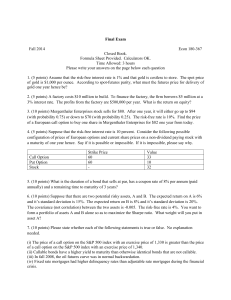

N08

advertisement

Options: valuation

Intro: Individual Equilibrium

• Option valuation: What is the equilibrium price for an option?

• In essence, we are interested in market equilibrium prices. It

is, however, easier to understand from an individual investor’s

point of view first.

Note: the timing of buying/selling an option contract!!!

• Example: Suppose you plan to long/short a European call

option on IBM.

Payoff

Buyer pays C

IBM price at T

x

t=0

t=T

Payoff

Time(t)

Seller gets C

IBM price at T

x

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Intro: Individual Equilibrium

• You buy/sell in order to acquire a future payoff structure. Your

future payoff after you have engaged yourself in a long/short

position of the IBM option is now “contingent” on the future

IBM’s share price.

• Depending on your belief, your portfolio, interest rate, etc.,

you will have in your mind a price you would be willing to

pay/get in order to engage in such a future payoff structure.

Payoff

Buyer pays C

IBM price at T

x

t=0

t=T

Payoff

Time(t)

Seller gets C

IBM price at T

x

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Individual => Market Eqm.

• We learnt from CAPM that a market equilibrium

must satisfy the following: Every individual

investment position is in his equilibrium.

• Therefore, market equilibrium essentially involve

all individual equilibria.

• In option pricing, we carry on the same idea. But

we use a short cut to formulate the equilibrium

option prices. We employ the concept called, “no

arbitrage”

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Arbitrage

In the last lecture, we have studied the Put-Call Parity.

In fact, it also uses the concept of no arbitrage.

What is arbitrage?

Definition:

“An arbitrage opportunity arises when an investor can construct a zero

investment portfolio that will yield a sure profit.”

•

Options?

Effectively, if the law of one price is violated, arbitrage opportunity

emerges. If a product is trading at different prices in two very close

locations, you take advantage by buying from the lower-priced location

and immediately selling at the higher-priced location. Your profit is equal

to the price differential. Again, arbitrage appears because the law of one

price is violated.

Terminology

Arbitrage

Binomial

Black-Scholes

Arbitrage

•

Imagine the above scenario would induce not only you but other people to

jump into it to take advantage of the price differential. It is the fact that so

many people are ready to jump on to an arbitrage opportunity that

essentially keeps the law of one price holds. Because the increased

demand at the lower-priced location will quickly jack up the price, while

the increased supply at the higher-priced location will push down the

price. This adjustment process goes on until the two prices equalize.

But how are we going to apply the concept to risky assets?

•

Imagine there are two portfolios each composed of totally different assets.

If their future payoffs across EVERY possible future state are EXACTLY

the same, the two portfolios should have the same present value. (e.g., if

IBM or Bombardier shares offer the exact same payoff structure to

investor, their share prices should be the same, regardless of them being

different companies. The bottom line: payoff structure, not assets)

•

What if their prices do differ? There is an arbitrage opportunity. Anyone

can construct the lower-cost portfolio. And sell it at a higher price and

earn immediate profit. Such forces of trying to take advantage of the misprice will eliminate the arbitrage opportunity.

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

No Arbitrage: An Example

•

Similarly put-call parity employs the concept of no arbitrage. A risk-less

portfolio should be priced as a risk-less asset.

Payoffs of 3 different assets in each of the 3 possible states

Risky

assets

•

•

•

Options?

x

y

z

Possible states

Good Normal Bad

100

80

70

15

25

30

70

30

10

It may not be that obvious, but imagine a portfolio with (2y + 1z) would

have a payoff structure exactly the same as if you hold 1x alone.

No arbitrage means, Px = 2Py + Pz

Payoff structure being the same = payoffs at EVERY possible state are

the same

Terminology

Arbitrage

Binomial

Black-Scholes

•

No Arbitrage: Put-Call Parity

We set up a similar table as the previous slide. Payoffs at expiration date

(i.e., Time = T) are listed in the table cells.

Possible states

ST >X

ST ≤X

X

X

ST

ST

Short 1 Call option

-(ST - X)

0

Long 1 put option

0

(X-ST)

Investments Risk-free Investment with an

amount equal to X/(1+R)T

Long a share of Stock

•

•

•

Same idea here. A portfolio consisting of the bottom 3 items would have a

payoff exactly the same as if you hold the top risk-free investment alone.

No arbitrage means, P2 - P3 + P4 = P1

Thus,

S0 + P – C = X/(1+Rf)T

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

No Arbitrage: Put-Call Parity

$

•

<= Long 1 put

ST

x

ST

The graph of combining

different options and

assets is such that the

payoffs of all assets are

added up vertically.

<= Long 1 stock

x

ST

<= Short 1 call

x

x

Total Payoff

ST

<= Total payoffs

x

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Financial Engineering

•

One of the many attractions of options is the ability they provide to create

investment positions with the resulting payoff structure dependent on a variety

of ways on the underlying securities’ prices.

$

•

<= Long 1 put

ST

x

ST

<= Long 1 call

•

x

•

ST

<= Short 1 put

ST

<= Short 1 call

x

Imagine the 4 different

payoffs patterns:

• Long Put

• Long Call

• Short Put

• Short Call

And imagine options with

different exercise prices

and expiration dates.

Wisely and creatively

combines options and

you can build up different

types of payoff structure

tailored towards your

investment needs.

x

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Option strategies

•

There are unlimited number of ways for how you combine different options to

form a specific payoff structure that you want.

•

To appreciate the power of using options, you need to be very familiar with the

payoff structures of options.

•

To be a successful financial controller, fund manager, pension fund manager,

investment banker, etc., or purely to get the most out of your personal

investments, you have to be creative in using options.

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Strategy: Protective Put

•

•

You would like to invest in Google, or you have already invested in Google. Since

recently, its share price has hit the 5-month low, you are unwilling to bear potential

loss beyond a given level. What you can do is the following:

• Invest in the Google stock

• Buy one put per share of Google stock

Such an option strategy is called protective put.

• The final payoff structure is such

that no matter how much Google’s

share drops in price, your overall

<= Long 1 stock

loss is limited to a fixed amount,

ST

whereas if Google’s share

x

increases in price, you will still

x

gain from it.

• The precise exercise price you

<= Long 1 put

ST

choose will dictate the maximum

x

Total Payoff

loss you are willing to bear.

• Again, it is a protective way of

x

holding a stock, that’s why it’s

<= Total Payoffs

called Protective Put.

ST

x

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Strategy: Covered Call

•

•

What if you're neutral on Google’s performance? (i.e., you think its stock price

will remain relatively unchanged) To potentially profit from such expectation:

• Invest in the Google stock

• Sell one call per share of Google stock

Such an option strategy is called covered call.

• The final payoff structure is such

that no matter how much Google’s

share price drops, your overall

loss is limited to the price you pay

<= Long 1 stock

today. And you still have the

ST

amount you acquired from selling

x

a call.

x

• If share price increases, and the

call holder exercises its right to

<= Short 1 call

ST

buy from you, you have a stock to

x

fulfill your obligation.

• If share price does not change

x

Total Payoff

much, for example, it remains at X

<= Total Payoffs

on the expiration date, then you’ve

ST

gained C, the sales price of the

x

call you sold.

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Strategy: Straddle

•

•

Imagine another scenario. A pharmaceutical company just release a drug which is

soon to be approved or disapproved by the FDA. You anticipate either a big jump of

its share price if FDA approves, or a big drop otherwise. To profit from it:

• Buy one call of that company’s stock.

• Buy one put of that company’s stock

Such an option strategy is called Straddle.

•

<= Long 1 call

ST

x

•

x

ST

<= Long 1 put

x

Total Payoff

The final payoff structure is such

that if that company’s stock price

varies a lot, you will benefit the

most.

If instead, the company’s stock

price doesn’t vary a lot because of

the news, you will likely make a

loss.

x

<= Total Payoffs

ST

x

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Valuation: Option definitions revisited

•

There are 2 basic types of options: CALLs & PUTs

•

A CALL option gives the holder the right, but not the obligation

•

•

To buy an asset

•

By a certain date

•

For a certain price

A PUT option gives the holder the right, but not the obligation

•

To sell an asset

•

By a certain date

•

For a certain price

•

an asset – underlying asset

•

Certain date – Maturity date/Expiration date

•

Certain price – strike price/exercise price

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Valuation: No arbitrage

•

We have mentioned that if the law of one price is violated, people will

jump into the opportunity and make pure profit out of nothing.

•

In equilibrium, such opportunity should have been eliminated.

•

The no arbitrage condition serves as one of the most basic unifying

principles in the study of financial markets

•

An application of that is given out in the previous slides to illustrate the

put-call parity.

•

And we’ll keep on using the no arbitrage condition in order to derive the

equilibrium option prices.

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Range of possible call option values

•

Let us first look at the boundary for a call option. Assuming the underlying

stock doesn’t payout dividend before the call option expires.

First, its value cannot be negative. Because the holder of a call option need

not be obligated to exercise it if it is not profitable to do so.

C≥0

[1 – lower bound]

Second, its value cannot be higher than the present stock price. Because

Stock price – exercise price is the payoff of the call.

C≤S0

[2 – Upper bound]

Third, its value cannot be lower than the present stock price minus the

present value of the exercise price.

C≥S0 - Present value of X

or

C≥S0 – X/(1+R)T

[3 – lower bound]

•

Reason for [3]: if you compare 2 different portfolios:

{a} buy a stock now at S0 and borrow X/(1+R)T

{b} buy a call option with exercise price X.

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Range of possible call option values

C≥S0 – X/(1+R)T

•

[3 – lower bound]

Reason for [3]: if you compare 2 different portfolios:

{a} buy a stock now at S0 and borrow X/(1+R)T

{b} buy a call option with exercise price X.

•

Payoff of {a} at maturity is ST – X (i.e, the stock price at time T - the

amount that you have to repay to your lender)

NOTE: This payoff can be +ve or –ve!

•

Payoff of {b} at maturity is either 0 if you don’t exercise, or ST – X if you

choose to exercise.

•

What we see is {b} has a more favorable payoff structure than that of {a},

if constructing {a} requires S0 – X/(1+R)T amount of money, than to

construct {b}, you need at least more than that amount.

•

Thus we have the lower bound of the value of call as C≥S0 – X/(1+R)T

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Range of possible call option values

•

•

C≥0

[1 – lower bound]

•

C≤S0

[2 – Upper bound]

•

C≥S0 – X/(1+R)T[3 – lower bound]

With all 3 boundary conditions, we get the following graph:

Call Value (C)

S0

X/(1+R)T

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Call option value as a function of stock

price

•

The value of call as a function of the current stock price is given in the

following red line.

Call Value (C)

S0

X/(1+R)T

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Factors affecting the call option value

•

We identify 5 factors that affect an option’s value

1) Stock price (S)

2) Exercise Price (X)

3) Volatility of the underlying stock price (σ)

4) Time to Maturity/expiration (T)

5) Interest rate (Rf)

•

You should familiarize yourself with the following table:

Factor

Stock price

Exercise price

Volatility of stock price

Time to expiration

Interest rate

Options?

Terminology

Effect on Call value

increases

decreases

increases

increases

increases

Arbitrage

Effect on Put value

decreases

increases

increases

increases

decreases

Binomial

Black-Scholes

Factors affecting the call option value

•

Stock price

•

Recall the payoff for call and put. Call: max{0,S-X}, Put: max{0, X-S}

•

The higher the stock price, the more likely that a call option will be

exercised in-the-money to get profit. Thus C ↑ if S0 ↑

•

The higher the stock price, the less likely that a put option will be

exercised in-the-money to get profit. Thus P ↓ if S0 ↑

Factor

Stock price

Exercise price

Volatility of stock price

Time to expiration

Interest rate

Options?

Terminology

Effect on Call value

increases

decreases

increases

increases

increases

Arbitrage

Effect on Put value

decreases

increases

increases

increases

decreases

Binomial

Black-Scholes

Factors affecting the call option value

•

Exercise price

•

Recall the payoff for call and put. Call: max{0,S-X}, Put: max{0, X-S}

•

The higher the exercise price, the less likely that a call option will be

exercised in-the-money to get profit. Thus C ↓ if X ↑

•

The higher the exercise price, the more likely that a put option will be

exercised in-the-money to get profit. Thus P ↑ if X ↑

Factor

Stock price

Exercise price

Volatility of stock price

Time to expiration

Interest rate

Options?

Terminology

Effect on Call value

increases

decreases

increases

increases

increases

Arbitrage

Effect on Put value

decreases

increases

increases

increases

decreases

Binomial

Black-Scholes

Factors affecting the call option value

•

Volatility of stock price

•

Recall the payoff for call and put. Call: max{0,S-X}, Put: max{0, X-S}

•

The higher the volatility of stock price , the higher the probability of S

being higher than X and thus the more likely the call will be exercised inthe-money to get profit. Thus C ↑ if σ ↑

•

Surprisingly, it is also true for put.

The higher the volatility of stock price , the higher the probability of S

being lower than X and thus the more likely the put will be exercised inthe-money to get profit. Thus P ↑ if σ ↑

Factor

Stock price

Exercise price

Volatility of stock price

Time to expiration

Interest rate

Options?

Terminology

Effect on Call value

increases

decreases

increases

increases

increases

Arbitrage

Effect on Put value

decreases

increases

increases

increases

decreases

Binomial

Black-Scholes

Factors affecting the call option value

•

Time to expiration

•

Recall the payoff for call and put. Call: max{0,S-X}, Put: max{0, X-S}

•

The longer the time to expiration, the more time allowed for the stock

price to climb above the exercise price and thus the more likely the call

will be exercised in-the-money to get profit. Thus C ↑ if T ↑

•

Surprisingly, it is also true for put.

The longer the time to expiration, the more time allowed for the stock

price to fall below the exercise price and thus the more likely the put will

be exercised in-the-money to get profit. Thus P ↑ if T ↑

Factor

Stock price

Exercise price

Volatility of stock price

Time to expiration

Interest rate

Options?

Terminology

Effect on Call value

increases

decreases

increases

increases

increases

Arbitrage

Effect on Put value

decreases

increases

increases

increases

decreases

Binomial

Black-Scholes

Factors affecting the call option value

•

Interest rate (risk-free)

•

Recall the put-call parity. S0 + P – C = X/(1+Rf)T

•

Keeping every other variables fixed, the higher the interest rate, the

smaller the RHS, and thus C has to increase to lower the LHS too. Thus

C ↑ if Rf ↑

•

Keeping every other variables fixed, the higher the interest rate, the

smaller the RHS, and thus P has to decrease to lower the LHS too. Thus

P ↓ if Rf ↑

Factor

Stock price

Exercise price

Volatility of stock price

Time to expiration

Interest rate

Options?

Terminology

- the least intuitive

Effect on Call value

increases

decreases

increases

increases

increases

Arbitrage

Effect on Put value

decreases

increases

increases

increases

decreases

Binomial

Black-Scholes

Binomial option pricing

•

With all the insights you have acquired. Let’s go to the first formal option pricing

model.

•

Assumption: The stock price can take only 2 possible values on the date the option

expires, no transaction cost and imperfections, frictionless market.

An example to illustrate, Binomial option pricing concerns about call options. Let’s now

consider a call, with exercise price = $125. Stock price is now $100. At expiration, it

will either go up to $200 or down to $50. (Note: NO probability is given)

$200

$100

$200 - $125 = $75

C

$50

Stock price

$0

Call option value

•

Consider a portfolio that consists of short 1 option and long m shares of

this stock.

•

Payoff of this portfolio is:

Options?

Either [Good state]

$200m - $75 if the stock price rises to $200

or

$50m if the stock price drops to $50.

[Bad state]

Terminology

Arbitrage

Binomial

Black-Scholes

Binomial option pricing

$200m

$100m

-$75

-C

$100m-C

$50m

$0

Long m Stocks + Short 1 Call

•

$200m-$75

=

$50m

The combined portfolio

Choose a specific m* to make the combined portfolio risk-less. (i.e.,

payoffs are the same in both states)

Set

$200m - $75 = $50m, solving, we have m* = 75/150 = 0.5

The ratio is what we needed. That means, if a portfolio consists of longing

1/2 share of the stock and shorting 1 call option, or if a portfolio consists

of longing 1 shares of the stock and shorting 2 call options, the portfolio is

risk-less.

$200m*-$75 = $25

$100m*-C = $50 - C

$50m*

= $25

The combined portfolio with m*

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Binomial option pricing

$200m*-$75 = $25

$100m*-C=$50 - C

$50m*

= $25

The combined portfolio with m*

•

So, the combined portfolio gives me $25 no matter which state is realized;

i.e, the portfolio is risk-less. The present value of this $25 at maturity

should be equal to the value of the combined portfolio that you pay now

(i.e., no arbitrage condition). Thus:

100m* - C = $50 – C = 25/(1+Rf)T

•

If time to expiration = 1 year, annual risk-free interest rate = 8%, then the

Call option should have a value equal to:

C = $50- 25 /(1+8%)1 = $26.85 (round up 2 significant decimal places)

•

Options?

Using the put-call parity, we can find the put option value with the same

exercise price and expiration date. [DO IT YOURSELF!!!]

Terminology

Arbitrage

Binomial

Black-Scholes

Black-Scholes option pricing formula

•

Generalizing the binomial option pricing, we have the Black-Scholes

formula, which is the Nobel prize winner Prof. Scholes’ main contribution

leading to his 1997 Nobel prize.

•

Black-Scholes formula:

C = S0N(d1) – X•e-RfT•N(d2)

Options?

Where

d1 = [ln(S0/X) + (Rf + σ2/2)T] / σ√T

And

d2 = d1 - σ√T

C

= Call Option Price

S0

= Current Stock Price

N(d1)

= Cumulative normal density function of (d1)

X

= Strike or Exercise price

N(d2)

= Cumulative normal density function of (d2)

Rf

= discount rate (risk free rate)

T

= time to maturity of option (as % of year)

σ

= volatility or annualized standard deviation of daily stock returns

Terminology

Arbitrage

Binomial

Black-Scholes

Black-Scholes option pricing forumla

C = S0N(d1) – X•e-RfT•N(d2)

Where

d1 = [ln(S0/X) + (Rf + σ2/2)T] / σ√T

And

d2 = d1 - σ√T

N(d1)= cumulative area

below d1 for a standard

normal distribution.

Standard Normal

Density Function

~ N(0,1)

-0.5

–0.2

0

If d1 = 0, N(d1) = 0.50

Options?

Terminology

0.2

0.5

If d1 = 0.5, N(d1) = 0.69

Arbitrage

Binomial

Black-Scholes

Black-Scholes option pricing forumla

Some of the important assumptions are as follows:

•

1) The stock will pay no dividends until after the option expiration date.

•

2) Both the interest rate and the standard deviation of daily return on the

stock are constant.

•

3) Stock prices are continuous, meaning that sudden extreme jumps such

as those in the aftermath of an announcement of a take-over attempt are

ruled out.

C = S0N(d1) – X•e-RfT•N(d2)

Options?

Where

d1 = [ln(S0/X) + (Rf + σ2/2)T] / σ√T

And

d2 = d1 - σ√T

Terminology

Arbitrage

Binomial

Black-Scholes

Black-Scholes: An example

C = S0N(d1) – X•e-RfT•N(d2)

Where

d1 = [ln(S0/X) + (Rf + σ2/2)T] / σ√T

And

d2 = d1 - σ√T

Example

What is the price of a call option given the

following?

S0 = 30, Rf = 5%, σ2 = 0.0305, X = $30, T = 1 year

d1 = 0.37362

N(d1) = 0.645657

d2 = 0.198978

N(d2) = 0.57886

C = S0[N(d1)] – Xe-rt[N(d2)]

C = $ 2.85, using put-call parity, we can calculate

the corresponding put option price.

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

Some more insights on options

• American Options can be exercised at anytime

before maturity

• European Options can be exercised at maturity

• It is never optimal to exercise an American call option

early:

Thus, American and European calls should have the

same price

• But it may be optimal to exercise an American put

option earlier than maturity

• Empirical evidence:

– Black-Scholes option pricing model does well at

pricing options that are at the money, but do much

worse as the options go deeper into or out of the

money

Options?

Terminology

Arbitrage

Binomial

Black-Scholes

For Final

• You will not need to remember the Black-Scholes formula.

• You have to try the Black-Scholes formula before the exam

because the final exam will for sure have a question concerning

the Black-Scholes. That means you have to know how to use a

Cumulative normal distribution table.

• You have to be familiar with the put-call parity and no arbitrage

condition.

• You have to know the Binomial option pricing too. Work it out at

least once.

• You should try to get yourself familiar with how to quote an

option price from CBOE. And you should be able to understand

the meaning of a table you see from a CBOE option quote.

• I strongly encourage you to do the exercises on options posted

on the course webpage. Try them before you look into the

solutions.

Options?

Terminology

Arbitrage

Binomial

Black-Scholes