Closing the Year - Jan 2015

advertisement

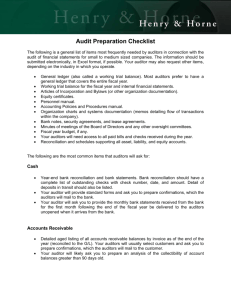

Stephen H. Kattell, MBA, CPA Kattell and Company, P.L. Serving the nonprofit community. Auditors - provide solutions that you don’t understand to problems you didn’t know you had. Necessary evil. Expensive. Time consuming. Nerve wracking. Annoying. Reduce the inconvenience. Reduce the cost. Increase the value to you. Remember: Knowledge is power. Today I hope to empower you. Primarily ◦ Auditors provide an opinion on the financial statements. Secondarily ◦ Auditors report “findings”: Deficiencies in processes or procedures Recommendations to improve efficiencies Violations of laws, regulations. These belong to the auditee – that’s YOU! ◦ The auditor may help draft them, but they are still yours. ◦ The auditor is not permitted to adjust them without your approval. ◦ The auditor can not add language you do not approve. HOWEVER, the auditor can modify the opinion on the financial statements. Start with the end in sight: Read the financial statements from last year. ◦ Is there anything you don’t understand? Ask your auditor to explain. ◦ Is there anything that is not clear? How can you make it clear? ◦ Is there anything missing? ◦ Do the numbers make sense? ◦ Does it tell your story? ◦ What could be added? ◦ What can be deleted as immaterial or insignificant? Provide the auditor any information needed for this year’s financial statement. Every organization is different: ◦ Different transactions ◦ Different processes and procedures ◦ Different emphasis on recording transactions throughout the year. By the end of the year: ◦ All transactions need to be posted. ◦ Accruals need to be made. ◦ Make adjustments to conform with GAAP. Record/adjust pledges receivable. ◦ Revise discount calculation for long term pledges. Adjust allowance for doubtful accounts. Adjust inventories for end of year counts. Property and equipment. ◦ Ensure all additions have been added. ◦ Ensure all deletions, disposals, sales have been taken off ◦ Compute depreciation Record all payables. Adjust accrual for payroll ◦ Include required taxes and benefits. Adjust accrual for compensated absences ◦ Include required taxes and benefits. Record interest accrual for significant debt. Defer revenues for any unearned collections. ◦ E.g. government grants. Record in-kind donations: ◦ ◦ ◦ ◦ ◦ ◦ Land Buildings Equipment Supplies Professional services Facilities and services for events Ask them for a list of requested documents, reports or schedules: ◦ Preliminary Will not include everything they will need. No auditor can predict everything they will need. ◦ Ask for clarification if: You don’t understand. You think it will take some time. Look at your trial balance. Are all assets debits? ◦ Legitimate exceptions include allowance for doubtful accounts and accumulated depreciation. Are all liabilities credits? Do net assets agree to PY? Are all revenues credits? Are all expenses debits? These appear as negative in financial statements. A detailed listing of all transactions for all accounts for the year under audit. Scan the general ledger: ◦ Are there any transactions that do not appear to belong in a particular account? ◦ Should any asset purchases be capitalized? ◦ Should debt payments be adjusted to reduce the principal amount of a loan. ◦ Discuss any questions with your auditor before you provide it to him/her. Simply provide a back-up copy to your auditor. However, you should still look for any problem areas (see previous slides) before you hand it over. Cash accounts: ◦ Bank statement for last month of the year. ◦ Bank statement for first month of next year. ◦ Bank reconciliation: Start with: EOY bank balance Plus: Deposits in Transit Minus: Outstanding Disbursements Equals: EOY book balance Receivables: ◦ Subsidiary listing showing each individual or entity who owes money and how much. Most software programs can provide this listing in an “aged” format. For long-term receivables, need to disclose maturities. ◦ The total of the listing should agree to the trial balance. ◦ Analysis of which accounts will not or may not pay. Should be prepared along with an analysis of bad debts expense. ◦ Auditors will: Test existence and collectability Trace receivables to subsequent receipts. Confirm receivables. (Required by GAAS). Agree to invoices, shipping documents, reimbursement requests. Pledges: ◦ Subsidiary listing showing each individual or entity who pledged money and how much. Typically kept in a spreadsheet. For long-term pledges, need to disclose maturities. ◦ The total of the listing should agree to the trial balance. ◦ Analysis of which accounts will not or may not pay. Should be prepared along with an analysis of bad debts expense. ◦ For long-term pledges – compute a discount. ◦ Auditors will: Trace to subsequent receipts. Consider confirmations. (Not required by GAAS). Agree to donor correspondence. Inventories: ◦ A detailed listing showing: The number of each item on hand. The unit cost of each item. The extended cost of each item. (# x cost = total) ◦ The total of this listing should agree to the trial balance. ◦ Auditors: Generally will observe inventory at year end. Will test the item cost by looking at the costs to purchase the items as provided by invoices. Test whether certain items are overvalued: Slow moving/obsolete – will never sell. Recorded cost is above current market value. Certificates of deposit: ◦ Any correspondence from the financial institution. ◦ Auditors may want to confirm. Investments – marketable securities. ◦ Statements from the broker. ◦ Inspect for the year. ◦ Copy for the last month of the year. Investments – other. ◦ Depends on what it is. Detailed schedule: ◦ ◦ ◦ ◦ ◦ Each asset owned. Original cost and date purchased. Accumulated depreciation at BOY. Depreciation expense for the year. Accumulated depreciation at EOY. For assets disposed: ◦ Detailed listing. ◦ Any evidence of approval. For new assets: ◦ Invoices/contracts documenting purchase cost. ◦ Consider the need to capitalize interest on construction. Detailed listing of amounts: ◦ ◦ ◦ ◦ What was paid? What is the term of the agreement? How much has been expensed prior to year end? How much will be expensed after year end? Insurance is the most common example. Auditors will want to see the invoice or payment documentation. Reminder: do not show next month’s insurance payment as a payable and a prepaid. Detailed list of amounts payable: ◦ Name of individual or entity owed and the amount. ◦ Total should agree to trial balance. Auditors may want to look at invoices. Auditors may want to perform a “search”. ◦ They will want a listing of disbursements made after year end. ◦ They will inquire regarding any other payments due. ◦ Don’t forget to include retainage on construction contracts. Examples are ◦ Accrued payroll. ◦ Accrued compensated absences. Detailed listing of amounts owed. Detailed calculations of amounts owed. For payroll related, don’t forget to add required fringe benefits: ◦ FICA ◦ Retirement Usually one GL account for each note payable. Some auditors like to confirm balances. Most will want to look at ◦ Statements from the lender (usually a financial institution). ◦ Note agreement. Needed for disclosure of Terms. Security provisions – liens, mortgages. ◦ Amortization schedule. Needed for disclosure of contracted maturities. Detailed schedule of amounts deferred and deferral period. Membership dues. ◦ Annual is usually easy. ◦ Monthly is a little more tricky. Be careful not to report a receivable and deferral for end of year billing for next year’s dues. Information on donations with restrictions. Auditors will typically want to see the donative instrument. Restricted net assets are “inventoriable”. Permanent restrictions Temporary restrictions ◦ Where are assets invested? ◦ Have you established an endowment fund? ◦ Are you in compliance with FUPMIFA? ◦ We love a roll-forward schedule: BOY + donations – uses = EOY. ◦ How much is unused at the end of the year? ◦ How did you track it? Auditors are required to assess the risks of fraud. Fraud occurs with: ◦ Motive, and ◦ Opportunity. Organizations institute internal controls to limit the opportunity. Two kinds: ◦ Fraudulent financial reporting. Aka cooking the books. ◦ Misappropriation of assets. Aka stealing the goods. Auditors usually are most concerned with cash Two general categories: ◦ Skimming – before the bank. ◦ Unauthorized disbursements – from the bank. If someone stole money before it was deposited, who would notice? Best practices: ◦ Credit cards, paypal, wire transfers, ie no cash or checks. ◦ For cash or checks Lock box Dual control ◦ Downside – expensive. Rule of Thumb – limit the controls needed by limiting the number of people who take possession of the cash. Have one person receive/collect and take to the bank – receptionist. ◦ Use an endorsement stamp. Have another review what has been deposited – accountant. Have another update the donor data base – development department. General donations are the most difficult to audit. ◦ Good controls over receipts. ◦ If your development office uses a donor data base, do you reconcile it to the accounting records? Most other receipts can be reasonably assured by preventing your accountant from handling the money. If someone were to steal money out of the account, who would notice? Don’t trust your accountant!!!!! ◦ They will keep track of everyone else. ◦ Who will keep track of them? Best practice for smaller entities: ◦ have someone in addition to the accountant review all disbursements as noted on the bank statement. ◦ Provide on line access. With good controls, this part is easy. Analyze the trends and have accurate explanations for fluctuations. Most auditors like to reconcile payroll tax reports to payroll expense accounts. ◦ Do this for them, they will love it!!!! Most auditors like to look at leases ◦ Potential capital leases. ◦ Required disclosures. Most are cost reimbursement. Revenues (the right to obtain or retain government’s money) = allowable costs. Auditors are concerned with: ◦ Allowable costs. ◦ Double dipping. Accounting records must track costs. ◦ Classes, departments, jobs, etc… Minutes of meetings of the board of directors. ◦ Include agenda materials We must gain an understanding of your internal controls. ◦ Do you have a policies and procedures document? ◦ Is it updated? ◦ Does it cover any changes for the year? Any communications from a regulatory agency? Any lawyers used to defend a lawsuit or other claims against the entity? Related party transactions? Subsequent events? Those final questions or information requests. ◦ There are always some. ◦ If they were easy, they would already be handled. ◦ Handle them now. Dating of the financial statements: who must approve the audit? ◦ Management? ◦ Audit/finance/executive committee? ◦ Full Board? Management representation letter. ◦ Must be obtain by auditor in writing before statements may be released. Read the financial statements. ◦ These are yours – no blaming the auditor. ◦ Do they make sense? If they tell a different story than what you expected, find out why. Obtain a listing of adjustments. ◦ These are your adjustments – no blaming the auditor. ◦ Make entries into your accounting system. Read the auditor’s reports. Understand the findings. Do you agree… ◦ With the facts? ◦ With the auditor’s assessment of the significance of the finding? ◦ With the auditor’s recommendations? ◦ Most auditors are willing to reword the finding. Write a response and present it to your Board. Entity received a thorough audit. An auditor who continues to be creative, not routine. Management and auditor have discussed findings and management is already implementing changes. Management who appreciates the audit process.