Chapter 5

advertisement

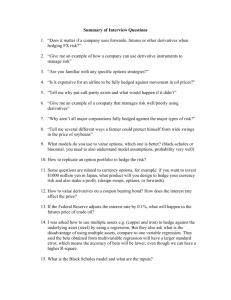

REPLICATING S&P500 INDEX FUTURES OPTIONS BY HEDGING THE GREEKS Tarunkumar Maheshchandra Mishra B.E., Hemchandracharya North Gujarat University, India, 2005 PROJECT Submitted in partial satisfaction of the requirements for the degree of MASTER OF BUSINESS ADMINISTRATION in FINANCE at CALIFORNIA STATE UNIVERSITY, SACRAMENTO FALL 2009 REPLICATING S&P500 INDEX FUTURES OPTIONS BY HEDGING THE GREEKS A Project by Tarunkumar Maheshchandra Mishra Approved by: ______________________________, Committee Chair Dr. Peter Sharp, PhD __________________________ Date ii Student: Tarunkumar Maheshchandra Mishra I certify that this student has met the requirements for format contained in the University format manual, and that this Project is suitable for shelving in the Library and credit is to be awarded for the Project. __________________________ Dr. Monica Lam, Ph.D. Associate Dean for Graduate and External Programs College of Business Administration iii ___________________ Date Abstract of REPLICATING S&P500 INDEX FUTURES OPTIONS BY HEDGING THE GREEKS by Tarunkumar Maheshchandra Mishra Statement of the Problem: Replication of an option is used to realize the same payoff that could have been realized by holding a position in the option itself when the target option is not available. In order to ensure that a portfolio’s market value does not decrease beyond a certain level, it is necessary to insure it by hedging with options. The project discusses the basic replication strategy, followed by its application on S&P 500 index futures September 2009 contract. The Greeks (delta, gamma, rho and kappa) of the option are used, in this replication strategy, to replicate the payoff. Sources of Data: The historical prices, for June and September 2009 contracts on S&P 500 index futures and the options on these contracts, are retrieved from Bloomberg.com and Reuters.com. The project does not list the data obtained from those sources because of their license restrictions. The Eurodollar historical prices data from November 2008 to September iv 2009 are obtained from the website of Federal Reserve Statistical Release, H.15 which is released everyday (unless holiday) at 2:30pm. The yield curves historical data from June 2000 to October 2009 are retrieved from the website of United States –Department of the Treasury, in the Interest Rates Statistics section. For analysis purposes, during the project, information is obtained from websites of Yahoo! Finance and CME Group/Chicago Board of Trade. Conclusions Reached: The results of the project lead to a conclusion that an option pay-off can be replicated by hedging the Greeks (delta, gamma, rho and kappa). The basic strategy of replication, which provides the hedge to the delta of an option, shows that investing a proportion of total investment, equal to the delta of the option, in the underlying asset of an option, will provide the same pay-off that could be realized by holding 100% position in the option itself. The hedging for gamma can be executed by investing a portion in another option with a higher gamma or a more liquid option. This proportion should be a fraction needed to neutralize the gamma of the target option payoff curve. Investing in more than one option, with shorter maturity period or higher gamma as compared to the target option, will reduce the gamma for replication of the target option. The importance of rho hedging is realized when there is a change in carrying cost; in this project, it is the interest rate. Whenever there is a high change in price along with the change in the interest rate, the replication is adjusted for risk if it is hedged by a proper interest rate addressing instrument like Eurodollar futures or other interest rate futures. After v empirical analysis, it is found that replication by hedging for delta, gamma and rho, all at a time, provide a better replication to that the delta hedge or delta-gamma hedge by itself. The project shows that replication of September 2009 contract for S&P 500 index futures. The net replication error from a delta-gamma neutral hedge is less as compared with the replication error from delta-neutral hedge. The project calculates the replicating error difference between delta-gamma neutral hedge and delta-neutral hedge. Delta-neutral hedge was $0.6187, $0.8773, and $0.1937 for September’09; call option with strike price of $1025 on January 15, 2009, January 27, 2009, and April 9, 2009, respectively. The calculations also provide an explanation for theta and rho exposures hedge in the replication. ________________________________, Committee Chair Dr. Peter Sharp, Ph.D. _______________________ Date vi ACKNOWLEDGEMENTS I would like to show my gratitude to Dr. Peter Sharp, Professor at California State University, Sacramento, under whose guidance I am able to work on my project and who provided me from the basics to detailed knowledge in financial markets. I would like to thank him for providing me an opportunity and assistance with resources and directed me to derive the results for this project. I would like to personally thank Mr. Ho Ho, Quantitative Portfolio Manager at California Public Employees Retirement System (CalPERS), Sacramento, who provided timely assistance for working strategies of replicating an option. Along with that I am thankful to my immediate supervisor and Investment Officer III at CalPERS, Sacramento, Ms. Lee Ann Nation and Division Chief, Mr. Matthew Flynn, for providing me resources and encouragement for analysis and research works that helped me concluding my project. And last but not least, I am indebted to Mr. Rafael Garcia (Investment Officer II), Mr. Christian Cardeno (Investment Officer III) and Investment Operations staff at CalPERS, Sacramento for providing me help with questions and analysis related to options and equity market. vii TABLE OF CONTENTS Acknowledgements ........................................................................................................ vii List of Tables ....................................................................................................................x List of Figures ................................................................................................................. xi Chapter 1. INTRODUCTION ........................................................................................................1 Sources Review .....................................................................................................2 Why Option Replication? .....................................................................................3 2. METHODOLOGY .......................................................................................................6 Basic Replication Strategy ....................................................................................6 Hedging the Delta .................................................................................................6 Combined Hedge for Delta and Gamma .............................................................11 Gamma Hedge Ratio in the Replication .............................................................16 3. IMPLEMENTATION OF METHODOLOGY...........................................................18 Example of Replicating September S&P500 Index Futures Call Option using the Greeks Hedging Strategy ....................................................................................18 Hedging the Error Related to Delta for the Target Call Option ..........................18 Hedging for Delta and Gamma ...........................................................................23 4. HEDGING WITH OTHER GREEKS AND VOLATILITY CONSIDERATIONS ..30 Role of Carrying Cost on Replication of a Target Option ..................................30 Rho Hedging .......................................................................................................32 Hedging for Kappa ..............................................................................................34 Hedging for Theta ...............................................................................................35 Project Limitations .............................................................................................37 5. CONCLUSION ...........................................................................................................38 Appendix (Rates from Eurodollar Futures versus US Treasury Bills) ...........................40 viii References .......................................................................................................................44 ix LIST OF TABLES Table 1 Change in Delta for Sep ’09 and June ’09 Call Options Prices ........................... 12 Table 2 Delta-Neutral Hedge on September ’09 S&P500 Index Futures Call Option for April 9, 2009, January 15, 2009 and January 27, 2009 ............................................. 20 Table 3 Values of Greeks for June 2009 Call Option ....................................................... 23 Table 4 Calculations: Multiplier for June’09 Call Option for Gamma Neutral Hedge .... 24 Table 5 Calculations: Delta and Gamma Neutral Hedge Pay-offs and Errors in Replication ................................................................................................................. 26 Table 6 Replication without Rho Hedging ....................................................................... 31 Table 7 Delta-gamma-rho Hedging .................................................................................. 33 Table 8 Theta Hedge ......................................................................................................... 36 x LIST OF FIGURES Figure 1 Historical Prices - September 2009 Futures Contract on S&P500 Index ............. 5 Figure 2 Historical Prices - September 2009 Futures Contract on S&P500 Index ............ 5 Figure 3 Delta Hedge: Tangents to Historical Price Curve of Target Call Option on September ’09 S&P 500 Index Futures Contract ........................................................ 8 Figure 4 Trend Lines showing Curvature Pay-offs for September and June 2009 S&P 500 Index Futures Contract Call Options ......................................................................... 11 Figure 5 Chart showing Change in Delta for Sep’09 and June’09 Call Options for a Specific Period ........................................................................................................... 13 Figure 6 Percent change in option delta to percent change in underlying index prices .... 14 Figure 7 Delta and Gamma Hedge on Target Option Pay-off Curvature ......................... 15 Figure 8 Comparison of Change in Option Price with Delta-Neutral Hedge Pay-off ...... 22 Figure 9 Comparison of Change in Option Price with Delta and Gamma Neutral Hedge Pay-off ....................................................................................................................... 27 Figure 10 Comparison of Delta Hedge Error with Delta-Gamma Hedge Error ............... 28 Figure 11 Yield curves for July-Dec 2000, July’07, Oct ’07, July’08, Oct’08 ................ 41 Figure 12 TED spread larger period (Jan’00 – Oct ’09) ................................................... 42 Figure 13 TED spread for shorter period (Jan ’08 -Oct ’08) ............................................ 42 xi 1 Chapter 1 INTRODUCTION Stock options provide a comparable alternative to direct investment in the underlying stock. To decide what to choose as the alternative requires some important facts to be explained. Those facts are: the valuation of the option over time, its anticipated rate of return over the specific period, the risk introduced in its pricing as a result of volatility in the underlying price, the margin requirements, the transaction costs for the option as compared to the transaction costs of the underlying asset, the buyers, the sellers, and how to get an option off, if the option position is not available. Modern portfolio theory says that, “the price behavior of an option is very similar to a portfolio of the underlying stock and cash that is revised in a particular way over time”, (Rubinstein and Leland). So there exists a replicating portfolio strategy, involving stock and cash only, that creates returns identical to those of an option. Option replication can be defined as a strategy or technique to create an option like payoff pattern through a series of transactions in the underlying or in related futures contracts. (Gastineau and Kritzman, 1996). The relevance is similar to traditional portfolio insurance of dynamic hedging using replicating strategies. It is also similar to creating a long-term option by using series of short-term options (Gastineau and Kritzman, 1996). The project focuses on replicating a longer maturity period option on S&P 500 index futures using another option, with shorter maturity period, on S&P 500 index futures. 2 Sources Review The project uses the book Option Pricing and Investment Strategies, 3rd edition, by Richard M. Bookstaber, as a major source for the replication strategy used to replicate a call option on S&P 500 index futures September ’09 contract. The chapter on option replication technology discusses the hedging techniques for the Greeks: delta, gamma, theta and kappa of the target option. The book explains the basic replication strategy as delta hedge, which is basically an investment in the underlying asset in a proportion equal to the delta of the target option. The gamma hedge during replication of an option can be created by introducing an option with higher gamma or more liquid option with less time to expiration, as compared to the target option. The delta-gamma neutral hedge has less replication error than the delta hedge. A second major resource for this project was the book Financial Options from Theory to Practice, 1st edition, 1992 by Stephen Figlewiski, William Silber, and Marti Subramanyam. The concept of index option replication is explained with the example of dynamic hedging and portfolio insurance. The book talks about the need for replication and general strategies on replication of an option pay-off. In addition, the project used the concept of implied volatility consideration for option pricing and added uncertainty with addition of securities in a replication portfolio. The risk-free interest rate for option pricing can be U.S treasury bills or Eurodollar futures. 3 The article, “Trading Interest Rate Inefficiencies: the stability and predictability of Eurodollar Futures calendar spreads makes them attractive for interest rate trading strategies. But to become fluent in Eurodollar forecasting, you'll need to learn a little about U.S. Treasuries.”, by Paul Cretien discusses the accurate prediction of the interest rates associated with the Eurodollar futures using the U.S. treasury yield curves and TED spread. In their article, “Can a dynamic strategy replicate the returns of an option?” by Michael Asay and Charles Edelsburg, the problems with dynamic hedging as change in the hedge ratios requires adjusting the hedge each and every time. The anticipated price gap for adjustment in hedge cannot be ideally observed as the price changes in the market. Moreover, the adjustment in positions can be done when prices change by at least a minimal amount to reach the hedge. Also, this adjustment involves adjustment in number of contract, which can lead to change in the number of contracts outstanding. Why Option Replication? Portfolio insurance is one of the important reasons that lead to a decision of pay-off replication. A portfolio can be insured by another portfolio that replicates the same payoff function equivalent to a protective put strategy (Figlewiski, Silber and Subramanyam,1992). Alternatively, an option replication technique can be used to duplicate the pay-off of an option and realize a desirable pay-off for a longer period beyond the life of the target option; and this pay-off is comparable to the derived price 4 from the option pricing model for that prolonged period. For instance, in order to receive a pay-off similar to an option on a portfolio, so as to insure the portfolio from a drop in market value; replication strategy can be useful, once a protective put strategy is decided, that involves an option on the portfolio. This protective put strategy should at least determine these factors: the minimum allowed portfolio market value to be maintained, the volatility of the portfolio and the duration for the insurance. Based on these decisions, an option on the portfolio can be designed and a similar pay-off to that option on the portfolio can be obtained using replication strategy. Replication can also be helpful in creating or hedging exotic options and some of lookback options. The reason behind considering an option on the portfolio, as a protective put strategy, is that the portfolio of options is expensive than options on portfolio (Markowitz, 2009). It is because the volatility of a portfolio of assets overall is less than the sum of volatilities of individual options in the portfolio, provided the assets in the portfolio are not correlated to each other (Armbruster, 2009). Based on this reasoning, the price associated to the option on portfolio, as determined by Black-Scholes option pricing model, turns out to be less than the sum of prices of options on individual assets in the portfolio. The project shows the replication of an S&P 500 index futures option expiring on September 18th, 2009. This replication method is based on hedging the Greeks, specifically delta and gamma, obtained from Black-Scholes option pricing model. Later, 5 there will be a short description about hedging the rho and kappa for the option during replication. Figure 1 Historical Prices - September 2009 Futures Contract on S&P500 Index (Futurespros.com, 2009) Figure 2 Historical Prices - September 2009 Futures Contract on S&P500 Index (Futurespros.com, 2009) 6 Chapter 2 METHODOLOGY Basic Replication Strategy The price movements of the stock and its options tend to fluctuate in the same direction. But the variation in option price may be smaller than the variation in the underlying stock. In other words, a dollar change in the stock price resembles to less than a dollar change in the price of its option. The conditions for replicating a call option on S&P 500 index futures contracts are: a) the initial investment must provide the same absolute dollar return, as a call for small changes in the underlying asset price; b) it must be equal to the value of the call to give the same rate of return; c) and it must not cost anything more than the initial investment. (Rubinstein and Leland, 1995). Hedging the Delta The basic replication strategy is the hedge with delta. The basic requirement for this option replication strategy is an accurate delta for the option from the pricing model. The delta measures the change in the price of option at a specific instance, with the change in the price of the underlying asset. So, after the hedge, there needs to be the same 7 movement in the position that is equivalent to the realized change in the option price. This can be understood with the help of following example. The Black-Scholes option pricing model determined the delta for S&P500 Index Futures call option on September 2009 contract, with strike price $1025, spot price $756, time to expire 206 days, interest rate 1.08151%, dividend yield 3.42% (Standard and Poor's, 2009) and implied volatility 30.3108%2, as 9.812%. This means the option price changes 9.812% as compared to the price of the underlying asset. If the price of S&P500 index future contract for September 2009 (denoted as SPU9, on a Bloomberg Terminal), goes up by $1, then the call option price will go up by $0.09812. In order to reflect this payoff for the call option, holding 9.812% position in the underlying will serve the purpose and so a $1 rise in the underlying lead us to realize 9.812% of $1 = $0.09812 pay-off. Similarly, if the price change in the underlying is $2, then the net change realized, by holding 9.812% of the underlying asset, should be $0.19624. In this case, looking at the pay-off, anyone will not be able to know whether the performance is a result of replication, which is holding the underlying asset, or holding a position in the associated option. 1 For calculation purposes a constant interest rate from 3-month Eurodollar futures taken as of May 29, 2009 through the entire project. 2 Volatility used in the project is the implied volatility calculated from the Black-Scholes option pricing model using the actual market price. 8 The hedging process is described in figure.3. The target call option is shown as the function of the price of the underlying asset, which is the SPU9 contract here. The slope of this curve at current price is given by its delta. Figure 3 Delta Hedge: Tangents to Historical Price Curve of Target Call Option on September ’09 S&P 500 Index Futures Contract Historical Price - Payoff curvatures x-axis: Underlying Price 30.00 y-axis : Option price 25.00 Hedging Option 20.00 15.00 Asset 2 Asset 1 Target Option 10.00 5.00 Historical Price 805 798.2 788.8 779.6 773.5 772.7 763 755.9 751.5 745.9 728.2 710.9 699.9 682.5 670.7 0.00 Expon. (Historical Price) Historical price series is the actual price of the SPU9 contract call option. The Expon (Historical Price) is the target option trend line. Introducing a certain specific proportion security such that the pay-off trend traces the target option curve then we will be very close to replicating actual payoff of the call option. The Asset (1) and Asset (2) 9 are the tangents to the trend line at two different prices. These tangents imply the percentage of the underlying positions we need to hold to get the payoff. For instance, holding 50%position in a stock will give 50% of profits and the payoff will have a line with slope of 0.5. Figure 3 illustrates the relation in target option price and the delta which used to replicate it. For instance, when the price of September ’09 contract on S&P500 price or SPU9C (Historical Prices, 2009) is $763.0, the call option with strike price $1025 is $8.00 with a delta of 10.5172%. The asset (1) line is the tangent to the target option price curve at underlying price $763 with a slope of 0.1051. At this point it can generate a payoff similar to the target option pay off by buying 10.5172% of September ’09 S&P 500 index futures contract (SPU9) (Historical Prices, 2009). It is this payoff that the replicating strategy must produce. This is in fact matching the slope which in turn is delta for the target call option. Because of the price volatility in the underlying futures contract, there is a continuous significant price movement in the associated target call option, and hence there is a continuous change in delta, which is represented by gamma for the call option. This price volatility will fail to replicate the pay-off if the proportion of position in the underlying contract is not changed with the change in delta. As the price of the contract increases from $763.3 to $788.8, the option price is likely to increase and the slope of the tangent increases to 11.9986%, which is the delta for the call option on this contract at strike price $1025. The change in the delta indicates the change in the position of the underlying asset from 10.5172% to 11.9986% to receive the same pay-off as the trend 10 line for the target option. Higher frequency of adjusting the hedge, by maintaining the position as per the delta of target option, will lead to a better replication of the target option pay-off. Consequently, multiple changes the position for the underlying contract also increases the transaction cost, and thereby increases cost to the replication. In this case, the curvature of the target option is expected because the option has different delta with the change in the price of the underlying contract. To hedge this change in delta of the target option with price of underlying contract, and generate equivalent payoff as of target option, a gamma neutral hedge should be added to the delta-neutral hedge in the replication strategy. In practice, it is not realistic to change positions continuously for the underlying holdings after every point change in the price as this can lead to very high trade activity and transaction costs, and thereby higher cost for replication. As the gamma hedge requires the hedging on a curve of target pay-off, an instrument with a curved payoff can provide a better hedge. Another call option with shorter duration to expiration than the target call option can be used to hedge the gamma effect in replication. The hedge is possible, because the option with shorter duration to expiration tend to have a greater gamma than the gamma of an option that has higher expiration period (Bookstaber, 1991). Thus, a combination of a specific portion of higher gamma option with specific portion zero gamma underlying assets in the hedge will match both the slope and the curvature of the target option pay-off. 11 Figure 4 Trend Lines showing Curvature Pay-offs for September and June 2009 S&P 500 Index Futures Contract Call Options 140.00 120.00 Historical price for SPU9 and SPM9 contract call options with strike price $1025 x-axis : underlying contract prices 100.00 80.00 y-axis: option prices 60.00 SPM9 SPU9 40.00 20.00 0.00 880.00 900.00 920.00 940.00 960.00 980.00 1000.001020.001040.00 Poly. (SPM9) Poly. (SPU9) -20.00 Figure 4 shows SPU9 – S&P index futures September’09 contract and SPM9 – S&P index futures June’09 contract. The dotted lines show the trend lines for historical prices for the call options on individual contracts. Combined Hedge for Delta and Gamma The theory for delta-gamma hedge says that the change in the price of the underlying as well as passage of time leads to inaccuracies in hedging (Bookstaber, 1991). It can be a single option or a portfolio of options. Therefore, it is very important to know the factors that are contributing to the change in the option price. The major contributors are the price of the underlying asset, the interest rates, and the volatility. The pricing model 12 (Black-Scholes Option Pricing Model) that is being used to calculate the prices must provide appropriate considerations to all prior mentioned factors when determining the option price or implied volatility. Expiry date for S&P 500 index futures June 2009 call option (SPM9C) with $1025 strike is June 15, 2009 while that for S&P 500 index futures September 2009 call option (SPU9C) with strike price $1025 is September 18, 2009. The delta for associated with the per cent change relationship is shown in the table below and presented in the graph. It also shows that the gamma for the SPM9 contract is higher as the time to expiration for the SPM9 call option is lower than the SPU9 call option at strike price 1025. Table 1 Change in Delta for Sep ’09 and June ’09 Call Options Prices Date Change in Delta(Sep'09 Call option) Change in Underlying Asset Price(SPU9) Change in Delta(June'09 Call option) 28-Nov-08 -21.9% -9.0% 36.3% 16-Jan-09 -16.4% -5.1% 21.2% 9-Feb-09 -20.0% -4.5% 18.0% 27-Feb-09 -16.4% -3.9% 2.2% 13-Jan-09 -11.2% -3.4% 24.1% 28-Jan-09 -15.2% -3.3% 20.0% 6-Apr-09 -14.9% -2.0% 8.3% 12-Dec-08 -4.5% -1.5% 35.1% 24-Feb-09 -6.7% -0.9% 4.2% 24-Dec-08 0.7% 0.5% 26.5% 7-Apr-09 4.1% 1.0% 6.1% 15-Apr-09 6.9% 1.5% 7.7% 29-Dec-08 6.9% 2.0% 26.6% 4-Dec-08 8.3% 3.0% 31.5% 20-Jan-09 9.7% 4.0% 16.9% 13 15-Dec-08 11.4% 4.6% 33.3% 9-Mar-09 29.5% 6.0% 0.9% 20-Mar-09 44.2% 7.0% 4.4% Table 1 shows some of the calculation change in the delta for Sep ’09 and June ’09 call options as they relate to the per cent change in the underlying contract for Sep ’09 S&P 500 index futures. Figure 5 Chart showing Change in Delta for Sep’09 and June’09 Call Options for a Specific Period 52.0% x-axis: Date 42.0% y-axis: % Change in delta 32.0% 22.0% 12.0% 2.0% Change in Delta Sep '09 Call Option -8.0% -18.0% -28.0% 8-Nov-08 18-Nov-08 28-Nov-08 8-Dec-08 18-Dec-08 28-Dec-08 7-Jan-09 17-Jan-09 27-Jan-09 6-Feb-09 16-Feb-09 26-Feb-09 8-Mar-09 18-Mar-09 28-Mar-09 7-Apr-09 17-Apr-09 27-Apr-09 7-May-09 17-May-09 27-May-09 6-Jun-09 16-Jun-09 26-Jun-09 -38.0% Change in Delta June '09 Call Option 14 Figure 6 Percent change in option delta to percent change in underlying index prices 50.0% x-axis : Change in the underlying price 40.0% 30.0% y-axis: Change in delta 20.0% Change in Delta for Sep'09 Call option 10.0% 0.0% Change in Delta for June '09 Call option -10.0% -20.0% Poly. (Change in Delta for Sep'09 Call option) -30.0% -100.0% -3.9% -2.4% -2.1% -1.7% -1.4% -1.2% -0.8% -0.2% 0.0% 0.1% 0.3% 0.6% 0.8% 1.1% 1.4% 2.0% 2.7% 3.2% 4.0% -40.0% Poly. (Change in Delta for June '09 Call option) Figure 6 shows a chart of the change in the delta values for Sep ’09 (SPU9C) and June ’09 (SPM9C) call options versus the change in the underlying asset prices. It is apparent that the series for the SPM9C call option is having higher changes in delta with the change in underlying price as compared with the call for SPU9 contract, except when the change in the underlying contract price rises above 1.4%. Higher change in delta shows higher gamma for the option. The data from the table above the graph is used to draw this relationship. The replication strategy that uses the higher gamma option to neutralize the curve for the target option is shown in the below graph. 15 Figure 7 Delta and Gamma Hedge on Target Option Pay-off Curvature Historical Price - Payoff curvatures 30.00 x-axis: Underlying Price 25.00 y-axis : Option price Hedging Option 20.00 15.00 Asset 2 Asset 1 Target Option 10.00 5.00 Historical Price 805 798.2 788.8 779.6 773.5 772.7 763 755.9 751.5 745.9 728.2 710.9 699.9 682.5 670.7 0.00 Expon. (Historical Price) Based on the analysis from figure 5 and figure 6, it is apparent that the June ’09 S&P 500 index futures call option can be used to replicate the September ’09 S&P 500 index futures call option pay-off. The basic replication strategy to be applied is shown in figure 7. In order to hedge the gamma for the target call option, it requires a specific proportion of the investment to be invested in the call option with higher gamma, in this case the June ’09 S&P 500 index futures call option or SPM9C. This multiplier to unit call option investment in the portfolio for replication is the gamma hedge ratio. 16 Gamma Hedge Ratio in the Replication The gamma hedge ratio is the proportion of option used to replicate the target option in order to develop a gamma neutral hedge. This ratio is the multiplier to unit call option; and can be calculated as follows: 1. Calculate the delta and gamma for the target call option and the call option to be used in replication, which is having higher gamma than the target call option.(In this case, June’09 call option is with higher gamma and Sep’09 call option is the target call option.) 2. Calculate the fraction that converts the gamma of June’09 call option equal to gamma of September ’09 call option. 3. This fraction is the gamma hedge ratio for the June’09 call option investment. When the call option with higher gamma (June ’09) is invested in a proportion equal to the gamma hedge ratio found from previous description, the net Greeks (delta, gamma, rho and kappa) can be calculated. The net Greeks are the difference of target call option Greeks and the Greeks multiplied with the gamma hedge ratio. For instance, net delta is the delta for target call option (September ’09 call option) minus product of gamma hedge ratio and delta of higher gamma call option (June ’09 call option). The net gamma turns out to be zero (gamma neutral hedge), and there appears to be values for net kappa and net rho. The net delta value can now be used as the delta for the replication and delta 17 hedge can be executed. To be more specific, the net delta is the proportion of investment to be made in the underlying asset (S&P 500 index futures contracts), so as to create a delta-neutral hedge after having previous gamma neutral hedge. 18 Chapter 3 IMPLEMENTATION OF METHODOLOGY Example of Replicating September S&P500 Index Futures Call Option using the Greeks Hedging Strategy Delta-neutral hedging and delta-gamma neutral hedging are the two replication strategies that are used to replicate the September 2009 call option, on S&P 500 index futures contract, with strike price of $1025. The aim is to reduce the error during replication and generating the pay-off close to the original option. Hedging the Error Related to Delta for the Target Call Option As discussed in methodology, in order to replicate a September 2009 call option on S&P 500 index futures contract, the delta for the call option is calculated for associated spot price of underlying asset (S&P 500 index futures contract for September 2009) using Black-Scholes option pricing model. For ease of explanation three specific pair of dates, April 9th, 2009, January 15th, 2009 and January 27th, 2009, are taken as examples of single day pay-off replication. These dates can provide a better explanation as the underlying S&P 500 index futures contract for September 19 ’09 price change on these dates is highly diverse. Note: The term “September’09 call option” in the tables is September 2009 call option on S&P 500 index futures contract and the term “June’09 call option” means the June 2009 call option on S&P 500 index futures. Table 2 shows September ’09 call option prices as well as underlying prices for April 9, 2009, January 15, 2009, and January 27, 2009. Adjacent to them are the next business day values, so that the values of underlying price, delta, gamma, rho and theta can be compared. It is apparent, from the table 3, that the change in the underlying prices is diverse. The replication error can be calculated for three different scenarios, in this case, small underlying asset price change of up to $2, underlying price change up to $10, and high price change observed in the underlying asset price. 20 Table 2 Delta-Neutral Hedge on September ’09 S&P500 Index Futures Call Option for April 9, 2009, January 15, 2009 and January 27, 2009 Sep '09 Call Option 9-Apr-09 13-Apr-09 15-Jan-09 16-Jan-09 27-Jan-09 28-Jan-09 Underlying contract price September 09 call option price Strike price Interest Rate Dividend Yield Implied volatility Time to expire(days) Delta Gamma Rho Theta Change in underlying price $849.10 $841.10 $832.70 $865.00 $19.00 $18.80 $33.90 $35.50 $1,025.00 $1,025.00 $1,025.00 $1,025.00 1.0850% 1.0850% 1.0850% 1.0850% $26.40 $1,025.00 1.0850% $32.80 $1,025.00 1.0850% 3.4200% 3.4200% 32.1692% 32.2341% 35.6672% 35.3623% 32.8105% 32.0699% 163 159 247 246 235 0.20388 0.20344 0.26210 0.27121 0.23223 0.00154 0.00155 0.00132 0.00134 0.00138 68.82500 67.18462 124.62747 129.81784 107.50820 53.27246 54.14368 52.62253 53.62200 46.66398 235 0.27129 0.00148 129.41694 50.94521 3.4200% $850.50 3.4200% $1.40 $832.00 3.4200% 3.4200% $9.10 $32.30 Change in the option price (pay-off) -$0.20 $1.60 $6.40 0.2039*84 0.2039*85 0.2621*83 0.2621*84 0.2322*832 9.1= 0.5= 2= 1.1= .7= 0.2322*865= Delta neutral hedge $173.1174 $173.4028 $218.0659 $220.4510 $193.3809 $200.8820 Delta neutral hedge pay-off $0.2854 $2.3851 $7.5011 Delta neutral hedge error 0.29-(0.20)= 2.39(1.60)= 7.50(6.40)= $0.4854 $0.7851 $1.1011 Delta-neutral hedge is shown in the calculations of table 2. The three vertical sections calculate the delta-neutral hedge pay-offs for dates April 9, 2009, January 15, 21 2009, and January 27, 2009. The change in the underlying from April 9th to April 13th is $1.4 (small underlying asset price change), from January 15th to January 16th is $9.1(underlying asset price change around $10) and from January 27th to January 28th is $32.3(high change in underlying asset price). The delta for Sep ’09 call option on April 9th is 0.20388, so as per the methodology discussed in chapter 2, the delta hedge pay-off equals to difference in delta times the underlying prices, which is (0.20388*850.5 – 0.20388*849.1=) $0.285. In case the investment was done in the call option, the realized pay-off would be ($18.8-$19=) -$0.2. This shows the realized replication error with delta-neutral hedge strategy with an underlying asset price change at -$0.485. Similarly, the replication error for January 15th with a $9.1 change in underlying asset price, as shown in table 2, is $0.7851 and for January 27th, with a $32.3 change in the underlying asset price, the replication error is $1.1011. 22 Figure 8 Comparison of Change in Option Price with Delta-Neutral Hedge Payoff (Daily Hedge) 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 0 -1 -2 -3 -4 -5 -6 -7 -8 -9 -10 -11 -12 -13 -14 -15 Change in option price ($) 8-Jun-09 25-May-09 11-May-09 27-Apr-09 13-Apr-09 30-Mar-09 16-Mar-09 2-Mar-09 16-Feb-09 2-Feb-09 19-Jan-09 5-Jan-09 22-Dec-08 8-Dec-08 24-Nov-08 Delta neutral hedge pay-off ($) Figure 8 shows comparison of the September 2009 call option price pay-off with delta-neutral hedge pay-off for the period November 24, 2008 to June 15, 2009. The dotted line is the September ’09 call option pay-off and the continuous line shows the delta-neutral hedge pay-off. The mismatch in the curves shows the error in replication. This hedge is a daily basis hedge, which means for every single day if the underlying asset price is changed, the replication hedge needs to be adjusted to receive target call option pay-off. 23 Hedging for Delta and Gamma The second most important factor to be considered, when using the delta as a hedging base, is the gamma of the target call option. For every dollar change in the underlying price, the change observed in delta of the option, on that underlying asset, is given by the gamma for that option ( Option Trading Tips, 2009). The table 3 shows the values for the delta, gamma, rho and theta for the June 2009 call option. Table 3 Values of Greeks for June 2009 Call Option June '09 Call Option Underlying contract price June '09 call option price Strike price Interest Rate 9-Apr-09 13-Apr-09 $852.60 15-Jan-09 $854.00 $835.80 $5.30 $4.70 $1,025.00 $1,025.00 $19.90 $1,025.00 1.085% 1.085% 1.085% 16-Jan-09 27-Jan-09 28-Jan-09 $844.90 $835.70 $868.00 $20.70 $12.60 $16.80 $1,025.00 $1,025.00 $1,025.00 1.085% 1.085% 1.085% Dividend Yield 3.42% 3.42% 3.42% 3.42% 3.42% 3.42% Implied volatility 32.3396% 32.0908% 35.5896% 34.9898% 31.6391% 30.5918% Time to expire(days) 68 64 152 151 140 139 Delta 0.09952 0.09261 0.20432 0.21204 0.15905 0.19970 Gamma 0.00147 0.00144 0.00147 0.00152 0.00147 0.00170 Rho 14.81989 13.04295 62.82797 65.55013 46.14975 59.61317 Theta 53.72233 52.29450 60.77288 61.80816 48.26203 55.63571 24 In order to find the proportion of June’09 call option for the gamma neutral hedge, the gamma values of the September’09 call option from the table 2 and gamma values of June’09 call option from table 3 are used. Table 4 Calculations: Multiplier for June’09 Call Option for Gamma Neutral Hedge 9-Apr-09 13-Apr-09 15-Jan-09 16-Jan-09 27-Jan-09 28-Jan-09 Price change in underlying Sep 09 contract Price change in Sep '09 call option Gamma hedge ratio for June '09 call option Gamma hedge ratio * June'09 call option price Modified delta Modified gamma Modified rho Modified theta $1.40 $9.10 $32.30 -$0.20 $1.60 $6.40 1.05113 0.89816 0.93592 $5.57 $4.94 $17.87 $18.59 June'09 call option $11.79 $15.72 0.10460 0.09734 0.18351 0.19044 0.14886 0.18690 0.00154 0.00152 0.00132 0.00136 0.00138 0.00159 15.57762 13.70983 56.42957 58.87450 43.19237 55.79303 56.46913 54.96830 54.58376 55.51361 45.16930 52.07046 25 For April 9, 2009, the gamma value for September ’09 call option is 0.001542 and for June ’09 call option, the gamma value is 0.001443. As a result, the gamma hedge ratio for June’09 call option is, (0.001542/0.001443=)1.05113. This means, in order to create a gamma neutral hedge, 1.05113 of June’09 call option should be bought in the portfolio. The net exposure to Greeks should now be modified by 1.05113 times, which means the delta for 1.05113 of June ’09 call option is (0.09952*1.05113=) 0.104604. Similarly, now the modified rho is 15.57762 and modified theta value is 56.46913. The modified gamma value is 0.001542, which justifies the gamma hedge ratio is used to match the gamma exposure of September’09 call option and create a gamma neutral hedge. The replication can be hedged for delta by using the delta-neutral hedge strategy. The proportion of required investment in underlying asset S&P500 index futures September 2009 contract, in this case, must be the value of net delta 0.09928, which is the difference of delta for September’09 call option(0.20388) and modified delta for 1.05113 of June’09 call option(0.104604). Similarly, net rho and net theta values should be 53.24737 and -3.19667, respectively. The net gamma value is 0, which shows a gamma neutral hedge in the replication process. As described in the methodology in chapter 2, and after finding out the gamma hedge ratio for gamma hedge and proportion of investment in underlying asset, the delta and gamma combined neutral hedge can be applied to replication by 26 adding 1.05113 of June’09 call option and 0.09928 of underlying asset (S&P 500 index futures September 2009 contract) to the portfolio. The pay-offs for this delta-gamma neutral hedge is shown in table 5. Table 5 Calculations: Delta and Gamma Neutral Hedge Pay-offs and Errors in Replication Net delta Net gamma Net rho Net theta Delta neutral hedge Delta and gamma neutral hedge Realized price change in June'09 call option position Realized price change with position in underlying Sep '09 contract Delta gamma neutral hedge payoff Error in replication 9-Apr-09 0.09928 0.00000 53.24737 -3.19667 15-Jan-09 0.07859 0.00000 68.19790 -1.96123 27-Jan-09 0.08337 0.00000 64.31583 1.49468 0.0993 of 0.0786 of 0.0834 of underlying asset underlying asset underlying asset Pay-offs 1.0511 of June'09 0.8982 of June'09 0.9359 of June'09 call option + call option + call option + 0.0993 of 0.0786 of 0.0834 of underlying asset underlying asset underlying asset -$0.6307 $0.7185 $3.9309 $0.1390 $0.7152 $2.6930 -$0.4917 $1.4337 $6.6238 $0.2917 $0.1663 $0.2238 The realized price change in 1.05113 of June’09 call option position is 1.05113 * (4.7-5.3) = -$0.6307. Similarly, the realized price change, with the delta-neutral 27 hedge, in the underlying September 2009 S&P 500 index futures contract is 0.09928 * (850.5 – 849.1) = $0.1390. The net delta-gamma neutral hedge pay-off will be -$0.4917, which shows replication error of $0.2917 ( = absolute value of $0.4917-(-$0.2)), when compared to the actual pay-off realized with the September 2009 call option price change. 8-Jun-09 25-May-09 11-May-09 27-Apr-09 13-Apr-09 30-Mar-09 16-Mar-09 2-Mar-09 16-Feb-09 2-Feb-09 19-Jan-09 5-Jan-09 22-Dec-08 8-Dec-08 24-Nov-08 Figure 9 Comparison of Change in Option Price with Delta and Gamma Neutral Hedge Pay-off (Daily Hedge) 15 13 11 9 Change 7 in option 5 price ($) 3 1 -1 -3 Delta -5 gamma -7 hedge -9 pay-off -11 ($) -13 -15 Figure 9 shows the comparison for September 2009 call option price pay-off, the dotted line, on daily basis with the delta-gamma hedge pay-off, the continuous line. 28 Comparing the replication error from table 2 to table 5 shows that error is reduced by $0.1937489, for April 9, 2009 Sep’09 call option replication, when using deltagamma hedge as compared to delta hedge. Similarly, the replication errors for September ’09 call option on date January 15, 2009 and January 27, 2009 can be calculated. The values for replication error for delta-gamma hedge, from table 5, are $0.1663 and $0.2238, respectively. There is an apparent $0.6188(=0.7851-0.1663) and $0.87730 (=1.1011-0.2238) benefit in replication with delta-gamma hedge as compared to replication with delta hedge. 8-Jun-09 25-May-09 11-May-09 27-Apr-09 13-Apr-09 30-Mar-09 16-Mar-09 2-Mar-09 16-Feb-09 2-Feb-09 19-Jan-09 5-Jan-09 22-Dec-08 8-Dec-08 24-Nov-08 Figure 10 Comparison of Delta Hedge Error with Delta-Gamma Hedge Error 7 6.5 6 5.5 Delta hedge 5 error ($) 4.5 4 3.5 3 2.5 2 1.5 Delta gamma 1 hedge 0.5 error ($) 0 Figure 10 shows the comparison of replication errors due to delta hedge and deltagamma combined hedge. This graph considers values on daily basis replication. 29 Ideally, for any replication this error line should be a horizontal line crossing 0 on xaxis. It can be observed that the delta-gamma combined hedge provides a better replication as compared to delta hedge. 30 Chapter 4 HEDGING WITH OTHER GREEKS AND VOLATILITY CONSIDERATIONS Role of Carrying Cost on Replication of a Target Option Carrying cost, which is the difference of the risk-free interest rate and the dividend yield (Investopedia, 2009) considered in the Black-Scholes option pricing model, has a significant role on replication when using delta and gamma hedge strategy on the target option. An example showing the effect of change in carrying cost on replication, of a September 2009 S&P 500 index futures call option, can illustrate the concept in a better way. For calculation purposes, it is assumed, in this case, that changes the carrying cost change is only due to changes in interest rate and the dividend yield is constant for the specific period considered in the example. Also, for calculating the call option prices for June’09 and September’09, with changed carrying cost, the implied volatility is assumed to be the same as compared implied volatility when there are no carrying cost alterations. Table 6 calculates the delta-gamma hedge replication error when the carrying cost drops by 100 basis points. This is a result of risk-free interest rate drop from 1.085% to 0.085%. 31 Table 6 Replication without Rho Hedging Underlying contract price Call option price Strike price Interest Rate Dividend Yield Implied volatility Time to expiry (days) Sep'09 call option 27-Jan-09 28-Jan-09 $832.70 $865.00 $26.40 $31.5243 $1,025.00 $1,025.00 1.0850% 0.0850% 3.4200% 3.4200% 32.8105% 32.0699% 235 234 Delta Gamma Rho Theta 0.23223 0.00138 107.50820 46.66398 Price change in underlying asset Price change for call option Gamma hedge ratio 0.9359 of June'09 call option price June '09 call option Modified delta Modified gamma Modified rho Modified theta June'09 call option 27-Jan-09 28-Jan-09 $835.70 $868.00 $12.60 $16.2121 $1,025.00 $1,025.00 1.0850% 0.0850% 3.4200% 3.4200% 31.6391% 30.5918% 140 139 0.15905 0.00147 46.14975 48.26203 $32.30 $5.12 0.93592 - $32.30 $3.61 =0.00138/0.00147 $11.79 $15.17 0.148860 0.001379 43.192470 45.169399 Net delta 0.083374 Net gamma 0.000000 Net rho 64.315728 Net theta 1.494580 Delta neutral hedge 0.08337 of underlying asset Pay-offs Delta gamma neutral hedge Realized price change in June'09 call option position Realized price change with position in underlying Sep '09 contract Delta gamma neutral hedge pay-off Error in replication (without rho hedge) 0.93592 of June'09 call option + 0.08337 of underlying asset $3.3807 $2.6930 $6.0736 $0.9493 32 Because of the change in the risk-free interest rate, the single day price change for June’09 and September’09 call options is different from the call prices shown in table 2 and table 3. This change is $5.12 for the target option (September ’09 call option) and $3.61 for the June’09 call option which is $6.40(=$32.8-$26.4) for September ’09 call option and $4.2 (=$16.8-$12.6) for June’09 call option, on January 27, 2009, if there is no change in the interest rate.(Please refer table 2 and table 3 for prices of September’09 and June’09 call options respectively.) The gamma hedge ratio stays the same 0.9352; and with this ratio the realized June ’09 call option price change is $3.3807. The delta hedge pay-off from table is $2.6930, so there is a net delta-gamma hedge error of $0.9493 for $32.3 change in underlying asset price. Comparing with the error value in table 5, this error is higher by $0.7255 (=0.9493-0.2238). Rho Hedging A Eurodollar futures is an instrument that is specifically related to interest rates. (Investopedia, 2009). This instrument assumes $1.00 change in future value for 100 basis points change in the risk-free interest rate. The values for delta and gamma are zero for Eurodollar futures. Hence, introducing them in the portfolio can mitigate the interest rate risk. 33 Eurodollar futures Intial Price Price after 100 bps drop Price (may 29th) 98.915 99.915 Interest rate 1.085% 0.085% The exposure for the Eurodollar futures is interest rate exposure and it has rho equal to -0.01, which can be used to hedge the error due to carrying cost. Table 7 Delta-Gamma Rho Hedging Modified delta Modified gamma Modified rho Modified theta 0.148860 0.001379 43.192470 45.169399 Net delta Net gamma Net rho Net theta 0.083374 0.000000 64.315728 1.494580 Delta neutral hedge 0.08337 of underlying asset Rho hedge = rho(Eurodollar futures) * net rho -0.01 * 64.31573 = -0.64316 of Eurodollar futures 99.915 - 98.915 =$1 -$0.64 Price change for Eurodollar futures Realized price change for rho hedge Pay-offs Delta gamma rho neutral hedge Realized price change in June'09 call option position Realized price change with position in underlying Sep '09 contract Realized price change with position in Eurodollar futures Delta gamma neutral hedge pay-off Error in replication (with rho hedging) 0.93592 of June'09 call option + 0.08337 of underlying asset+ -0.64316 of Eurodollar futures $3.3807 $2.6930 -$0.6432 $5.4305 $0.3061 Table 7 shows the rho hedging added to delta-gamma hedging calculations from table 6. The rho hedge can be done by multiplying the rho of Eurodollars with net rho, 34 obtained after subtracting the modified rho (table 6) from the rho for target call option (September’09 call option on January 27, 2009). The calculations in table 7 differ from table 6 only for the part of rho hedging, which is shown in third and the last section (pay-off section) of table 7. The resulting replication error is calculated as $0.3061 which is $0.6432 (=$0.9493$0.3061) less than the replication error, $0.9493, from table 6 (replication without rho hedging). Hedging for Kappa The kappa hedging, during replication with Greeks of the target option, is hedging the volatility of the option by introducing instruments with different volatility, thereby reducing the replication error as compared to hedging for the delta of the target option. Apparently, there is a cost associated to introducing instruments with different volatility in the portfolio, and it tends to increase the net cost of the replication. There is no instrument available directly related to the volatility risk for a predetermined cost over the life of the target option. Since, the Black-Scholes option pricing model takes into consideration the factors that are highly contributive to the volatility; it is not possible to determine the total volatility cost as it is a function of expiration of the option, exercise price, and current volatility in underlying asset price. And since the volatility hedge is uncertain for every instrument we use to 35 hedge the delta, gamma or rho, it actually happen to introduce more uncertainty per instrument it can add to replicating portfolio, and more uncertainty in determining the cost associated to it. Hedging for Theta Considering the net theta for the target option from the table 5, after introducing gamma hedge to the replicating portfolio, it is apparent that the net theta is having a considerably small value or less than zero. Upon introducing the underlying asset in a proportion equal to the delta hedge ratio, the net theta value for the portfolio is reduced to a negative value, which means that there is no theta exposure in the replicating. The reason behind the automatic hedge is that the theta exposure is closely related to gamma exposure. So application of gamma hedge to the replication portfolio reduces the theta exposure to a small value which can be hedged using the delta hedge. Table 8 shows the calculations of modified theta as the product of delta hedge ratio with the theta of target call option. The gamma hedge on the September’09 call option, for January 27, 2009, leaves a positive 1.49 value for the theta exposure. But by introducing, 0.08377 of underlying asset, S&P 500 index futures contract for September 2009, the modified theta increases to a value of 3.89, which is higher by 2.395 units to the value of net theta, 1.49, after gamma hedge. This results in a net 36 negative value for the replicating portfolio, consisting of 0.03591 of June ’09 call option and 0.08337 of underlying asset, for September ’09 target call option. Table 8 Theta Hedge (Refer table 5) Sep'09 Call option Delta Gamma Rho Theta Delta gamma hedge for Sep'09 call option 9-Apr-09 15-Jan-09 27-Jan-09 0.20388 0.00154 68.82500 53.27246 0.26210 0.00132 124.62747 52.62253 0.23223 0.00138 107.50820 46.66398 June'09 Call Option Delta Gamma Rho Theta 0.099516528 0.001466906 14.81988895 53.72232753 0.204318288 0.001468703 62.82797493 60.77287753 0.15905 0.00147 46.14975 48.26203 Gamma hedge ratio 1.05112967 0.89815994 0.935917871 0.09928 0.00000 53.24737 -3.19667 0.07859 0.00000 68.19790 -1.96123 0.08337 0.00000 64.31583 1.49468 0.099278574 0.07858796 0.08337 5.288813591 4.135497323 3.890563779 -8.48549 -6.09673 -2.39588 Net delta Net gamma Net rho Net theta Delta hedge ratio modified theta (=delta hedge ratio * theta of target option Effect on Net theta by introducing underlying in a proportion equal to delta hedge ratio 37 Project Limitations The project has a limited scope to the discussion of hedging with delta, gamma and rho hedging. The discussion of hedging other Greeks such as: eta, lambda etc. for the option is not covered in the project. The replication discussed and applied is good for one day period replication. The hedge needs to be adjusted for associated Greek hedging. For instance, gamma hedge needs to be adjusted with the change in gamma value and rho hedge needs to be adjusted every time the interest rate changes. The major factors behind those limitations of discussed replication strategy are: 1. Accuracy of Black-Scholes option pricing model consideration of volatility as it predicts the target option price. 2. There is a change in the price as number of outstanding options, used in the replication, changes. Also, the number of contracts available at an acceptable price to provide the hedge changes overtime depending on trade activity (Asay and Edelsburg, 1986). 3. A hedge for replication depends on the underlying asset price gap between two consecutive price changes. There exists an uncertainty when aiming for an anticipated minimum price gap to adjust the hedge for replication. 38 Chapter 5 CONCLUSION Replication of an option can be done by hedging the Greeks: delta, gamma, rho, kappa, and theta of the option. The hedging for delta exposure can be done by investing a proportion, called as delta hedge ratio in the project, equal to delta of the target option, in the underlying asset. The gamma exposure can be hedged by investing a proportion in another option with higher gamma or more liquid option and this proportion can be a fraction needed to neutralize the gamma of the target option payoff curve. Investing in more than one option with shorter maturity periods as compared to the target option helps reduce the gamma for replication or a portfolio of options. The empirical results from the project conclude that delta-gamma neutral hedging replicates S&P500 Index Futures call option with comparatively less error as compared with delta-neutral hedge. The values for replication error for delta-gamma neutral hedge is less than $0.6187, $0.8773 and $0.1937 for September’09 call option on dates January 15, 2009, January 27, 2009 and April 9, 2009 respectively, as compared with delta-neutral hedge. 39 The importance of rho is towards changes in carrying cost, in this case, the interest rates. Whenever there is a high change in price along with the change in the interest rate, the replication is adjusted for risk, if it is hedged by a proper interest rate addressing instruments like Eurodollar futures or other interest rate futures. The volatility hedge during replication can lead to higher transaction costs and can also induce uncertainty per instrument included depending on how the instrument is correlated to other instruments in the same portfolio. This problem is associated with kappa hedging, as there is no specific instrument that is having a specific volatility at a predetermined price. Lastly, the accuracy of the option pricing model has high resemblance to better hedging as it captures the factors affecting the payoff of the target option. 40 APPENDIX Rates from Eurodollar Futures versus US Treasury Bills The risk-free rate derived from the mean of rates of months June’08-Oct ’09 can be used. But there are related arguments for using those rates instead of 1.085% as the risk-free rate. The investor sentiment does consider the historical rates even though it is outlier but looking to higher rates, there are more capital flights into risk-free assets which ultimately draw the rates down. It is logical to take the median over the mean of the interest rates. The resulting risk-free rate comes out to be 1.65%. The project uses Eurodollar futures rates instead of U.S. Treasury bill, for couple of reasons: First, the spread for adjacent quarterly Eurodollar futures which historically seem to be small and during the period of trading it remains nearly constant as compared to U.S. Treasury bills. Second, interest rates provided by Eurodollar futures prices can be well predicted with US treasury yield curve and TED – (Eurodollar deposit rate and T Bill rate spread) (Cretien, 2006). 41 Figure 11 Yield curves for July-Dec 2000, July’07, Oct ’07, July’08, Oct’08 6.5000 6.2500 6.0000 5.7500 5.5000 5.2500 5.0000 4.7500 4.5000 4.2500 4.0000 3.7500 3.5000 3.2500 3.0000 2.7500 2.5000 2.2500 2.0000 1.7500 1.5000 1.2500 1.0000 0.7500 0.5000 0.2500 - Yield Curves Mean of July2000 to Dec 2000 Mean of July'07 Mean of Oct '07 Mean of July'08 Mean of Oct '08 1 mo3 mo6 mo 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr20 yr30 yr This graph shows the yield curves for rates on t-bills with different maturities and shows a comparison between October 2008, July 2008, October 2007, July 2007 and a period of July 2000 to December 2000. Data is taken from the website of US Department of Treasury, historical prices. Refer to the bibliography section. 42 Figure 12 TED spread larger period (Jan’00 – Oct ’09) 5.0000 Euro$ - Tbill spread (3 month contracts) 4.0000 3.0000 2.0000 1.0000 Jan-00 Apr-00 Jul-00 Oct-00 Jan-01 Apr-01 Jul-01 Oct-01 Jan-02 Apr-02 Jul-02 Oct-02 Jan-03 Apr-03 Jul-03 Oct-03 Jan-04 Apr-04 Jul-04 Oct-04 Jan-05 Apr-05 Jul-05 Oct-05 Jan-06 Apr-06 Jul-06 Oct-06 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 - This graph shows the Eurodollar and T bill spread (TED) for the period January 2000 – October 2009. Figure 13 TED spread for shorter period (Jan ’08 -Oct ’08) 3month Euro$ - 3 monthTbill spread 5 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 This graph shows the TED for a period January 2008 – October 2009. Oct-09 Sep-09 Aug-09 Jul-09 Jun-09 May-09 Apr-09 Feb-09 Mar-09 Jan-09 Dec-08 Nov-08 Oct-08 Sep-08 Aug-08 Jul-08 Jun-08 May-08 Apr-08 Mar-08 Feb-08 Jan-08 3month Euro$ - Tbill spread 43 Under normal distribution major capital in the markets was distributed on both risky and riskless assets. But as market started freezing, there was a capital flight to quality and preservation and driving the demand of riskless assets high up and resulting in lowering the returns (Broadle, Chernov and Johannes, 2009). The TED (Eurodollar to T bill spread) shows the surge starting July’07 going up by 72 basis points as compared to Oct ’07 and in 2008, it went up by 327 basis points starting from July’08 to October ’08. The increasing spread showed an increase in default risks. Under such circumstances, the investors might have had sentiment to invest in riskless instruments. Referring back to the chart of T-bill yield curves, the mean of July to December in 2000 was an inverted yield curve that showed intent of upcoming economic recession. Mean of July ’07 T Bill yield curve was close to flat showing an increased demand in riskless instruments and its high trading resulted in decreasing interest rates for upcoming years. And certainly October ’07 and July ’08 yield curves show resemblance with spiked TED spread for the same period. This shows a transition in slope of yield curves have a relation to TED spread, and ultimately increases the window of risk for less risky assets. As the slope of the yield curve changes, the TED spread increases, which means investors are tending towards safer investments. But to what extent this effect exists is beyond the scope of this project analysis. 44 REFERENCES Option Trading Tips. Option Gamma. 25 November 2009 <http://www.optiontradingtips.com/greeks/gamma.html>. Armbruster, Mark. "Rumors of MPT's Death Greatly Exaggerated." 15 July 2009. Index Universe. <http://www.indexuniverse.com/sections/features/6168-rumors-of-mptsdeath-greatly-exaggerated.html>. Asay, Michael and Charles Edelsburg. "Can a dynamic strategy replicate the returns of an option?" The Journal of Futures Markets (1986): 6,1. Black Scholes Option Pricing Model. Derivative One. 28 November 2009 <http://www.derivativesone.com/kb/black_scholes.aspx>. Bookstaber, Richard. Option Pricing and Investment Strategies. 3rd edition. Chicago: Probus Publishing Co., January 19991. Broadle, Mark, Mikhail Chernov and Michael Johannes. "Understanding Index Option Returns." The Reivew of Financial Studies 22 (2009): 4493-4529. Cretien, Paul D. Trading interest rate inefficiencies: the stability and predictability of Eurodollar futures calendar spreads makes them attractive for interest rate trading strategies. But to become fluent in Eurodollar forecasting, you'll need to learn a little about U. 1 January 2006. 1 November 2009 <http://www.allbusiness.com/personalfinance/investing-trading-futures/855769-1.html>. Derman, Emanuel; Kani, Iraj; Ergener, Denis. "Quantitative Strategies Research Notes Static Options Replication." May 1994. Emanuel Derman. Goldman Sachs . <http://www.ederman.com/new/docs/gs-options_replication.pdf>. Elton, Edwin J and Martin J Gruber. "Modern Portfolio Theory, 1950 to date." Journal of Banking & Finance 21.11-12 (1997): 1743-1759. Figlewiski, Stephen, William Silber and Marti Subramanyam. Financial Options from Theory to Practice. 1st. McGraw Hill, 1992. Futurespros.com. 1 Nov 2009 <http://www.futurespros.com/futures-indexes/s-p-500index?smlID=10900&page=chart&sym=SPU9&type=LINE>. 45 Gastineau, Gary and Mark Kritzman. Dictionary of Financial Risk Management. 1996. Frank J. Fabozzi Associates. 11 2009 <http://www.amex.com/servlet/AmexFnDictionary?pageid=display&word=Option%20 Replication>. "Historical Prices." Bloomberg Terminal. 29 October 2009. Hull, John and Alan White. "The General Hull-White Model and Super Calibration." Financial Analysts Journal (Nov-Dec 2001): 57, 6. Investopedia. Forbes Digital Company. 29 11 2009 <http://www.investopedia.com/terms/c/costofcarry.asp>. Markowitz, Harry. "Harry Markowitz." Columbia Electronic Encyclopedia, October 2009. 1. Perrakis, Stylianos and Jean Lefoll. "Option pricing and replication with transaction costs and dividends." Journal of Economic Dynamics and Control 24.11-12 (2000): 1527-1561. Randell, Sean David. Numerical Techniques for the American Put. MS Dissertation. Johannesburg: Faculty of Science, University of Witwatersand, 2006. Rubinstein, Mark and Hayne E Leland. "Replicating options with positions in stock and cash." Financial Anlyast Journal (1995): 51, 1. Shaun, Martin Levitan. "Advanced Mathematics of Finance Honours Lattice Methods for Barrier Options." N/A (December 10, 2001). "Standard and Poor's." Google's cache snapshot. The McGraw-Hill Companies. 26 October 2009 <http://74.125.95.132/search?q=cache:g5Qt32U5J3UJ:www2.standardandpoors.com/po rtal/site/sp/en/us/page.topic/indices_500dividend/2,3,2,2,0,0,0,0,0,1,1,0,0,0,0,0.html+sp 500+dividend+yield+3.42%25&cd=1&hl=en&ct=clnk&gl=us&client=firefox-a>. System, Board of Governors of the Federal Reserve. Federal Reserve Statistical Release. Vers. H.15. 11 2009 <http://www.federalreserve.gov/releases/h15/data/Business_day/H15_ED_M3.txt>. 46 Treasury, U.S. Department of. Daily treasury yield curve rates. Oct 2000-2009. 11 2009 <http://www.ustreas.gov/offices/domestic-finance/debt-management/interestrate/yield_historical_main.shtml>.