Slideshow 2

advertisement

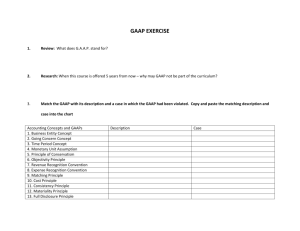

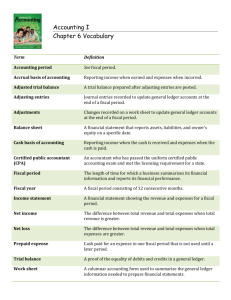

5.2 Setting up the General Ledger Slideshow 2 List of Topics Slide No. Setting Up the System Manager Activating the GENERAL LEDGER Verifying the Fiscal Calendar Setting Up the GENERAL LEDGER Step 1: Step 2: Step 3: Step 4: 4 10 12 13 Define Options Define Account Structures Specify G/L Source Codes Create Source Journal Profiles Generally Accepted Accounting Principles (GAAP) Cost Principle Full Disclosure Principle Objectivity Principle Business Entity Concept Time Period Principle Consistent Reporting Principle Matching Principle Why are adjustments necessary? 15 18 19 20 21 22 23 24 25 26 27 28 29 CCSL: Sample Company Throughout the book, you will be working on the accounts of Collegiate Computer Systems Limited (CCSL), our sample company. Click. CCSL utilizes the accrual basis of accounting. Study the difference between accrual and cash basis accounting at the right. Click. CCSL consists of three departments and it uses the Department feature of ACCPAC. This means that you can produce departmental income statements and a consolidated income statement. Study the descriptions at the right. Click. CCSL utilizes three ACCPAC modules: G/L, A/P and A/R. When used with other modules, the G/L is first set up, as it contains the Chart of Accounts. Click to continue. Accrual vs. Cash Basis Accounting Collegiate Computer Systems Limited (CCSL) Accrual Basis accounting SYSTEM MANAGER Generally Accepted Accounting Principles (GAAP) Department 10 – Service stipulate that revenue shouldAdmin be recognized and Common Purchases and resells computer hardware and Database recorded when a service has been providedand or a Services Services Pervasive SQL software; maintains an inventory of hardware product has been delivered (for cash or on credit). software. Expenses should be recognized and recorded when a Department GENERAL 20 – Product service has been provided or products have been LEDGER Deals mainly with service contracts and repair orders. delivered (for cash or on credit). This is the main Department – Officemethod. premise of the30 accrual ACCOUNTS ACCOUNTS Provides administrative and general office support to RECEIVABLE PAYABLE the Sales and Service Departments. Cash Basis accounting Revenue is recognized and recorded when cash is received, and expenses are recognized and recorded when paid. This method is contrary to the accrual method and not consistent with GAAP. Setting up the System Manager There are 5 steps in setting up the System Manager. Study them at the right. Steps in Setting Up the System Manager Click to continue. 1. Create the System Database 2. Create the Company Database 3. Activate Administrative and Common Services. 4. Verify the fiscal year starting date. 5. Set up the Company Profile in Common Services. Setting up the System Manager Step 1: Create the System Database From the START menu, you can access the ACCPAC Database Setup program. Click. The list of existing databases appear, depending on what has been previously installed in your computer. Click the NEW button. Database ID may consist of up to six capital letters and numbers. Once the database is created, this can not be changed. Database Format – you may select from a list of databases recognized by ACCPAC. Click. Be sure that the correct Database Category is selected. Click. Be sure that the folder you enter has enough storage space, as this is where your company files will be stored. Click to continue. Setting up the System Manager Step 2: Create the Company Database The procedure is very similar to the creation of the System database. Click. Be sure that the Database Format is the same as the System Database. Click. The Database Category must be Company. Click. The proper System Database ID must be selected. Click. You must also make sure that the company database folder is in the same folder location as the system database folder. Click to continue. Setting up the System Manager Steps 1 and 2 Complete Once the databases have been created, the CCSL databases whould appear in the Database Setup window. Click to continue. CCSL databases Setting up the System Manager Step 3: Activate CCSL Administrative and Common Services After setting up the databases, you can activate the Administrative and Common Services for the company. Click and study the functions managed by Administrative Services. Click again and study the functions of the Common Services. Common Services Administrative Services Hold and maintain data such as: • • • • To activate Administrative Services, click Proceed. • Click the Proceed button now. • Step 4: Verify the Fiscal Year Starting Date When the Common Services Activation window opens, change the date to the first day of the company’s fiscal year, then click the Proceed button. Click to continue. • Company Profile including name, address, telephone, e-mail, contact, and so forth; User IDs, Security, and User Authorizations, which Fiscal Calendar, which is the calendar fordata the and determine who can access the company current andare previous fiscal years; what tasks they permitted to do; Currency, which which determines the currency orusers User Interfaces, determine the fields currencies for transactions; are allowedused to view in the application windows; Optional Tables, which provides for customizable Data Integrity, which checks the company data for additional data; and errors; Scheduling, which established the month Data Activation, which activatestimes otherinACCPAC or year when tasks are to besuch done. modules, suchcertain as G/L, or services, as Bank Services; and Restart Maintenance, which is used if a batch fails during posting. Setting up the System Manager Step 5: Create the Company Profile in Common Services ACCPAC creates the data tables for Common Services. Click. You would then fill in the Common Services Activation ADDRESS page. Click the OPTIONS tab. In these three fields, you may choose one of the three options: None – allows you to proceed with an error in an entry without warning. Warning – displays a warning if the entry has an error, which you may choose to ignore or correct. Error – will not allow you to proceed without correcting the error. Click to continue Setting up the System Manager Step 5: Create the CCSL Company Profile in Common Services (continued) Accepting 30 for Warning Date Range instructs ACCPAC to warn you if you enter a date in a date field that is more than 30 days earlier or later than the current Session Date. Click. CAD for Functional Currency stands for Canadian Dollar. It can not be be changed after the activation procedure is completed. Click OK. The main CCSL ACCPAC desktop window then appears. Click to continue. Activating the GENERAL LEDGER It is very important to backup your data before activating G/L. Click. If you are not entering historical information from a previous fiscal year, the Oldest Fiscal Year Starting Date would be the current fiscal year, which in our example, is 01/01/2009. It is important that the correct date is entered; otherwise the G/L will be set up incorrectly and you will either have to start over, or correcting the dates would be a difficult process. Click . You have successfully activated G/L when you see the icon on the right-pane desktop. Click to continue. Verifying the Fiscal Calendar Before proceeding, you should ensure that the dates and settings in the fiscal calendar are correct. Click. Active must be checked; otherwise, you will be unable to post entries for 2009. Click. In this example, CCSL’s fiscal year starts from January 1 and ends December 31. Any fiscal year start/end dates may be used. However, once the fiscal calendar is set, it cannot be changed without the permission of the Canada Revenue Agency. Click. The status in all these fields must be left Unlocked; otherwise, attempting to post entries to a Locked period will create an error. You would Lock the period in order to disallow further entry to that period; e.g., at year-end. Click to continue. Setting up the GENERAL LEDGER There are 4 steps in setting up the General Ledger. Study them at the right. Click to continue. Steps in Setting Up the System Manager 1. Define Options – options define how the G/L functions, the default retained earnings account and the account lengths and segments. 2. Define Account Structures – define how account segments are used in account numbers. 3. Specify Source Codes – set up codes for transactions from different sources. 4. Create Source Journal Profiles – customize journal reports. Step 1: Define Options Study the Company page in the G/L Options window, then click the various tabs and study the relevant information on each page. Be sure to click the tabs from left to right consecutively. Set up in Common Services and cannot be changed. This refers to the contact in the Accounting Department, which may be different from the contact person entered in the Company Profile in Common Services. Step 1: Define Options (continued) The Posting Statistics information is only for display. Ignore it. Click. This box must be checked. Provisional Posting allows you to post a batch temporarily to test the effect of the entries on the financial statements before permanently posting them. This is particularly useful at year-end, especially when there are many adjustment entries. Click. Checking Force Listing of Batches would require that you print the batch to any print destination before posting. This allows greater control over processing. Click. Entries can be imported into the ACCPAC G/L from other programs; e.g., MS Excel. Click to study the options. Click to continue. All Fields – any field can be changed. Fiscal Year, Period, Trans Date – only these date fields can be changed. No Edit – no changes are allowed. Step 1: Define Options (continued) Fiscal Year Sets contain only the net change in account balances and budget data for each account. Keeping 2 years of fiscal sets will allow you to produce prior year comparisons for income statements and balance sheets. Click. This number must be equal to or less than the number of fiscal year sets. Transaction detail maintains each posted entry on file with all original details. Click the SEGMENTS tab. Step 1: Define Options (continued) Defining Account Segments allows you to create account numbers most suitable to your accounting system. For example, if you are using the Department feature, you will be able to include a segment in the account number that refers to each department, thus making it easy to identify corresponding accounts. Click and study examples of account numbering systems using Account Segments. Account Numbering Using Segments Example: 10-325-500 Click and study how to define the segments according to the desired account numbering system. Click again. Selecting Yes for Use in Closing allows you in the future to use different closing accounts for different departments. Click to continue. Division Department BC/Yukon Administration Account Salary Expense CCSL Numbering System 6010-10 Account Department Salary Expense Service Step 2: Define Account Structures CCSL utilizes two different account structures: Click and study CCSL’s account numbering structures. By using the two-segment account structure, you will be able to use the same account number for related entries for all departments. For example, you can use 4000 for all revenue accounts: 4000-10 for the Product Department, 4000-20 for the Service Department. Click . When you open the G/L Account Structures window, the two account segments that you have defined earlier would appear. To complete the G/L Account Structures window, you would highlight each of the segments and click the INCLUDE-> button. Click to view the completed window. Click to continue. CCSL’s Account Numbering Structures • ACC (Single-segment account) consisting of 4 digits; e.g., 1000 for CASH. • DEPT – (Two-segment account) consisting of 6 digits; e.g., 4000-10 for SERVICE REVENUE; 4000 for the account, and 10 identifying the department (Service Department). Step 3: Specify G/L Source Codes Source codes are useful in producing reports for similar transactions. For example, you will be able to produce a report for all reallocations if you attach a code (e.g., GL-RT) to all reallocation transactions. Click and study the pre-set Source Ledger codes. Source Ledger Codes GL – General Ledger AP – Accounts Payable AR – Accounts Receivable BK – Bank Services These pre-defined Source Ledger codes cannot be changed, deleted or added to. Click . Source Type Codes You can then add a second part, referred to as Source Type code, which identifies the transaction type. JE – Journal Entry Click to view examples of Source Type codes. PY – Payment There are pre-defined source codes to which you can add your own. AD – Adjustment Click again to view some useful source codes. Click to continue. IN – Invoice Step 4: Create Source Journal Profiles To be able to print reports using Source Codes, you must first create a Source Journal Profile that lists the Source Codes to be included in the report. Click. You would enter the name of the profile. Click. To select the Source Codes, you can use the Finder icon. Click the FINDER icon (see gold arrow). You can then highlight the code you wish to include in the particular profile, and click Select. Click to view an example of a completed Journal Profile. This is the last step in setting up the GENERAL LEDGER. In the next slideshow, you will learn how to set up the Chart of Accounts. Click to continue. General Journal Generally Accepted Accounting Principles (GAAP) How would you know how to interpret a transaction and how to record it? Processing transactions in ACCPAC is no different from what you have already learned in your Accounting course. You simply follow Generally Accepted Accounting Principles (GAAP). Click and study the definition. GAAP not only guides you in determining how to treat transactions and communicate financial information but it can also help interpret financial statements between companies. Click to continue. GAAP A set of policies, procedures and guidelines that direct accounting practitioners to record and report financial information. GAAP is published in a handbook by the Canadian Institute of Chartered Accountants (CICA). GAAP: Cost Principle You will apply GAAP when you complete the exercises in the various modules. The slides that follow discuss the principles that apply to ALL types of transactions. First is the Cost Principle. Click and study the principle, then read the example below. Example: A computer bought for $3,000 is recorded as an asset at the time of purchase. If the value of that same computer decreased in price to $2,500 shortly after purchasing it, the value in the accounting records remains the same. Any change in the market value of the asset does not get reflected in the accounting records. This principle is followed even when the value of the asset increases. Click to continue. Cost Principle All assets purchased must be recorded in the company accounting records at their purchase price (historical cost). GAAP: Full Disclosure Principle Next is the Full Disclosure Principle. Click. Example: A firm may report an unusually high amount of a particular expense on the Income Statement. To avoid confusion or misunderstanding, the entry should include a note explaining the high expenditure item, thus following the Full Disclosure Principle. Click to continue. Full Disclosure Principle Full disclosure requires that all relevant information pertaining to the firm that may be important to the users of the information must be revealed on the financial statements. GAAP: Objectivity Principle Click and study the Objectivity Principle, then read the example below. Example: A company should use and file relevant source documents (invoices, cheques, memos, etc.) that can be verified and are free of any personal bias and judgment. These source documents should be part of the audit trail. Click to continue. Objectivity Principle The Objectivity Principle requires that all information reflected in the accounting records and financial statements is gathered, analyzed, recorded and communicated using only independent and verifiable data separate from any influences of the gatherer and recorder. GAAP: Business Entity Concept Click and study the concept of Business Entity, then read the example below. Example: The company’s financial records should not include information about the owner’s personal belongings, such as a house or a personal car. The owner should also have his or her own bank account separate from the company’s bank account. If the owner wants to invest more money into the business, a cheque or money transfer should be made to the company and recorded in the company books as additional investment. Click to continue. Business Entity Concept A company’s financial information is recorded and reported separately from the owner’s personal financial information. GAAP: Time Period Principle Click and study the principle. According to this principle, an organization’s activities are identified with specific time periods; e.g., a month, threemonth quarters, or a year. Most companies prepare monthly (month-end) reports and use one year (year-end) as their primary accounting period. The annual reporting period (referred to as fiscal year) is not always the same as the calendar year ending December 31. A fiscal year can consist of any 12 consecutive months. Click to continue. Time Period Principle The economic life of a business can be divided into time periods. GAAP: Consistent Reporting Click and study the Consistent Reporting Principle, then read the example below. Example: Owners and managers use information reported on financial statements when making decisions. Information from one year is often compared to previous years’. If accounting information is recorded and reported differently from one year to the next, the information cannot be compared. Click to continue. Consistent Reporting Principle In the preparation of financial statements, the same accounting concepts are applied in the same way in each accounting period. GAAP: Matching Principle Click and study the principle and example below. Example: An accounting consultant, Faye Anderson, bought $600.00 worth of paper and printing supplies in December. She collected $2,800.00 consulting fees from her clients that month. Faye entered $600.00 for paper and printing supplies as prepaid asset at the time of purchase. At the end of the month, she calculated that she used up $285.00 worth of the supplies she purchased earlier. When Faye prepares her monthly financial statement for December, she should report the $2,800.00 revenue and her expenses to earn the revenue, including $285.00 (not $600.00) for supplies. Click to continue. Matching Principle Expenses are matched with revenues in the period when efforts are made to generate the revenue. Why are adjustments necessary? ALL adjustments are entered in the General Journal. Why would you need to do adjustments? During an accounting period (GAAP: Time Period Principle), the company records the financial events during that time and produces financial statements. At the end of the accounting period, adjustments are necessary before producing financial reports for a number of reasons. For example, if services are performed before the end of one month and would not be completed until the following month, fees earned until the end of the current month should be recorded (GAAP: Realization of Revenue Principle). Similarly, office supplies used up for the month should result in a reduction in PREPAID OFFICE SUPPLIES (GAAP: Matching Principle). Click to continue. Time Period Principle The economic life of a business can be divided into time periods. Revenue Recognition Principle Revenue should be recognized in the period in which it is earned. Matching Principle Expenses are matched with revenues in the period when efforts are made to generate the revenue. More… Go back to your text and proceed from where you have left off. Press ESC now, then click the EXIT button. EXIT