MODERN AUDITING

7th Edition

William C. Boynton

California Polytechnic State

University at San Luis Obispo

Raymond N. Johnson

Portland State University

Walter G. Kell

University of Michigan

Developed by:

Gregory K. Lowry, MBA, CPA

Saint Paul’s College

John Wiley & Sons, Inc.

CHAPTER 8

THE CONCEPT OF MATERIALITY

Materiality

Audit Risk

Preliminary Audit Strategies

The Concept of Materiality

The FASB defines materiality as

The magnitude of an omission or

misstatement of accounting

information that, in the light of

surrounding circumstances, makes it

probable that the judgment of a

reasonable person relying in the

information would have been changed

or influenced by the omission or

misstatement.

Preliminary Judgments About

Materiality

The auditor makes preliminary judgments

about materiality levels in planning the audit.

This assessment is referred to as planning

materiality, and may ultimately differ from the

materiality levels used at the conclusion of the

audit in evaluating the audit findings because:

1. the surrounding circumstances may

change and

2. additional information about the client will

have been obtained during the course of

the audit.

Preliminary Judgments About

Materiality

In planning an audit, the auditor should

assess materiality at the following 2 levels:

1. The financial statement level because

the auditor’s opinion on fairness

extends to the financial statements

taken as a whole.

2. The account balance level because the

auditor verifies account balances in

reaching an overall conclusion on the

fairness of the financial statements.

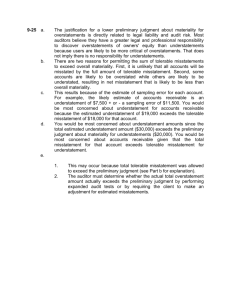

Materiality Levels Based on a Variable

Percentage of Total Assets or Revenue

Figure 8-1

If the Greater of

Total Assets or Revenue Is

Over

$

0

30 thousand

100 thousand

300 thousand

1 million

3 million

10 million

30 million

100 million

300 million

1 billion

3 billion

10 billion

30 billion

100 billion

300 billion

But Not Over

$ 30 thousand

100 thousand

300 thousand

1 million

3 million

10 million

30 million

100 million

300 million

1 billion

3 billion

10 billion

30 billion

100 billion

300 billion

Of Excess

Over

Materiality Is

$

0 + .059

1,780 + .031

3,970 + .0214

8,300 + .0145

18,400 + .0100

38,300 + .0067

85,500 + .0046

178,000 + .00313

397,000 + .00214

856,000 + .00145

1,840,000 + .00100

3,830,000 + .00067

8,550,000 + .00046

17,800,000 + .00031

39,700,000 + .00021

82,600,000 + .00015

$

0

30 thousand

100 thousand

300 thousand

1 million

3 million

10 million

30 million

100 million

300 million

1 billion

3 billion

10 billion

30 billion

100 billion

300 billion

Materiality at the

Financial Statement Level

Quantitative Guidelines

Currently, neither accounting nor auditing

standards contain official guidelines on

quantitative measures of materiality. The

following are illustrative of some guidelines used

in practice:

5% to 10% of net income before taxes (10% for

smaller incomes, 5% for larger ones)

1/2% to 1% of total assets

1% of equity

1/2% to 1% of gross revenue

A variable percentage based on the greater of

total assets or revenue

Materiality at the

Financial Statement Level

Qualitative Considerations

Qualitative considerations relate to the causes

of misstatements. A misstatement that is

quantitatively immaterial may be qualitatively

material.

Materiality at the

Account Balance Level

1. Account balance materiality is the

minimum misstatement that can exist in

an account balance for it to be considered

materially misstated.

2. Misstatement up to that level is known as

tolerable misstatement.

3. The concept of materiality at the account

balance level should not be confused with

the term material account balance.

Allocating Financial Statement

Materiality to Accounts

1. When the auditor’s preliminary judgments about

financial statement materiality are quantified,

a preliminary estimate of materiality for each

account may be obtained by allocating financial

statement materiality to the individual

accounts.

2. The allocation may be made to both balance

sheet and income statement accounts.

3. In making the allocation, the auditor should

consider:

a. the likelihood of misstatements in the

accounts and

b. the probable cost of verifying the account.

Relationship between Materiality

and Audit Evidence

1. It is generally correct to say that the

lower the materiality level, the greater

the amount of evidence needed.

2. It is also generally correct to say that

the larger or more significant an account

balance is, the greater the amount of

evidence needed.

The Audit Risk Model

Audit risk is the risk that the auditor

may unknowingly fail to appropriately

modify his or her opinion on financial

statements that are materially

misstated.

The audit risk model expresses the

relationship among the audit risk

components as follows:

AR = IR x CR x DR

The Audit Risk Model

SAS Nos. 39, 43, and 45 contain an

expanded audit risk model that

subdivides detection risk into 2

components.

AP for analytical procedures risk and

TD for tests of details risk.

Hence, the relationship among audit

risk components can be expressed as:

AR = IR x CR x AP x TD

Risk Components Matrix

Figure 8-2

Risk that Analytical Procedures

Will Not Detect Material Misstatements

Inherent Risk

Assessment

Control Risk

Assessment

High

Moderate

Low

Very Low

Maximum

Maximum

High

Moderate

Low

Very Low

Very Low

Very Low

Low

Very Low

Very Low

Low

Moderate

Very Low

Low

Moderate

High

Low

Moderate

*

*

High

Maximum

High

Moderate

Low

Very Low

Very Low

Low

Moderate

Very Low

Low

Moderate

High

Low

Moderate

High

*

Moderate

*

*

*

Moderate

Maximum

High

Moderate

Low

Very Low

Low

Moderate

High

Low

Moderate

High

*

Moderate

High

*

*

High

*

*

*

Low

Maximum

High

Moderate

Low

Low

Moderate

High

*

Moderate

High

*

*

High

*

*

*

*

*

*

*

Assessing the Components of

Audit Risk

1. Inherent risk is the susceptibility of an

assertion to a material misstatement,

assuming that there are no controls.

2. Control risk is the risk that a material

misstatement that could occur in an

assertion will not be prevented or

detected on a timely basis by the entity’s

internal controls.

3. Detection risk is the risk that the auditor

will not detect a mater misstatement that

exists in an assertion.

Interrelationships Among Materiality,

Audit Risk, and Audit Evidence

Figure 8-3

Alternative Preliminary Audit Strategies

Figure 8-4

4 Common Preliminary Audit Strategies

Figure 8-5

Relationship Between Strategies

and Transaction Cycles

The previously described strategies are

intended to characterize the audit

approaches for different assertions, not for

the entire audit.

Frequently, however, a common strategy is

applied to groups of assertions affected by a

transaction class within a transaction cycle.

Relationship Between Strategies

and Transaction Cycles

The following framework is representative of

practice:

Major Classes of Transactions

Cycle

Revenue

Sales, cash receipts, and sales adjustments

Expenditure

Purchases and cash disbursements

Personnel Services

Payroll

Production

Manufacturing of inventory

Investing

Investments in long-term assets or monetary investments of

excess cash

Financing

Financing from current long-term debt and capital stock

CHAPTER 8

THE CONCEPT OF MATERIALITY

Copyright

Copyright 2001 John Wiley & Sons, Inc. All rights

reserved. Reproduction or translation of this work

beyond that permitted in Section 117 of the 1976

United States Copyright Act without the express

written permission of the copyright owner is

unlawful. Request for further information should

be addressed to the Permissions Department, John

Wiley & Sons, Inc. The purchaser may make backup

copies for his/her own use only and not for

distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages,

caused by the use of these programs or from the

use of the information contained herein.