Answers Quiz Chapter 4

advertisement

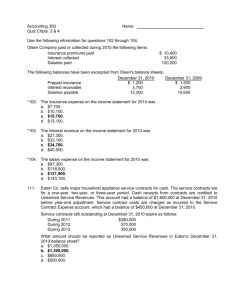

Name ______________________________________ ACG 301 Quiz Chapter 4 Fall 2011 Instructions: Select the most correct answer. Show your work where appropriate. 1. Information in the income statement helps users to A) evaluate the past performance of the enterprise. B) provide a basis for predicting future performance. C) help assess the risk or uncertainty of achieving future cash flows. D) all of these. 2. The single-step income statement emphasizes A) the gross profit figure. B) total revenues and total expenses. C) extraordinary items and accounting changes more than these are emphasized in the multiple-step income statement. D) the various components of income from continuing operations. 3. Under which of the following conditions would material flood damage be considered an extraordinary item for financial reporting purposes? A) Only if floods in the geographical area are unusual in nature and occur infrequently. B) Only if the flood damage is material in amount and could have been reduced by prudent management. C) Under any circumstances as an extraordinary item. D) Flood damage should never be classified as an extraordinary item. 4. When a company discontinues an operation and disposes of the discontinued operation (component), the transaction should be included in the income statement as a gain or loss on disposal reported as A) a prior period adjustment. B) an extraordinary item. C) an amount after continuing operations and before extraordinary items. D) a bulk sale of plant assets included in income from continuing operations. 5. Prophet Corporation has an extraordinary loss of $600,000, an unusual gain of $420,000, and a tax rate of 40%. At what amount should Prophet report each item? Extraordinary loss Unusual gain A) $(600,000) $420,000 B) (600,000) 252,000 C) (360,000) 420,000 D) (360,000) 252,000 Extraordinary Losses and Gains reported net of tax: ($600,000) * (1 – Tax Rate) = ($600,000) * (1-40%) = ($360,000) Unusual gains and losses reported as part of continued operations at gross. Taxes deducted later. Page 1 of 4 6. Leonard Corporation reports the following information: Correction of overstatement of depreciation expense in prior years, net of tax Dividends declared Net income Retained earnings, 1/1/12, as reported $ Leonard should report retained earnings, 12/31/12, at A) $1,785,000. B) $2,125,000. C) $2,340,000. D) $2,555,000. Beg RE, 1/1/12 Prior period adjustment: Overstatement of depreciation expense (net of tax) + Net Income -Dividends declared Ending RE, 12/31/12 $2,000,0000 215,000 500,000 (160,000) $2,555,000 Page 2 215,000 160,000 500,000 2,000,000 7. Logan Corp.'s trial balance of income statement accounts for the year ended December 31, 2012 included the following: Other information: Logan's income tax rate is 30%. Finished goods inventory: January 1, 2012 $160,000 December 31, 2012 140,000 On Logan's multiple-step income statement for 2012, Income before extraordinary item is A) $128,000. B) $94,000. C) $65,800. D) $49,000. Sales Revenue COGS Gross Profit $280,000 100,000 180,000 Selling Expenses: Sales Commission Expense $ 16,000 Freight-out 6,000 Bad Debt Expense 6,000 Total Selling Expenses 28,000 Administrative Expenses: Administrative Expenses Total Expenses 50,000 78,000 Other Revenues/Gains: Interest Revenue 10,000 Other Expenses/Losses: Loss on disposal of equipment Income before income taxes Income Tax Expense (30%) Income Before Extraordinary Income 18,000 94,000 28,200 65,800 Page 3 8. Which of the following is true about intraperiod tax allocation? A) It arises because certain revenue and expense items appear in the income statement either before or after they are included in the tax return. B) It is required for extraordinary items and cumulative effect of accounting changes but not for prior period adjustments. C) Its purpose is to allocate income tax expense evenly over a number of accounting periods. D) Its purpose is to relate the income tax expense to the items which affect the amount of tax. 9. Which of the following is included in comprehensive income? A) Investments by owners. B) Unrealized gains on available-for-sale securities. C) Distributions to owners. D) Changes in accounting principles. 10. Benedict Corporation reports the following information: Net income Dividends on common stock Dividends on preferred stock Weighted average common shares outstanding Benedict should report earnings per share of A) $4.50. B) $5.40 C) $6.60. D) $7.50. EPS = (Net Income –Preferred Dividends) / Wtd avg common shares outstanding EPS= (750,000 – 90,000) / 100,000 shares EPS = $6.60 Page 4 $750,000 210,000 90,000 100,000