Relevant costs and revenues

advertisement

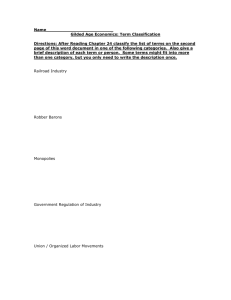

Relevant costs and revenues How to identify relevant information in an “sea” of information. What product costs are relevant? Kinds of decisions • • • • • Purchase of new equipment Special orders Dropping/adding a product line Dropping/adding a segment Make or buy Important information characteristics • Accurate • Timely • Relevant What is relevant information? Relevant information differs across decision alternatives. Relevant costs are avoidable (escapable ) costs. All costs are considered avoidable except: Sunk costs Costs that don’t differ across decision alternatives Sunk costs • Basketball tickets • Tickets to the theater • Investments in business projects Other cost concepts • Outlay costs • Opportunity costs Steps in the decision process • Define the objective and determine the decision criterion • Identify the potential courses of action • Assemble all of the costs associated with each alternative under consideration • Eliminate the costs that are sunk • Eliminate the costs that do not differ across alternatives • Make a decision based on the remaining costs Village Pizza Village Pizza’s owner bought his current pizza oven two years ago for $9000, and it has one more year of life remaining. He is using straight-line depreciation for the oven. He could purchase a new oven for $1900, but it would last only one year. The owner figures the new oven would save him $2600 in annual operating costs. Consequently he has decided against buying the new oven, since doing so would result in a loss of $400 over the next year. Village Pizza How do you suppose the owner came up with $400 as the loss for the next year if the new pizza oven were purchased? Explain. Village Pizza What is wrong with the owner’s analysis? Provide a correct analysis. Special orders • Should production be increased to produce the special order? • Yes, if the change in revenues exceeds the change in costs. • Does the company have excess capacity? • Will the increase in revenues exceed out-of-pocket costs? • Are there strategic issues not captured by the financial analysis? Interlaken Chemical Company Interlaken Chemical company recently received an order for a product it does not normally produce. Since the company has excess production capacity, management is considering accepting the order. Production of the special order would require 8000 kilograms of theolite. Interlaken does not use theolite for its regular product, but the firm has 8000 kilograms of the chemical on hand from the days when it used theolite regularly. The book value of the theolite is $2 per kilogram. The theolite could be sold to a chemical wholesaler for $14,500. Interlaken could buy theolite for $2.40 per kilogram. Interlaken Chemical Company • How would we normally solve this problem? – – – – Define the decision criterion Define the alternatives Assemble the costs: Product costs Eliminate those that are sunk or that do not differ across alternatives – Choose based on the remaining costs Interlaken Chemical Company • For this problem, we’re working to assemble the costs. What is the relevant cost of the DM theolite? Interlaken Chemical Company • Interlaken’s special order also requires 1,000 kilograms of genatope, a solid chemical regularly used in the company’s products. The current stock of genatope is 8,000 kilograms with a book value of $8.10 per kilogram. • If the special order is accepted, the firm will be forced to restock genatope earlier than expected, at a predicted cost of $8.70 per kilogram. Without the special order, the purchasing manager predicts that the price will be $8.30, when normal restocking takes place. Any order of genatope must be in the amount of 5,000 kilograms. Interlaken Chemical Company • What is the relevant cost of genatope? Mr. Smith’s trip home • Mr. Smith purchased a round trip airline ticket from Durham, NC, to St. Louis, MO. He flew to St. Louis on Monday and planned to return on Friday. Unknown to him, the corporate jet also made the trip to St. Louis this week and was scheduled to return on Friday. Mr. Smith thought he might as well save the company some money, so he cashed in his return ticket and flew home on the corporate jet. Did he make the correct decision? – Was the cost of flying the corporate jet from St. Louis to Durham relevant? – Was the cost of the one-way commercial flight relevant? – What would shareholders want Mr. Smith to do? Mr. Smith’s trip home Mr. Smith is a manager in his company and he is evaluated based on his division’s profit. When Mr. Smith received his divisional income statement for the month, he discovered he had been charged more than twice the cost of the commercial airline ticket for his trip on the corporate jet. Mr. Smith called Accounting to question the charge and was told that passengers were always allocated a share of the cost of the trip. Mr. Smith was charged the same amount as the Vice President who ordered the trip. Did he make the correct decision? Bonner Company: make or buy A vendor has offered to supply a component for $19 (FOB destination) that has previously been manufactured internally. Should Bonner make or buy? Per unit 8000 units DM $6 $48,000 DL 4 32,000 Variable overhead 1 8,000 Supervisor’s salary 3 24,000 Depreciation of spec. equip. 2 16,000 Allocated general overhead 5 40,000 Total cost $21 $168,000 Bonner Company: make or buy • Suppose the firm can use the space freed up if they do not manufacture to produce another product that will contribute $60,000. Should they make or buy? Xyon Company: make or buy Xyon Co. has purchased 10,000 pumps annually from Kobec, Inc. Because the price keeps increasing and reached $68 per unit last year, Xyon’s management has asked for an estimate of the cost of manufacturing the pump in Xyon’s own facilities. Xyon makes stampings and castings and has little experience with products requiring assembly. The engineering, manufacturing, and accounting departments have prepared a report for management which includes the estimate shown (next slide) for an assembly run of 10,000 pumps. Additional production employees would be hired to manufacture the pumps, but no additional equipment, space or supervision would be needed. Xyon Company: make or buy • The report states that total costs for 10,000 units are estimated at $957,000 or $95.70 per unit. The current purchase price is $68 a unit, so the report recommends continued purchase of the product. Components $120,000 Assembly labor* 300,000 Manufacturing overhead** 450,000 General and admin. Overhead*** 87,000 Total costs $957,000 *Assembly labor consists of hourly production workers **Mfg O/H is applied to products on a DL$ basis. VOH is 50%. FOH is 100% ***General and admin. is 10% of other costs. Xyon Company: make or buy • Should Xyon make or buy? What is the cost to make? To buy? Leland Mfg: make or buy Leland Mfg. Company uses 10 units of part KJ37 each month in the production of radar equipment. The cost of manufacturing one unit of KJ37 is the following: Direct material $1,000 Material handling (20% of DM$) 200 Direct labor 8,000 Manufacturing overhead (150% of DL$) 12,000 Total cost $21,200 Material handling represents the direct variable costs of the Receiving Dept. that are applied to direct materials and purchased components on the basis of their cost. Leland Mfg.: make or buy Leland’s annual manufacturing overhead budget is one-third variable and two-thirds fixed. Scott Supply, one of Leland’s reliable vendors, has offered to supply part number KJ37 at a unit price of $15,000. 1. If Leland purchases the KJ37 units from Scott, the capacity Leland used to mfg. these parts would be idle. Should Leland decide to purchase the parts from Scott, the unit cost of KJ37 would increase (decrease) by what amount? Leland Mfg.: make or buy Leland Mfg.: make or buy • Assume Leland Manufacturing is able to rent out all of its idle capacity for $25,000 per month. If Leland decides to purchase the 10 units from Scott Supply, Leland’s monthly cost for KJ37 would increase (decrease) by what amount? Leland Mfg.: make or buy • Assume that Leland Mfg. Does not wish to commit to a rental agreement but could use its idle capacity to manufacture another product that would contribute $52,000 per month. If Leland elects to manufacture KJ37 in order to maintain quality control, what is the net amount of Leland’s cost from using the space to manufacture part KJ37. Chemung: Closing a department • What is relevant? – Division contribution - not division profit – Traceable fixed costs – Contribution margin - traceable fixed costs = division contribution Chemung: closing a department Chemung Metals Co. is considering the elimination of its Packaging Dept. Management has received an offer from an outside firm to supply all Chemung’s packaging needs. To help her in making the decision, Chemung’s president has asked the controller for an analysis of the cost of running Chemung’s Packaging Dept. Included in that analysis is $9,100 of rent, which represents the Packaging Dept.’s allocation of the rent on Chemung’s factory. If the Packaging Dept. is eliminated, the space it used will be converted to storage space. Currently, Chemung rents storage space in a nearby warehouse for $11,000 per year. The warehouse rental would no longer be necessary if the Packaging Dept. were eliminated. Chemung: closing a department • What is the relevant cost of the space that will be freed up if Chemung closes the dept.? • If Chemung closes its packaging department, the department manager will be appointed manager of the Cutting Dept. The packaging department manager makes $45,000 per year. To hire a new Cutting Dept. manager will cost $60,000 per year. • Is the $45,000 salary relevant? • Is the $60,000 salary relevant? Day Street Deli: dropping a product Day Street Deli’s owner is disturbed by the poor profit performance of his ice cream counter. He has prepared the following profit analysis. Sales $45,000 Less: Cost of food 20,000 Gross profit 25,000 Less: Operating expenses Wages of counter personnel 12,000 Paper products 4,000 Utilities (allocated) 2,900 Depr. Of counter equip. 2,500 Depr. Of bldg. (allocated) 4,000 Deli manager’s salary 3,000 Loss on ice cream counter $(3,400) Day Street Deli: dropping a product Criticize the owner’s analysis Thursday • Hanson Manufacturing case. • What would happen to income if product 103 were dropped? Hanson would lose 103 contribution. • Also look at the effect of the price change on total contribution. Group work • Answer Super Clean and hand in your solution.