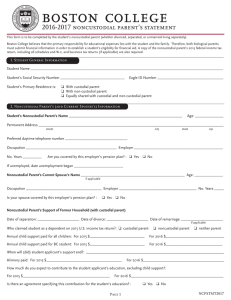

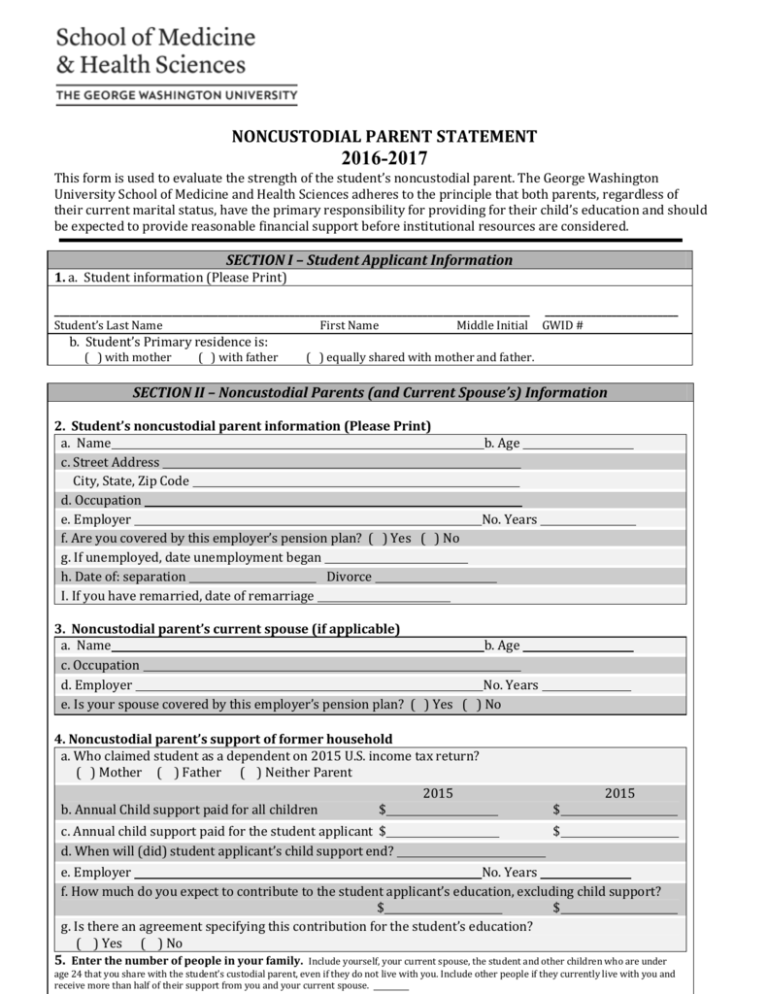

2016-2017 Non-Custodial Parent Statement

advertisement

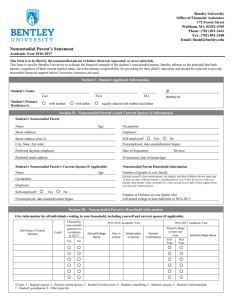

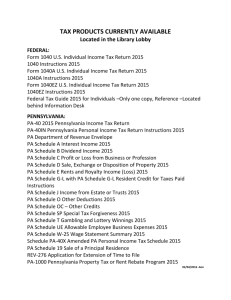

NONCUSTODIAL PARENT STATEMENT 2016-2017 This form is used to evaluate the strength of the student’s noncustodial parent. The George Washington University School of Medicine and Health Sciences adheres to the principle that both parents, regardless of their current marital status, have the primary responsibility for providing for their child’s education and should be expected to provide reasonable financial support before institutional resources are considered. SECTION I – Student Applicant Information 1. a. Student information (Please Print) _____________________________________________________________________________________________ Student’s Last Name First Name Middle Initial __________________________ GWID # b. Student’s Primary residence is: ( ) with mother ( ) with father ( ) equally shared with mother and father. SECTION II – Noncustodial Parents (and Current Spouse’s) Information 2. Student’s noncustodial parent information (Please Print) a. Name c. Street Address City, State, Zip Code d. Occupation e. Employer f. Are you covered by this employer’s pension plan? ( ) Yes ( ) No g. If unemployed, date unemployment began h. Date of: separation Divorce I. If you have remarried, date of remarriage b. Age No. Years 3. Noncustodial parent’s current spouse (if applicable) a. Name b. Age c. Occupation d. Employer No. Years e. Is your spouse covered by this employer’s pension plan? ( ) Yes ( ) No 4. Noncustodial parent’s support of former household a. Who claimed student as a dependent on 2015 U.S. income tax return? ( ) Mother ( ) Father ( ) Neither Parent 2015 b. Annual Child support paid for all children $ c. Annual child support paid for the student applicant $ d. When will (did) student applicant’s child support end? 2015 $ $ e. Employer No. Years f. How much do you expect to contribute to the student applicant’s education, excluding child support? $ $ g. Is there an agreement specifying this contribution for the student’s education? ( ) Yes ( ) No 5. Enter the number of people in your family. Include yourself, your current spouse, the student and other children who are under age 24 that you share with the student’s custodial parent, even if they do not live with you. Include other people if they currently live with you and receive more than half of their support from you and your current spouse. 6. Write in the number of children from question 5, who will attend college at least half-time during 2016-2017. _____ 7. Give information for all individuals included in your household in question 5. Include yourself and your current spouse (if any). Full name of family member: Relation to family member Age SECTION III – NONCUSTODIAL PARENT’S (AND CURRENT SPOUSE’S) 2015 INCOME 8. The following 2015 U.S. income tax return figures are (fill in only one): ( ) estimated. Will file IRS Form 1040EZ or 1040A ( ) estimated. Will file IRS Form 1040. ( ) from a completed IRS Form 1040EX or 1040A ( ) from a completed IRS Form 1040. ( ) a tax return will not be filed. (Skip to 13) 9. 2015 total number of exemptions: ____ ____ 10. 2015 Adjusted Gross Income (IRS Form 1040, line 37 or 1040A, line 21 or 1040EZ, line 4) $ Breakdown of income in question 10 a. wages, salaries, tips (IRS Form 1040, line 7 or 1040A, line 7 or 1040EZ, line 1) b. Interest and dividend income (IRS Form 1040, lines8a and 9a or 1040A, lines 8a and 9a or 1040EZ, line 2 c. Net income (or loss) from business, farm, rents, royalties, partnerships, estates, trusts, etc. (IRS Form 1040, lines 12, 17and 18) If a loss, enter the amount in parenthesis. d. Other taxable income such as alimony received, capital gains (or losses), pensions, annuities, etc. (IRS Form 1040, lines 10, 11, 13, 14, 15b, 16b, 19, 20b and 21 or 1040A, lines 10, 11b, 12b, 13 and 14b or 1040 EZ, line 3) e. Adjustments to income (IRS Form 1040, line 36 or 1040A, line 20) $ $ $ $ $ 11. a. 2015 U.S. income tax paid (IRS Form 1040, line 55 or 1040A, line 35 or 1040EZ, line 11) $ b. 2015 education credits – Hope and Lifetime Learning (IRS Form 1040, line 49 or 1040A, line 31) $ 12. 2015 itemized deductions (IRS Schedule A, line 29. Write in “0” if deductions were not itemized). $ 13. 2015 income earned from work by student’s noncustodial parent. $ 14. 2015 income earned from work by noncustodial parent’s spouse. $ 15. 2015 untaxed income and benefits (Give total amount for the year. Do not give monthly amounts.) Breakdown of income in question 15 a. Social Security benefits received b. Child support received for all children c. Deductible IRA and/or SEP, SIMPLE or Keogh payments d. Payments to tax-deferred pension and savings plans e. Other – Earned Income Credit; housing, food and living allowances; taxexempt interest income; foreign income exclusion; etc. $ $ $ $ $ SECTION IV – NONCUSTODIAL PARENT’S (AND CURRENT SPOUSE’S) 2015 EXPENSES 16. Child support paid by both the custodial parent and spouse because of divorce or separation. $ ________________________________ SECTION V – NONCUSTODIAL PARENT’S (AND CURRENT SPOUSE’S) ASSETS AND DEBTS 17. Cash, savings, checking accounts, bonds and trust funds (as of today). $ ____________________ 18. Investments – net value of stocks and other securities (List kinds and amounts in VI.) $______________________________ 19. Business and/or Farm: 19. a. Present market value 19. b. Indebtedness 19. c. Percentage of ownership $ $ % 20. Current value of tax-deferred pensions, annuities and savings plans (for example, SRA’s, 401(k)s, TDAs, 403(b)s, 408s, 457s, 501(c)s, etc.) $ SECTION VI– REMARKS Use this space to explain any special circumstances. If more space is required, attach a letter to this form. SECTION VII-CERTIFICATION AND AUTHORIZATION Parent Signature Date Please return to: Office of Financial Aid, The George Washington University, 2300 I St. NW, Washington, DC 20052 Phone: 202–994–2960 Fax 202-994 -9488