TY-15-Scenario-2 - Earn It! Keep It! Save It!

advertisement

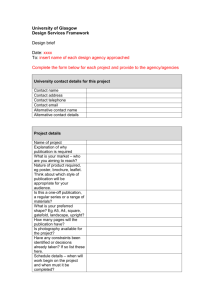

EKS Training Scenario Two Ground Rules o Don’t work ahead – stay on the current task o Turn off your cell phone o Question/Comments – raise your hand, stay in your seat o No side conversations - don’t even ask your neighbor for help o Returning volunteers sit next to new volunteers o Bring your materials every day o At least try to do your homework – bring your questions 4 Steps: Class Structure 1. As a class, we will review Interview Notes, Intake & Interview Sheet (13614-C) & supporting documents for each scenario. 2. Instructor will teach Tax Law – referencing Publication 4012 and 13614-C 3. Instructor will show you how to enter information into TaxWise. WATCH! 4. Now DO! Students will enter information on TaxWise Scenario #2 What you will learn in this scenario: Scenario #2 1. Head of Household Filing Status 2. Exemptions: Dependency 3. Business Income 4. Adjustments – Student Loan Interest 5. Credits: 6. Determining Itemization 7. Affordable Care Act – Exemptions Child Tax Credit, Additional Child Tax Credit, Child and Dependent Care Credit, American Opportunity Credit and Retirement Savings Credit What you will review in this scenario: 1. Filing Status 2. Personal Exemptions 3. Income – W-2, Interest Income, and Unemployment 4. Credits- Refundable vs Nonrefundable 5. Itemized Deductions versus Standard Deduction Earned Income Tax Credit Let’s review Cheryl’s Information: Scenario #2 Interview Notes Intake & Interview sheet - 13614-C Tax Documents Interview Notes Review What did you learn about Cheryl? Deep Dive with the 13614-C Did they bring all the required documents? Everything accurate? Intake & Interview What’s missing/wrong/mismatched that needs to be changed? Compare tax documents and interview notes Make any corrections needed on 13614-C Fill out greyed out boxes (dependency and ACA) Publication 4012, Tabs K-3 and K-4 Does this taxpayer need to file their return? Who should Or should they? file? Publication 4012, Tab A Is client eligible for VITA services? In Scope? What certification level is needed to prepare this return? Publication 4012, pages 8-10 Scope of Services Chart Tax Law Topic #1 Dependency Exemption: Review personal exemption and dependency exemption What is a “qualifying child” or “qualifying relative”? Publication 4012, Tab C-3 Tax Law Topic #1 What exemptions can Cheryl take? Do Jeremy and Joshua qualify as “qualifying relatives” or “qualifying children”? Tax Law Topic #2 Head of Household Filing Status Publication 4012, C-3, Tab B-1, B-3 and B-4 Tax Law Topic #2 Review 13614-C, Part II, numbers 1 & 2 Let’s review the Decision Tree Could Cheryl qualify for more than one status? You Got This!: Enter Cheryl’s: TaxWise Personal information on Main Information Sheet Everything on page one of 13614-C goes on Main Info Publication 4012, K-6 to K-11 for Main Info You Got This!: Enter Cheryl’s: TaxWise Income documents: W-2, 1099-G & 1099-INT Publication 4012, D-3 to D-9 for Income Students: WATCH instructor TaxWise Enter Cheryl’s dependents’ information on the Main Information Sheet Publication 4012, K-8 Students: TaxWise Enter Cheryl’s dependents’ information on the Main Information Sheet Publication 4012, K-8 Business Income Businesses with inventory, employees, depreciation, business use of home or a net loss are out of scope (Sch C-EZ rules) Tax Law Topic #3 Any Form 1099-MISC with nonemployee compensation (box 7) for a trade or business must be reported on Line 1 of the Schedule C-EZ Cash Income is considered Business Income and should be reported on a Schedule C or C-EZ Taxpayers can claim expenses for their trade or business and this will reduce the amount of Gross Receipts Self-employment taxes will be paid on Gross Receipts (TaxWise calculates) Publication 4012, Tab D-13 to D-15 Business Income Which one’s EZ? Tax Law Topic #3 Schedule C-EZ Schedule C Only one per return (if TP and SP both have businesses won’t work) Multiple per return possible Simplified expenses Must categorize expenses (advertising, insurance, supplies, licenses, etc.) Has limit of $5,000 expenses No expense limit Publication 4012, Tab D-13 to D-15 Tax Law Topic #3 Review 13614-C, Part III Let’s review the 1099-MISC What did Cheryl receive this for? Did she have any expenses related to this business income? Students: WATCH instructor Enter Cheryl’s 1099-MISC income on Schedule C-EZ TaxWise Must link 1099-MISC to line 1 Publication 4012, Tab D-13 to D-15 Students: Enter Cheryl’s 1099-MISC income on Schedule C-EZ TaxWise Must link 1099-MISC to line 1 Publication 4012, Tab D-13 to D-15 Adjustments Tax Law Topic #4 What are adjustments to income? Where are they on the 1040? Does Cheryl have an “adjustment to income”? Publication 4012, Tab E-4 & Cheryl’s 13614-C Students: WATCH instructor Enter Cheryl’s 1098-E on 1040 Worksheet 2 TaxWise Publication 4012, Tab E-5 Students: TaxWise Enter Cheryl’s 1098-E on 1040 Worksheet 2 Publication 4012, Tab E-5 Deductions: Deductions reduce a taxpayer’s taxable income Tax Law Topic #5 Taxpayer can take Standard or Itemized Deductions (should take the larger): Standard – a fixed dollar amount based on filing status Itemized – uses your qualified expenses like mortgage interest, medical or dental expenses, charitable contributions Use Schedule A Have documentation Publication 4012, Tab F & Schedule A Itemized Deductions: Tax Law Topic #5 Medical Expenses need to be more than 10% of the taxpayer’s AGI before it will count against the deduction amount How much are Cheryl’s unreimbursed medical expenses? So many details in Publication 17 Publication 4012, Tab F, Publication 17 & Schedule A Students: WATCH instructor Let’s enter Cheryl’s deductions on Schedule A. TaxWise Interview notes & Publication 4012, Tab F-5 Students: Enter Cheryl’s deductions on Schedule A. TaxWise Publication 4012, Tab F-5 Should Cheryl itemize her deductions? TaxWise Publication 4012, Tab F and Schedule A Tax Credits: Tax Law Topic #6 Two Types: Refundable & Nonrefundable Nonrefundable credits allow taxpayers to lower their liability to zero. Refundable credits allow taxpayers to lower their tax liability and receive as a payment once liability is zero. Nonrefundable Credits: Child & Dependent Care Credit* Lifetime Learning - Education Credit Retirement Savings Credit* Tax Law Topic #6 Child Tax Credit* Less common: Credit for Elderly or the Disabled Foreign Tax Credit Publication 4012, Tab G & J *Let’s look at the 4012 for more details on these credits Refundable Credits: Additional Child Tax Credit* Tax Law Topic #6 American Opportunity Tax Credit – Education Credit* Earned Income Tax Credit* Publication 4012, Tabs G, I & J *Let’s look at the 4012 for more details on these credits You Got This!: TaxWise Enter Cheryl’s Schedule EIC Worksheet Publication 4012, Tab I-6 and I-7 Students: WATCH instructor TaxWise Enter Cheryl’s childcare expenses on Form 2441 for the Child and Dependent Care Credit Interview Notes & Publication 4012, Tab G-5 Students: Enter Cheryl’s childcare expenses on Form 2441 for the TaxWise Child and Dependent Care Credit Interview Notes & Publication 4012, Tab G-5 Students: WATCH instructor TaxWise Enter Cheryl’s tuition expenses on Form 8863 for the American Opportunity Credit 1098-T & Publication 4012, Tab J-7 Students: Enter Cheryl’s tuition expenses on Form 8863 for the TaxWise American Opportunity Credit 1098-T & Publication 4012, Tab J Let’s review credits calculated on TaxWise: TaxWise Did Cheryl qualify for these credits? Child Tax Credit Additional Child Tax Credit Affordable Care Act Exemptions Did Cheryl and her dependents have coverage all year? Tax Law Topic #7 If no, let’s review the exemptions before assessing the Shared Responsibility Payment Interview Notes, 13614-C, 1095-C and Publication 4012, Tab ACA Students: WATCH instructor TaxWise Enter Exemption information on ACA Worksheet and 8965 Interview Notes, 13614-C, 1095-C and Publication 4012, Tab ACA Students: TaxWise Enter Exemption information on ACA Worksheet and 8965 Interview Notes, 1095-C and Publication 4012, Tab ACA Completing the CA return 1. Get the red out! Most information will automatically populate from the federal return 2. State EITC Form – 3514* 3. If you have entered more than one W-2 on the 1040, you will have to manually add the additional W-2’s. The first W-2 will carry over, but the rest won’t. 4. Make sure to complete the direct deposit or balance due portion of the return 5. Complete the CA Renters Credit Worksheet when applicable. *At the time of this ppt creation, details on how TaxWise will auto-populate the 3514 were not available Does Cheryl want to direct deposit her refund? If so, is she requesting to split her refund? Does she want to buy a savings bond? Refund 13614-C and Interview Notes Ask Every Taxpayer (AET)! Remind Cheryl of the savings option Savings Answer Questions Be enthusiastic and positive! Remember: Bank Account Numbers On the 8888, fill in both accounts, amounts, choose checking/savings Best practice to check they were entered in correctly On the 540, check the “different account” option, will have to enter twice to verify You Got This!: TaxWise Enter Cheryl’s Form 8888 Interview Notes & Publication 4012, Tab K-14 to K-15 THINGS YOU NEED TO KNOW ABOUT FINISHING A RETURN Finishing the return 1. Ask the questions in the Prep Use Fields 2. All returns must be Quality Reviewed (checklist on 13614-C) Tab, K-25 3. Run Diagnostics to check for errors 4. Print returns (Federal and State) for Taxpayer 5. Review return with taxpayer (Formula 1040 activity) 6. Have Taxpayer and Spouse sign 8879s for Federal and State and remind them they are responsible for their return and by signing, they are agreeing it is accurate: One copy for the taxpayer One copy for the VITA Site Publication 4012, Tab K Do we have matching AGI, refund? Let’s review entry of: Check our work - W-2 - 1099-MISC - 1098-T - 1098-E - Form 2441 - ACA Exemptions - Split refund Can an unmarried person claim “head of household” status? Publication 4012, Tab B-1, B-3, B-4 and C-3 Yes, if they provide more than half of the cost of keeping their home and a “qualified person” lived with them for ½ the year. True or False: The term “dependent” means the person met all the requirements to be “qualifying child” or “qualifying relative”. Publication 4012, Tab C-3 Look it up! True A taxpayer must have this to qualify for EITC? Publication 4012, Tab I Earned Income What are some examples of earned income? Publication 4012, Tab I-1 Taxable wages, self-employment earnings True or False: Laura’s foster son Jack is 12. He is a US citizen, he lives with Laura and she provides his full financial support. Is Jack a qualifying child for the child tax credit? Publication 4012, Tab G-8 True Look it up! The tax credit for child and dependent care expenses allows taxpayers to claim a credit for expenses paid for the care of children under what age? Publication 4012, Tab G-3 13 True or False: For the CDCC, the qualifying person must live with the taxpayer for the entire year? Publication 4012, Tab G-3 False, the qualifying person must live with them for more than ½ the year. What are the two deductions options? Publication 4012, Tab F Standard or Itemized What is the most common big ticket item for itemizing deductions? Publication 4012, Tab F-3 and F-4 Mortgage Interest Name two requirements to qualify for the Child Tax Credit Publication 4012, Tab G-8 and G-9 Qualifying Child must be under age 17, a US Citizen, US National or Resident Alien, be claimed as a dependent and live with the taxpayer for more than half the year Look it up! Is the Child Tax Credit a refundable or nonrefundable credit? Publication 4012, Tab G-8 Nonrefundable, but the client may be eligible for the Additional Child Tax Credit which is refundable. What should you do for every tax return to ensure the taxpayer receives EITC, if eligible? Publication 4012, Tab K-8 Always check the EIC box on the Main Information Sheet when entering dependents