CSCS CSD Public Rating Dec2011 - Central Securities Clearing

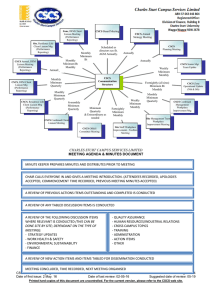

advertisement