Insurance & financial advice: risky business?

advertisement

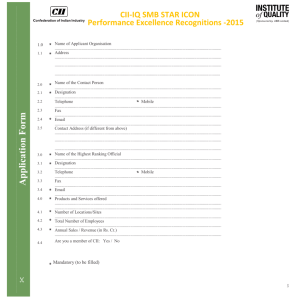

Insurance & financial advice: risky business? Caspar Bartington The Chartered Insurance Institute Chris Sloan Dip CII Allianz Paul Scarff Chartered Financial Planner AFSL Why are we here? Challenging perceptions Reassurance • The fundamental importance of insurance • The opportunities within financial advice • The stability of both insurance and financial advice in a turbulent sector The CII is… • The world’s largest professional body for insurance…and financial services (PFS) • 95,000 members in 150 countries Insurance is… • Peace of mind – moving risk elsewhere • Everything and anything • £300m paid out in claims – every day Great industry Fundamental to modern life No insurance = • No shipping and travel • No construction and motoring • No risk taking = no innovation Big business Diverse challenges: Hurricanes, earthquakes, investments, finance, airline going out of business, piracy And it’s big…very big • • • • Over 320,000 employed directly + 1m 2nd largest export 20% of the total net worth of UK plc 2nd largest insurance market in the world Introduction to Commercial Underwriting Chris Sloan My route into insurance University University of Strathclyde, graduating in 2007 with BA(Hons) in Marketing Also spent exchange year at AUT University in New Zealand Why Insurance? Scanning University’s Career website, was unsure about what path was right for me. After reading job details of Graduate Underwriter scheme decided it was closely matched to my skills/ambitions Researched insurance industry and Allianz – was impressed! Solid industry with a great deal of interaction and opportunity to continue education through CII and Allianz’s Underwriting Academy Looking to learn a ‘core skill’ © Copyright Allianz The story so far... • First days – September 2007 Induction week with the various graduate schemes – networking opportunities Was given a mentor and ‘buddy’ for any problems Looking at existing policies, processing MTAs and renewals • Business Development – September 2008 Dealing with new business enquiries More chance to talk to brokers on a daily basis and write policies from scratch Corporate hospitality events • Ongoing Underwriting Academy – have completed Level 1, now studying for Level 2 I have passed 5 exams and if successful will be awarded ACII by end of 2009 © Copyright Allianz Day in the life • • • • • • • • • • 0830Arrive in work and plan day, check emails 0900Make phone calls to brokers to discuss cases allocated that day 1000Work on various cases, Fleet, Motor Trade and Property & Casualty 1200Attend meeting to discuss various technical and commercial developments 1230Lunch 1330Refer more complicated cases to Senior U/W and discuss, making my recommendation and discussing U/W factors 1430Admin/Check emails 1500Project work/reports/prospecting/prospecting 1600Finalise quotes and discuss with brokers, may meet with them to discuss upcoming cases etc 1730 Finish up and do some study from home © Copyright Allianz Allianz Insurance • Offers 7 different graduate career paths: around 30 per year - Corporate Management Trainee - Underwriting Management - Claims Management - Sales, Marketing and Business - IT - Finance - Actuarial and Planning • The second biggest insurer in the world • Behind household names such as Cornhill Direct and Pet Plan • Head Office is based in Guildford, reporting to Allianz in Munich © Copyright Allianz Opportunities Diverse range: • Specialist and technical roles such as claims, loss adjusting, underwriting, broking – UK and international • General business roles such as accounting, marketing, HR and business management Skills, training and professional development Superb rewards – without compromising life Qualifications • CII Certificate in Insurance (A level ) • CII Diploma in Insurance (degree yr one) • CII Advanced Diploma in Insurance (degree) – also known as ACII • Fellowship (FCII) • Chartered status – Insurer, Insurance Broker, Insurance Practitioner Qualifications – subjects Subject areas include • Broking • Underwriting • Insurance law • Risk management • Marine insurance • Reinsurance Big names And many more……. www.insurancecareers.cii.co.uk • Business explanations • Profiles • Case studies • Job descriptions • Links to employers Financial advice is • • • • • About people, not just numbers An ever-changing environment An opportunity to earn significant sums Not a 9 to 5 job – you’re in charge! A range of roles from individual to corporate Financial Planning & Wealth Management Paul E Scarff Chartered Financial Planner Presented by Paul Scarff, CFP │ February 2009 Company background • We are a Scotland-based firm of Independent Financial Advisers, with offices in Edinburgh and Glasgow • We have been accredited with the prestigious ‘Chartered Financial Planners’ title. This is the industry’s gold standard for the highest standards of professionalism • We provide personal face-to-face investment, pension and financial planning advice. Based on this principle we build strong, trusting and lasting relationships with our clients • We work in partnership with over 90 Chartered Accountant firms, offering advice to their clients Career to date • Trainee Bank Clerk with Royal Bank of Scotland in 1986 – Bank qualifications – Seven years working up to Branch Assistant Manager • ‘Man from the Pru’ for three years – FPC qualification (previous version of Certificate in Financial Planning) – Universities’ and schools’ AVC pension schemes • Financial Planning Manager at RBS in 1996 – Three years of working with small business customers in Lanarkshire – AFPC qualification (replaced by Diploma and Advanced Diploma in Financial Planning) • AFS as Independent Financial Adviser (IFA) since 1999 – Pension and Investment Specialist – Chartered Financial Planner status – Management buyout in 2007 Changing landscape • 25 years ago • Now • Insurance salesman • Fee-based (specified or hourly rate) • Home service • Long-term client relationship • Initial commission • Qualifications? • Recurring income generation • No regulation • Wealth management • Short-term client relationship • Career path • Highly regulated • Higher qualification entry level A financial planning process Define Goals Agree your investment aims & objectives Regular Reviews Risk Profile Ongoing portfolio management review at agreed time intervals Assess your attitude to risk Tax Strategy Asset Allocation Ensure the most tax efficient implementation of your investment portfolio Determine the appropriate asset allocation to meet your risk/return objectives Fund Selection Partnership with SEI & fund selection for peripheral asset classes Typical financial planning services • Mortgages • Protection – Personal – Business • • Trusts – Inheritance Tax – Charities & Non-Profit Organisations Saving Tax (Avoidance not Evasion!) • Savings – VCT, EIS, Film Partnerships • Investments – Offshore – Product selection • – ISA’s – Collectives – Offshore – Stakeholder and Personal Pensions – Specialist Products – Group Schemes – SIPP’s • Wealth Management • Retirement Planning Lifestyle Financial Planning Typical Clients • Self-employed business owners • Employers • Pre-retirement • Post-retirement • Will & Tax Planning • Moving home • Medium/long-term Investment Great opportunities in financial advice • Ageing sector means many retire soon (average age of IFA is over 50) • Professional standards continue to go up • Various Options • – Support services (Retail sector) – Paraplanner (£15K to £35K) – many graduates start here – Mortgage Advisers (£20k to £35K) – Company-employed (‘Tied’) advisers (£25K to £50k) – Independent Financial Advisers (£25K to £100k+) Modern business models – excellent Business Owner opportunities THIS PRESENTATION HAS BEEN DELIVERED BY Authorised and regulated by the Financial Services Authority Accountants Financial Services (Scotland) Ltd. Buchanan Court, 132 Calton Road Edinburgh, EH8 8JQ,Tel: 0131 557 0777 14 Royal Crescent, Glasgow G3 7SL, Tel: 0141 331 0800 Web: www.afsl.net The values of investments can fall as well as rise and past performance is not a guide to future performance Big business Major employers include • • • • • • Tenet Sesame Bankhall Positive Solutions Origen Plus the major banks Skills Not just numeracy! • • • • • Analysis Negotiation Written and verbal communication Adaptability and flexibility Relationship building Qualifications • CII Certificate in Financial Planning – key • CII Diploma in Financial Planning – RDR • CII Advanced Diploma in Financial Planning • Fellowship – FPFS • Chartered Financial Planner Qualifications – subjects Subject areas include • Retirement planning • Trusts • Financial planning • Mortgages • Personal tax • Investments Looking ahead – GI • • • • • • Many formalised graduate schemes Most open Q3 Most close by year end Limited internships and placements Getting work experience will really help SMEs? Some useful websites GI • britinsurance.com/careers/graduates • allianz.co.uk/careers • lloyds.com/about_us/careers/graduate_careers • jobs.axa.co.uk/graduates/index • willis.com/careers/graduate_careers • whatifaon.co.uk • escapethehorror.com Looking ahead – FS • • • • Very few formalised graduate schemes Few internships and placements Getting work experience will really help SMEs? Some useful websites FS • tenetjobs.co.uk • origenfs.co.uk/people/careers • moneyportal.com/join-us • awdplc.com/careers Credits with your degree Insurance framework • It typically takes 3 years to get to ACII level • You will get credits equal to two or three units (saving several months of study) with a degree in one of the following •Accounting •Business •Economics •Finance •Law •Management Credits with your degree Financial advice framework • It typically takes 2 years to get to Dip FP level • You will get credits equal to two or three units (saving several months of study) with a degree in one of the following •Accounting •Business •Economics •Finance •Law •Management Careers office information • Top 50 UK insurance companies • Top 15 UK life assurance companies • Top 50 UK financial advice companies In summary • Great industry with wide range of roles • Great opportunities to progress quickly • Great future – even now! Take a closer look cii.co.uk/thepfs.org Caspar.bartington@cii.co.uk