Exploring the External Environment

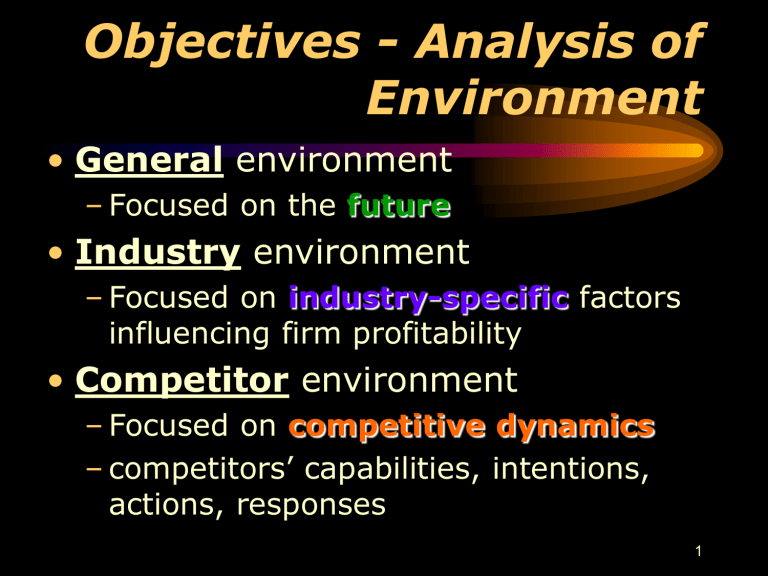

Objectives - Analysis of

Environment

• General environment

– Focused on the future

• Industry environment

– Focused on industry-specific factors influencing firm profitability

• Competitor environment

– Focused on competitive dynamics

– competitors’ capabilities, intentions, actions, responses

1

Analysis of Environment

Is a continuous process

Scan : Identify signals of changes and trends

Monitor : interpret changes & trends

Forecast : future scenarios from monitoring

Assess : timing and importance of forecast to current or prospective firm strategies

Which PEOPLE in the firm should do this?

What limits the effectiveness of this process?

2

Analysis of Environment

• Your firm is interdependent with BROAD institutional dynamics:

– Demographic

– Economic

– Political/legal

– Sociocultural

– Technological

– Global

3

Analysis of Environment

Demographic trends in …

Population size

Age structure

Skills/education

Geographic distribution

Ethnic mix

Income distribution

4

Analysis of Environment

Economic segment

(examples)

Inflation/interest rates (hurdle costs)

Trade deficits or surpluses

Budget deficits or surpluses

Consumption, savings, tax rates

GDP, business cycles

5

Analysis of Environment

Political/Legal Segment (examples)

Antitrust laws (Whole Foods)

Tax laws (incentives)

Regulatory philosophies (SOX)

Labor/training laws (EEOC)

Educational policies (gov backed student loans)

6

Analysis of Environment

Sociocultural segment

(examples)

Opportunity cost of work

(leisure)

Social concerns (greening, alcohol, meat)

Shifts in social preferences (on-line networking)

Shifts in product/service preferences

(track my child; Care Trak Int’l)

7

Analysis of Environment

Technological Segment (examples)

Process architectures (McD, FedEx)

New General Purpose Technologies (IT)

Private / Public R&D

(Human Genome Project)

Converging technologies (VOIP, bioinformatics)

Standard setting (cell phone interoperability)

8

Environmental Analysis

Global

Trade regions as boundaries

Critical global markets

Locating product & factor markets

cultural and institutional attributes

IP & property rights

9

Environmental Analysis

Segment dynamics

– Demographic

– Economic

– Political/legal

– Sociocultural

– Technological

– Global

• Generate economic effects on industries/firms (S/D, & factor costs)

10

Industry Environment

• Interdependence among firms competing for similar customers

• Competitive actions and responses.

• Interactions among factors determine industry profit potential.

1. Threat of new entrants

2. Power of suppliers

3. Power of buyers

4. Product substitutes

5. Intensity of rivalry

11

Industry Environment

• Define the industry - current and potential customers and the firms that serve them.

• Analyze industry and competitors.

• Note:

– Suppliers and buyers can become competitors through integration.

– Producers of potential substitutes may become competitors.

12

5 Forces Industry Analysis

13

Threat of New Entrants

Barriers to entry

Economies of scale

Product differentiation

Capital requirements

Switching costs

Access to distribution channels

Cost disadvantages independent of scale

(e.g., sites, subsidies, learning)

Government policy

Expected retaliation

14

Learning effects

• World War 2 - same plants, same rate of output - lower costs over time

• Important for complex products and processes where humans can learn

• A possible source of ‘first-mover’ advantage

• Boston Consulting Group focused on the experience curve and learning effects

15

Cost

($ per unit of output)

Economies of

Scale Versus Learning

Learning

C

A

Economies of Scale – reversible.

B

AC

1

AC

2

Output

16

Bargaining Power of

Suppliers

• A supplier group is powerful when: it is dominated by a few large companies; satisfactory substitute products are not available to industry firms; industry firms are not a significant customer for the supplier group; suppliers’ goods are critical to buyers’ marketplace success; effectiveness of suppliers’ products has created high switching costs; suppliers are a credible threat to integrate forward into the buyers’ industry.

17

Bargaining Power of

Buyers

• Buyers (customers) are powerful when:

• they purchase a large portion of an industry’s total output

• the sales of the product being purchased account for a significant portion of the seller’s annual revenues

• they could easily switch to another product

• the industry’s products are undifferentiated or standardized, and buyers pose a credible threat if they were to integrate backward into the seller’s industry

18

Threat of Substitute

Products

• Product substitutes are strong threat when:

• customers face few switching costs

• substitute product’s price is lower

• substitute product’s quality and performance capabilities are equal to or greater than those of the competing product

19

Intensity of Rivalry

• Intensity of rivalry is stronger when competitors:

• are numerous or equally balanced

• experience slow industry growth

• have high fixed costs or high storage costs

• lack differentiation or have low switching costs

• experience high strategic stakes

• have high exit barriers

20

High Exit Barriers

• Common exit barriers include:

• specialized assets (assets with values linked to a particular business or location)

• fixed costs of exit such as labor agreements

• strategic interrelationships (relationships of mutual dependence between one business and other parts of a company’s operation, such as shared facilities and access to financial markets)

• emotional barriers (career concerns, loyalty to employees, etc.)

• government and social restrictions

21

Industry Scope

• What is an industry?

• Useful to consider chain of related products (complements) when assessing industry attractiveness

22

Orit Gadiesh and James L. Gilbert

Harvard Business Review

May-June 1998

THE PC INDUSTRY’S PROFIT POOL

40%

30

The value chain for the PC industry includes six key activities; the profitability of the activities varies widely. Manufacturers compete in the largest but least-profitable segment of the chain.

20

10

0

0 other components personal computers microprocessors share of industry revenue

Value chain focus

Axes

Vertical—operating margin

Horizontal—share of industry software peripherals services

100%

23

The Profit Pool Lens

The profit pool is the total profit earned in an industry at all points along the industry’s value chain

Segment profitability may vary by customer group, product category, geographic market, or distribution channel

Profit concentration may be very different than revenue concentration

Shape of the profit pool reflects the competitive dynamics of a business

Interactions of companies and customers

Competitive strategies of competitors

Product pools are not stagnant

24

25

THE U.S. AUTO INDUSTRY’S PROFIT

POOL

25%

20

The automotive industry encompasses many value-chain activities. The way that profits and revenues are distributed among these activities varies greatly. The most profitable areas of the car business are not the ones that generate the biggest revenues.

15

10

5

0

0 new car dealers auto manufacturing source: Harvard Business Review, May-June 1998 used car dealers auto loans gasoline leasing warranty auto insurance share of industry revenue service repair

100% aftermarket parts auto rental

26

Profit Pools: Company

Examples

Firms

Automakers

U-Haul

Elevators

(OTIS)

Harley

Davidson

Polaroid

Core Business

Auto manufacturing

Sources of

Highest ROI

Auto leasing, insurance

Truck Rental

Elevator

Manufacturing

Packing materials, storage

Service

Motorcycles

Accessories (consumer products), leasing, service, restaurants

Instant Photography

Cameras

Film

27

Implications

Focusing on growth and market share can lead a company to choose unprofitable segments of an industry

Today’s deep revenue pool may be tomorrow’s dry hole .

The goal should be to focus on profitable opportunities

Industry should be considered more broadly than traditional definition

Automobile industry includes

Component manufacture and supply

New car assembly and delivery

New car warrantee and service

New car financing, leasing, and insurance

Used car sales and service

28

Strategic Groups

Strategic group: a group of firms in an industry following the same or similar strategy along the same strategic dimensions.

The strategy followed by a strategic group differs from strategies being implemented by other companies in the industry.

29

Competitor behavior

Competitor intelligence is the ethical gathering of needed information and data about competitors’ objectives, strategies, assumptions, and capabilities what drives the competitor as shown by its future objectives what the competitor is doing and can do as revealed by its current strategy

What the competitor believes about itself and the industry, as shown by its assumptions

What the the competitor may be able to do, as shown by its capabilities

30

Competitor Analysis

Future objectives

Current strategy

Assumptions

Capabilities

Response

Response:

What will our competitors do in the future?

Where do we hold an advantage over our competitors?

How will this change our relationship with our competitors?

31

Assessing competitive

Strength vis a vis Rivals

1. List industry key success factors and other relevant measures of competitive strength

2. Rate firm and key rivals on each factor using rating scale of 1 - 10 (1 = weak; 10 = strong)

3. Decide whether to use a weighted or unweighted rating system

4. Sum individual ratings to get overall measure of competitive strength for each rival

5. Determine whether the firm enjoys a competitive advantage or suffers from competitive disadvantage

32

An Unweighted Competitive

Strength Assessment

KSF/Strength Measure ABC Co.

Rival 1 Rival 2 Rival 3 Rival 4

Quality/product performance

Reputation/image

Manufacturing capability

Technological skills

Dealer network/distribution

New product innovation

Financial resources

Relative cost position

Customer service capability

Overall strength rating

8

8

2

10

9

9

5

5

5

61

5

7

10

1

4

4

10

10

7

58

Rating Scale: 1 = Very weak; 10 = Very strong

10

10

7

3

10

10

4

7

10

71

5

5

3

1

1

25

1

1

5

3

1

1

1

4

4

32

6

6

1

8

33

A Weighted Competitive

Strength Assessment

KSF/Strength Measure

Quality/product performance

Weight

0.10

ABC

Co.

8 / 0.80

Rival 1 Rival 2

5/0.50

10/1.00

Rival 3

1/0.10

Reputation/image

Manufacturing capability

Technological skills

Dealer network/distribution

New product innovation

Financial resources

Relative cost position

Customer service capability

Sum of weights

0.10

0.10

0.05

0.05

0.05

0.10

0.35

0.15

1.00

8/0.80

2/0.20

10/0.50

9/0.45

9/0.45

5/0.50

5/1.75

5/0.75

7/0.70

10/1.00

10/1.00

4/0.40

1/0.05

7/0.35

4/0.20

10/0.50

4/0.20

10/0.50

10/1.00

7/0.70

10/3.50

3/1.05

7/1.05

10/1.50

1/0.10

5/0.50

3/0.15

5/0.25

5/0.25

3/0.30

1/0.35

1/0.15

Overall strength rating 6.20

8.20

7.00

2.10

Rating Scale: 1 = Very weak; 10 = Very strong

Rival 4

6/0.60

6/0.60

1/0.10

8/0.40

1/0.05

1/0.05

1/0.10

4/1.40

4/1.60

2.90

34

Why Do a Competitive

Strength Assessment ?

Reveals firm’s competitive position

Pinpoints the company’s competitive strengths and weaknesses

Identifies competitive advantage, parity, or disadvantage

Identifies possible offensive attacks

Identifies possible defensive actions

35