2010D-Farm-Management-Test - Mid

advertisement

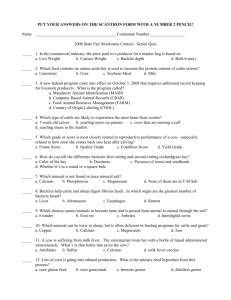

2010 DISTRICT FFA FARM MANAGEMENT CONTEST Multiple Choice Section The Farm Management Contest is designed to test student understanding of the application of economic principles in farm management. Each question is worth three (3) points. Choose the best answer and mark the appropriate box on the score sheet provided. There is only one correct answer to each question. Answers have been rounded. 1. Corn has an expected yield of 150 bushels per acre and a production cost of $300.00 per acre. Expected market prices are $3.50 per bushel for corn and $9.00 per bushel for soybeans. Soybeans can be raised at a production cost of $150 per acre. At what breakeven yield per acre would soybeans generate the same net return per acre as corn? A. 41.7 bushels B. 42.3 bushels C. 48.6 bushels D. 53.6 bushels E. None of the above 2. A farmer sold his 5000-bushel corn crop at several different times during the year. He sold 1000 bushels at $3.50, 2000 bushels at $3.00, and 2000 bushels at $4.00. What was his average price per bushel? A. $2.67 B. $3.00 C. $3.20 D. $3.50 E. None of the above 3. The self-employment tax rate for Medicare is A. 1.45% B. 2.90% C. 5.30% D. 7.65% E. None of the above 4. A farmer purchases 800-pound feeder steers for $1.05 per pound and plans to sell the steers at 1200 pounds. The farmer estimates the total cost of gain to be $0.75 per pound. The nearest breakeven price when the steers are sold at 1200 pounds is A. $0.87 per pound B. $0.90 per pound C. $0.95 per pound D. $0.97 per pound E. None of the above 5. How many total acres are included in the "S 1/2 of the SW 1/4 and SE 1/4 of Section 15, Twp. 10N, R4W of the 5th Principle Meridian"? A. 80 acres B. 120 acres C. 160 acres D. 240 acres E. None of the above 6. How much perimeter fence would be required to completely enclose the parcel of land described in the question above? A. 1.5 miles B. 2.0 miles C. 2.5 miles D. 3.0 mile E. None of the above 7. The Kansas City Board of Trade wheat futures contract is for A. hard red winter wheat. B. hard red spring wheat. C. soft ed winter wheat. D. durum wheat. E. None of the above 8. If the total cost of producing 100 units of output is $400 and the average variable cost per unit is $3, then which of the following statements is true? A. Total variable cost of the 100 units is $400. B. Total fixed cost is equal to $100. C. Average fixed cost is $3. D. Average total cost is $3. E. None of the above 9. Farmer Jones has less current assets than current liabilities. current ratio is A. negative. B. zero. C. between 0 and 1. D. greater than 1. E. None of the above Her 10. Economists use elasticities to relate the percentage change in one variable to the percentage change in another variable. The cross-price elasticity of demand estimates the impact on the demand for a good with respect to the change in the price of another good. A negative crossprice elasticity indicates the two goods are A. substitutes. B. complements. C. inferior. D. luxuries. E. None of the above 11. The own-price elasticity of supply estimates the impact on the quantity of a good supplied by a change in the price of the good. Normally, one would expect the own-price elasticity of supply to be A. positive. B. negative. C. zero. D. None of the above 12. The income elasticity of demand estimates the impact of a change in income on the demand for a good. For normal goods, the income elasticity of demand is A. positive. B. negative. C. zero. D. None of the above 13. A soybean producer decides to store his soybeans in the local elevator for 4 months. The price at harvest is $9.40 per bushel and the elevator charges 2 cents per bushel per month for storage plus a 5-cent per bushel handling charge. He has 5,000 bushels to sell and must borrow $47,000 at 7% annual interest while he stores the soybeans. What price must he receive for his soybeans to break even and cover his storage and opportunity costs? A. $9.53 B. $9.69 C. $9.75 D. $9.83 E. None of the above 14. How many square feet are in an acre? A. 5,280 B. 12,250 C. 43,560 D. 100,000 E. None of the above 15. The term "exchange rate" refers to A. how much of one currency is needed to acquire a unit of another currency. B. how much principal is reduced by payments on an amortized loan. C. the ratio between current and long-term debt. D. the difference in value between a dollar today and a dollar one year from today. E. None of the above 16. A cord is a stack of wood measuring A. 2' x 4' x 4' B. 4' x 4' x 4' C. 4' x 4' x 8' D. 4' x 8' x 8' E. None of the above 17. A procedure for expressing future cash flows in today's dollars is called A. compounding. B. discounting. C. deflating. D. inflating. E. None of the above 18. Farmer Brown has a debt-to-asset ratio of 53%. must be A. negative. B. 47%. C. Less than 110%. D. Greater than 115%. E. None of the above His debt-to-equity ratio 19. How many pounds of 48% protein soybean meal must be mixed with 9% protein corn to make a ton of 18% protein feed? A. 386 pounds B. 390 pounds C. 439 pounds D. 462 pounds E. None of the above 20. Which A. B. C. D. E. of the following is a market function? storing transporting grading processing All of the above 21. Farmer Johnson has a rate of return on assets of 4% when assets are valued using the cost method, and a rate of return on assets of 5% when the assets are valued using market valuation. This means that the value of assets using the cost method A. is greater than the market valuation. B. is equal to the market valuation. C. is less than the market valuation. D. produces a higher return to farm assets. E. None of the above 22. A farm business has a debt/worth ratio of 1:2. Its current liabilities total $30,000 and its non-current liabilities total $120,000. What is the value of its assets? A. $450,000 B. $360,000 C. $240,000 D. $120,000 E. None of the above 23. A cattle feeding operation has sales of $730,000, feed purchases of $300,000, other costs of $400,000, an opening inventory of $380,000, and a closing inventory of $360,000. What is the net farm income for this operation on an accrual basis? A. $10,000 B. $30,000 C. $50,000 D. $730,000 E. None of the above 24. If corn silage as fed contains 70% moisture and 2.2% protein, the dry matter would be what percent protein? A. 2.80 B. 3.08 C. 6.57 D. 7.33 E. None of the above 25. On March 1, 2009, Kate borrowed $25,000 to plant corn. On November 1, 2009, she repaid the $25,000 along with $1,100.00 interest. What annual interest rate did she pay? A. 5.5% B. 6.6% C. 7.7% D. 8.8% E. None of the above 26. A $50,000 loan amortized at 8% interest for 20 years yields annual payments of $5,092.61. How much of the first year's payment is principal? A. $1,092.61 B. $1,700.00 C. $2,592.61 D. $4,000.00 E. None of the above 27. For the above loan of $50,000, if the 20th and final payment includes $377.23 of interest, what was the outstanding principal balance after the 19th payment? A. $5,688.07 B. $4,715.38 C. $4,622.77 D. $377.23 E. None of the above 28. For the above loan of $50,000, how much total interest is paid over the life of the loan? A. $101,852.20 B. $51,852.20 C. $43,000.00 D. $7,544.60 E. None of the above 29. At the beginning of last year, a farmer had an outstanding loan for $125,000. The interest rate was 7% APR. If the farmer made one loan payment at the end of the year of $20,500, what was the outstanding balance at the end of the year? A. $104,500 B. $113,250 C. $115,750 D. $120,500 E. None of the above 30. A feedlot operator purchases a pen of 60 feeder steers with an average weight of 753 pounds and sells them at an average weight of 1142 pounds. Total feed cost for the pen is $16,634. Feed cost per pound of gain is equal to A. $0.515 B. $0.649 C. $0.713 D. $0.733 E. None of the above 31. A producer sells 12 feeder steers for $104/cwt. The average weight per steer is 750 pounds. There is a 3% sales commission and yardage fees of $2.10 per head. The net amount received for the pen of steers would be A. $9,027.60 B. $9,054.00 C. $9,403.20 D. $9,958.80 E. None of the above 32. You can claim a tax deduction for a charitable contribution of $________ or more only if you have a written acknowledgment from the charitable organization. A. $100 B. $250 C. $1,000 D. $5,000 E. None of the above 33. The business profit for a year would be found on A. The balance sheet. B. The cash flow budget. C. The income statement. D. A partial budget. E. All of the above. 34. How many gallons of water must be mixed with a quart of herbicide to make a 2% solution? A. 12.25 B. 12.50 C. 24.75 D. 98.00 E. None of the above 35. A metric ton weighs A. 1876.3 pounds. B. 2000.0 pounds. C. 2204.6 pounds. D. 2520.3 pounds. E. None of the above 36. A hectare equals A. 0.40 acres B. 1.74 acres C. 2.47 acres D. 5.05 acres E. None of the above 37. The CME live cattle futures contract is for ______ pounds of fed cattle. A. 10,000 B. 40,000 C. 50,000 D. 100,000 E. None of the above 38. In legal terminology, an agent has one's A. right of ownership of property. B. authority to transact business. C. complete control and liability. D. no financial responsibility. E. None of the above 39. On a dry matter basis, corn is roughly 69% starch and 8.7% crude protein. dry mill ethanol plant converts all the starch in corn to ethanol while leaving the protein unchanged in the byproduct, dried distillers grain. Mathematically, what percent crude protein would you expect in this byproduct? A. 8.7% B. 17.4% C. 20.6% D. 28.1% E. None of the above 40. If dried distillers grain has 10% moisture and sells for $130 per ton, what would be the nutrient equivalent price for wet distillers grain which has 65% moisture? A. $42.00 per ton B. $50.56 per ton C. $93.89 per ton D. $108.89 per ton E. None of the above 2010 DISTRICT FFA FARM MANAGEMENT CONTEST Problems Section Choose the best answer and mark the corresponding numbered space on the answer sheet. Computations may be done in the margins or on the back of the paper. Each question is worth four (4) points. There is only one correct answer for each question. Answers have been rounded. PROBLEM I - Market Value Balance Sheet Using the information below, complete the net worth statement for January 1, 2010: Land . . . . . . . . . . . . . . . . . . . . . . $450,000 House . . . . . . . . . . . . . . . . . . . . . . 60,000 Machinery and equipment . . . . . . . . . . . . . 122,000 Cows . . . . . . . . . . . . . . . . . . . . . . 45,000 Calves . . . . . . . . . . . . . . . . . . . . . 17,000 Accounts payable . . . . . . . . . . . . . . . . 7,017 Autos . . . . . . . . . . . . . . . . . . . . . . 41,000 Sows and boars. . . . . . . . . . . . . . . . . . 35,000 Market hogs . . . . . . . . . . . . . . . . . . 120,000 Checking and savings. . . . . . . . . . . . . . . 12,500 Soybeans. . . . . . . . . . . . . . . . . . . . . 14,000 Hog buildings . . . . . . . . . . . . . . . . . . 23,000 Feed and hay. . . . . . . . . . . . . . . . . . . 13,000 Operating loan balance . . . . . . . . . . . . . 89,000 Accounts receivable . . . . . . . . . . . . . . . 1,250 Accrued interest owed . . . . . . . . . . . . . . 22,692 Accrued taxes owed. . . . . . . . . . . . . . . . 7,900 30-year land loan balance is $320,000. $12,000 plus interest is due March 1 of each year. 5-year tractor loan balance is $26,000. $6,500 plus interest is due November 30 of each year. 30-year home loan balance is $51,000. $600 plus interest is due each month. Current Assets: Current Liabilities: ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ Total _________________ Total __________________ Non-current Assets: Non-current Liabilities: ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ ________________________________ __________________________________ Total ______________ Total __________________ Total Assets _________________ Net Worth Total Liabilities ________________ _________________ Questions 1 through 7 refer to PROBLEM I 1. The total value of current assets on January 1, 2010, was A. $176,500 B. $177,750 C. $180,250 D. $212,750 E. None of the above 2. The total value of non-current assets was A. $776,000 B. $782,500 C. $789,700 D. $801,700 E. None of the above 3. The total value of current liabilities was A. $126,609 B. $133,109 C. $145,709 D. $152,309 E. None of the above 4. The total value of non-current liabilities was A. $371,300 B. $390,500 C. $396,400 D. $397,000 E. None of the above 5. The net worth was A. $404,700 B. $430,141 C. $523,609 D. $953,750 E. None of the above 6. The net working capital was A. $25,441 B. $54,309 C. $177,750 D. $430,141 E. None of the above 7. What would the value of farm production need to be in order to have a capital turnover ratio of 0.30? A. $129,042 B. $187,690 C. $238,413 D. $286,125 E. None of the above PROBLEM II -- Enterprise Budget Use the dairy cow budget below to answer Questions 8 through 16. _________________________________________________________________ DAIRY COW REPLACEMENTS IN 100 COW HERD 20,000 pounds of milk sold per year per cow unit 39% replacement rate Operating Inputs Units Price Quantity Value Promotion assess Cwt 0.35 200.00 70.00 Milk hauling Cwt 0.57 200.00 114.00 Dairy ration, 16% Cwt 8.70 98.67 858.43 Hay Tons 95.00 5.59 531.05 Salt & minerals Lbs 0.15 130.00 19.50 Milk replacer Lbs 0.75 5.00 3.75 Calf starter Lbs 0.11 50.00 5.50 Pasture AUMS 16.00 3.48 55.68 Breeding fees Dol 25.00 1.00 25.00 Vet medicine Dol 52.00 1.00 52.00 Supplies Dol 39.00 1.00 39.00 Accounting Hd 18.00 1.00 18.00 Utilities Dol 47.00 1.00 47.00 Machinery labor Hr 6.00 10.69 64.14 Equipment labor Hr 6.00 6.27 37.62 Livestock labor Hr 6.00 43.40 260.40 Mach fuel, lube, repair 102.91 Equip fuel, lube, repair 27.74 Total Operating Costs 2331.72 ____________________________________ Fixed Costs Amount Value Machinery Interest @ 10% 371.17 37.12 Depr, taxes, insurance 54.98 Equipment Interest @ 10% 452.75 45.27 Depr, taxes, insurance 70.22 Livestock Dairy cow, 20,000 1475.00 Dairy heifer, 20,000 520.00 Dairy repl. heifer 20,000 273.00 Interest @ 10% 2268.00 226.80 Total Fixed Costs 434.39 ______________________________________ Production Units Price Quantity Value Milk Cwt 12.90 200.00 2580.00 Dairy cows Cwt 43.00 4.44 190.92 Dairy bull calf Hd 105.00 0.48 50.40 Dairy heifers Cwt 60.00 0.04 2.40 Total Receipts 2823.72 _______________________________________ Returns above total operating costs 492.00 Returns above all specified costs 57.61 _________________________________________________________________ 8. Total operating cost per cow is: A. $492.00 B. $588.65 C. $2,331.72 D. $2,823.72 E. None of the above 9. The return above total operating cost per cow is: A. $66.70 B. $492.00 C. $501.52 D. $521.95 E. None of the above 10. How many A. B. C. D. E. hours of labor are budgeted per cow? 10.69 43.40 60.36 260.40 None of the above 11. If each cow is milked for 305 days, how many pounds of milk are given per cow per day on average? A. 8.46 B. 12.90 C. 65.57 D. 200.00 E. None of the above 12. What is the total budgeted interest cost per cow? A. $82.29 B. $226.80 C. $309.19 D. $434.39 E. None of the above 13. What price per pound is paid for hay? A. 2.66 cents B. 4.75 cents C. 5.59 cents D. 26.51 cents E. None of the above 14. What interest rate is used in this budget? A. 6.7% B. 7.5% C. 8.0% D. 10% E. None of the above 15. If all feed costs are increased by 20%, what will be the total returns per cow above all costs? A. -$294.78 B. -$237.17 C. -$175.46 D. +$197.22 E. None of the above 16. If all feed costs are increased by 20%, what milk price will cause the returns above all costs to equal zero? A. $13.89/cwt. B. $14.02/cwt. C. $14.09/cwt. D. $14.37/cwt. E. None of the above PROBLEM IV -- Supply and Demand The graph represents the supply of wheat (S), the demand for wheat in the U.S.(DUS), the demand for wheat for export (DF), and the total demand of for wheat (DT). 23. What is A. B. C. D. E. the market equilibrium price of wheat in the U.S.? P1 P2 P3 P4 None of the above 24. At the market equilibrium price, how much wheat will be used in the U.S.? A. Q1 B. Q2 C. Q3 D. Q4 E. Q5 25. At the market equilibrium price, how much wheat will be exported? A. Q1 B. Q2 C. Q3 D. Q4 E. Q5 26. Without A. B. C. D. E. foreign demand, the equilibrium price of wheat would be P1 P2 P3 P4 P5 For Questions 27 and 28, include foreign demand and assume higher yields per acre cause the supply to increase from S to S1 27 The increased supply of wheat should cause wheat demand to A. shift to the left and up. B. shift to the right and down. C. not change. D. None of the above 28. Higher wheat yield would cause A. exports of wheat to go up. B. the equilibrium price of wheat to go down. C. Both of the above D. the foreign demand for wheat to shift left. E. None of the above PROBLEM V - Marketing On November 10, a farmer has 5,000 bushels of corn in his bin. He sells it on February 15. Ignore commissions, storage cost, and interest. November 10 quotes: March futures price = $3.70 Expected basis = $0.10 under the board Strike price $3.20 $3.30 $3.40 $3.50 $3.60 $3.70 --- Premiums --Call Put $0.73 $0.01 $0.63 $0.02 $0.53 $0.03 $0.43 $0.08 $0.33 $0.15 $0.24 $0.24 February 15 quotes: March futures price = $3.75 Basis = $0.05 under the board --- Premiums --Call Put $0.58 $0.01 $0.48 $0.02 $0.38 $0.04 $0.28 $0.11 $0.19 $0.19 $0.12 $0.29 29. What is A. B. C. D. E. the cash price of corn on February 15? $3.65 $3.70 $3.75 $3.80 None of the above 30. If the farmer sold a futures contract on November 10 and bought back the contract on February 15, what would be the realized price per bushel (cash + net on futures) for the corn? A. $3.65 B. $3.70 C. $3.75 D. $3.80 E. None of the above 31. If the farmer bought a $3.50 Put on November 10 and sold the Put on February 15, what would be the realized price per bushel (cash + net on options) for his corn? A. $3.62 B. $3.67 C. $3.68 D. $3.73 E. None of the above 32. If the farmer bought a $3.50 Put and sold a $3.50 Call on November 10,and sold the Put and bought back the Call on February 15, what would be the realized price per bushel (cash + net on options) for his corn? A. $3.52 B. $3.78 C. $3.83 D. $3.88 E. None of the above 33. Given all the information above, which of the following actions taken on November 10 turned out to be the most profitable? A. Selling a futures contract. B. Buying a $3.50 Put option. C. Buying a $3.50 Put and selling a $3.50 Call. D. Selling the corn on November 10. E. Taking no market action. PROBLEM VI - Time Value of Money Use the following information to answer Questions 34-40. N Present Value of a $1 Future Value of a $1 Present Value of Annuity 1 2 3 4 5 6 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 1.0600 1.1236 1.1910 1.2625 1.3382 1.4185 0.9434 1.8334 2.6730 3.4651 4.2124 4.9174 34. What is A. B. C. D. E. the present value of a dollar to be received in 4 years? 74.73 cents 79.21 cents $1.26 $3.47 None of the above 35. A field of alfalfa will produce $1,000 during the first year, $2,800 during each of the next 4 years and $2,000 in the sixth year. To the nearest dollar, what is the present value of this income stream? A. $10,431 B. $11,507 C. $12,301 D. $13,104 E. None of the above 36. A beef cow produces after-tax returns at the end of the year of $70/year for 5 years and can be sold for $400 after-tax at the end of the fifth year. Assume the above table uses the appropriate discount rate and determine the current value of the cow to the nearest dollar. A. $285 B. $478 C. $496 D. $594 E. None of the above 37. With one year of income remaining in the beef cow in Question 36, how much should she be worth, to the nearest dollar, using the above tables? A. $406 B. $443 C. $455 D. $470 E. None of the above 38. If the farmer expects interest rates to increase, but no change in net returns to cattle, what impact is this likely to have on the present value of the beef cow? A. Decrease the present value B. Increase the present value C. Would not change the present value D. Cannot tell 39. 40. What is the annual payment on a $20,000 loan amortized over 4 years? A. $4,747.89 B. $5,244.94 C. $5,771.84 D. $5,904.58 E. None of the above What discount rate is used in the table for this problem? A. 5.0% B. 6.0% C. 6.5% D. 7.0% E. None of the above