Workers, - University of Missouri

advertisement

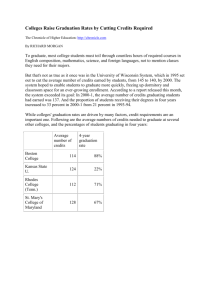

Workers, Put Some EXTRA MONEY in Your Pocket!! Claim Your Tax Credits! Tax credits offset any federal income taxes you owe. With some credits (called “refundable” credits), you can also receive all or part of the credit in your refund check. The Earned Income Credit and Child Tax Credit are refundable credits. Some families are eligible for more than $7,000 in tax credits. Make sure you claim any credits you are eligible to receive. Who can get the Earned Income Credit? For information about how you can get the Earned Income Credit and free help filing your taxes, call the IRS at 1-800829-1040. Avoid refund delays! Be sure to provide the correct name and Social Security number for each person listed on your tax return. Families with one child who earn less than $36,052 in 2011 (or less than $41,132 for married workers) are eligible for a credit of up to $3,094. Families with two children who earn less than $40,964 in 2011 (or less than $46,044 for married workers) are eligible for a credit of up to $5,112. Families with three or more children who earn less than $43,998 in 2011 (or less than $49,078 for married workers) are eligible for a credit of up to $5,751. Workers without a qualifying child who earn less than $13,660 in 2010 (or less than $18,740 for married workers) are eligible for a credit of up to $464. Who can get the Child Tax Credit? Families with qualifying children can receive up to $1,000 per child. For more info on qualifying children, call the IRS at 1-800-829-1040. Who can get the Additional Child Tax Credit? Families with earned income of more than $3,000 in 2011 and have not used the full amount of their child tax credit can receive the remaining amount as refundable credit of up to $1,000 per child. Who can get the Saver’s Credit? THE 2011 EARNED INCOME CREDIT CAMPAIGN University of Missouri Extension Taney County 122 Felkins Avenue, P.O. Box 598 Forsyth, MO 65653 1-417-546-4431 1-888-504-0443 Workers who contribute to retirement plans or Individual Retirement Accounts (IRAs) can receive a tax credit worth up to $1,000 (or $2,000 if married filing jointly), based on their retirement contributions and yearly income. You are eligible for the Saver’s Tax Credit if you are age 18 or older, not a full time student, not claimed as a dependent on someone else’s return and your 2011 adjusted gross income is less than $56,500 if filing jointly, less than $42,375 if filing as head of household, or less than $28,250 if filing single or married filing separately. To receive any of these credits, you must file a federal income tax return. Free help preparing tax returns is available through several volunteer tax assistance programs. To find the free tax assistance site near you, call the University of Missouri Outreach & Extension at 573-884-1690. To make the most of your tax credits, avoid refund anticipation loans! These short-term loans (often just for a matter of days) are expensive. Direct deposit and electronic filing are just as fast and less costly. In Southwest Missouri VITA is sponsored by the University of Missouri Outreach & Extension, the Internal Revenue Service, Stone and Taney County OACAC Neighborhood Centers, College of the Ozarks, White River Valley Electric Cooperative, Ozark Highland Parents as Teachers, the Hollister Elementary School, Taney County Extension Council, Experience Works, and the Healthy Families Taskforce of Stone and Taney counties. The University of Missouri is an Equal Opportunity Employer/Affirmative Action Organization Committed to a Diverse Work Force. University Outreach and Extension does not discriminate on the basis of race, color, national origin, sex, sexual orientation, religion, age, disability or status as a Vietnam-era veteran in employment or programs.