Modification Proposal version 3

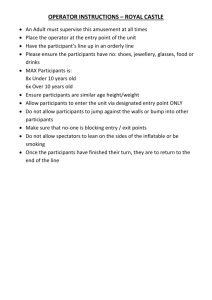

advertisement