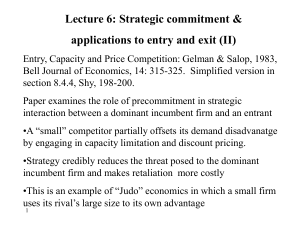

Powerpoint: Game Theory Fundamentals and Applications

advertisement

Game Theory 1 Game Theory Definition The study of strategic decision making. More formally, it is the study of mathematical models of conflict and cooperation between intelligent rational decision-makers. Game Theory is used to analyze how firms interact but has many other applications. 2 Other Applications of Game Theory National Defense – Terrorism and Cold War Movie Release Dates and Program Scheduling Auctions http://en.wikipedia.org/wiki/Spectrum_auction http://en.wikipedia.org/wiki/United_States_2008_wireless_spectrum_auction Sports – Cards, Cycling, and race car driving Politics – positions taken and $$/time spent on campaigning Nanny Monitoring Group of Birds Feeding Mating Habits 3 Grey’s Anatomy vs. The Donald NBC delays 'Apprentice' premiere By Nellie Andreeva NBC is taking the premiere of "Celebrity Apprentice" out of the cross-hairs of the last original episode of ABC's "Grey's Anatomy"... or so it seems. NBC on Wednesday said that it will push the launch of "Apprentice" from Jan. 3 to Jan. 10, expanding "Deal or No Deal" to two hours on Thursday, Jan. 3. The move follows ABC's midseason schedule announcement Friday that included the last original episode of "Grey's" airing Jan. 3,… 4 Grey’s Anatomy vs. The Donald 'Grey' move has NBC red Peacock shifts 'Apprentice' back By Nellie Andreeva The Thursday night scheduling tango between NBC and ABC continued Thursday morning when ABC officially announced that it will move the last original episode of "Grey's Anatomy" from Jan. 3 to Jan. 10. That led to a reversal in NBC's Wednesday decision to push the premiere of "Celebrity Apprentice" from Jan. 3 toJan. 10 to avoid the first-run "Grey's." NBC said Thursday afternoon that "Apprentice," hosted by Donald Trump, will now launch Jan. 3 as originally planned. 5 Game Theory and Movie Release Dates The Imperfect Science of Release Dates New York Times On Dec. 25, which this year happens to be a Thursday, five new movies will be released in theaters -- six, if you count a new Disney IMAX film called ''Young Black Stallion.'' As with the Fourth of July and Thanksgiving, there is a special cachet to opening a film on Christmas Day…. The casual moviegoer rarely ponders why a particular bubbly romantic comedy, serialkiller thriller, literary costume drama or animated talking-farmanimals movie opens on the day it does. Movies come; movies go; movies wind up on video. To those responsible for putting those films on the screen, however, nothing about the timing of their releases is arbitrary. 6 Game Theory and Movie Release Dates (cont.) Last December featured one of the most dramatic games of chicken in recent memory, when two films starring Leonardo DiCaprio were both slated to open on Christmas weekend. Ultimately, Miramax blinked first, moving the release of Martin Scorsese's ''Gangs of New York'' five days earlier and ceding the holiday to the other DiCaprio film, DreamWorks' ''Catch Me if You Can.'' ''We didn't think about moving,'' says Terry Press, the head of marketing for DreamWorks. ''We had been there first, and 'Catch Me if You Can' was perfect for that date.'' This year, DreamWorks chose to schedule a somber psychological drama, ''House of Sand and Fog,'' for the day after Christmas, deferring a bit to Miramax. ''I don't want our reviews to run on the same day as 'Cold Mountain,''' Press says. Ever wonder why a movie theater shows a preview of an 7 upcoming movie that is to be released in 2 years? Other Applications of Game Theory National Defense – Terrorism and Cold War Movie Release Dates and Program Scheduling Auctions http://en.wikipedia.org/wiki/Spectrum_auction http://en.wikipedia.org/wiki/United_States_2008_wireless_spectrum_auction Sports – Cards, Cycling, and race car driving Politics – positions taken and $$/time spent on campaigning Nanny Monitoring Group of Birds Feeding Mating Habits Parenting 8 Game Theory Secrets for Parents Wall Street Journal July, 2014 The party is over, and you're down to the last bit of cake. All three of your children want it. If you're familiar with game theory, you might think of the classic strategy in which one person cuts the cake and the other chooses the slice. But how do you divide it three ways without anyone throwing a fit? Game theory is, in essence, the science of strategic thinking—a way of making the best decision possible based on the way you expect other people to act. It was once the domain of Nobel Prize-winning economists and big thinkers on geopolitics, but now parents are getting in on the act. Though game theory assumes, as a technical matter, that its players are rational, it applies just as well to not-always-rational children. A key lesson in game theory, says Barry Nalebuff, a professor at the Yale School of Management, is to understand the perspective of the other players. It isn't about what you would do in another person's shoes, he says; it's about what they would do in their shoes. "Good game theory," he says, "appreciates the quirks and features that make us unique and takes us as we are." The same could be said of good parenting. So how to deal with the problem of dividing a piece of cake into three equal shares? Try this: After the first child cuts and the second one chooses, each child further cuts his or her own slice into thirds. The third child then chooses a third of a slice from each plate. It might get messy, but all three should feel fairly treated. 9 Game Theory Secrets for Parents Wall Street Journal July, 2014 Credible Punishments: In game theory as in parenting, you have to deliver on your threats, like actually turning off the TV if you said you were going to, even if it punishes you too. Joshua Gans, an economist at the University of Toronto and the author of "Parentonomics," offers advice for gaining a credible reputation at home. When his children were young and would disobey, he would say, "I'm thinking of a punishment." It's much easier to pretend to think of a punishment than to come up with a new one every time, he notes—or, worse, to issue a noncredible threat in the heat of the moment. ("That's it, I'm canceling Christmas!") Once he earned his credibility, he found that he had only to close his eyes and count to 10, and his children would spring into action. The Bedtime Ultimatum: For shortening the bedtime routine with several children to tuck in, one parent advises using an ultimatum game of take-it-or-leave-it. Before bed, just have the children play rocks, paper, scissors and allow the winning child to choose the book. If the others don't agree with the choice, no one gets a story. Sleep Training 101: Game theory can work from the earliest days of parenthood. Prof. Nalebuff applies the concept of backward induction to help new mothers get some sleep. If a mother repeatedly gets up in the middle of the night with the child, he explains, eventually the child will only respond to the mother comforting him. Instead, mothers should look forward and reason backward: If you ever want your husband to get up in the middle of the night, then you have to get him involved at the very start. Everyone, it seems, needs to be sleep trained. 10 Game Theory Terminology Simultaneous Move Game – Game in which each player makes decisions without knowledge of the other players’ decisions (ex. Cournot or Bertrand Oligopoly). Sequential Move Game – Game in which one player makes a move after observing the other player’s move (ex. Stackelberg Oligopoly). 11 Game Theory Terminology Strategy – In game theory, a decision rule that describes the actions a player will take at each decision point. Normal Form Game – A representation of a game indicating the players, their possible strategies, and the payoffs resulting from alternative strategies. 12 Example 1: Prisoner’s Dilemma (Normal Form of Simultaneous Move Game) Martha’s options Don’t Confess Peter’s Don’t Confess Options Confess Confess M: 2 years P: 2 years M: 1 year P: 10 years M: 10 years P: 1 year M: 6 years P: 6 years What is Peter’s best option if Martha doesn’t confess? Confess (1<2) What is Peter’s best option if Martha confess? 13 Confess (6<10) Example 1: Prisoner’s Dilemma Martha’s options Don’t Confess Peter’s Don’t Confess Options Confess Confess M: 2 years P: 2 years M: 1 year P: 10 years M: 10 years P: 1 year M: 6 years P: 6 years What is Martha’s best option if Peter doesn’t confess? Confess (1<2) 14 What is Martha’s best option if Peter Confesses? Confess (6<10) Example 1: Prisoner’s Dilemma Martha’s options First Payoff in each “Box” is Row Player’s Payoff . Don’t Confess Confess Peter’s Don’t Confess 2 years , 2 years 10 years , 1 year Options Confess 1 year , 10 years 6 years , 6 years Dominant Strategy – A strategy that results in the highest payoff to a player regardless of the opponent’s action. 15 Example 2: Price Setting Game Firm B’s options Firm A’s Options Low Price High Price Low Price 0,0 50 , -10 High Price -10 , 50 10 , 10 Is there a dominant strategy for Firm B?Low Price Is there a dominant strategy for Firm A? Low Price 16 Nash Equilibrium A condition describing a set of strategies in which no player can improve her payoff by unilaterally changing her own strategy, given the other player’s strategy. (Every player is doing the best they possibly can given the other player’s strategy.) 17 Example 1: Nash? Martha’s options Don’t Confess Confess Peter’s Don’t Confess 2 years , 2 years 10 years , 1 year Options Confess 1 year , 10 years 6 years , 6 years Nash Equilibrium: (Confess, Confess) 18 Example 2: Nash? Firm B’s options Firm A’s Options Low Price High Price Low Price 0,0 50 , -10 High Price -10 , 50 10 , 10 Nash Equilibrium: (Low Price, Low Price) 19 Chump, Chump, Chump http://videosift.com/video/Game-Theory-in-BritishGame-Show-is-Tense?loadcomm=1 20 EXAMPLE 3: Entry into a fast food market: Is there a Nash Equilibrium(ia)? Yes, there are 2 – (Enter, Burger King’s options Don’t Enter) and (Don’t Enter, Enter). Implies, no Enter Don’t Enter need for a dominant Skaneateles Skaneateles strategy to have NE. McDonalds’ Enter Skaneateles Options Don’t Enter Skaneateles PBK = -40 PM = -30 PBK = 0 PM = 50 PBK = 40 PM = 0 PBK = 0 PM = 0 Is there a dominant strategy for BK? NO Is there a dominant strategy for McD? NO 21 EXAMPLE 4: Monitoring Workers Is there a Nash Equilibrium(ia)? Not a pure strategy Nash Equilibrium– Worker’s1 options player chooses to take one action with probability Randomize the actions yields a Nash = mixed strategy John Nash proved an equilibrium alwaysShirk exists Work Manager’s Monitor Options Don’t Monitor W: 1 M: -1 W: -1 M: 1 W: -1 M: 1 W: 1 M: -1 Is there a dominant strategy for the worker? NO Is there a dominant strategy for the manager? NO 22 Mixed (randomized) Strategy Definition: A strategy whereby a player randomizes over two or more available actions in order to keep rivals from being able to predict his or her actions. 23 Calculating Mixed Strategy EXAMPLE 4: Monitoring Workers Manager randomizes (i.e. monitors with probability PM) in such a way to make the worker indifferent between working and shirking. Worker randomizes (i.e. works with probability Pw) in such a way as to make the manager indifferent between monitoring and not monitoring. 24 Example 4: Mixed Strategy Worker’s options Work Shirk PW Manager’s Monitor Options PM Don’t Monitor 1-PM 1-PW W: 1 M: -1 W: -1 M: 1 W: -1 M: 1 W: 1 M: -1 25 Manager selects PM to make Worker indifferent between working and shirking (i.e., same expected payoff) Worker’s expected payoff from working PM*(1)+(1- PM)*(-1) = -1+2*PM Worker’s expected payoff from shirking PM*(-1)+(1- PM)*(1) = 1-2*PM Worker’s expected payoff the same from working and shirking if PM=.5. This expected payoff is 0 (-1+2*.5=0 and 1-2*.5=0). Therefore, worker’s best response is to either work or shirk or randomize between working 26 and shirking. Worker selects PW to make Manager indifferent between monitoring and not monitoring. Manager’s expected payoff from monitoring PW*(-1)+(1- PW)*(1) = 1-2*PW Manager’s expected payoff from not monitoring PW*(1)+(1- PW)*(-1) = -1+2*PW Manager’s expected payoff the same from monitoring and not monitoring if PW=.5. Therefore, the manager’s best response is to either monitor or not monitor or randomize between monitoring or not monitoring . 27 Nash Equilibrium of Example 4 Worker works with probability .5 and shirks with probability .5 (i.e., PW=.5) Manager monitors with probability .5 and doesn’t monitor with probability .5 (i.e., PM=.5) Neither the Worker nor the Manager can increase their expected payoff by playing some other strategy (expected payoff for both is zero). They are both playing a best response to the other player’s strategy. 28 Example 4A: What if costs of Monitoring decreases and Changes the Payoffs for Manager Worker’s options Manager’s Monitor Options Don’t Monitor Work Shirk W: 1 M: -1 W: -1 M: 1 1.5 W: -1 M: 1 -.5 W: 1 M: -1 29 Nash Equilibrium of Example 4A where cost of monitoring decreased Worker works with probability .625 and shirks with probability .375 (i.e., PW=.625) Same as in Ex. 5, Manager monitors with probability .5 and doesn’t monitor with probability .5 (i.e., PM=.5) The decrease in monitoring costs does not change the probability that the manager monitors. However, it increases the probability that the worker works. 30 Example 5: Mixed Strategy and Tennis http://www.fuzzyyellowballs.com/introducing-the-fyb-strategy-quiz/ Game: Server’s Possible Strategies: (Serve Left , Serve Right) Receiver’s Possible Strategies: (Defend Left , Defend Right) Receiver has a high probability of winning the point if she defends the side the server serves to. 31 Example 5: Mixed Strategy and Tennis (Payoffs are probability of winning point) Receiver Server Serve Left Defend Left Defend Right DL 1-DL .6 , .4 .75 , .25 .7 , .3 .55 , .45 SL Serve Right 1-SL Mixed Strategy Equilibrium (SL =.5 , DL =.67) This results in the probability of the server winning the point to be .65 irrespective of whether he serves to the left or right. 32 Example 5: Mixed Strategy and Tennis What about the Real World? Minimax Play at Wimbleton Walker and Wooders (AER 2001) http://www.finance.uts.edu.au/staff/johnwooders/WimbledonAER.pdf “We use data from classic professional tennis matches to provide an empirical test of the theory of mixed strategy equilibrium. We find that the serveand-return play of John McEnroe, Bjorn Borg, Boris Becker, Pete Sampras and others is consistent with equilibrium play.” Results: Probability Server wins is the same whether serve right or left. Which side server serves is not “serially independent”. 33 Example 6 A Beautiful Mind http://www.youtube.com/watch?v=CemLiSI5ox8 34 Example 6: A Beautiful Mind Other Student’s Options Pursue Blond John Nash’s Pursue Blond Options Pursue Pursue Brunnette 1 Brunnette 2 0,0 100 , 50 100 , 50 Pursue Brunnette 1 50 , 100 0,0 50 , 50 Pursue Brunnette 2 50 , 100 50 , 50 0,0 Nash Equilibria: (Pursue Blond, Pursue Brunnette 1) (Pursue Blond, Pursue Brunnette 2) (Pursue Brunnette 1, Pursue Blond) (Pursue Brunnette 2, Pursue Blond) 35 Sequential/Multi-Stage Games Extensive form game: A representation of a game that summarizes the players, the information available to them at each stage, the strategies available to them, the sequence of moves, and the payoffs resulting from alternative strategies. (Often used to depict games with sequential play.) 36 Example 7 Potential Entrant Don’t Enter Enter Incumbent Firm Potential Entrant: 0 Incumbent: +10 Price War (Hard) Potential Entrant: Incumbent: -1 +1 Share Market (Soft) +5 +5 37 Example 7: With “Downstream” Actions Potential Entrant Don’t Enter Incumbent Firm Enter Potential Entrant PIM1 PE1 Incumbent Firm Incumbent Firm PIM2 and so on…. Suppose each period the incumbent sets the optimal price as a monopolist and maximizes the present discounted value of profits which is +10. PID1 Potential Entrant PE2 The present discounted value of profits for the incumbent and potential entrant depends on their strategies. and so on…. 38 Example 7 Potential Entrant Don’t Enter Enter Incumbent Firm Potential Entrant: 0 Incumbent: +10 Price War (Hard) Potential Entrant: Incumbent: Share Market (Soft) -1 +1 What are the Nash Equilibria? +5 +5 39 Nash Equilibria 1. (Potential Entrant Enter, Incumbent Firm Shares Market) 2. (Potential Entrant Don’t Enter, Incumbent Firm Price War) Is one of the Nash Equilibrium more likely to occur? Why? Perhaps (Enter, Share Market) because it doesn’t rely on a noncredible threat. 40 Subgame Perfect Equilibrium A condition describing a set of strategies that constitutes a Nash Equilibrium and allows no player to improve his own payoff at any stage of the game by changing strategies. (Basically eliminates all Nash Equilibria that rely on a non-credible threat – like Don’t Enter, Price War in Prior Game) 41 Example 7 Potential Entrant Don’t Enter Enter Incumbent Firm Potential Entrant: 0 Incumbent: +10 Price War (Hard) Potential Entrant: Incumbent: Share Market (Soft) -1 +1 +5 +5 What is the Subgame Perfect Equilibrium? (Enter, Share Market) 42 Big Ten Burrito Example 8 Enter Don’t Enter Chipotle Enter BTB: -25 Chip: -50 Chipotle Don’t Enter Enter +40 0 0 +70 Don’t Enter 0 0 43 Big Ten Burrito Enter Don’t Enter Chipotle Enter BTB: -25 Chip: -50 Chipotle Don’t Enter Enter +40 0 0 +70 Don’t Enter 0 0 Use Backward Induction to Determine Subgame Perfect Equilibrium. 44 Subgame Perfect Equilibrium Chipotle should choose Don’t Enter if BTB chooses Enter and Chipotle should choose Enter if BTB chooses Don’t Enter. BTB should choose Enter given Chipotle’s strategy above. Subgame Perfect Equilibrium: (BTB chooses Enter, Chipotle chooses Don’t Enter if BTB chooses Enter and Enter if BTB chooses Don’t Enter.) 45 Example 9: Limit Pricing When a firm sets it price and output so that there is not enough demand left for another firm to enter the market profitably. 46 Incumbent (suppose monopolist) Example 9: Lower Price, PL Potential Entrant Monopoly Price, PM Don’t Enter Enter Potential Entrant Enter Incumbent Hard Ball PE: Inc: Soft Ball PL Don’t Enter Incumbent PM Hard Ball -1 +5 0 0 8+1 8+5 8+8 8+10 -1 10+1 Soft Ball +5 10+5 PL 0 10+8 PM 0 10+10 Note: Incumbent’s profits are $10 per period if set monopoly price and $8 per period if set lower price. What price the incumbent sets initially does not influence second period profits for incumbent or potential entrant. For simplicity, second period 47 payoffs are not discounted. Incumbent (suppose monopolist) Example 9: Lower Price, PL Potential Entrant Monopoly Price, PM Don’t Enter Enter Potential Entrant Enter Incumbent Hard Ball PE: Inc: Soft Ball PL Don’t Enter Incumbent PM Hard Ball -1 +5 0 0 8+1 8+5 8+8 8+10 -1 10+1 Soft Ball +5 10+5 PL 0 10+8 PM 0 10+10 Note: Incumbent’s profits are $10 per period if set monopoly price and $8 per period if set lower price. What price the incumbent sets initially does not influence second period profits for incumbent or potential entrant. For simplicity, second period 48 payoffs are not discounted. Incumbent (suppose monopolist) Example 9a: Lower Price, PL Potential Entrant Monopoly Price, PM Don’t Enter Enter Potential Entrant Enter Incumbent Hard Ball PE: Inc: Soft Ball PL Don’t Enter Incumbent PM Hard Ball -1 -.5 0 0 8+1 8+5 8+8 8+10 -1 10+1 Soft Ball -.5 10+5 PL 0 10+8 PM 0 10+10 Note: Incumbent’s profits are $10 per period if set monopoly price and $8 per period if set lower price. What price the incumbent sets initially does not influence second period profits for incumbent or potential entrant. For simplicity, second period 49 payoffs are not discounted. Incumbent (suppose monopolist) Example 9a: Lower Price, PL Potential Entrant Monopoly Price, PM Don’t Enter Enter Potential Entrant Enter Incumbent Hard Ball PE: Inc: Soft Ball PL Don’t Enter Incumbent PM Hard Ball -1 -.5 0 0 8+1 8+5 8+8 8+10 -1 10+1 Soft Ball -.5 10+5 PL 0 10+8 PM 0 10+10 Note: Incumbent’s profits are $10 per period if set monopoly price and $8 per period if set lower price. What price the incumbent sets initially does not influence second period profits for incumbent or potential entrant. For simplicity, second period 50 payoffs are not discounted. Questions: 1. 2. Can you think of examples where the price the incumbent sets the first period could influence second period profits of the incumbent and perhaps the entrant? Are there other actions the incumbent can take prior to the potential entrant’s entry decision that could influence this decision? (R&D, Capital Investment, Lobbying, etc.) 51 Predatory Pricing Definition: When a firm first lowers its price in order to drive rivals out of business (and scare off potential entrants), and then raises its price when its rivals exit the market. What insights does the analysis on limit pricing provide for the logic of predatory pricing? 52 Example 10: The Hold-Up Problem Dan Conlin Invest in Firm Specific Knowledge Don’t Invest Dan Conlin Dan Conlin and M&M and M&M negotiate negotiate salary salary Dan Conlin: wI-CI wDI Marsh&McClennan: 200-wI 150-wDI Let wI and wDI denote Dan’s wage if he invests and doesn’t invest in the firm specific knowledge, respectively. Let the cost of investing for Dan be CI and let CI=30. Dan Conlin is worth 200 to M&M if he invests and is worth 150 if he 53 doesn’t. Example 10: The Hold-Up Problem Dan Conlin Invest in Firm Specific Knowledge Dan Conlin and M&M negotiate salary Dan Conlin: wI-CI Marsh&McClennan: 200-wI Don’t Invest Dan Conlin and M&M negotiate salary wDI 150-wDI Assume that Dan’s best “outside option” is a wage of 100 whether or not he invests in the firm specific knowledge and that the outcome of the negotiations are such that Dan and 54 M&M split the surplus. This means that wI=150 and wDI=125. Example 10: The Hold-Up Problem Dan Conlin Invest in Firm Specific Knowledge Don’t Invest Dan Conlin Dan Conlin and M&M and M&M negotiate negotiate salary salary Dan Conlin: wI-CI=150-30 wDI=125 Marsh&McClennan: 200-wI =200-150 150-wDI=150-125 Subgame Perfect Equilibrium outcome has Dan Conlin not investing in the firm specific knowledge and receiving a wage of 125 even though the cost of the knowledge is 30 and it 55 increases his value to the firm by 50. Example 10: The Hold-Up Problem Dan Conlin Invest in Firm Specific Knowledge Don’t Invest Dan Conlin Dan Conlin and M&M and M&M negotiate negotiate salary salary Dan Conlin: wI-CI=150-30 wDI=125 Marsh&McClennan: 200-wI =200-150 150-wDI=150-125 What would you expect to happen in this case? Dan Conlin and M&M would divide cost of obtaining the knowledge. 56 Example 11: General Knowledge Investment Dan Conlin Invest in General Knowledge Don’t Invest Dan Conlin Dan Conlin and M&M and M&M negotiate negotiate salary salary Dan Conlin: wI-CI=160-30 wDI =125 Marsh&McClennan: 200-wI =200-160 150-wDI=150-125 Assume the game is as in the “hold-up” problem but that Dan’s best “outside option” is a wage of 120 if he invests in general knowledge and 100 if he does not. This means that 57 wI=160 and wDI=125 (assuming split surplus when negotiate). Example 11: General Knowledge Investment Dan Conlin Invest in General Knowledge Don’t Invest Dan Conlin Dan Conlin and M&M and M&M negotiate negotiate salary salary Dan Conlin: wI-CI=160-30 wDI =125 Marsh&McClennan: 200-wI =200-160 150-wDI=150-125 Subgame Perfect Equilibrium outcome has Dan Conlin investing in the general knowledge and receiving a wage of 160. 58 Example 12: Hold-up Problem (same idea as the Fisher Auto-body / GM situation) Suppose there are two players: a computer chip maker (MIPS) and a computer manufacturer (Silicon Graphics). Initially, MIPS decides whether or not to customize its chip (the quantity of which is normalized to one) for a specific manufacturing purpose of Silicon Graphics. The customization costs $75 to MIPS, but adds value of $100 to the chip only when it is used by Silicon Graphics . The value of customization is partially lost when the chip is sold to an alternative buyer, who is willing to pay $60. If MIPS decides not to customize the chip, it can sell a standardized chip to Silicon Graphics at a price of zero and Silicon Graphics earns a payoff of zero from using the chip. If MIPS customizes the chip, the two players enter into a bargaining game where Silicon Graphics makes a take-it-or-leave-it price offer to MIPS. In response to this, MIPS can either accept the offer (in which case the game ends) or reject it (in which case MIPS approaches an alternative buyer who pays $60). 59 Example 12: Hold-Up Problem MIPS Don’t Customize Customize Silicone Graphics 0 : MIPS 0 : Silicon Graphics Offer Price p MIPS Accept MIPS: p-75 Silicon Graphics: 100-p Reject 60-75= -15 0 Subgame Perfect Equilibrium – MIPS accepts price p if p>60. Silicone Graphics offers a price p=60. MIPS does not customize. The outcome of this game is that MIPS does not 60 customize even though there is a surplus of $25 to be gained. Is the Hold-Up Problem Applicable to other Situations? YES 1. 2. 3. 4. 5. Upstream Firm Investing in Specific Capital to produce input for Downstream Firm. Coal Mines located next to Power Plants. An academic buying a house before getting tenure or a big promotion. Taxing of Oil and Gas Lines by local jurisdictions. Multinational firms operating in foreign countries (Foreign Direct Investment) East Lansing Public Schools allocating a certain amount of money for capital expenditures and a certain amount for operating expenditures 61 Applying Game Theory to an Oligopoly Market Definition of an OligopolyA market structure in which there are only a few firms each of which is large relative to the total industry (results in strategic interaction). 62 Warning Due to the complexity involved in analyzing oligopolies and the differences across industries/markets, there is no single model that is relevant to all oligopolies. 63 Cournot Oligopoly Example 1. 2. 3. 4. Few firms in market serving many customers. Firms produce either differentiated or homogeneous products. Each firm believes rivals will hold their output constant if it changes its output. Barriers to entry exist. 64 Numerical Example of Cournot Oligopoly Two Firms: Firm 1 and Firm 2 Firms produce a homogenous product Market Demand is P=100-Q Q=Q1+Q2 where Q1 is Firm 1’s output and Q2 is Firm 2’s output Each firm has constant marginal cost of 20 and zero fixed costs. 65 What if the firms perfectly collude? What total output should they produce? Q=40. Can’t have more profits than what a monopolist would. 100 90 80 70 60 50 D 40 30 MC Q 20 10 0 0 10 20 30 40 50 60 70 80 90 100 MR 66 Suppose firms collude where both firms produce an output of 20 (i.e., Q1=Q2=20) Firm 1’s Profits = 60*20-20*20=800 100 90 Firm 2’s Profits = 60*20-20*20=800 80 70 60 50 D 40 =AVC=ATC 30 MC Q 20 10 0 0 10 20 30 40 50 60 70 80 90 100 67 Why might you expect that the firms will not be able to collude in this manner? If Firm 1 thinks Firm 2 will produce 20, then Firm 1 can increase his profits to 900 if produce 30. 100 Firm 1’s Profits = 50*30-20*30=900 90 Firm 2’s Profits = 50*20-20*20=600 80 70 60 50 D 40 30 =AVC=ATC MC Q 20 10 0 0 10 20 30 40 50 60 70 80 90 100 68 Nash Equilibrium A situation in which neither firm has an incentive to change its output given the other firm’s output. (Also called Cournot Equilibrium.) In this numerical example, it is for each firm to produce an output of 26.67. If Firm 2 produces an output of 26.67, Firm 1 maximizes profits by producing an output of 26.67 (and vice versa). 69 Profits from Cournot Equilibrium: Q1=26.67 and Q2=26.67 so Q=Q1+Q2=53.3 100 Firm 1 Profits=46.66*26.67-20*26.67= 713 Firm 2 Profits=46.66*26.67-20*26.67= 713 90 80 70 60 50 D 46.6640 30 MC =AVC=A Q TC 20 10 0 0 10 20 30 40 50 60 70 80 90 100 53.33 70 Cournot Equilibrium compared to Perfect Collusion Cournot Equilibrium Q1=26.67 , Firm 1 Profits = 713 Q2=26.67 , Firm 2 Profits = 713 Perfect Collusion Q1=20 , Firm 1 Profits = 800 Q2=20 , Firm 2 Profits = 800 71 What if Firms Interact Repeatedly: Infinitely Repeated Interaction Suppose Firm 1 thinks Firm 2 won’t deviate from Q2=20 if Firm 1 doesn’t deviate from collusive agreement of Q1=20 and Q2=20. In addition, Firm 1 thinks Firm 2 will produce at an output of 80 in all future periods if Firm 1 deviates from collusive agreement of Q1=20 and Q2=20. Firm 1’s profits from not cheating Today In 1 Year In 2 Years In 3 Years In 4 Years 800 800 800 800 800 … Firm 1’s profits from cheating (by producing Q1=30 Today) Today In 1 Year In 2 Years In 3 Years In 4 Years 900 0 0 0 0 … 72 Industry Characteristics that Facilitate Collusion 2. 3. 4. 5. 6. 7. Stable Industry Few Number of Firms If a firm cheats on a collusive agreement, the probability the firm is “caught” is high. Ability to Credibly Punish in a Severe Manner. Industry demand is growing. Expectation of firms’ behavior is clear. 73 My All Time Favorite example of how expectations are formed Coca-Cola, PepsiCo Set To Call Off Bitter Soft-Drink Price War Staff Reporter of The Wall Street Journal ATLANTA -- A brief but bitter pricing war within the soft-drink industry might be drawing to a close -- all because no one wants to be blamed for having fired the first shot. Coca-Cola Enterprises Inc., Coca-Cola Co.'s biggest bottler, said in a recent memorandum to executives that it will "attempt to increase prices" after July 4 amid concern that heavy price discounting in most of the industry is squeezing profit margins. The memo is a response to statements made to analysts last week by top PepsiCo Inc. executives. Pepsi, of Purchase, N.Y., said "irrational" pricing in much of the soft-drink industry might temporarily squeeze domestic profits, and it laid the blame for the price cuts at Coke's door. 74 My All Time Favorite example of how expectations are formed In the June 5 memo, Summerfield K. Johnston Jr. and Henry A. Schimberg, the chief executive and the president of Coca-Cola Enterprises, respectively, said the bottler's plan is to "succeed based on superior marketing programs and execution rather than the short-term approach of buying share through price discounting." "This is a first step to disengagement," said Andrew Conway, an analyst in New York for Morgan Stanley & Co. "Coke and Pepsi are out to improve profitability for the category, not destroy it, so this would bode for a stabilization." For all the signals of a truce, though, Coca-Cola Enterprises' memo could just as easily be seen as throwing down the gauntlet. Messrs. Johnston and Schimberg said in the memo that should "the competition" view the attempt to raise prices "as an opportunity to gain share through predatory pricing, we will, as we have in the past, respond immediately." 75 Bertrand Oligopoly 1. 2. 3. 4. 5. Few firms in market serving many customers. Firms produce a homogeneous product at a constant marginal cost (need not actually be the case). Firms engage in price competition and react optimally to prices charged by competitors. Consumers have perfect information and there are no transaction costs. Barriers to entry exist. 76 What if Firm 1 and Firm 2 choose price and react optimally to price charged by other firm? Will firms be able to collude on a price of $60? Firms could not collude on a price of $60 because each firm would have incentive to undercut other firm. In D the end, you would expect both firms to set a price of $20 (equal to MC) and haveMC zero Q profits. 100 90 80 70 60 50 40 30 20 10 0 0 10 20 30 40 50 60 70 80 90 100 77 Using Game Theory to Devise Strategies in Oligopolies that Increase Profits Examples: 1. Price Matching- advertise a price and promise to match any lower price offered by a competitor. 100 Bertrand Oligopoly 90 80 In the end, you would expect both firms to set a price of $20 (equal to MC) and have zero profits. 70 60 50 D 40 30 MC Q 20 10 0 0 10 20 30 40 50 60 70 80 90 100 78 Using Game Theory to Devise Strategies in Oligopolies that Increase Profits Examples: 1. Price Matching- advertise a price and promise to match an lower price offered by a competitor. In Bertrand example, perhaps each firm would set a price of $60 and say will match. 2. Induce Brand Loyalty – frequent flyer program 3. Randomized pricing – inhibits consumers learning as to who offers lower price and reduces ability of competitors to undercut price. 79