Recommendation 2

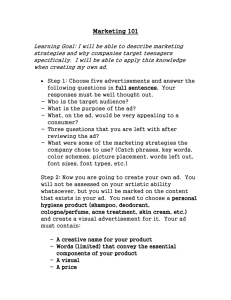

advertisement

THE FORD COMPANY Prepared for: client Faculty Prepared by Team #: names Refer to Communications Quick Guide EXECUTIVE SUMMARY Plain text 12 pt font Full justify 2 1 Industry Overview 2 Main Competitors 3 Porter’s Five Forces 4 PEST-D Analysis 5 Industry Statistics 6 Company Analysis 7 SWOT Analysis 8 Current Ratios 13 Recommendations 14 REC 1: Decrease Music Section, Add a Textbook Section 15 REC 2: Restructure Marketing Strategy 19 REC 3: Offer Monthly Plan for Nook 24 Conclusion References Appendices 28 29 31 APPX A: Comparing Current Ratios 32 APPX B: Explanations of Financial Impacts 33 APPX C: 5 Year Forecast 36 TABLE OF CONTENTS Introduction TABLE OF CONTENTS Introduction……………………………………………………………………………1 Industry Analysis……………………………………………….…………………...2 External Environment…………………………………………………3 Porter’s Five Forces…………………………………………………….4 Key Industry Issues……………………………………………………..5 Key Success Factors…………………………………………………….6 Opportunities and Threats………………………………………….7 Company Analysis…………………………………………………..………………8 Company Overview…………………………………………………….9 Company Structure…………………………………………………..10 Sales……………………….………………………………………………..11 Organizational Structure…………………………………………..12 Suppliers and Customers…………………………..……………..13 Marketing Strategies………………………………………………..14 Competitor Profile: Borders Group, Inc…………………….15 Competitor Profile: Books-A-Million…………………………16 Competitor Profile: Amazon.com, Inc……………………….17 Market Share……………………………………………………………18 Benchmarking……………………………………............…………..……..…19 Liquidity Ratios………………………………………………..….……20 Profitability Ratios………………………………………..…………..21 Debt Ratios………………………………………………………….……23 Strengths and Weaknesses………………………………..….….24 SWOT Summary…………………………………………………….….25 Recommendations…………………………………………………..…………..26 Recommendations Overview……………………………….……27 Print on Demand…………………………………………......……...28 Improve Customer Loyalty Program…….….………………..32 Expand Marketing With Text Message Alerts…….……….36 Expanding the Digital Bookstore…………………….….………40 Conclusion……………………………………………………………………….…..44 Works Cited and Appendices (Should be listed with titles)……………………………………………..…45 Full justify Introduction to the topic: INTRODUCTION 12 pt font The purpose of the report An overview of how you will go about presenting the material 5 Overview of the section about to cover 12pt font Intro to topic of the section. You may state your thesis for the section. Why you are covering it How you are covering it Example: The auto industry is plagued by high executive pay, operations inefficiencies, high healthcare costs etc etc. Industry profit margins have declined steadily in the last 2 decades. In this section we analyze the auto industry by conducting a PEST analysis to identify the factors contributing to the auto industry’s decline and utilizing Porter’s Five Forces Model to understand the competitive nature of the industry. We conclude this section by summarizing the findings from our analysis and indicating the key success factors critical to the success of industry’s players. INDUSTRY ANALYSIS Fiscal Year 2005 Annual Report 1st Qtr. Quarter Ended 2nd Qtr. 3rd Qtr. 4th Qtr. Total Fiscal year 2003 Revenue $7,746 $8,541 $7,835 $8,065 $32,187 Gross profit 6,402 6,404 6,561 6,761 26,128 Net income 2,041 1,865 2,142 1,483 7,531 Basic earnings per share 0.19 0.17 0.2 0.14 0.7 Diluted earnings per share 0.19 0.17 0.2 0.14 0.69 $8,215 $10,153 $9,175 $9,292 $36,835 Gross profit 6,735 7,809 7,764 7,811 30,119 Net income 2,614 1,549 1,315 2,690 8,168 Basic earnings per share 0.24 0.14 0.12 0.25 0.76 Diluted earnings per share 0.24 0.14 0.12 0.25 0.75 $9,189 $10,818 $9,620 $10,161 $39,788 Gross profit 7,720 8,896 8,221 8,751 33,588 Net income Fiscal year 2004 Revenue Fiscal Year 2004 INDUSTRY ANALYSIS Market Risk Fiscal year 2005 Revenue 2,528 3,463 2,563 3,700 12,254 Basic earnings per share 0.23 0.32 0.24 0.34 1.13 Diluted earnings per share 0.23 0.32 0.23 0.34 1.12 (1) Includes charges totaling $750 million (pre-tax) related to the Fabrikam settlement and $1.15 billion in impairments of investments. (2) Includes stock-based compensation charges totaling $2.2 billion for the employee stock option transfer program. (3) Includes charges totaling $756 million (pre-tax) related to Contoso subsidiaries and other matters. Narrative should be in 12 pt font Add narrative to summarize your interpretations of data and what you are concluding. The so what question. 7 INDUSTRY ANALYSIS 1st Year Sales Figures Market Distribution Financial Summary Our perennial 3rd Quarter boost was larger than expected contributing to an exceptionally strong year. Distribution of sales across the geographic markets looks fairly steady. Our new product line, released this year, is early in its adoption phase. We expect to see substantial revenue contribution from these products over the next two years. Use 12 pt font and full justify 8 Product Division Business Process Model 2002 2003 2004 2005 10.3 % 12.1% 13.2% 17.0% 1.3% 2.3% 2.2% 2.7% Services 12.0% 11.0% 8.9% 9.2% Widget Sales 78.0% 82.3% 82.5% 84.0% Installations 5.3% 7.9% 12.2% 15.1% Electronics Consumer Goods Operating Changing Supporting (1) Percentages based on domestic comparison to competitors in directly related industries. (2) Percentages based on standing at the end of each fiscal year. (3) Values provided by a third party agency. Optimizing On the last page of each section include a summary of the main lessons learned. The lessons learned would carry over to other sections and be linked to your recommendations. This helps the flow of the argument throughout the report. Contoso Design Manufacturing Quality Assurance Section Summary Summary Organizational Structure Product Development INDUSTRY ANALYSIS Market Share by Division Human Resources Headquarters Subsidiaries Finance Summaries of industry analysis may include opportunities and threats. Example: In summary, it is clear that environmental concerns and the fluctuating prices of oil have affected consumer demands for American cars and changed the focus of automakers on producing more fuel efficient cars. IT innovations present further opportunities to enhance consumer experiences and increase demand. 9 Overview of the section about to cover 12pt font Intro to topic of the section. You may state your thesis for the section. Why you are covering it How you are covering it Link the section to the previous section Example: The previous section identified key success factors necessary for success in the auto industry today. In this section we analyze the Ford company in light of these factors. Our analysis will include a review of Ford’s current performance and plans. We conclude this section by identifying For’s main strengths and weaknesses. (you may list the strengths and weaknesses here too). COMPANY ANALYSIS 10 Make sure these headings are 14 pt font (heading level 2) COMPANY ANALYSIS Company background Cost 11 INDUSTRY ANALYSIS Summary Summarize the company analysis by highlighting the main strength and weaknesses. Particularly, the main weakness they are facing and must address. You may reiterate the main issues by presenting the SWOT summary. Summary of section 12 S W O T COMPANY ANALYSIS Summary of SWOT 13 Overview of the section about to cover 12pt font Link the analysis to the recommendation: Restate the main problems and opportunities identified through your analysis (and listed in the SWOT). State that you will provide a number of recommendations to address problems and opportunities. You may list your recommendations Example: As identified in our analysis, the Ford company suffers from a number of problems and opportunities. We identify inefficiencies in operations and high executive pay to be the most significant of their problems. In the following section we provide two recommendations to address these problems. Our following section will illustrate that our recommendations will decrease operation costs by 20% and company moral. Each recommendations section will conclude with a detailed financial forecast to illustrate the impact of each recommendation. RECOMMENDATIONS Problem Recommendation High Executive Pay Restructuring Reward System Inefficient Operations Business Process Reengineering 14 i. What it is ii. Why (situate in the SWOT) iii. How iv. Implications: financial and overall benefits v. Limitations RECOMMENDATIONS Recommendation 1: Restructure Reward System Why 15 RECOMMENDATIONS Recommendation 1: Restructure Reward System Summary Reiterate the problem and solution. Also restate the financial impact. 16 i. What it is ii. Why (situate in the SWOT) iii. How iv. Implications: financial and overall benefits v. Limitations RECOMMENDATIONS Recommendation 2: Business Process Reengineering Why 17 RECOMMENDATIONS Recommendation 2: Business Process (cont.) Reengineering Summary Reiterate the problem and solution. Also restate the financial impact. 18 CONCLUSION Restate the purpose of the report. Restate the main findings of your analysis. Identify your recommendations and how they might impact the company. 19 REFERENCES Refer to communications quick guide 20 APPENDICES 21