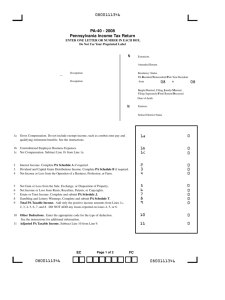

or Refund

advertisement

Tax Basics Taking Some of the Confusion Out of Filing Your Taxes Montgomery County Julie D. Judy Family and Consumer Sciences “Educating People to Help Themselves” Overview • • • • • • • • Ways to File Basic Tax Equation Income Sources Deductions Exemptions Credits Pitfalls Paying Your IRS Debt How Can You File? • • • • • • e-file through the IRS Tax Software On-site Preparers Certified Public Accountants Tax Attorneys VITA Sites Definitions • Gross Income: total amount of money you make • Deductions: items that reduce your taxable income • Exemptions: items that reduce your taxable income • Adjusted Gross Income (AGI): Gross income minus deductions • Credits: items that reduce the amount of taxes that you owe Simplified Tax Formulas Basic Steps for Determining Taxes Owed (or Refund) 1. Gross Income – Deductions & Exemptions = AGI 2. AGI x Tax Rate = Taxes Due (or Refund) 3. Taxes Due – Credits = Total Taxes Paid (or Refund) Ex. Susan’s salary = $30,000 Deductions/Exemptions = $10,000 AGI = $20,000 $20,000 x 15% = $ 2,245 Credits = $ 3,000 Refund = $ 755 Sources of Income • • • • • • • • Employment Wages (W-2) Investments Social Security Benefits Pensions or Annuities (1099-R) Government Payments (1099-G) Tax Refund from last year Home Sales Other Income (including children’s income) Biggest Deductions • • • • • • • Home Children Cars and Personal Property Medical Expenses Education Charitable Contributions Retirement/Investments Exemptions • Self • Spouse • Dependents + + + Tax Credits • • • • • • Earned Income Credit Child Tax Credit Dependent and Child Care Credit Hope Credit Lifetime Learning Credit Retirement Savings Contribution Credit More Credits • • • • • • Residential Energy Credits Mortgage Interest Credits Electric/Clean Fuel Car Credits Health Coverage Tax Credit Telephone Tax Refund Elderly/Disabled Credit Refundable vs. Non-refundable • Refundable credits allow you to get money back when you don’t owe any taxes. • Non-refundable credits will reduce the amount of taxes you owe but will not give you money back. Common Mistakes • Not filing • Not providing proper documentation for charitable contributions • Ignoring preprinted IRS materials • Forgetting to sign your return • Not meeting the deadline TAX HELP • Personal Computer – www.irs.gov – FAQs – Forms and Publications – Refund Status • Telephone – Order forms and publications (1-800-829-3676) – Ask questions (1-800-829-1040) – Prerecorded messages (1-800-829-4477) • In-person – 1-800-829-1040 for locations – VITA sites (Volunteer Income Tax Assistance) – TCE sites (Tax Counseling for the Elderly) – IRS Taxpayer Assistance Centers (local #s in phone book) Consumer Beware! Rapid Tax Refunds or Refund Anticipation Loans (RALs) Refund Anticipation Checks (RACs) Stored Value Cards Comparison of Options E-file RAL RAC SVC $0 $100 $25 $25 $0 $32 $32 $32 Tax Preparation Fee $0 $146 $146 $146 Check Cashing Fee $0 $65 $65 $0 Refund Receipt 7-10 days 1-4 days 7-10 days 7-10 days APR 0% Up to 700% Advantages Free; no risk Immediate cash No upfront costs; bank account not required Bank account not required Risk None High: may owe the lender; damage to credit Low: no risk, but high in cost Medium: overdrawn accounts; loss of card Total $0 $343 $268 $204 RAL Loan Fees (including dummy account fee) Application/Admin Fee Better Options To avoid paying unnecessary fees for a rapid refund, consider any of the following options: • • • • • Open a bank deposit account Don’t go to check cashers File tax returns electronically Delay paying bills Have taxes done for free What To Do with Your Refund • • • • • Pay down/off some bills Build up your emergency fund Invest it Splurge Combination Montgomery County Julie D. Judy Family and Consumer Sciences “Educating People to Help Themselves” Earned Income Credit (EIC) • Started by Congress in 1975 • Provides income to workers and their families whether they owe income taxes or not • 27% of eligible families do not participate • Refundable Eligibility • Families with 2+ qualifying children, AGI up to $36,348 ($38,348 for married filing jointly), up to $4,140 in credit • Families with 1 qualifying child, AGI up to $32,001 ($34,001 for married filing jointly), up to $2,506 in credit • Workers age 25-64 with no qualifying children, AGI up to $11,060, up to $376 in credit EIC Values What is a Qualifying Child? • May be a natural child, grandchild, stepchild, adopted child, foster child, or sibling if cared for as your child • Must be under 19 years of age (age 24 if fulltime student or ANY age if totally and permanently disabled) • Does not have to be your dependent but had to live with you for more than half of the year More About Children • If divorced, either parent can claim a qualifying child, but not both. • If divorced, several qualifying children could be divided between the parents by agreement. • In cases of joint custody when the parents can’t agree, the parent with whom the child lived the longest during the year (or if that’s equal, the parent with the highest AGI) can claim the child. Requirements for EIC • Must have earned income derived from wages, salaries, tips, or self-employment • Must file a tax return to receive money • Must be a US citizen or resident alien for the entire year • Must have a valid Social Security Number (you and any qualifying children) • Cannot file as ‘married filing separately’ • Investment income cannot exceed $2,550 • Cannot file Form 2555 or 2555EZ, Foreign Earned Income Additional Information • Non-taxable income is not included in AGI • Filing for and receiving the EIC has no effect on certain welfare benefits including food stamps, low-income housing, supplemental security income, and Medicaid. • Temporary Assistance to Needy Families (TANF) may be affected. How Do You Get the Credit? • Workers without children, File Form 1040 EZ • Workers with children, file Form 1040A or Form 1040, then file Schedule EIC • If you owe, you subtract the credit. You will owe less or get money back. • If you don’t owe, you get money back. – $500 taxes due + $2000 credit = $1500 refund Advanced EIC • Not everyone is eligible to participate • File a W-5 form with your employer State and Local EICs Some State and Local Earned Income Tax Credits Based on the Federal Credit Refundable Credits District of Columbia Maryland New Jersey New York Rhode Island Non-refundable Credits Delaware Maine Virginia Local Credits Montgomery County, Maryland New York City, New York Child Tax Credit (CTC) • Up to $1000 per child • Nonrefundable credit • Must use Form 1040 or Form 1040A, not Form 1040EZ • Must provide the name and identification number (usually a Social Security number) on your tax return (or Form 8901) for each qualifying child Qualifying Children for CTC A qualifying child for purposes of the child tax credit is a child who: • Is your son, daughter, stepchild, foster child, adopted child, brother, sister, stepbrother, stepsister, or a descendant of any of them (for example, your grandchild), • Was under age 17 at the end of the tax year, • Did not provide over half of his or her own support for the tax year, • Lived with you for more than half of the tax year, and • Was a U.S. citizen, a U.S. national, or a resident of the United States. Limits to CTC You will not receive the full $1,000 credit if either (1) or (2) applies: 1. The amount you owe is less than the credit. Ex. You owe $600. Because you only owe $600 and this is a non-refundable credit, you will only receive $600 from the Child Tax Credit. 1. Your modified adjusted gross income (MAGI) is above the amount shown below for your filing status. – Married filing jointly - $110,000. – Single, head of household, or qualifying widow(er) $75,000. – Married filing separately - $55,000. Additional Child Tax Credit • This credit is for certain individuals who get less than the full amount of the child tax credit. • Refundable Dependent & Child Care Credit • Provides a credit for money paid to someone to care for your child(ren) • Both spouses must have earned income, unless one was a full-time student or mentally/physically incapable of self-care • Nonrefundable Qualifying Expenses • Care of your dependent who is under 13 • Care of your spouse who was mentally or physically not able to care for him/herself AND lived with you for more than one-half the year • Care for your dependent who was mentally or physically unable to care for him/herself AND lived with you for more than one-half the year. Additional Requirements • Must provide taxpayer identification number of the qualifying person • Must report the name, address, and taxpayer identification number of the care provider unless the provider is tax-exempt • Cannot file as ‘Married filing separately.’ • Cannot pay someone you claim as a dependent, or your child under 19, even if you don’t claim them as a dependent Hope Credit • A credit to help offset the costs of higher education • Nonrefundable credit • Up to $1,500 for qualified education expenses paid per eligible student Claiming the Hope Credit • You paid qualified expenses of higher education • You paid for an eligible student • The eligible student is yourself, your spouse, or your dependent for whom you claimed an exemption on your tax return • Must file single or married filing jointly • MAGI must be less than $53,000 or $107,000 for married persons • Cannot be a nonresident alien • Cannot claim Hope and Lifetime Learning Credits for the same student in same year Qualified Expenses • Tuition • Student activity fees • Course-related books, supplies and equipment (if required by the institution as a condition of enrollment) Lifetime Learning Credit • A credit to help offset the costs of higher education • Nonrefundable credit • Up to $2,000 for qualified education expenses paid per return Comparing Education Credits Hope Credit Lifetime Learning Credit Up to $1,500 credit per eligible student Up to $2,000 credit per return Available ONLY until the first 2 years of post-secondary education are completed Available for all years of postsecondary education and for courses to acquire or improve job skills Available ONLY for 2 years per eligible student Available for an unlimited number of years Student must be pursuing an undergraduate degree or other recognized education credential Student does not need to be pursuing a degree or other recognized education credential Student must be enrolled at least half-time for at least one academic period beginning during the year Available for one or more courses No felony drug conviction on student’s record Felony drug conviction rule does not apply Retirement Savings Contribution Credit • • • • • • • Up to $2000 per person Nonrefundable Must make eligible contributions Must be born before January 2, 1988 Cannot be a full-time student Cannot be someone else’s dependent AGI cannot exceed $50,000 (married filing jointly), $37,500 (head of household), or $25,000 (single, married filing separately) • Use Form 8880 to determine the rate and amount of credit • You must use Form 1040 or 1040A