The Depository of The Nigerian Capital Market

advertisement

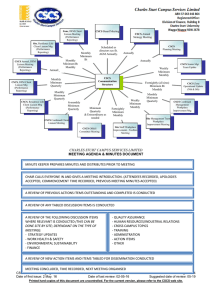

Central Securities Clearing System Presentation On (1) (2) Custodianship of shares in CSCS System Process of Full Dematerialisation of shares in Nigerian Capital Market. (3) CSCS Data Exchange Application Presented By Mrs. P. O. Onyenwe Deputy General Manager/Head, Depository Dept. Central Securities Clearing System The Depository of The Nigerian Capital Market. 1 CUSTODIANSHIP OF SHARES IN CSCS SYSTEM Presently most Securities in CSCS depository are held under the custody of stockbroking firms while those of some institutional or High Net worth investors are under Custodians or directly under the CSD. Fund settlement is on a net basis and to the stockbroking firm’s account who in turn distributes to their clients accordingly. Custodian client’s fund settlement is equally netted and made to the Custodian account. Securities settlement/lodgement are at the beneficial owner’s names (segregated) and/or Nominee/Omnibus accounts. In order to achieve greater transparency, confidence of investors and Security of assets, a new custodial framework for the Nigerian Capital Market is being proposed by the stakeholders led by Securities and Exchange Commission 2 Proposals being evaluated for consideration are: 1. Mixed Custodianship: The present asset holding pattern in CSCS under stockbroking firms and Custodians are maintained with some modifications. Payments for purchase of shares are to be made into designated centrally controlled brokers’ accounts or beneficial owners designated bank accounts. Brokers execute trades based on mandate. Cash settlements are made directly into clients’ accounts through Nigerian Interbank Settlement System. (NIBSS). 3 2. Pure Custodianship: Investor’s Securities are migrated into their account under a nominated Custodian in beneficial owners’ names or omnibus accounts as maintained. The investors’ stockbroking firms are linked to that under the Custodian for execution of trades. CSCS process transaction and advises settlement Banks on Custodian’s financial obligation. Proceeds are remitted directly to clients' account. 4 PROCESS OF FULL DEMATERIALISATION OF SHARES IN NIGERIAN CAPITAL MARKET All shares in the Nigerian Capital Market must be deposited in the CSCS Depository (dematerialised) before transaction can occur on them. This is the market practice since inception of CSCS in 1997. Shares bought from the secondary market are processed electronically and stored in the Depository. All Bonus and Public Offering shares were issued in physical certificate forms up to 2006 when Securities and Exchange Commission approved and announced commencement of electronic lodgement of shares directly into investors’ CSCS account. The foregoing led to the current partially dematerialised capital market environment. 5 •The Nigerian Commission is Regulatory currently Authority, leading all Securities stakeholders & Exchange towards the implementation of full dematerialisation of shares in the capital market. •To this end, a nationwide formal launching of Dematerialisation programme and Enlightenment campaign are being planned to commence in November 2010. •Securities and Exchange Commission will issue guideline to listed companies and all market operators on the agreed implementation procedure. •Registrars are to ensure that the register of members of their principals (quoted companies) are reconciled, consolidated and forwarded to CSCS on or before February 2011. •Completion of the dematerialization exercise is expected to be in January 2012. 6 CSCS DATA EXCHANGE APPLICATION CSCS Data Exchange application is a complete solution targeted at achieving a paperless communication with the CSD by its participants. The solution is built with Life-ray framework and JAVA programming language. This web-based application has been customised to meet the business needs of the Nigerian Capital Market participants which includes exchange of data (in various formats), letters and others requests. The system will go live in a couple of weeks having completed market-wide Users Acceptance Test (UAT). The primary objective of this application it to enable secure and seamless end to end communication between CSCS and its participants. CSCS’s participants include; Registrars, Stock broking firms, Settlement Banks, Custodians, etc. 7 DESIGN: This application is not available on World Wide Web. The IP (Internet Protocol) addresses of the systems used by participants are preregistered and must be validated on sign on. In addition Entrust Token with eight-layer authentication is used to boost security on the application. Any entry from unknown source is automatically rejected. ADVANTAGES: CSCS Data Exchange will provide the participants of the Nigerian Capital Market with the following advantages. •Security: The application will provide us the opportunity to exchange data in a secure manner as every document sent or received is validated. • Speed: Correspondences to and fro market participants will be achieved within the shortest possible time. •Reduced Cost: The cost despatching mails among the market participants will drastically reduce. CONCLUSION: With the Data Exchange in place, the Nigerian Capital Market is on its way towards achieving complete Straight Through Processing (STP). 8 The End. 9