Pay settlements and average earnings

advertisement

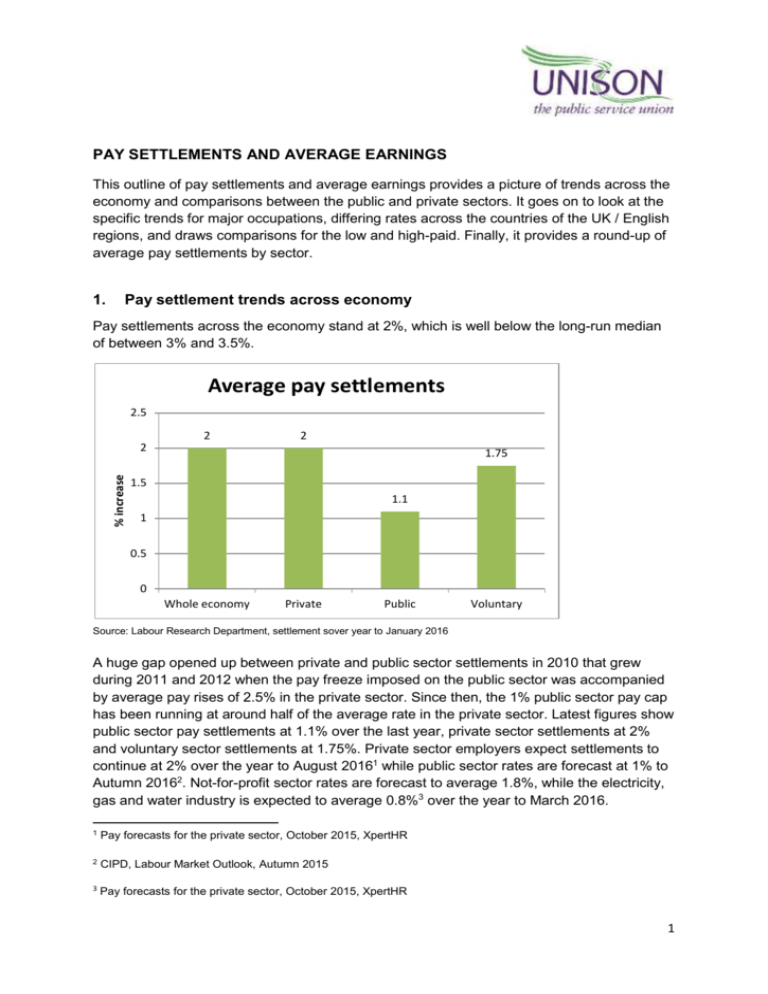

PAY SETTLEMENTS AND AVERAGE EARNINGS This outline of pay settlements and average earnings provides a picture of trends across the economy and comparisons between the public and private sectors. It goes on to look at the specific trends for major occupations, differing rates across the countries of the UK / English regions, and draws comparisons for the low and high-paid. Finally, it provides a round-up of average pay settlements by sector. 1. Pay settlement trends across economy Pay settlements across the economy stand at 2%, which is well below the long-run median of between 3% and 3.5%. Average pay settlements 2.5 2 2 % increase 2 1.75 1.5 1.1 1 0.5 0 Whole economy Private Public Voluntary Source: Labour Research Department, settlement sover year to January 2016 A huge gap opened up between private and public sector settlements in 2010 that grew during 2011 and 2012 when the pay freeze imposed on the public sector was accompanied by average pay rises of 2.5% in the private sector. Since then, the 1% public sector pay cap has been running at around half of the average rate in the private sector. Latest figures show public sector pay settlements at 1.1% over the last year, private sector settlements at 2% and voluntary sector settlements at 1.75%. Private sector employers expect settlements to continue at 2% over the year to August 20161 while public sector rates are forecast at 1% to Autumn 20162. Not-for-profit sector rates are forecast to average 1.8%, while the electricity, gas and water industry is expected to average 0.8%3 over the year to March 2016. 1 Pay forecasts for the private sector, October 2015, XpertHR 2 CIPD, Labour Market Outlook, Autumn 2015 3 Pay forecasts for the private sector, October 2015, XpertHR 1 2. Average earnings trends across economy The graph below shows trends in average earnings growth over the last two years. Since April 2013, private sector earnings growth has been running ahead of the public sector every month except two. Over the last year, the private sector rate accelerated sharply while the public sector rate flattened out, until a recent drop-off in private sector rates. In November 2015, the rate across the economy was 2%, private sector growth was 2.2% and average public sector wages rose by 1.5%. % change of 3 month average on previous year Average earnings growth 4.5 4.0 3.5 3.0 2.5 2.0 Whole Economy Private sector 1.5 Public sector 1.0 0.5 0.0 Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov 14 14 14 14 15 15 15 15 15 15 15 15 15 15 15 Month Source: Office for National Statistics, Labour Market Statistics, January 2016 Forecasts of average earnings predict that growth will stand at 3.4% during 2016 and grow to 3.9% by 2020 following the pattern shown below4. 4 Office for Budgetary Responsibility, Economic and Fiscal Outlook, November 2015 2 Forecast average earnings growth 4.5 4 % annual growth 3.5 3 2.5 2 1.5 1 0.5 0 2016 2017 2018 2019 2020 Note on difference between pay settlements and average earnings Before public sector average earnings growth dropped well below the private sector rate in 2013, average earnings were often used as a basis to argue that the public sector continues to see improvements in pay that are not matched by the private sector and particularly as a basis for attacking pay progression. The flaw in these arguments is that the use of average earnings growth for comparisons does not simply reflect changes due to pay settlements and pay progression. Changes in the average are affected by a multitude of factors that affect the composition of the public and private workforce. Any changes that swell the lower paid end of the workforce and/or reduce the proportion of higher paid employees, such as differences between the sectors in recruiting staff on part time or zero hours contracts, or redundancies that hit the most recent recruits hardest, will act as a downward pressure on the average. The government’s drive toward greater outsourcing in itself tends to lower private sector average earnings growth and raise public sector growth because of the marked tendency for outsourcing to focus on lower paid sections of the workforce. Therefore, average earnings growth does not offer any kind of sound basis for judging actual changes in the pay packet of a worker in the public or private sector. Pay settlement data forms a much sounder basis for comparison as it eradicates the differences in workforce composition that affects average earnings growth comparisons. 3 3. Earnings growth by occupation The Annual Survey of Hours and Earnings (ASHE) provides data that can form useful comparators for changes in average earnings experienced by UNISON members. The table below shows the change in median gross annual pay for full-time staff within the main job categories listed. A listing of earnings growth for more specific jobs within these categories can be found on the Office for National Statistics website by clicking here ASHE data on changes in median gross annual pay for full-time employees Job Type Annual % change 2014/15 All employees 1.6 Managers, directors and senior officials 1.0 Corporate managers and directors 1.3 Other managers and proprietors -1.3 Professional occupations 1.0 Science, research, engineering and technology professionals 1.4 Health professionals -0.3 Teaching and educational professionals 1.0 Business, media and public service professionals 2.4 Associate professional and technical occupations 0.8 Science, engineering and technology associate professionals 0.7 Health and social care associate professionals -0.8 Protective service occupations 1.0 Culture, media and sports occupations 0.4 Business and public service associate professionals 0.9 Administrative and secretarial occupations 2.2 Administrative occupations 2.5 Secretarial and related occupations -0.1 Skilled trades occupations 1.5 Skilled agricultural and related trades 0.8 Skilled metal, electrical and electronic trades 0.9 Skilled construction and building trades 1.3 Textiles, printing and other skilled trades 2.3 Caring, leisure and other service occupations 0.2 Caring personal service occupations -0.1 Leisure, travel and related personal service occupations 1.9 Sales and customer service occupations 2.8 Sales occupations 3.3 Customer service occupations 2.1 4 4. Earnings growth by region The Annual Survey of Hours Earnings provides a breakdown of earnings growth by region and local authority can be found at http://www.ons.gov.uk/ons/rel/ashe/annual-survey-ofhours-and-earnings/2015-provisional-results/stb-ashe.html#tab-Regional-earnings Data on the proportion of employees paid below the living wage is available by parliamentary constituency at http://visual.ons.gov.uk/how-many-jobs-are-paid-less-than-the-living-wagein-your-area/ For England, a table setting out the cost of housing relative to wages by local authority district is available at https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/321017/Table _577.xlsx 5. Earnings of low-paid staff The adult minimum wage rose to £6.70 an hour in October 2015 and in November 2015 the Living Wage Foundation announced that new “living wage” rates of £9.40 an hour in London and £8.25 an hour across the rest of the UK (accredited Living Wage employers have until next April to implement this rate). The Living Wage has become a standard benchmark for the minimum needed for low-paid staff to have a “basic but acceptable” standard of living. There are now approaching 2,000 employers accredited as living wage employers by the Living Wage Foundation, including some of the largest private companies in the UK, such as Barclays, HSBC, IKEA and Lidl. Over a quarter of the FTSE 100 companies are now accredited. Across the public sector, there have been widespread agreements to introduce the living wage: The Scotland government has established the living wage within all its public sector organisations Minimum rates have been raised to the living wage or above in the most recent pay settlements for staff at: Wales NHS, higher education sector police staff in England and Wales Framework agreements for support staff in more than 12,000 schools across the UK set the living wage as a key target Even where the living wage has not been achieved, pay deals have delivered considerably higher than average rises for the lowest paid staff. For local government employees on NJC terms and conditions, the 2015 pay agreement resulted an a 8.6% rise for the lowest paid staff and among staff on Agenda for Change terms and conditions in NHS England the 2015 deal led to a 5.6% increase. Furthermore, even where national agreements have not achieved a living wage settlement, a major proportion of individual councils, NHS trusts, schools and academies have taken up 5 the living wage on their own initiative. A UNISON Freedom of Information survey covering local government, the NHS, universities, further education colleges and police authorities that drew over 900 responses found that 51% of employers across these sectors already pay at least the living wage to their lowest paid staff. Though not directly classified as public sector, a Guardian survey in June 2015 also revealed that two thirds of housing associations pay the living wage, with a third accredited by the Living Wage Foundation and a third paying the wage without official accreditation. Only a minority of employers that adopt the Living Wage have gone down the route of seeking official accreditation as a living wage employer. However, there are now 39 councils accredited as living wage employers by the Living Wage Foundation, along with nine trusts and 34 acadamies / schools. “National living wage” In July 2015, the government announced in its emergency budget that it will introduce a “national living wage” from April 2016 for workers aged 25 or over. In reality this “living wage” is simply a relabelling of the national minimum wage and raising of the rate for a section of the UK workforce. The rate to come into force in 2016 will be £7.20 an hour and the government has set out the expectation that the rate will rise to 60% of median earnings by 2020. The Office for Budgetary Responsibility (OBR) has estimated that this will lead to a rate of £9.30 an hour5 by 2020. If this forecast turns out to be correct and the Low Pay Commission follows a straight path to the 2020 target, the OBR predicts that the National Minimum Wage for workers aged 25 or over will unfold as follows: Hourly rate 5 2016 2017 2018 2019 2020 £7.20 £7.65 £8.20 £8.70 £9.30 Office for Budgetary Responsibility, Economic and Fiscal Outlook, November 2015 6 If you are faced with an employer who argues that the government is set to introduce a “national living wage” from April 2016 for workers aged over 24 and therefore there is no need for the employer to adopt the Living Wage set out by the Living Wage Foundation, the following points set out why that argument is wrong: The national minimum wage that has been relabelled by the government as the “national living wage” is a figure that has not been worked out on a rigorous basis related to the actual cost of living. Over time it is set to move toward a target rate set at 60% of average earnings, which is a valuable benchmark for reducing inequality in the workplace. However, the reason the UK wide and the London living wages are better measures of the real wage needed to achieve a decent standard of living is that they take account of changes in prices, whereas the cost of living has no direct role in the government’s “living wage.” For example, the Greater London Authority works out the London living wage by calculating the wage needed to achieve a “low cost but acceptable standard of living” for a range of typical families and then it averages the result against the figure advanced by the government based on 60% of average earnings. Loughborough University works out the UK living wage by gathering public views of the items needed for a minimum but acceptable standard of living, costing those items and adding relevant current rates for rent, council tax and childcare. It then ensures that rises don’t act as an excessive burden on organisations by capping any increase at 2% above changes in average earnings. In short, the government’s “living wage” acts as a welcome limit on wage inequality, but it doesn’t ensure that an organisation’s lowest paid staff can afford a decent standard of living. Only the UK and London living wages announced by the Living Wage Foundation fulfil that role. Welfare cuts Changes to minimum wage rates have to be seen in the context of the July 2015 budget, which announced cuts to welfare benefits valued at £12 billion. Analysis by the Institute for Fiscal Studies6 of the net impact of the changes makes the key observation below: “Among the 8.4 million working age households who are currently eligible for benefits or tax credits who do contain someone in paid work the average loss from the cuts to benefits and tax credits is £750 per year. Among this same group the average gain from the new NLW, is estimated at £200 per year (in a “better case” scenario). This suggests that those in paid work and eligible for benefits or tax credits are, on average, being compensated for 26% of their losses from changes to taxes, tax credits and benefits through the new NLW.” 6 Institute for Fiscal Studies, An assessment of the potential compensation provided by the new ‘National Living Wage’ for the personal tax and benefit measures announced for implementation in the current parliament, September 2015 7 In addition, research commissioned by the TUC using the IPPR tax-benefit model looked at the combined effect of the budget from changes to Universal Credit work allowance, the benefit freeze, minimum wage, personal income tax allowance and higher rate income tax threshold.7 This analysis found that the net results will be a fall in the annual income of the poorest 40% of working households. Between 2015/16 and 2020/21, the average loss for the poorest 20% of working households will be £460 a year. 6. Comparisons of pay cap against wider economy The graphs below put the public sector pay cap in the context of developments across the wider economy. While the average value of public sector pay rises over the last five years has been 3.4%, the value of the economy has increased by over 12%, the cost of living has risen by almost 20%, the pay of chief executives for the UK’s largest companies has grown by over 20% and company profits have jumped by 28%. Growth rate How does public sector pay compare over the last five years 30.00% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% Pay rise since 2010* Value of economy Cost of living*** Top bosses' pay Company profits ** **** ***** Sources: * Based on median public sector pay rise of 0.4% in 2010 (Incomes Data Services), followed by pay freezes in 2011 and 2012, then 1% pay cap in 2013,2014 and 2015 ** Based on growth in gross domestic product between Q1 2010 and Q3 2015 from Office for National Statistics, Preliminary Estimate of GDP, Quarter Q3 (July to September) 2015 *** Based on Retail Prices Index between January 2010 and December 2015, taken from Office for National Statistics, Consumer Price Inflation, December 2015 **** Based on growth in average FTSE 100 chief executive pay between 2010 and 2014 from High Pay Centre, The State of Pay, August 2015 ***** Based on corporations' operating surpluses between Q1 2010 and Q3 2015 from Office for National Statistics, Quarterly National Accounts, Quarter 3 (July - September) 2015 When examining the outlook over the next four years, during which time the pay cap is set to remain in force, the average increase in the value of the economy is set to run at 2.4%, the cost of living is due to grow at 3% a year and average earnings growth is expected to average 3.7%. 7 TUC, July Budget 2015 Reforms – Impact on households, September 2015 8 How does the pay cap compare to forecasts for next few years? 4 3 2 1 0 Pay cap Value of economy* Cost of living ** Average wages*** Sources: * Based on average annual gross domestic product forecast between 2016 and 2020 from Office for Budgetary Responsibility, Economic and Fiscal Outlook, November 2015 ** Based on average annual growth in Retail Prices Index forecast between 2016 and 2019 from HM Treasury, Forecasts for the UK Economy, November 2015 *** Based on average annual earnings growth forecast between 2016 and 2020 from Office for Budgetary Responsibility, Economic and Fiscal Outlook, November 2015 7. Latest pay settlements Average pay settlements by sector Sector Average reported pay settlements Across economy 2.0% Private sector 2.0% Public sector 1.1% Not for profit 1.75% Energy & gas 1.5% Water & waste management 1.8% Retail & wholesale 2.3% Transportation & storage Admin & support services Security 2.0% 2.0% 2.0% Source: Labour Research Department, based on reported settlements in sector over last year If you require greater detail on pay settlements for particular sectors, contact the Bargaining Support Group on bsg@unison.co.uk 9 Most recent pay rises among some of UNISON’s largest bargaining groups Bargaining Group Most recent pay settlement Local Government Services NJC (England, Wales & Northern Ireland) BASIC: 2.2% from Jan 15 for staff above SCPs 10 and non-consolidated payments ranging £325 to £100 EXCEPTION: Rises ranging from 8.56% to 2.32% for SCPs 5-10 Scottish Joint Council for Local Government Employees BASIC: 1.5% from Apr 15 – Mar 16, 1% from Apr 16 – Mar 17 EXCEPTION: Bottom points raised to Living Wage ENGLAND: BASIC 1% from April 2015 for all except top pay band / EXCEPTION: Bottom rate lifted to £15,100 Health - Agenda for Change staff SCOTLAND: BASIC: 1% from April 2015 / EXCEPTION: Bottom point raised to Living Wage WALES: BASIC: £187 non consolidated from December 2014 and 1% from April 2015 / EXCEPTION: Bottom point raised to Living Wage NORTHERN IRELAND: 1% for those on top of band from April 2015 ENGLAND: 1% from August 2014 and bottom point raised to Living Wage Further Education SCOTLAND: 1% or £300, whichever is the greater, from April 2015 All directly employed staff receive at least Living Wage. WALES; 1% from August 2015 BASIC: 1% from August 2015 on all points above SCP9 Higher Education EXCEPTION: Bottom point raised to Living Wage for staff on 35 hour week and tapering ranging between 1.1% and 2.6% for bottom eight points BASIC: 0.9% increase from September 2015 Sixth Form Colleges (England) EXCEPTION: Additional increases for the lowest paid which increased the value of the offer to 1% of paybill Police Staff (England & Wales) 2.2% or £400 (whichever is the greater) from 1 March 2015 to 31 August 2016 10