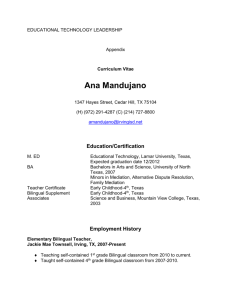

2013 IRVING Tax Preparation Assistance Sites Free

advertisement

2013 IRVING Tax Preparation Assistance Sites Free Tax Assistance for Middle-to-Low Income Taxpayers *Spanish language assistance available at all sites AARP Tax Aide Sites Irving Central Library Heritage Senior Center 801 Irving Blvd. Saturday, 10 a.m. – 2 p.m. February 2 - April 13 200 S. Jefferson St. Monday and Thursday, 8 a.m. – noon February 4 - April 15 Numbered Forms given out beginning at 9 a.m. – limited number available each week No advance reservations Must be present First Come, First Served Basis Seniors Only – Appointment Required Grace Beckner 214-770-5599 Pick up information packet before appointment at Heritage Senior Center VITA (Volunteer Income Tax Assistance) Site Nimitz High School Irving Cares 440 S. Nursery Road Irving, TX 75017 Tuesday, January 22 Tuesday, January 29 Saturday, February 2 Tuesday, February 5 Friday, April 5 IRS Certified Nimitz Student Tax Preparers 2 p.m. to 8 p.m. 9 a.m. to 2 p.m. 9 a.m. to 2 p.m. 2 p.m. to 8 p.m. 2 p.m. to 8 p.m. Please call 214-978-0081 for additional information or to make an appointment. APPOINTMENTS ARE REQUIRED. See the other side for information about what documents to bring with you. Irving Cares participates in Earn It! Keep It! Save It! This United Way program offers free tax preparation services to qualifying people who make less than $50,270. 100 West Oakdale Irving, TX 75060 Time: 9 a.m. - 1 p.m. Every Saturday February 2 - April 1 As volunteers, we are trained and tested in current tax law using IRS material to prepare the following: E-File Direct Deposit Form 5405 Form 982 Form 1040EZ Form 1040 Earned Income Tax Credit Form 1040-ES Schedule A, B, EIC & R Form 1040A EZ Form 8888 (Direct Deposit) Form 2441 (Child and Dependent Credit) Information provided as a public service by the Irving Public Library Information may be subject to change Tax Preparation Assistance is available to middle and low-income taxpayers. AARP Tax-Aide sites give special attention to those ages 60 and older. Prepare for Your Meeting with Tax Preparation Before meeting tax assistance volunteer, gather together some basic information and bring it with you to the site, such as: Copy of last year's income tax returns W-2 forms from each employer Unemployment compensation statements SSA-1099 form if you were paid Social Security benefits All 1099 forms (1099-INT, 1099-DIV, 1099-misc., etc.) showing interest and/or dividends as well as documentation showing the original purchase price of your sold assets 1099 forms showing Miscellaneous income 1099R forms if you received a pension or annuity All forms indicating federal income tax paid Dependent Care information (name, employer ID, Social Security number) All receipts or canceled checks if itemizing deductions Social Security numbers for all dependents. Your spouse, if you are filing a joint return Voided check(s), if you want your tax refund deposited directly into your account(s) Forms our IRS-certified volunteers can prepare: Form 1040 EZ Form 1040 A with Schedules 1, 2, 3 & EIC Form 1040 with Schedules A, B, EIC & R Form 1040 – V Form 1040 – ES Form 2441 (Child and Dependent Care Credit) Form 8863 (Education Credits) Form 8812 (Additional Child Tax Credit) Schedule C (Profits or Loss from Business) Forms that require the assistance of a paid preparer: Complicated and Advanced Schedule D (Capital Gains and Losses) Schedule E (Rents and Losses) Form SS-5 (Request for Social Security Number) Form 2106 (Employee Business Expenses) Form 3903 (Moving) Form 8606 (Nondeductible IRA) Form 8615 (Minor’s Investment Income) NOTE: This is a basic guideline for available services. Individual sites may have additional limitations and/or capabilities regarding income tax preparation.