here

advertisement

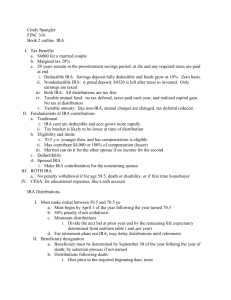

Creating Private Investments Using Qualified/IRA Funds Presentation at Union League Club, Entrepreneur Group & Real Estate Group David Lynam, Principal, Lynam & Associates Introduction Self directed IRAs have proven to be a powerful investment tool for many investors. While they aren’t for everyone, they are an excellent tool for individuals who have profitable investment opportunities in non-traditional investments. Self directed IRAs allow for greater control and enable an individual to invest into assets they know. IRA/LLC Investment Structure IRA invests into a newly created limited liability company (LLC) IRA owner cannot use an existing LLC that they personally own IRA owns membership units in the LLC IRA/LLC is subject to the prohibited transaction/self dealing rules LLC buys real estate (or other asset) Benefits of IRA/LLC Investment Structure Protects IRA owner, IRA & custodian from liabilities and claims arising from assets inside the LLC Important for: Rental real estate Real estate rehab projects Other investments which can create potential liability Ex., slip-and-fall accident at rental property the injured party would be forced to sue the IRA/LLC but could not sue the IRA, the IRA owner, or the custodian of the IRA. State and federal bankruptcy laws ONLY protect IRA from creditors of IRA owner Checkbook control Establishing IRA/LLC 1. Engage an experienced attorney to prepare the IRA/ LLC documents and provide a written opinion as to the legality of the IRA/ LLC. 1. Required by most self directed IRA custodians 2. Some custodians also require an attorney or CPA to be listed as a designated advisor to the IRA owner with regard to prohibited transactions and operational compliance 2. Appropriately plan for the investments the IRA/ LLC intends to undertake. 3. Decide which state to establish the IRA/ LLC 4. 1. Where does the IRA owner reside? 2. Where does the IRA owner intend to acquire assets? Verify that your self directed IRA custodian will allow you as the IRA owner to serve as manager of the IRA/ LLC, or whether an independent manager is preferable Establishing IRA/LLC 5. Appropriately plan for who the owners of the IRA/LLC will be 1. 6. Best to determine upon setup and formation of IRA/LLC Complete set of LLC documents 1. Articles of organization w/IRA as member & owner as manager 2. Operating agreement tailored to IRA being a member 3. Tax ID or EIN with IRA as owner 4. Subscription document and agreement (optional) 5. Buy direction letter 6. Opinion letter or designated advisor agreement IRA/LLC & the Prohibited Transaction Rules Who an IRA cannot transact with, IRC § 4975 IRA holder and his/her spouse Lineal ascendants (parents, grandparents, etc) Lineal descendants (children, grandchildren & their spouses) Any entity in which any disqualified parties have 50% or more interest You cannot buy, sell, lease, or exchange property you currently own to your IRA (or vice versa) You cannot stay, vacation, or personally use an IRA-owned property You cannot personally extend credit to the IRA (or vice versa) You cannot personally provide goods or services to the IRA (or vice versa) You cannot receive ANY consideration as a result of the IRA (or vice versa) IRA/LLC & the Prohibited Transaction Rules A prohibited transaction could occur: During the creation of the LLC In the change of ownership In the management of the IRA/ LLC, or In the investments or transactions that the IRA/ LLC enters into Repetto, et al v. Commissioner, T.C.M. 2012-168 (U.S. Tax Ct. 2012) 3 Types of Prohibited Transactions Per Se Prohibited Transactions When IRA engages in a transaction with a disqualified person Dealings vs. transactions Extension of Credit Prohibited Transactions IRA debts cannot be secured, guaranteed, or extended from the personal assets of the IRA owner Self-Dealing (Conflict of Interest) Prohibited Transactions CATCH ALL When disqualified person benefits from IRA’s investment Ellis v. Commissioner, T.C.M. 2013-245 (2013) IRA acquired 98% of newly established LLC that was owned 2% by unrelated person and was in the business of buying and selling cars IRA owner was actively involved and paid as the general manager of IRA/LLC (1) Prohibited transaction when the IRA bought LLC ownership? NO Tax Court: …IRA’s purchase of the initial LLC membership interest was not a prohibited transaction because it’s analogous to when an IRA acquires initial shares of new corporation RULE: IRA can acquire substantially all or all of the initial membership interest of an LLC in exchange for a cash investment. (2) Self dealing when IRA owner was paid compensation to manage IRA/LLC? YES Tax Court: payments were not for management of the IRA but for management of the IRA/LLC and its business activities; prohibited transaction resulted in termination of IRA and distribution of 100% resulting in taxable income and penalties RULE: prohibited transaction to pay IRA owner compensation for managing the IRA/LLC IRA Owner or Disqualified Person as Manager In the basic IRA/ LLC structure: IRA is the 100% owner/member of the LLC IRA owner is manager The payment of salary to the IRA owner, even indirectly by an IRA owned LLC, is a prohibited transaction. The plain language of the reasonable compensation exemption to the prohibited transaction rules found in IRC § 4975 (d)( 10) is that the exemptions apply to all prohibited transactions including self dealing and per se prohibited transactions. The IRS and the Tax Court, however, seem to view the matter differently and have taken the position that any compensation, whether reasonable or not, from the IRA/ LLC to the IRA owner results in a prohibited transaction. LLC documents must include a restriction We recommend an independent manager when possible IRA Owner or Disqualified Person as Manager If necessary to use disqualified person, should restrict extent of services provided Only administrative and investment oversight functions: Signing contracts or agreements as manager of the IRA/ LLC Paying bills, receiving income, and signing checks as the manager of the IRA/ LLC business bank account Making decisions as to investments, expenses, tenants, vendors, employees, contractors, and other business activities Should NOT provide services that would result in a contribution of value Example: IRA/ LLC owns property that is being renovated. If the IRA owner does the physical work to remodel the kitchen, then such work could be deemed a contribution of value from the IRA owner to the IRA. Contributions are governed by IRC § 408(a)(1) which states that “… no contribution will be accepted unless it is in cash….” A contribution other than cash is considered an excess contribution and is subject to penalties. We recommend an independent manager when possible Why do we care about prohibited transactions? If prohibited transaction was caused by IRA owner: Disqualification of the IRA and distribution of the entire account taxes and/or penalties Accuracy related penalty on gains earned by IRA assets AFTER the prohibited transaction If prohibited transaction was caused by party other than IRA owner: Initial excise tax of 15% on the amount involved (to be paid by the disqualified person) Additional tax of up to 100% on the amount involved if the prohibited transaction is not corrected within the taxable period or within 90 days after the IRS mails the notice of deficiency Prohibited transactions in a 401( k) or other qualified plan: 15% penalty on the amount involved Potential 100% penalty if the prohibited transaction is not corrected Why do we care about prohibited transactions? The statute of limitations may be 3 years, 6 years, or unlimited 3 years after tax return disclosing the prohibited transaction; IRS Form 5329 (transaction w/owner or other fiduciary) or IRS Form 5330 (not a fiduciary) to declare prohibited transaction and pay applicable taxes and penalties SOL extended up to 6 years when there was a substantial omission from the return that related to the prohibited transaction Since the filing of IRS Form 5329 rarely happens, the legal statute-of-limitations for most prohibited transactions is indefinite. Indefinite SOL when false return, a willful attempt to evade tax, or no return IRA/LLC Tax Reporting & Maintenance 1 IRA single-member LLC disregarded for tax purposes IRS Pub 3402 (2012) and Tres. Regs. § 301.7701-3 IRA/LLC does not need to file a federal tax return Multiple IRAs federal partnership tax return Annual Requirements: State registration Asset Valuation Income and expense records (in case of audit) Minutes IRA/LLC & Non-Recourse Loans An IRA/ LLC can obtain a nonrecourse loan The same nonrecourse loan restrictions apply to the IRA/ LLC as apply to the IRA Unrelated debt financed income tax (UDFI) is also applied in the same ways Most major loan programs offered to self directed IRAs have the same terms and funding requirements when an IRA/ LLC is used instead of an IRA. Additional Investments from Wife’s IRA to LLC? Question: If I set up an IRA/LLC now with my IRA owning 100% of the IRA/LLC, can my wife’s IRA later invest into that same IRA/LLC? A. No, the transfer of ownership from your IRA to your wife’s IRA would be a prohibited transaction. It is possible to have each IRA invest at the formation of the IRA/LLC and to take ownership at formation according to the amounts invested from each IRA (rather than it transferring from one to the other). The Multi-Member IRA/LLC Investment Structure Benefit = Multiple IRAs or individual investors can pool investment capital Must be properly established and administered Federal partnership tax return (US 1065) must be filed annually Ownership Allocation should be based on the amount of $$$ invested Do NOT allocate for services or for “finding the deal” IRA must receive same % per $ as an individual investor Do NOT special allocate profits and losses b/t IRA and disqualified person Additional Investments into the LLC? DOL Advisory Opinion 2003-15A Numerous Verizon retirement plans were invested into a company and owned various portions of ownership Question: Whether additional contributions and distributions between the company and the different retirement plans would result in a prohibited transaction. “transactions between the Verizon Plans [retirement plans] and the CIV [company, e.g. IRA/ LLC], including the initial and subsequent contributions to the CIV by the Verizon Plans and distributions from the CIV to the Verizon Plans, would not be prohibited under section 406( a) of ERISA [or under IRC § 4975]. While this specific factual scenario was discussed under ERISA, the rules under ERISA are nearly identical to the rules for IRAs under IRC § 4975, and the DOL stated in its opinion that its opinion should be read with the same effect under IRC § 4975. Additional contributions must be pro-rata Prohibited transaction where ownership changes b/t a disqualified person and an IRA Cash Deal from Multiple IRAs Bob & Emily both open self-directed IRAs Bob transfers $50k from another IRA Emily transfers $50k from another IRA Bob & Emily create a new limited liability company (LLC) Cannot use an existing LLC that either of them personally own IRAs contribute $$$ for LLC interests LLC is owned by both IRAs LLC buys property LLC manages property, collect income, pays expenses IRA/LLC Do’s Provide Annual Valuations to the custodian Make distributions from LLC pro-rata according to ownership %s Perform rigorous due diligence on investments in which LLC intends to invest Set up separate bank account and maintain separate bookkeeping Unless your Company is a “Single-Member-LLC,” file your annual partnership tax return for the Company (Form 1065) Report any UBTI or UDFI that arises from the operations of your Company (reported on Form 990 for IRAs and form 5500 for 401(k)s. Update your Beneficiary Designation forms with the custodian Consult with your CPA or Attorney for your specific situation in order to avoid prohibited transactions or unintended tax consequences Checklist: IRAs and Real Estate Is the contract and deed/title in the IRA’s name? Did the IRA custodian sign the contract and legal agreements for the IRA, or, where applicable, did the manager of the IRA/ LLC sign them? Did the IRA owner refrain from using personal expenses in purchasing and maintaining the property? If the IRA obtained a loan to purchase the property, was the loan nonrecourse, and is the IRA owner aware of possible UDFI taxes on any net profits from the debt? Is the IRA custodian, the property manager, or a properly established IRA/ LLC, receiving the rental income and paying the expenses for the property? Does the IRA have sufficient capital available to cover an unexpected property expense? Is the IRA owner holding the property for investment, and are the IRA owner and other disqualified persons avoiding personal use or benefit from the property? Was the broker or agent in the transaction (when applicable) a non-disqualified person? Did the IRA owner refrain from personally benefitting from the IRA’s purchase? UDFI (unrelated debt financed income) Tax/ UBIT (unrelated business income tax) Tax on investments in trade or business Does not apply to dividends, interest, royalties, or capital gains Exclusive Benefit Rule The Exclusive Benefit Rule requires that all investments from a retirement account be made for the benefit of the retirement account. IRC § 408( a) IRA investments must be made at fair market value at the time of the investment. Special consideration or unfair terms for the IRA will violate the exclusivebenefit rule. A fair return commensurate with the prevailing rate must be provided. At arm’s length Step Transaction Doctrine The prohibited transaction rules cannot be avoided by using a “straw person” in the middle of a transaction between a disqualified person and an IRA. These arrangements violate the step transaction doctrine. When the extra step is being created and implemented solely to defeat the tax code and serves no other economic purpose in the transaction. In Conclusion Self directed IRAs are a powerful investment tool for investors with profitable investment opportunities in non-traditional investments. High-profile figures have built significant IRA holdings by making self directed IRA investments Ex. Mitt Romney, former CEO of Bain Capital and Presidential Candidate Invested his IRA into early stage or turn-around private businesses that were not publically traded His non-traditional IRA value was reported in 2012 at $20 to 100 million Questions? Union League Club of Chicago, Entrepreneur Group & Real Estate Group David Lynam, Principal, Lynam & Associates