Primer on Options

advertisement

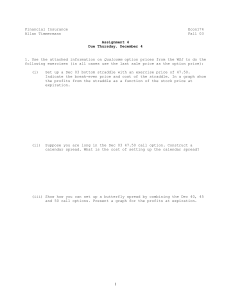

OLLI Class Fall, 2011 Call options A listed call option on an individual stock is a contract that allows the call buyer to buy from the call option seller (or writer) 100 shares of a specified stock at a specified price (striking price) any time before the date of expiration by paying a premium to the option seller Put options A listed put option is a contract which allows the put buyer to: sell to the put option seller (writer) 100 shares of a specified stock at a specified price (striking price) any time before the date of expiration by paying a premium to the option seller Essential terms The buyer of a put or call has a long position in the option and the right of exercise. The call seller has a short position and has the obligation to sell the stock if assigned. The put seller is short the put and must buy the stock if assigned. American or European Style All listed options can be traded prior to expiration, but: American options can be exercised anytime prior to expiration. All listed equity options and the OEX (S&P100) are American options. European options can be exercised only at expiration. Most index options are European style options. All else equal, an American option will have a higher premium than the identical European option Types of Options Available Individual equity/stock options Index Options Broad Based (S&P 500, DJIA, S&P 100) Sector indexes LEAPS (long term options up to 2 years) FLEX options (customized contracts) Interest Rate options Foreign Currency options Creating a call payoff diagram Exercise price = 70 70 days to expiration Interest rate = .06 Stock price = $70 Premium = $ 5.25 Stock and call payoff at expiration stock 65 70 75 80 call payoff 0-5.25 = -5.25 0-5.25 = -5.25 5-5.25 = - .25 10-5.25 =+4.75 stock payoff -70+ 65 = - 5.00 -70+ 70 = 0.00 -70+ 75 = + 5.00 -70+ 80 = +10.00 Risk Management Strategies: Long stock compared to buying call Profit long stock 70 5.25 buy call 75.25 Market outlook: bullish Loss stock price at expiration Risk Management Strategies: Short the call: (i.e. sell the call) Profit 5.25 sell call 70 stock price at expiration Market outlook: bearish Loss Risk Management Strategies: Covered Call: long stock - sell call long stock Profit 5.25 sell call 64.75 70 long stock - short call stock price at expiration Loss Market outlook: long term bullish but short term neutral Risk Management Strategies: Buy Put compared to shorting stock Profit short stock 70 4.625 Loss 65.375 Market outlook: bearish stock price at expiration buy put Risk Management Strategies: Short put: (sell the put) Profit sell put 4.625 70 stock price at expiration 65.375 Market outlook: bullish Loss Risk Management Strategies: Protective put: long stock + buy put long stock Profit long stock + buy put buy put 70 4.625 Loss stock price at expiration Market outlook: nervously bullish The Costless Collar: long stock + put - call Buy stock @ $70 sell 75 call @ +3.25. buy 65 put @ -2.625 net cost of $69.375 Profit 5.625 3.25 2.65 4.375 Loss +stock -call 65 70 75 +put stock price at expiration Market outlook: neutral but nervously bearish Trading Volatility: The Straddle Long straddle: buy the call and put with same characteristics. Exercise price is $70: profit/loss profit/loss Stock call@$5.25 put@$4.625 portfolio 55 -5.25 10.375 5.125 60 -5.25 5.375 .125 65 -5.25 .375 -4.875 70 -5.25 - 4.625 -9.875 75 - .25 - 4.625 -4.875 80 +4.75 - 4.625 .125 85 +9.75 - 4.625 5.125 Risk Management Strategies: Long straddle: buy call + buy put Profit buy put buy call 70 stock price at expiration 9.875 Loss Market outlook: volatility will increase Risk Management Strategies: Sell the straddle: short call + short put 9.875 Profit sell call sell put 70 stock price at expiration Loss Market outlook: volatility will decrease Creating a Synthetic Forward Sell the 70 put for $4.625 and buy the 70 call for $5.25 for a debit of $ .625. -put + call profit 4.625 -put 70 5.25 loss +call Stock price At expiration It Depends on Your Market View Just the fact, ma’am: The S&P 500 (SPY) is at 128.00 having varied between 135 and 125 since January 2011. Volatility is relatively low, about 17 on the VIX You own 1,000 shares of SPY stock. SPY Option Premiums: June 17, 2011 SPY 500 @ 128 Strike Aug Price Calls Puts 120 9.45 1.90 125 5.68 3.12 130 2.65 5.08 135 .82 8.45 Sep Dec Calls Puts Calls Puts 10.50 2.95 11.75 4.95 6.75 4.40 8.20 6.60 3.65 6.70 5.40 8.90 1.60 9.25 3.25 11.25 Aug: 63 days Sep: 105 days Dec: 182 days You could sell all your stock, but … what if you’re wrong. Let’s consider some option strategies: Conservative Strategies to Manage Downside Risk Covered call strategy: Sell Aug calls with strike of 130 (neutral to slightly bearish) Protective put strategy: Buy Sep puts with strike of 125 (bearish, but don’t want to be out of the market). Collar strategy: Sell Aug 130 calls and buy Aug 120 puts (very bearish). Payoff Table Covered Call: long stock @ 128 +sell Aug 130 call @ 2.65 Stock call@$2.65 115 (2.65 - 0.00) 120 (2.65 - 0.00) 125 (2.65 - 0.00) 128 (2.65 - 0.00) 130 (2.65 - 0.00) 135 (2.65 - 5.00) 140 (2.65 -10.00) = = = = = = = +2.65 +2.65 +2.65 +2.65 +2.65 -2.35 -7.35 Stock@128 -13.00 - 8.00 - 3.00 0.00 + 2.00 + 7.00 +12.00 portfolio -10.35 - 5.35 - .35 + 2.65 + 4.65 + 4.65 + 4.65 Covered Call: long stock - sell call Own Stock at 128; Sell 130 Aug Call $2.65 Profit 4.65 125.35 130 long stock - short call stock price at expiration Loss Market outlook: long term bullish but short term neutral Max Return = (4.65/128) = 3.6% for 63 days; max loss unlimited less $2.65 Payoff Table Protective Put: Long Stock @ 128 + Buy Sep 125 put @ 4.40 Stock Put@4.40 115 (-4.40+10.00) 120 (-4.40+ 5.00) 125 (-4.40 - 0.00) 128 (-4.40 - 0.00) 130 (-4.40 - 0.00) 135 (-4.40 - 0.00) 140 (-4.40 - 0.00) = = = = = = = +5.60 + .60 -4.40 -4.40 -4.40 -4.40 -4.40 Stock@128 -13.00 - 8.00 - 3.00 0.00 + 2.00 + 7.00 +12.00 portfolio -7.40 -7.40 -7.40 -4.40 -2.40 +2.60 +7.60 Protective put: long stock + buy put Profit long stock + buy put 125 Max loss price 120.60 7.40 Loss 134.40 stock price at expiration Market outlook: nervously bullish Max loss = 7.40/128 = 5.8% over 105 days; Max gain = unlimited Payoff Table Collar: Long Stock @ 128 Sell Sep 130 call @ 3.65; Buy Sep 120 put @ 2.95 Stock call@3.65 115 + 3.65 120 + 3.65 125 + 3.65 128 + 3.65 130 + 3.65 135 - 1.35 140 - 6.35 put@2.95 + 2.05 - 2.95 - 2.95 - 2.95 - 2.95 - 2.95 - 2.95 Stock@128 - 13.00 - 8.00 - 3.00 0.00 + 2.00 + 7.00 +12.00 portfolio - 7.30 - 7.30 - 2.30 + 1.30 + 2.70 + 2.70 + 2.70 The Costless Collar: long stock + put - call Profit $2.30 120 130 $7.30 Loss stock price at expiration Market outlook: neutral but nervously bearish Max loss = 5.7%; Max gain = 1.8%; over 105 days Instead of a limit order below the market, sell a “cash secured” put Payoff table “Cash Secured Put”: Sell Dec 120 put @4.95; Invest cash (T-bills) of $120-$4.95 = $115.05 Stock Cash of 115.051 115 115.05 120 115.05 125 115.05 128 115.05 130 115.05 135 115.05 140 115.05 1Would 2This 120 put@+4.95 - 0.05 + 4.95 + 4.95 + 4.95 + 4.95 + 4.95 + 4.95 portfolio2 115.00 120.00 120.00 120.00 120.00 120.00 120.00 include 182 days of interest, which today is close to 0% is a return of 4.95/115.05 = 4.3% for 182 days (8.6% annualized) if the market stays above 120. You think the market will be flat until early fall then will rally above 140 by December. Split Strike Synthetic: Buy the Dec 135 call for $3.25 Sell the Dec 120 put for $4.95 Payoff table Split Strike Synthetic: Sell Dec 120 put @4.95; Buy Dec 135 call @3.25 Stock 135 call@-3.25 115 - 3.25 120 - 3.25 125 - 3.25 128 - 3.25 130 - 3.25 135 - 3.25 140 + 1.75 120 put@+4.95 - 0.05 + 4.95 + 4.95 + 4.95 + 4.95 + 4.95 + 4.95 portfolio - 3.30 + 1.70 + 1.70 + 1.70 + 1.70 + 1.70 + 6.70 Synthetic Forward: Long Call + Short Put profit 1.70 -put 120 135 Stock price At expiration loss You are out of the market between 120 and 135 with a return of $1.70 over 182 days You are willing to buy stock if the market goes below 120 and sell what you have above 135 Sell a “Strangle” – sell a put and call with same expirations but different strikes. Sell the Dec 135 Call for $3.25 and sell the Dec 120 put for $4.95, you own the stock at 128: Stock 115 120 125 128 130 135 140 135 call + 3.25 + 3.25 + 3.25 + 3.25 + 3.25 + 3.25 - 1.75 120 put - 0.05 + 4.95 + 4.95 + 4.95 + 4.95 + 4.95 + 4.95 stock - 13.00 - 8.00 - 3.00 0.00 + 2.00 + 7.00 +12.00 portfolio - 9.00 .20 + 5.20 + 8.20 + 10.20 + 15.20 + 15.20 Sell a strangle and own the stock: Sell 120 put; sell 135 call; own the stock Profit 15.20 .20 115 120 135 stock price at expiration Loss Sell you stock at $141.20 if market goes above 135; Buy more stock at $11.80 if market goes below 120.