm’s Short-Run Decision to Shut Down A shutdown refers to a short-run decision to stop production temporarily because the firm’s revenue cannot even cover variable costs. Exit refers to a long-run permanent decision to leave the market. A firm exits the market if it makes negative economic profit in the long-term. The Firm’s Short-term Decision to Shut Down The firm ignores its fixed costs (= sunk costs) when deciding to shut down or not in the short-term, but considers them when deciding whether to exit or not in the long-term. Fixed costs are costs that have already been committed and cannot be recovered in the short-term. example: rent and lease contracts. The Firm’s Short-Run Decision to Shut Down The firm shuts down if its revenue is less than its variable costs: Shut down if TR < VC – Shut down if TR / Q < VC / Q – Shut down if P < AVC Figure 3 The Competitive Firm’s Short Run Supply Curve Costs If P > ATC, the firm will continue to produce at a profit. Firm’s short-run supply curve MC ATC If P > AVC, firm will continue to produce in the short run. AVC Firm shuts down if P < AVC 0 Quantity Copyright © 2004 South-Western The Firm’s Long-Run Decision to Exit or Enter a Market In the long run, a firm exits the market if the profit is negative . Exit if TR < TC if TR/Q < TC/Q if P < ATC A new firm Enters the market if profit is positive, or if: P > ATC Figure 4 The Competitive Firm’s Long-Run Supply Curve Costs Firm’s long-run supply curve Firm enters if P > ATC MC = long-run S ATC Firm exits if P < ATC 0 Quantity Copyright © 2004 South-Western THE SUPPLY CURVE IN A COMPETITIVE MARKET The competitive firm’s long-run supply curve is the part of its marginal-cost curve that lies above average total cost. Figure 5 Profit as the Area between Price and Average Total Cost (a) A Firm with Profits Price MC ATC Profit P ATC P = AR = MR 0 Quantity Q (profit-maximizing quantity) Copyright © 2004 South-Western Figure 5 Profit as the Area between Price and Average Total Cost (b) A Firm with Losses Price MC ATC ATC P P = AR = MR Loss 0 Q (loss-minimizing quantity) Quantity Copyright © 2004 South-Western FIRM VERSUS MARKET SUPPLY Market supply equals the sum of the quantities supplied by all firms in the market. The Short Run: Market Supply with a Fixed Number of Firms For any given price, each firm supplies a quantity of output so that its marginal cost equals price. The market supply curve adds up the individual firms’ marginal cost curves. Figure 6: SR Market Supply with a Fixed Number of Firms (a) Individual Firm Supply (b) Short Run Market Supply Price Price SR MC Supply $2.00 $2.00 1.00 1.00 0 100 200 Quantity (firm) 0 100,000 200,000 Quantity (market) Copyright © 2004 South-Western The Long Run: Market Supply with Entry and Exit Long run equilibrium is reached when there are no more entries or exits in the market. Firms will enter or exit the market until profit approaches to zero. Then longrun equilibrium happens when profit equals zero.Then at the long run equilibrium, price must be equal to the minimum of average total cost. The Long Run: Market Supply with Entry and Exit Then long-run market supply curve is horizontal at price = min(ATC). At the long-run equilibrium, firms operate at their efficient scale (scale that minimizes ATC). Figure 7 Market Supply with Entry and Exit (a) Firm’s Zero-Profit Condition (b) Long Run Market Supply Price Price SR MC Supply ATC LR P = minimum ATC Supply Demand, D1 0 Quantity (firm) 0 Quantity (market) Copyright © 2004 South-Western Why Do Competitive Firms Stay in Business If They Make Zero Profit? Remember that accounting (nominal) profit is positive even if economic profit is zero. The firm making zero economic profit means the firm is doing the best it can and there is no other alternative that will give better profit. If there was, current economic profit would be negative. See example in notes. Exercise: A Shift in Demand and Short Run and Long Run Consequences An increase in demand raises price and quantity in the short run. Firms earn profits because price now exceeds average total cost. Figure 8 An Increase in Demand in the Short Run and Long Run (a) Initial Condition Market Firm Price Price MC ATC Short-run supply, S1 A P1 Long-run supply P1 Demand, D1 0 Quantity (firm) 0 Q1 Quantity (market) Figure 8 An Increase in Demand in the Short Run and Long Run (b) Short-Run Response Market Firm Price Price Profit MC ATC P2 B P2 S1 A P1 P1 D2 Long-run supply D1 0 Quantity (firm) 0 Q1 Q2 Quantity (market) Copyright © 2004 South-Western Figure 8 An Increase in Demand in the Short Run and Long Run (c) Long-Run Response Market Firm Price Price MC ATC B P2 S1 S2 C A P1 Long-run supply P1 D2 D1 0 Quantity (firm) 0 Q1 Q2 Q3 Quantity (market) Copyright © 2004 South-Western