MBA Module 1 PPT

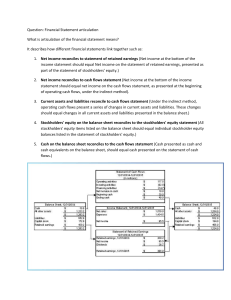

advertisement

Accounting Prof: Jim Wallace TA: Charles Yeh Overview of Week 1 Administrative stuff What is financial accounting? Financial statements GAAP What number do you want? Administrative Stuff Who am I Who is your T.A. Teaching philosophy Syllabus Homework Calculator Web Access to Class Info The site should contain: Syllabus PowerPoint slides Handouts Homework solutions http://www.cgu.edu/pages/3471.asp What is Financial Accounting? A method to communicate financial information to interested external parties. Users include capital providers, regulators, customers, suppliers, employees, etc Capital suppliers include debt and equity providers Financial accounting is used for both prediction and control Some Preconceptions - Misconceptions? Accounting yields the “truth.” Accounting is rigid. Accounting is useless. Accounting is hard! Accountants are boring. Other Types of Accounting Managerial Non-profit Tax The Financial Statements The accounting equation Balance Sheet Income Statement Statement of Cash Flows Statement of Owners Equity Statement of retained earnings Balance Sheet Mirrors the Accounting Equation Assets = Liabilities + Equity Uses of funds = Sources of funds Assets are listed in order of liquidity Current and non-current Liabilities are listed in order of maturity Equity consists of Contributed Capital and Retained Earnings Assets To be reported on a balance sheet, an asset must: 1. 2. Be owned or controlled by the company Must possess expected future benefits Most Assets are Reported at Historical Cost Historical Cost is Objective Verifiable Therefore, not subject to bias However, historical cost is not particularly “relevant” to most readers of the balance sheet “Relevance vs. Reliability” is an important issue with accountants. Disney’s Assets Liabilities Liabilities are listed in order of maturity Current Liabilities come due in less than a year. Noncurrent liabilities come due after a year. Companies desire more current assets than current liabilities – this difference is called net working capital Disney’s Liabilities and Equity Equity Equity consists of: Contributed Capital (cash raised from the issuance of shares) Earned Capital (retained earnings). Retained Earnings is updated each period as follows: Market Value vs. Book Value Stockholders’ equity = Company book value Book value is determined using GAAP. Book value is not the same as Market Value. Market Value = # of Shares x Price per share On average, US company book value is roughly two-thirds of market value. Income Statement Walt Disney’s Income Statement Accrual Accounting Accrual accounting refers to the recognition of revenue when earned (even if not received in cash) and the matching of expenses when incurred (even if not paid in cash). Accrual Accounting Accrual accounting rests on two guiding principles: Revenue Recognition Principle – record revenue when Earned Realized or Realizable Matching Principle – record expenses when Incurred Neither the recognition of revenue nor the recording of expense necessarily involves the receipt or payment of cash Statement of Stockholders’ Equity Statement of Equity is a reconciliation of the beginning and ending balances of stockholders’ equity accounts. Main equity categories are: Contributed capital Retained earnings (including Other Comprehensive Income or OCI) Treasury stock Disney’s Statement of Stockholders’ Equity Statement of Cash Flows Statement of cash flows (SCF) reports cash inflows and outflows Cash flows are reported based on the three business activities of a company: 1. 2. 3. Operating activities: transactions related to the operations of the business. Investing activities: acquisitions and divestitures of long-term assets Financing activities: issuances and payments toward equity, borrowings, and long-term liabilities. Walt Disney Company’s Statement of Cash Flows Articulation of Financial Statements Financial statements are linked within and across time – they articulate. Balance sheet and income statement are linked via retained earnings. Absent of equity transactions such as stock issuances and purchases and dividend payments, the change in stockholders’ equity equals the income or loss for the period. In Class Example Baron Coburg Oversight of Financial Accounting GAAP Oversight of Financial Accounting SEC oversees all publicly traded companies Financial Accounting Standards Board (FASB) Generally Accepted Accounting Principles (GAAP) Basic Assumptions and Principles Monetary Unit Fiscal period Going concern Objectivity (Reliability) Consistency Versus comparability Question? Financial statements must contain objective and verifiable numbers if they are to be useful. Yet, many estimates and subjective assumptions are required for the preparation of these reports. Please reconcile these apparently inconsistent statements. Exception to the Basic Principles Materiality Only transactions with amounts large enough to make a difference are considered material Non-material transactions can be treated in the easiest manner Information Beyond Financial Statements Management Discussion and Analysis (MD&A) Independent Auditor Report Financial Statement Footnotes Audit Report Financial statements present fairly and in all material respects company financial condition. Financial statements are prepared in conformity with GAAP Financial statements are management’s responsibility. Auditor responsibility is to express an opinion on those statements Auditing involves a sampling of transactions, not investigation of each transaction Audit opinion provides reasonable assurance that the statements are free of material misstatements Auditors review accounting policies used by management and estimates used in preparing the statements Question? The SEC requires all publicly traded companies to have their financial statements audited. Prior to this requirement many companies voluntarily had their statements audited. Given the cost and inconvenience, why would they do this? What Number Do You Want? Accounting is a political process, not an exact science. There is a great deal of discretion available to managers. Earnings Management Reasons to manage earnings ACCOUNTING NUMBERS HAVE ECONOMIC CONSEQUENCES BEYOND SIMPLY RECORDING TRANSACTIONS Earnings Management - Why Compensation contracts Debt contracts Political considerations Transaction Analysis Transaction analysis is the process of identifying impacts of transactions and events on the balance sheet, income statement, or both. We use the following template: Journal Entries Transaction Analysis Credit Sales Transaction Accrued Expense Transaction Deferred Revenue Transaction Asset Write-Down (Impairment) Transaction Takeaways Financial statements that are produced are the result of one possible set of rules that have resulted from a political process. Users need to be aware of these limitations. Users should read the notes to the financial statements since these contain a lot of useful guidance to interpreting the statements. Financial Statement Limitations Assets are valued at historical cost less an estimated depreciation Other possibilities include cost, net realizable value, replacement cost, price level adjusted Not all assets appear Human capital, internally generated goodwill Could be argued that approach is more conservative Financial Statement Limitations Not all liabilities appear Contingencies appear only in the footnotes Off balance sheet financing Other limitations include management biases and a lack of timeliness Financial Accounting: not an exact science GAAP allows companies choices in preparing financial statements (inventories, property, and equipment). Financial statements also depend on countless estimates. Financial Accounting in Context A company’s financial statements only tell part of the story. You must continually keep in mind the world in which the company operates. Financial statement analysis must be conducted within the framework of a thorough understanding of the broader forces which impact company performance.