Walmart vs. Kiranas

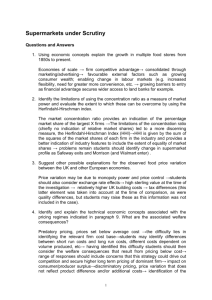

advertisement

Reuters In India, A Nation of Shopkeepers Frets Over Retail Reform By Annie Banerji NEW DELHI | Thu Sep 20, 2012 2:57am EDT NEW DELHI (Reuters) - Customers squeezing through the narrow aisles of Sushant Goel's tiny grocery store in central Delhi need to be careful. Just brushing up against the rickety free-standing shelves packed with food and toiletries can cause them to wobble dangerously. Goel, 61, inherited the general store, or kirana, in Delhi's Bengali Market from his father 23 years ago and is now slowly handing over the business to his sons. Like many kiranas, it is a business built on a reputation for reliability of service, one earned over generations. But thousands of kirana owners like Goel planned to close their shops on Thursday to protest against a government decision to allow in foreign supermarkets such as Wal-Mart Stores Inc (WMT.N). They fear the move could lead to the destruction of the ubiquitous family-owned stores that occupy a central place in Indian daily life and help give the country the highest shop density in the world. "If these big guys storm in and wreck what I've fostered for decades, then my family and I will have to resort to a different business," said Goel, who - after much thought - decided to open on Thursday because he couldn't afford to lose the business. These fears are being exploited by the main opposition Bharatiya Janata Party (BJP), despite the pro-business party itself having championed retail reform when it was in power more than a decade ago. Elections are due soon in several states, and many, including Goel, see the BJP's call for protests as a cynical ploy to curry favour with kirana owners. With an estimated 50 million kiranas and some 220 million people dependent on them for their livelihoods, according to the Confederation of All India Traders, mom-and-pop store owners represent a huge political constituency. India, it is said, is a nation of shopkeepers. Political parties of all stripes have loudly rejected the government's decision and warned that better-organized foreign supermarkets will wipe out kiranas, leaving millions unemployed. But Reuters interviews with industry analysts, store owners and some of their customers suggest that while change is inevitable in India's mostly unorganized retail sector, kiranas will likely survive and perhaps even thrive alongside supermarkets. How? Location. Kiranas are in every nook and cranny of densely populated neighborhoods, whereas domestic supermarkets are mostly found in shopping malls. With land at a premium, foreign supermarkets will likely have to set up shop outside the main cities. Kiranas also offer goods and services specifically tailored to customers who usually live only a few blocks away from the store. Want a box of matches delivered free to your home, or two eggs instead of six, or rice by the ounce instead of the pound, and all of it on credit until the end of the month? Kirana owners understand the importance of customer loyalty in a competitive market and easily accommodate such requests. "It's like craving Domino's Pizza and spicy street-side snacks at the same time. I want a mix of both," said investment banker Aramya Jain, 38, as she shopped in Goel's kirana, picking up a bottle of mango pickle, an assortment of Indian spices, foreign-brand cereal and chocolate syrup. Kirana shops vary in size, most of them smaller than 400 square feet (37.2 sq metres). Some are walk-in stores but many owners operate out of residential garages or run hole-in-the-wall operations where they sell their goods over the counter. "The political mayhem over fears of extinction of these shops seems misplaced," the Federation of Indian Chambers of Commerce and Industry (FICCI) and global accounting firm PricewaterhouseCoopers said in a study released this month. "The traditional kirana stores and outlets in India have been able to compete very successfully with modern retail for a very long time," it said. "Their presence in the midst of a residential area is a big advantage." BANKING ON CUSTOMER LOYALTY Driven by a swelling middle class and growing incomes, the value of the retail sector is expected to surge to $1.3 trillion by 2020, the report said. Organized retail, which now accounts for only about 5 percent of the sector, is expected to outstrip growth by unorganized retail, for which read kiranas. Estimates of the current size of the retail sector vary. FICCI pegged it at $500 billion, but government data gives a lower estimate of $350-$370 billion. While Sushant Goel is hopeful his business will ultimately survive the entry of foreign supermarkets, just as it weathered the arrival of national supermarkets a decade ago, other kirana owners are not so confident. In the industrial hub of Noida, about 16 km (10 miles) from Goel's store, Brijesh Bhati stands inside his dimly lit store, which operates out of a 300 square feet garage - just enough space for two employees to grab goods off the shelves and hand them over the counter to customers. "If the foreigners do come in, they will snatch everything from us. It will be like the British Raj again. But we will drive them out, just like we did before," said Bhati. The "foreigners", many of whom already operate joint cash-and-carry ventures with Indian partners, won't be coming in any time soon. The government's new policy of allowing foreign chains a 51 percent stake in supermarkets for the first time comes with tough conditions. Foreign retailers will be allowed to set up only in cities with a population of more than 1 million and only in states that want them. The retailers must make a minimum investment of $100 million and must source at least 30 percent of goods from local, small industries. But the Confederation of All India Traders, which represents small and mediumsized businesses in the unorganized retail sector, fears that foreign supermarkets will crush opposition by undercutting the mom-and-pop stores with lower prices. "Once they are able to wipe out the competition, they control and dominate the retail and then dictate the prices," said Praveen Khandelwal, the confederation's general secretary. "If we allow them to have total control from back-end to frontend, then the country will become captive at the hands of multinational companies." Such fears are overblown, said Debashish Mukherjee, a partner at global management consultancy A.T. Kearney. Consumers tend to visit supermarkets to do monthly shops or make bulk purchases while still relying on mom-and-pop stores for smaller items. Back in his new Delhi store, Goel is banking on carefully earned customer loyalty to keep him in business: the well-thumbed notebooks on his counter containing customers' monthly credit accounts are key to that. "Over the years we've become like family to most of our customers and that's why we offer them services that foreign supermarkets most likely will not," he said.