Net Income

advertisement

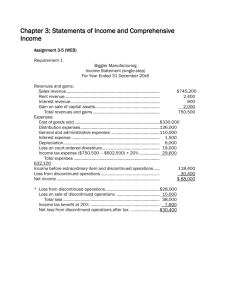

MODULE 9 ADVANCED INCOME STATEMENT ISSUES Advanced Income Statement 1 ADVANCED INCOME STATEMENT ISSUES Irregular Items Discontinued Items Extraordinary Items Unusual Items (Restructuring) Earnings per Share Advanced Income Statement 2 INCOME STATEMENT FORMATS A Review A multi-step income statement: Separates operating and non-operating activities Classifies expenses by function X CORPORATION INCOME STATEMENT For the period ending December 31, 20XX Sales Cost of Goods Sold Gross Profit Selling, General, and Administrative Expenses Income from Operations Rent Income Investment Gains Interest Expense Income before Tax Tax Expense Net Income Earnings per Share (44,000 shares outstanding) $150,000 -70,000 80,000 -10,000 70,000 10,000 5,000 -5,000 80,000 -25,000 $55,000 Operating revenues and expenses NonOperating revenues and expenses $1.25 Operating – within corporate mission Non-Operating – rent, interest, equipment sales Note: Multistep income statements usually include Gross Profit (Sales – Cost of Goods Sold). Advanced Income Statement 3 CONSOLIDATED STATEMENT OF EARNINGS The Home Depot, Inc. and Subsidiaries AMOUNTS IN MILLIONS, EXCEPT SHARE DATA Amounts in millions NET SALES Cost of Sales GROSS PROFIT Operating Expenses: Selling, General and Administrative Depreciation and Amortization Total Operating Expenses January 28, 2007 January 29, 2012 $70,395 46,133 24,262 100.0% 65.5% 34.5% $90,837 61,054 29,783 100.0% 67.2% 32.8% 16,028 1,573 17,601 22.8% 2.2% 25.0% 18,348 1,762 20,110 20.2% 1.9% 22.1% OPERATING INCOME Interest and Other (Income) Expense: Interest and Investment Income Interest Expense Other Interest and Other, net 6,661 9.5% 9,673 10.6% EARNINGS BEFORE TAXES 6,068 8.6% 9,308 10.2% Provision for Income Taxes 2,185 3.1% 3,547 3.9% EARNINGS FROM CONTINUING OPERATIONS 3,883 Advanced Income Statement 13 -606 0 -593 -0.9% 5.5% 27 -392 0 -365 5,761 4 -0.4% 6.3% IRREGULAR ITEMS “DE” Items In the US, two items: Discontinued Operations Extraordinary Items receive special treatment. Treatment: Show near the bottom of the income statement (prior to net income) net of taxes Note: DE items receive this treatment whether single or multi-step. Income before DE items is referred to as “Income from Continuing Operations” IFRS standards do not recognize extraordinary items. Advanced Income Statement 5 INCOME STATEMENT WITH “DE” ITEMS X CORPORATION INCOME STATEMENT For the period ending December 31, 20XX Sales Cost of Goods Sold Gross Profit Selling, General, and Administrative Expenses Income Before Unusual and Infrequent Items Unusual Item Infrequent Item Income from Cont Operations Before Tax Tax Expense Income from Continuing Operations Discontinued Operations ($2,700 before tax effect of $700) Extraordinary Items (5,400 before tax effect of $1400) Net Income Earnings per Share from (10,000 shares): Continuing Operations Discontinued Operations Extraordinary Items Net Income Advanced Income Statement $100,000 -25,000 75,000 -10,000 65,000 -5,000 -5,000 55,000 -30,000 25,000 -2,000 -4,000 $19,000 These taxes apply to items above and not “DE” items DE items are net of tax $2.50 .20 .40 $1.90 Show separate EPS for DE items 6 IRREGULAR ITEMS Discontinued Operations Discontinued Operations – component that (1) will be eliminated from ongoing operations, and (2) has no management involvement after disposal. Rules: a component must be a product group or division, but not a brand Discontinued operations are always reported net of taxes Reported in two parts: Part 1 - Gain or loss from operations of discontinued operations Part 2 - Gain or loss from the disposal (FMV – BV) Advanced Income Statement 7 IRREGULAR ITEMS Discontinued Operations Al Carbon’s Tacos operates Fire in the Hole Donuts (FITH), a subsidiary that management believes does not fit well in the company. During 20X1, Al Carbon, announced a plan to sell FITH. Fire in the Hole lost $300 and $250 thousand during 20X1 and 20X2 respectively, and no buyer seemed interested in purchasing FITH. (See A) However, in 20X3, FITH earned $100 thousand (see B) and Taco Joe agreed to purchase FITH for $500 thousand, $50 thousand more than the current net worth (see C). The income statement disclosure related to the discontinued operation would be: (in thousands of US$) 20X3 20X2 20X1 Income from continuing operations 3,000 2,500 2,000 Discontinued operations Gain(Loss) from discontinued operations Gain on sale of discontinued operations Net income Advanced Income Statement C B A 100 50 (250) -- (300) – $3,150 $2,250 $1,700 8 DISCONTINUED OPERATIONS EXAMPLE On December 22, 2003 GM completed a series of transactions that resulted in the split-off of Hughes from GM and the simultaneous sale of GM’s approximately 19.8% economic interest in Hughes to the News Corporation. GENERAL MOTORS CORP. & SUBSIDIARIES Consolidated Statements of Income Years ended December 31 2004 2003 2002 $193,517 $185,837 $177,867 159,951 20,394 11,980 192,325 152,435 20,957 9,464 182,856 147,192 20,834 7,503 175,529 Income before income taxes 1,192 2,981 2,338 Income tax (benefit) expense Equity income and minority interests Income from continuing operations (911) 702 2,805 731 612 2,862 644 281 1,975 – – (219) 1,179 (239) – $2,805 $3,822 $1,736 (Dollars in millions) Net sales Cost of sales and other expenses Selling, general, and administrative expenses Interest expense Total costs and expenses Discontinued operations (Loss) from discontinued operations Gain on sale of discontinued operations Net income Part 1 – Hughes lost $458 million over 2002-2003. Advanced Income Statement Part 2 – GM sold Hughes in 2003 at a gain of $1.179 billion. 9 IRREGULAR ITEMS Extraordinary Items Extraordinary Item – non recurring material items that differ from the entity’s business activities. They are both: Unusual in Nature – possess a high degree of abnormality Infrequent in Occurrence – not reasonably expected to recur in the foreseeable future The following are not extraordinary: Write downs of receivables, inventories and equipment Foreign currency gains and losses Sale of PP&E and investments Corporate restructuring It’s unusual. Effects of a strike It’s infrequent. Early extinguishment of debt It’s highly extraordinary Immaterial items my dear Watson. IFRS standards do not recognize extraordinary items. Advanced Income Statement 10 IRREGULAR ITEMS Restructuring Charges Attention should be paid to items that may be unusual or infrequent, but not both. Restructuring charges are a common example. Restructuring charges – usually relate to activities such as layoffs, closings, asset impairments. Some companies report restructuring charges as unusual items (“other losses” or “other expenses”). Restructuring charges are NOT “DE” items and should NOT be shown net of taxes. Advanced Income Statement 11 RESTRUCTURING EXAMPLE McDonald’s Corporation Consolidated Statement of Income (In millions, except per share data) Years ended December 31, Revenues from Company-operated restaurants Revenues from franchised restaurants Total revenues Operating costs and expenses Food and packaging Payroll and employee benefits Occupancy and other operating expenses Total Company-operated restaurant expenses Franchised restaurants--occupancy expenses Selling, general and administrative expenses Other operating (income) expense Made for You costs Special charge Total operating costs and expenses Operating income Interest expense Nonoperating (income) expense Income before provision for income taxes Provision for income taxes Net income 1999 1998 1997 $ 9,512.5 3,746.8 13,259.3 $ 8,894.9 3,526.5 12,421.4 $ 8,136.5 3,272.3 11,408.8 3,204.6 2,418.3 2,206.7 7,829.6 737.7 1,477.6 (124.1) 18.9 0 9,939.7 3,319.6 396.3 39.2 2,884.1 936.2 $ 1,947.9 2,997.4 2,220.3 2,043.9 7,261.6 678.0 1,458.5 (60.2) 161.6 160.0 9,659.5 2,761.9 413.8 40.7 2,307.4 757.3 $ 1,550.1 2,772.6 2,025.1 1,851.9 6,649.6 613.9 1,450.5 (113.5) 0 0 8,600.5 2,808.3 364.4 36.6 2,407.3 764.8 $ 1,642.5 Made for You – a new food preparation system that allows us to serve fresher, better-tasting food at high speed. The system supports future growth because it can more easily accommodate an expanded menu. Why did income go down in 1998? Special Charge – comprised of employee severance, lease cancellation and write-off of capitalized technology made obsolete. How do we distinguish between restructuring and items that should have been normal expenditures in past years? Advanced Income Statement 12 DICK’S SPORTING GOODS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME February 2, February 3, January 28, 2008 2007 2006 Fiscal Year Ended (Amounts in thousands, except per share data) Net sales Cost of goods sold, GROSS PROFIT $3,888,422 2,730,359 1,158,063 $3,114,162 2,217,463 896,699 $2,624,987 1,887,347 737,640 Selling, general and administrative expenses Merger integration and store closing costs Pre-opening expenses INCOME FROM OPERATIONS 870,415 — 18,831 268,817 682,625 — 16,364 197,710 556,320 37,790 10,781 132,749 Gain on sale of investment Interest expense, net INCOME BEFORE INCOME TAXES — 11,290 257,527 — 10,025 187,685 (1,844) 12,959 121,634 102,491 $155,036 75,074 $112,611 48,654 $72,980 $1.42 $1.33 $1.10 $1.02 $0.73 $0.68 109,383 116,504 102,512 110,790 99,584 107,958 Provision for income taxes NET INCOME EARNINGS PER COMMON SHARE: Basic Diluted WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: Basic Diluted In Notes: Merger integration and store closing costs associated with the purchase of Galyan’s of $37.8 million were recognized in 2005. The cost relates primarily to closing Dick’s stores in overlapping markets and advertising the re-branding and re-grand opening of the former Galyan’s stores. Net income as a percent of sales for each of the years was: 2008 2007 2006 3.99% 3.62% 2.78% Would have been 4.22% without merger costs What is the reason for a significantly lower percentage during 2006? Are you willing to “excuse” Dick’s Sporting Goods for this reason? Advanced Income Statement 13 EARNINGS PER SHARE Earnings per share are required at the bottom of the income statement. The Basic EPS Calculation: EPS = Earnings (or loss) for period - earnings applicable to senior securities* Weighted average number of shares of CS * for example, preferred stock dividends The denominator is weighed to prevent end of year manipulation. Diluted EPS must also be shown if the company has stock options, convertible bonds and preferred stock, or other agreements that potentially reduce common stockholders earnings Did you know: EPS is the only ratio GAAP tells us how to calculate? NI – PS Div # shares IFRS and US GAAP calculate basic and diluted EPS similarly. Advanced Income Statement 14 Earnings per Share Example Walmart (in millions except per share data) Sales Other income-net Cost of sales Selling and administrative expenses Interest costs: Debt Capital leases Interest income Provision for income taxes Minority interest Net income Per share of common stock: Basic net income Diluted net income Dividends 2003 2002 2001 $ 244,524 2,001 191,838 41,043 $ 217,799 1,873 171,562 36,173 $ 191,329 1,787 150,255 31,550 803 260 (138) 4,487 (193) 8,039 1,083 274 (171) 3,897 (183) 6,671 1,104 279 (188) 3,692 (129) 6,295 1.81 1.81 0.30 1.49 1.49 0.28 1.41 1.40 0.24 Earnings per share are required on the face of the income statement for all publicly-traded companies. Discussion Question: Does Walmart use a single step or multistep income statement? Thought question: If Company A has an EPS of $5, and Company B has an EPS of $4, which has higher profitability? Advanced Income Statement 15 Advanced Income Statement 16 ANALYSIS OF AN INCOME STATEMENT McCormick & Co. Consolidated Statement of Income (millions except per share data) for the year ended November 30 Net sales Cost of goods sold 2007 2006 $2,916.2 1,724.4 1,191.8 $2,716.4 1,601.8 X Selling, general and administrative expense Restructuring charges Operating income 806.9 30.7 354.2 772.6 72.4 269.6 Interest expense Other income, net Income from consolidated operations before income taxes 60.6 8.8 302.4 53.7 7.1 223.0 Income taxes Net income from consolidated operations 92.2 210.2 64.7 158.3 (.8) 21.4 .7 $X 26.8 19.9 2.8 $202.2 $1.78 $1.73 $1.53 $1.50 (Loss) gain on sale of unconsolidated operations Income from unconsolidated operations Minority interest Net income Earnings per share – basic Earnings per share – diluted Does McCormick use a single step or multi-step income statement? Multi-step – Non operating is shown separately. What is the gross profit of McCormick for 2006? $2,716.4 – 1,601.8 = $1,114.6 What is net income for McCormick in 2007? $210.2 – 0.8 + 21.4 + 0.7 = 230.1 What is the number of shares outstanding for McCormick in 2007? Basis EPS = $230.1 million / Shares = $1.78 ; Shares = 129.3 million Advanced Income Statement 17 PROFITABILITY RATIOS 1. Profit Margin on Sales Indicates: The relation of profits to sales. Profit Margin = Net Income Sales Interpretation: Higher - less sales are needed to generate a desired level of profit. How is the ratio improved? Hint: The denominator is the top of the IS and the numerator is the bottom of the IS. What is in between? 2. Return on Assets Indicates: How assets are utilized to achieve a profit. Return on Assets = Current Year Net Income Average Total Assets Options: Some add interest expense to the numerator to put leveraged and unleveraged entities on equal basis. Interpretation: Higher - greater ability to produce profits. Advanced Income Statement 18 3. Return on Stockholders' Equity Indicates: The degree of profitability attributable to stockholders. Differs from ROA to extent that the entity is leveraged (has debt). Return on Equity = Current Year Net Income Average Stockholders’ Equity Options: Some subtract PS dividends from numerator to evaluate only amounts available to CS. Interpretation: Higher - a greater degree of profits available to stockholders. Advanced Income Statement 19