ch13-18

ch 13

Quick Quizzes

1. Farmer McDonald’s opportunity cost is $300, consisting of 10 hours of lessons at $20 an hour that

he could have been earning plus $100 in seeds. His accountant would only count the explicit

cost of the seeds ($100). If McDonald earns $200 from selling the crops, then McDonald earns a

$100 accounting profit ($200 sales minus $100 cost of seeds) but incurs an economic loss of $100

($200 sales minus $300 opportunity cost).

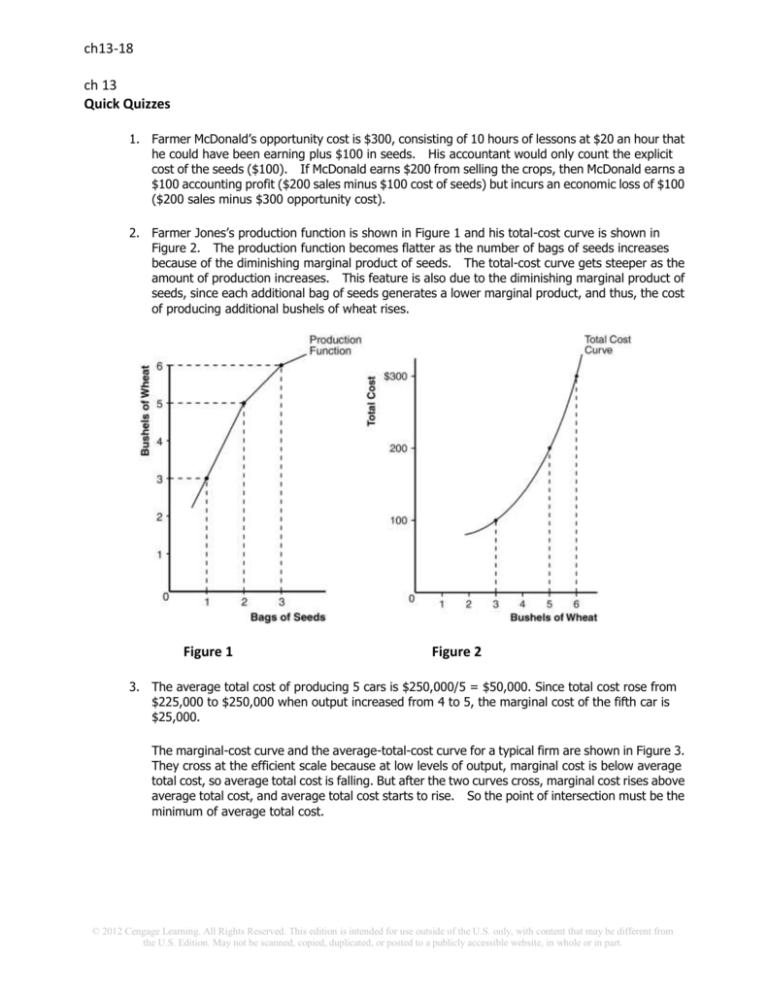

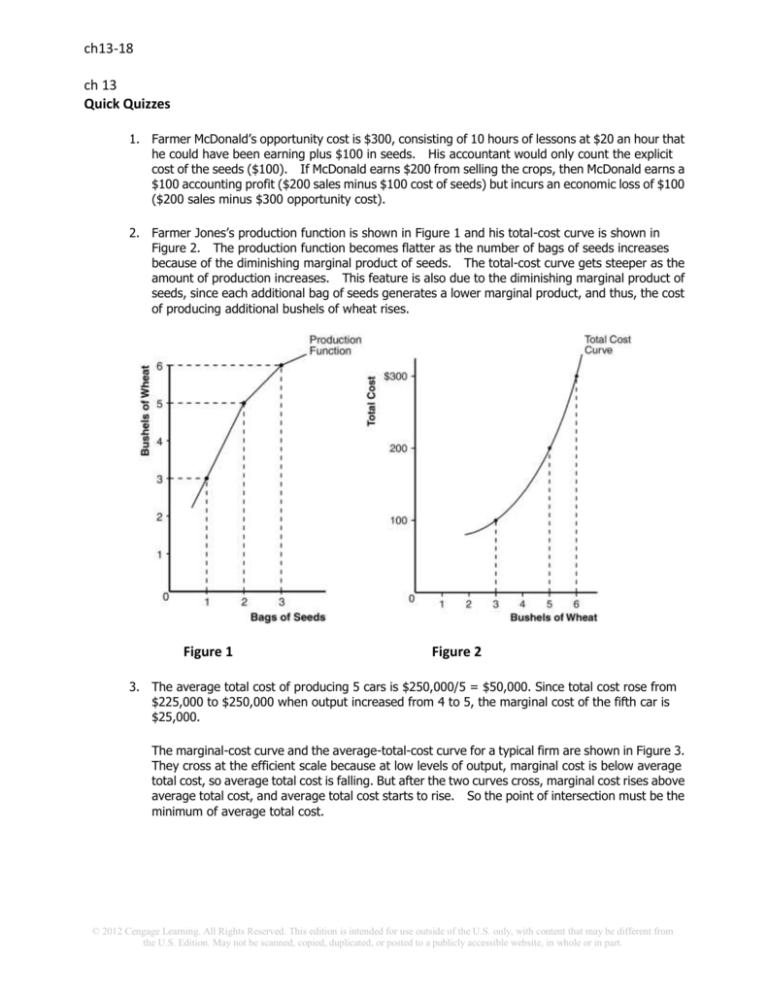

2. Farmer Jones’s production function is shown in Figure 1 and his total-cost curve is shown in

Figure 2. The production function becomes flatter as the number of bags of seeds increases

because of the diminishing marginal product of seeds. The total-cost curve gets steeper as the

amount of production increases. This feature is also due to the diminishing marginal product of

seeds, since each additional bag of seeds generates a lower marginal product, and thus, the cost

of producing additional bushels of wheat rises.

Figure 1

Figure 2

3. The average total cost of producing 5 cars is $250,000/5 = $50,000. Since total cost rose from

$225,000 to $250,000 when output increased from 4 to 5, the marginal cost of the fifth car is

$25,000.

The marginal-cost curve and the average-total-cost curve for a typical firm are shown in Figure 3.

They cross at the efficient scale because at low levels of output, marginal cost is below average

total cost, so average total cost is falling. But after the two curves cross, marginal cost rises above

average total cost, and average total cost starts to rise. So the point of intersection must be the

minimum of average total cost.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Figure 3

4. The long-run average total cost of producing 9 planes is $9 million/9 = $1 million. The long-run

average total cost of producing 10 planes is $9.5 million/10 = $0.95 million. Since the long-run

average total cost declines as the number of planes increases, Boeing exhibits economies of

scale.

Questions for Review

1. The relationship between a firm's total revenue, profit, and total cost is profit equals total revenue

minus total costs.

2. An accountant would not count the owner’s opportunity cost of alternative employment as an

accounting cost. An example is given in the text in which Caroline runs a cookie business, but she

could instead work as a computer programmer. Because she's working in her cookie factory, she

gives up the opportunity to earn $100 per hour as a computer programmer. The accountant

ignores this opportunity cost because money does not flow into or out of the firm. But the cost is

relevant to Caroline’s decision to run the cookie factory.

3. Marginal product is the increase in output that arises from an additional unit of input. Diminishing

marginal product means that the marginal product of an input declines as the quantity of the

input increases.

4. Figure 4 shows a production function that exhibits diminishing marginal product of labor. Figure 5

shows the associated total-cost curve. The production function is concave because of diminishing

marginal product, while the total-cost curve is convex for the same reason.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Figure 4

Figure 5

5. Total cost consists of the costs of all inputs needed to produce a given quantity of output. It

includes fixed costs and variable costs. Average total cost is the cost of a typical unit of output

and is equal to total cost divided by the quantity produced. Marginal cost is the cost of producing

an additional unit of output and is equal to the change in total cost divided by the change in

quantity. An additional relation between average total cost and marginal cost is that whenever

marginal cost is less than average total cost, average total cost is declining; whenever marginal

cost is greater than average total cost, average total cost is rising.

Figure 6

6. Figure 6 shows the marginal-cost curve and the average-total-cost curve for a typical firm. There

are three main features of these curves: (1) marginal cost is U-shaped but rises sharply as output

increases; (2) average total cost is U-shaped; and (3) whenever marginal cost is less than

average total cost, average total cost is declining; whenever marginal cost is greater than average

total cost, average total cost is rising. Marginal cost is increasing for output greater than a certain

quantity because of diminishing returns. The average-total-cost curve is downward-sloping

initially because the firm is able to spread out fixed costs over additional units. The

average-total-cost curve is increasing beyond some output level because as quantity increases,

the demand for important variable inputs increases; therefore, the cost of these inputs increases.

The marginal-cost and average-total-cost curves intersect at the minimum of average total cost;

that quantity is the efficient scale.

7. In the long run, a firm can adjust the factors of production that are fixed in the short run; for

example, it can increase the size of its factory. As a result, the long-run average-total-cost curve

has a much flatter U-shape than the short-run average-total-cost curve. In addition, the long-run

curve lies along the lower envelope of the short-run curves.

8. Economies of scale exist when long-run average total cost decreases as the quantity of output

increases, which occurs because of specialization among workers. Diseconomies of scale exist

when long-run average total cost rises as the quantity of output increases, which occurs because

of the coordination problems inherent in a large organization.

Quick Check Multiple Choice

1. a

2. d

3. d

4. c

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

5. b

6. a

Problems and Applications

1. a. opportunity cost; b. average total cost; c. fixed cost; d. variable cost; e. total cost; f. marginal

cost.

2. a. The opportunity cost of something is what must be given up to acquire it.

b. The opportunity cost of running the hardware store is $550,000, consisting of $500,000 to

rent the store and buy the stock and a $50,000 implicit cost, because your aunt would quit

her job as an accountant to run the store. Because the total opportunity cost of $550,000

exceeds the projected revenue of $510,000, your aunt should not open the store, as her

economic profit would be negative.

3. a. The following table shows the marginal product of each hour spent fishing:

Hours

0

1

2

3

4

5

Fish

0

10

18

24

28

30

Fixed Cost

$10

10

10

10

10

10

Variable Cost

$0

5

10

15

20

25

Total Cost

$10

15

20

25

30

35

Marginal Product

--10

8

6

4

2

b. Figure 7 graphs the fisherman's production function. The production function becomes flatter

as the number of hours spent fishing increases, illustrating diminishing marginal product.

Figure 7

c.

The table shows the fixed cost, variable cost, and total cost of fishing. Figure 8 shows the

fisherman's total-cost curve. It has an upward slope because catching additional fish takes

additional time. The curve is convex because there are diminishing returns to fishing time

because each additional hour spent fishing yields fewer additional fish.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Figure 8

4. Here is the completed table:

Workers

Output

0

1

2

3

4

5

6

7

0

20

50

90

120

140

150

155

Marginal

Product

--20

30

40

30

20

10

5

Total

Cost

$200

300

400

500

600

700

800

900

Average

Total Cost

--$15.00

8.00

5.56

5.00

5.00

5.33

5.81

Marginal

Cost

--$5.00

3.33

2.50

3.33

5.00

10.00

20.00

a. See the table for marginal product. Marginal product rises at first, then declines because of

diminishing marginal product.

b. See the table for total cost.

c.

See the table for average total cost. Average total cost is U-shaped. When quantity is low,

average total cost declines as quantity rises; when quantity is high, average total cost rises as

quantity rises.

d. See the table for marginal cost. Marginal cost is also U-shaped, but rises steeply as output

increases. This is due to diminishing marginal product.

e. When marginal product is rising, marginal cost is falling, and vice versa.

f.

When marginal cost is less than average total cost, average total cost is falling; the cost of the

last unit produced pulls the average down. When marginal cost is greater than average total

cost, average total cost is rising; the cost of the last unit produced pushes the average up.

5. At an output level of 600 players, total cost is $180,000 (600 × $300). The total cost of

producing 601 players is $180,901. Therefore, you should not accept the offer of $550, because

the marginal cost of the 601st player is $901.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

6. a. The fixed cost is $300, because fixed cost equals total cost minus variable cost. At an output

of zero, the only costs are fixed cost.

b.

Quantity

0

1

2

3

4

5

6

Total

Cost

$300

350

390

420

450

490

540

Variable

Cost

$0

50

90

120

150

190

240

Marginal Cost

(using total cost)

--$50

40

30

30

40

50

Marginal Cost

(using variable cost)

--$50

40

30

30

40

50

Marginal cost equals the change in total cost for each additional unit of output. It is

also equal to the change in variable cost for each additional unit of output. This

relationship occurs because total cost equals the sum of variable cost and fixed cost

and fixed cost does not change as the quantity changes. Thus, as quantity increases,

the increase in total cost equals the increase in variable cost.

7. The following table illustrates average fixed cost (AFC), average variable cost (AVC), and average

total cost (ATC) for each quantity. The efficient scale is 4 houses per month, because that

minimizes average total cost.

Quantity

0

Variable

Cost

$0.00

Fixed

Cost

$200.00

1

2

3

4

5

6

7

10.00

20.00

40.00

80.00

160.00

320.00

640.00

200.00

200.00

200.00

200.00

200.00

200.00

200.00

Total

Cost

$200.0

0

210.00

220.00

240.00

280.00

360.00

520.00

840.00

Average

Fixed Cost

---

Average

Variable Cost

---

Average

Total Cost

---

$200.00

100.00

66.67

50.00

40.00

33.33

28.57

$10.00

10.00

13.33

20.00

32.00

53.33

91.43

$210.00

110.00

80.00

70.00

72.00

86.67

120.00

8. a. The lump-sum tax causes an increase in fixed cost. Therefore, as Figure 10 shows, only

average fixed cost and average total cost will be affected.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Figure 10

b. Refer to Figure 11. Average variable cost, average total cost, and marginal cost will all be

greater. Average fixed cost will be unaffected.

Figure 11

9. a. The following table shows average variable cost (AVC), average total cost (ATC), and

marginal cost (MC) for each quantity.

Quantity

0

1

2

3

4

5

6

Variable

Cost

$0.00

10.00

25.00

45.00

70.00

100.00

135.00

Total

Cost

$30.00

40.00

55.00

75.00

100.00

130.00

165.00

Average

Variable Cost

--$10.00

12.50

15.00

17.50

20.00

22.50

Average

Total Cost

--$40.00

27.50

25.00

25.00

26.00

27.50

Marginal

Cost

--$10.00

15.00

20.00

25.00

30.00

35.00

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

b. Figure 12 shows the three curves. The marginal-cost curve is below the average-total-cost

curve when output is less than four and average total cost is declining. The marginal-cost

curve is above the average-total-cost curve when output is above four and average total cost

is rising. The marginal-cost curve lies above the average-variable-cost curve.

Figure 12

10. The following table shows quantity (Q), total cost (TC), and average total cost (ATC) for the three

firms:

Quantit

y

1

2

3

4

5

6

7

Firm A

TC

ATC

$60.00

70.00

80.00

90.00

100.00

110.00

120.00

$60.00

35.00

26.67

22.50

20.00

18.33

17.14

Firm B

TC

ATC

$11.00

24.00

39.00

56.00

75.00

96.00

119.00

$11.00

12.00

13.00

14.00

15.00

16.00

17.00

Firm C

TC

ATC

$21.00

34.00

49.00

66.00

85.00

106.00

129.00

$21.00

17.00

16.33

16.50

17.00

17.67

18.43

Firm A has economies of scale because average total cost declines as output increases. Firm B

has diseconomies of scale because average total cost rises as output rises. Firm C has economies

of scale from one to three units of output and diseconomies of scale for levels of output beyond

three

ch14

Quick Quizzes

1. When a competitive firm doubles the amount it sells, the price remains the same, so its total

revenue doubles.

2. A profit-maximizing competitive firm sets price equal to its marginal cost. If price were above

marginal cost, the firm could increase profits by increasing output, while if price were below

marginal cost, the firm could increase profits by decreasing output.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

A profit-maximizing competitive firm decides to shut down in the short run when price is less than

average variable cost. In the long run, a firm will exit a market when price is less than average

total cost.

3. In the long run, with free entry and exit, the price in the market is equal to both a firm’s marginal

cost and its average total cost, as Figure 1 shows. The firm chooses its quantity so that marginal

cost equals price; doing so ensures that the firm is maximizing its profit. In the long run, entry

into and exit from the market drive the price of the good to the minimum point on the

average-total-cost curve.

Figure 1

Questions for Review

1. The main characteristics of a competitive firm are: (1) there are many buyers and many sellers in

the market; (2) the goods offered by the various sellers are largely the same; and (3) usually

firms can freely enter or exit the market.

2. A firm’s total revenue equals its price multiplied by the quantity of units it sells. Profit is the

difference between total revenue and total cost. Firms are assumed to maximize profit.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

3. Figure 2 shows the cost curves for a typical firm. A competitive firm chooses the level of output

that maximizes profit where marginal cost equals price (Q*), as long as price exceeds average

variable cost at that point (in the short run), or exceeds average total cost (in the long run). Total

revenue can be measured by the rectangular area with a height of P* and a base of Q*. Total cost

can be measured by the rectangular area with a height of ATC’ and a base of Q*.

Figure 2

4. A firm will shut down temporarily if the revenue it would get from producing is lower than the

variable costs of production. This occurs if price is less than average variable cost.

5. A firm will exit a market if the revenue it would get from remaining in business is less than its total

cost. This occurs if price is less than average total cost.

6. A competitive firm's price equals its marginal cost in both the short run and the long run. In both

the short run and the long run, price equals marginal revenue. The firm should increase output as

long as marginal revenue exceeds marginal cost, and reduce output if marginal revenue is less

than marginal cost. Profits are always maximized when marginal revenue equals marginal cost.

7. The competitive firm's price must equal the minimum of its average total cost only in the long run.

In the short run, price may be greater than average total cost (in which case the firm is earning a

profit), price may be less than average total cost (in which case the firm is incurring a loss), or

price may be equal to average total cost (in which case the firm is breaking even). In the long run,

if firms are earning profits, other firms will enter the industry, which will lower the price of the

good. In the long run, if firms are incurring losses, they will exit the industry, which will raise the

price of the good. Entry or exit continues until firms are making neither profits nor losses. At that

point, price equals average total cost.

8. Market supply curves are typically more elastic in the long run than in the short run. In a

competitive market, because entry or exit occurs until price equals average total cost, quantity

supplied is more responsive to changes in price in the long run.

Quick Check Multiple Choice

1. c

2. b

3. d

4. a

5. d

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

6. c

Problems and Applications

1. a. As shown in Figure 3, the typical firm's initial marginal-cost curve is MC1 and its

average-total-cost curve is ATC1. In the initial equilibrium, the market supply curve, S1,

intersects the demand curve at price P1, which is equal to the minimum average total cost of

the typical firm. Thus, the typical firm earns no economic profit. The rise in the price of crude

oil increases production costs for individual firms (from MC1 to MC2 and from ATC1 to ATC2)

and thus shifts the market supply curve to the left, to S2.

Figure 3

b. When the market supply curve shifts left to S2, the equilibrium price rises from P1 to P2, but

the price does not increase by as much as the increase in marginal cost for the firm. As a

result, price is less than average total cost for the firm, so profits are negative.

In the long run, the negative profits lead some firms to exit the market. As they do so, the

market supply curve shifts to the left. This continues until the price rises to equal the

minimum point on the firm's average-total-cost curve. The long-run equilibrium occurs with

supply curve S3, equilibrium price P3, total market output Q3, and firm's output q3. Thus, in

the long run, profits are zero again and there are fewer firms in the market.

2. Once you have ordered the dinner, its cost is sunk, so it does not represent an opportunity cost.

As a result, the cost of the dinner should not influence your decision about whether to finish it.

3. Bob' total variable cost is his total cost each day less his fixed cost ($280 - $30 = $250).

His average variable cost is his total variable cost each day divided by the number of

lawns he mows each day ($250/10 = $25). Because his average variable cost is less

than his price, he will not shut down in the short run. Bob's average total cost is his

total cost each day divided by the number of lawns he mows each day ($280/10 = $28).

Because his average total cost is greater than his price, he will exit the industry in the

long run.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

4. Here is the table showing costs, revenues, and profits:

Quantity

0

Total

Cost

$8

Marginal

Cost

---

Total

Revenue

Marginal

Revenue

---

Profit

$-8

$0

1

9

$1

8

-1

$8

2

3

4

5

6

7

10

11

13

19

27

37

1

1

2

6

8

10

16

24

32

40

48

56

8

8

8

8

8

8

6

13

19

21

21

19

a. The firm should produce five or six units to maximize profit.

b. Marginal revenue and marginal cost are graphed in Figure 4. The curves cross at a quantity

between five and six units, yielding the same answer as in Part (a).

Figure 4

c.

This industry is competitive because marginal revenue is the same for each quantity. The

industry is not in long-run equilibrium, because profit is not equal to zero.

5. a. Costs are shown in the following table:

Q

0

1

2

3

4

5

6

TFC

$100

100

100

100

100

100

100

TVC

$0

50

70

90

140

200

360

AFC

---$100

50

33.3

25

20

16.7

AVC

---$50

35

30

35

40

60

ATC

---150

85

63.3

60

60

76.7

MC

---50

20

20

50

60

160

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

b. If the price is $50, the firm will minimize its loss by producing 4 units, where price is equal to

marginal cost. When the firm produces 4 units, its total revenue is $200 ($50 x 4 = $200) and

its total cost is $240 ($100 + $140). This would give the firm a loss of $40. If the firm

shuts down, it will earn a loss equal to its fixed cost ($100). The CEO did not make a wise

decision.

c.

If the firm produces 1 unit, its total revenue is $50 and its total cost is $150 ($100 + $50), so

its loss will still be $100. This was also not the best decision. The firm could have reduced its

loss by producing more units because the marginal costs of the second and third unit are

lower than the price.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

6. a. Figure 5 shows the curves of a typical firm in the industry, with average total cost ATC1,

marginal cost MC1, and marginal revenue equal to price P1. The long-run-supply curve is the

marginal cost curve above the minimum point of ATC1.

b. The new process reduces Hi-Tech’s marginal cost to MC2 and its average total cost to ATC2,

but the price remains at P1 because other firms cannot use the new process. Thus Hi-Tech

produces Q2 units and earns positive profits.

c.

When the patent expires and other firms are free to use the technology, all firms’

average-total-cost curves decline to ATC2, so the market price falls to P3 and firms earn zero

profit.

Figure 5

7. Since the firm operates in a perfectly competitive market, its price is equal to its marginal revenue

of $10. This means that average revenue is also $10 and 50 units were sold.

8. a. Profit is equal to (P – ATC) × Q.

$200.

Price is equal to AR. Therefore, profit is ($10 – $8) × 100 =

b. For firms in perfect competition, marginal revenue and average revenue are equal. Since

profit maximization also implies that marginal revenue is equal to marginal cost, marginal

cost must be $10.

c.

Average fixed cost is equal to AFC /Q which is $200/100 = $2. Since average variable cost is

equal to average total cost minus average fixed cost, AVC = $8 − $2 = $6.

d. Since average total cost is less than marginal cost, average total cost must be rising.

Therefore, the efficient scale must occur at an output level less than 100.

9. a. If firms are currently incurring losses, price must be less than average total cost. However,

because firms in the industry are currently producing output, price must be greater than

average variable cost. If firms are maximizing profits, price must be equal to marginal cost.

b. The present situation is depicted in Figure 6. The firm is currently producing q1 units of output

at a price of P1.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Figure 6

c.

Figure 6 also shows how the market will adjust in the long run. Because firms are incurring

losses, there will be exit in this industry. This means that the market supply curve will shift to

the left, increasing the price of the product. As the price rises, the remaining firms will

increase quantity supplied; marginal cost will increase. Exit will continue until price is equal to

minimum average total cost. Average total cost will be lower in the long run than in the short

run. The total quantity supplied in the market will fall.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

10. a. The table below shows TC and ATC for a typical firm:

Q

TC

ATC

1

2

3

4

5

6

11

15

21

29

39

51

11

7.5

7

7.25

7.8

8.5

b. At a price of $11, quantity demanded is 200. With marginal revenue of $11, each firm will

choose to produce 5 pies where their marginal cost is closest to the marginal revenue without

exceeding marginal revenue. Therefore, there will be 40 firms (= 200/5). Each producer will

earn total revenue of $55 ($11 5), total cost is $39, so profit is $16.

c.

The market is not in long-run equilibrium because firms are earning positive economic profit.

Firms will want to enter the market.

d. With free entry and exit, each producer will earn zero profit in the long run. Long-run

equilibrium will occur when price is equal to minimum average total cost ($7). At that price,

600 pies are demanded. Each firm will only produce 3 pies (the quantity at which, MC is

closest to MR without exceeding MR) meaning that there will be 200 pie producers in the

market.

11. a. Figure 7 illustrates the situation in the U.S. textile market. With no international trade, the

market is in long-run equilibrium. Supply intersects demand at quantity Q1 and price $30,

with a typical firm producing output q1.

Figure 7

b. The effect of imports at $25 is that the market supply curve follows the old supply curve up to

a price of $25, then becomes horizontal at that price. As a result, demand exceeds domestic

supply, so the country imports textiles from other countries. The typical domestic firm now

reduces its output from q1 to q2, incurring losses, because they were breaking even (profit

equal to zero) in long-run equilibrium when the price was $30 and their average total cost has

not decreased.

c.

In the long run, domestic firms will be unable to compete with foreign firms because their

costs are too high. All the domestic firms will exit the market and other countries will supply

enough to satisfy the entire domestic demand.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

12. a. The firms' variable cost (VC), total cost (TC), marginal cost (MC), and average total cost

(ATC) are shown in the table below:

Quantity

1

2

3

4

5

6

VC

1

4

9

16

25

36

TC

17

20

25

32

41

52

MC

1

3

5

7

9

11

ATC

17

10

8.33

8

8.20

8.67

b. If the price is $10, each firm will produce 5 units. There are 100 firms in the industry, so there

will be 5 100 = 500 units supplied in the market.

c.

At a price of $10 and a quantity supplied of 5, each firm is earning a positive profit because

price is greater than average total cost. Thus, entry will occur and the price will fall. As price

falls, quantity demanded will rise in accordance with the law of demand. This entry will

continue until price is equal to minimum average total cost, $8, and each firm is producing

the quantity at which marginal revenue ($8) is equal to marginal cost (4 units if we assume

units are not divisible). Therefore, the quantity supplied by each firm decreases.

d. Figure 8 shows the long-run market supply curve, which will be horizontal at minimum

average total cost, $8. Each firm produces 4 units.

Price

and

Costs

Market

Firm

MC

ATC

P=$8

P=$8

S

q=4

Figure 8

ch15

Quick Quizzes

1. A market might have a monopoly because: (1) a key resource is owned by a single firm; (2) the

government gives a single firm the exclusive right to produce some good; or (3) the costs of

production make a single producer more efficient than a large number of producers.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Examples of monopolies include: (1) the water producer in a small town, who owns a key

resource, the one well in town; (2) a pharmaceutical company that is given a patent on a new

drug by the government; and (3) a bridge, which is a natural monopoly because (if the bridge is

uncongested) having just one bridge is efficient. Many other examples are possible.

2. A monopolist chooses the amount of output to produce by finding the quantity at which marginal

revenue equals marginal cost. It finds the price to charge by finding the point on the demand

curve that corresponds to that quantity. The monopolist wants to charge the highest possible

price but still sell his profit-maximizing level of output.

3. A monopolist produces a quantity of output that is less than the quantity of output that maximizes

total surplus because it produces the quantity at which marginal cost equals marginal revenue

rather than the quantity at which marginal cost equals price. This lower production level leads to

a deadweight loss.

4. Examples of price discrimination include: (1) movie tickets, for which children and senior

citizens get lower prices; (2) airline prices, which are different for business and leisure travelers;

(3) discount coupons, which lead to different prices for people who value their time in different

ways; (4) financial aid, which offers college tuition at lower prices to poor students and higher

prices to wealthy students; and (5) quantity discounts, which offer lower prices for higher

quantities, capturing more of a buyer’s willingness to pay. Many other examples are possible.

Compared to a monopoly that charges a single price, perfect price discrimination reduces

consumer surplus to zero, increases producer surplus, and increases total surplus because there

is no deadweight loss.

5. Policymakers can respond to the inefficiencies caused by monopolies in one of four ways: (1) by

trying to make monopolized industries more competitive; (2) by regulating the behavior of the

monopolies; (3) by turning some private monopolies into public enterprises; or (4) by doing

nothing at all. Antitrust laws prohibit mergers of large companies and prevent large companies

from coordinating their activities in ways that make markets less competitive, but such laws may

keep companies from merging and generating synergies that increase efficiency. Some

monopolies, especially natural monopolies, are regulated by the government, but it is hard to

keep a monopoly in business, achieve marginal-cost pricing, and give the monopolist an incentive

to reduce costs. Private monopolies can be taken over by the government, but the companies

are not likely to be well-run. Sometimes doing nothing at all may seem to be the best solution,

but there are clearly deadweight losses from monopoly that society will have to bear.

Questions for Review

1. Government-created monopoly comes from the existence of patent and copyright laws. Both

allow firms or individuals to be monopolies for extended periods of time—20 years for patents,

the life of the author plus 70 years for copyrights. But this monopoly power is good, because

without it, no one would write a book or a song and no firm would invest in research and

development to invent new products or pharmaceuticals.

2. An industry is a natural monopoly when a single firm can supply a good or service to an entire

market at a smaller cost than could two or more firms. As a market grows, it may evolve from a

natural monopoly to a competitive market.

3. A monopolist's marginal revenue is less than the price of its product because its demand curve is

the market demand curve. Thus, to increase the amount sold, the monopolist must lower the

price of its good for every unit it sells. This cut in price reduces the revenue on the units it was

already selling.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

A monopolist's marginal revenue can be negative because to get purchasers to buy an additional

unit of the good, the firm must reduce its price on all units of the good. The fact that it sells a

greater quantity increases the firm’s revenue, but the decline in price decreases the firm’s

revenue. The overall effect depends on the price elasticity of demand. If demand is inelastic,

marginal revenue will be negative.

4. Figure 1 shows the demand, marginal-revenue, average-total-cost, and marginal-cost curves for

a monopolist. The intersection of the marginal-revenue and marginal-cost curves determines the

profit-maximizing level of output, Qm. The profit-maximizing price, Pm can be found using the

demand curve. Profit is shown as the rectangular area with a height of ( PM – ATCM) and a base of

QM .

Figure 1

5. The level of output that maximizes total surplus in Figure 1 is where the demand curve intersects

the marginal-cost curve, Qc. The deadweight loss from monopoly is the triangular area between

Qc and Qm that is above the marginal-cost curve and below the demand curve. It represents

deadweight loss, because society loses total surplus because of the monopoly. The deadweight

loss is equal to the value of the good (measured by the height of the demand curve) less the cost

of production (given by the height of the marginal-cost curve), for the quantities between Qm and

Q c.

6. One example of price discrimination is in publishing books. Publishers charge a much higher price

for hardback books than for paperback books—far higher than the difference in production costs.

Publishers do this because die-hard fans will pay more for a hardback book when the book is first

released. Those who don't value the book as highly will wait for the paperback version to come

out. The publisher makes a greater profit this way than if it charged just one price.

A second example is the pricing of movie tickets. Theaters give discounts to children and senior

citizens because they have a lower willingness to pay for a ticket. Charging different prices helps

the theater increase its profit above what it would be if it charged just one price.

Many other examples are possible.

7. The government has the power to regulate mergers between firms because of antitrust laws.

Firms might want to merge to increase operating efficiency and reduce costs, something that is

good for society, or to gain market power, which is bad for society.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

8. When regulators tell a natural monopoly that it must set price equal to marginal cost, two

problems arise. The first is that, because a natural monopoly has a marginal cost that is always

less than average total cost, setting price equal to marginal cost means that the firm will incur a

loss. The firm would then exit the industry unless the government subsidized it. However, getting

revenue for such a subsidy would cause the government to raise other taxes, increasing the

deadweight loss. The second problem of using costs to set price is that it gives the monopoly no

incentive to reduce costs.

Quick Check Multiple Choice

1. d

2. b

3. d

4. a

5. b

6. c

Problems and Applications

1. The following table shows revenue, costs, and profits:

Price

Quantity

$100

90

80

70

60

50

40

30

20

10

0

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

1,000,00

0

Total

Revenue

$0

9,000,000

16,000,000

21,000,000

24,000,000

25,000,000

24,000,000

21,000,000

16,000,000

9,000,000

0

Marginal

Revenue

---$90

70

50

30

10

-10

-30

-50

-70

-90

Total Cost

Profit

$2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

7,000,000

8,000,000

9,000,000

10,000,000

11,000,000

12,000,000

$-2,000,000

6,000,000

12,000,000

16,000,000

18,000,000

18,000,000

16,000,000

12,000,000

6,000,000

-2,000,000

-12,000,000

a. A profit-maximizing publisher would choose a quantity of 400,000 at a price of $60 or a

quantity of 500,000 at a price of $50; both combinations would lead to profits of $18 million.

b. Marginal revenue is less than price. Price falls when quantity rises because the demand curve

slopes downward, but marginal revenue falls even more than price because the firm loses

revenue on all the units of the good sold when it lowers the price.

c.

Figure 2 shows the marginal-revenue, marginal-cost, and demand curves. The

marginal-revenue and marginal-cost curves cross between quantities of 400,000 and

500,000. This signifies that the firm maximizes profits in that region.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Figure 2

d. The area of deadweight loss is marked “DWL” in the figure. Deadweight loss means that the

total surplus in the economy is less than it would be if the market were competitive, because

the monopolist produces less than the socially efficient level of output.

e. If the author were paid $3 million instead of $2 million, the publisher would not change the

price, because there would be no change in marginal cost or marginal revenue. The only

thing that would be affected would be the firm’s profit, which would fall.

f.

To maximize economic efficiency, the publisher would set the price at $10 per book, because

that is the marginal cost of the book. At that price, the publisher would have negative profits

equal to the amount paid to the author.

2. a. Figure 3 illustrates the market for groceries when there are many competing supermarkets

with constant marginal cost. Output is QC, price is PC, consumer surplus is area A, producer

surplus is zero, and total surplus is area A.

Figure 3

Figure 4

b. Figure 4 illustrates the new situation when the supermarkets merge. Quantity declines from

QC to QM and price rises to PM. Consumer surplus falls by areas D + E + F to areas B + C.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Producer surplus becomes areas D + E, and total surplus is areas B + C + D + E. Consumers

transfer the amount of areas D + E to producers and the deadweight loss is area F.

3. a. The following table shows total revenue and marginal revenue for each price and quantity

sold:

Price

Quantity

24

10,000

Total

Revenue

$240,000

Marginal

Revenue

----

Total

Cost

Profit

$190,000

$50,000

22

20,000

$20

440,000

20

30,000

18

40,000

14

60,000

150,000

450,000

200,000

520,000

250,000

550,000

300,000

540,000

12

720,000

50,000

340,000

16

600,000

16

100,000

8

800,000

4

840,000

b. Profits are maximized at a quantity where MR=MC. The quantity at which MC is closest to

MR without exceeding it is 50,000 CDs at a price of $16. At that point, profit is $550,000.

c.

As Johnny's agent, you should recommend that he demand $550,000 from them, so he

receives all of the profit (rather than the record company). The firm would still choose to

produce 50,000 CDs because their marginal cost would not change.

4. a. The table below shows total revenue and marginal revenue for the bridge. The

profit-maximizing price will occur at the quantity at which marginal revenue equals marginal

cost. In this case marginal cost equals zero, so the profit-maximizing quantity occurs where

marginal revenue equals 0. This occurs at a price of $4 and quantity of 400,000 crossings.

The efficient level of output is 800,000 crossings, because that is where price is equal to

marginal cost. The profit-maximizing quantity is lower than the efficient quantity because the

firm is a monopolist.

Price

$8

7

6

5

4

3

2

1

0

Quantity

(in Thousands)

0

100

200

300

400

500

600

700

800

Total Revenue

(in Thousands)

$0

700

1,200

1,500

1,600

1,500

1,200

700

0

Marginal

Revenue

---$7

5

3

1

-1

-3

-5

-7

b. The company should not build the bridge because its profits are negative. The most revenue

it can earn is $1,600,000 and the cost is $2,000,000, so it would lose $400,000.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

c.

If the government were to build the bridge, it should set price equal to marginal cost to be

efficient. Since marginal cost is zero, the government should not charge people to use the

bridge.

Price

$8

Area

= 1/2 x 8 x 800,000

= $3,200,000

Demand

800,000

Quantity of Crossings

Figure 5

d. Yes, the government should build the bridge, because it would increase society's total

surplus. As shown in Figure 5, total surplus has area ½ × 8 × 800,000 = $3,200,000, which

exceeds the cost of building the bridge.

5. Larry wants to sell as many drinks as possible without losing money, so he wants to set quantity

where price (demand) equals average total cost, which occurs at quantity QL and price PL in

Figure 6. Curly wants to bring in as much revenue as possible, which occurs where marginal

revenue equals zero, at quantity QC and price PC. Moe wants to maximize profits, which occurs

where marginal cost equals marginal revenue, at quantity QM and price PM.

Figure 6

6. a. Figure 7 shows the firm’s average-total-cost curve and marginal-cost curve. (The

marginal-cost curve is a horizontal line at $0 because there are no variable costs.) Because

average total cost falls continuously as output rises, this firm is a natural monopoly.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Figure 7

b. If price is equal to $0, each person would visit the museum 10 times (= 10 – 0). Figure 8

shows the consumer surplus each resident would get. The benefit to each resident would be

consumer surplus (½ 10 $10 = $50) minus the tax ($24) or $26.

Figure 8

c.

The table below shows the total revenue and profit for the town at various prices:

Price

$2

3

4

5

Qd per resident

8

7

6

5

Total Revenue

1,600,000

2,100,000

2,400,000

2,500,000

Profit

-800,000

-300,000

0

100,000

A price of $4 would allow the town to break even.

d. At a price of $4, each consumer would earn consumer surplus equal to ½ 6 6 = $18. (See

Figure 9.) Consumers would be worse off. The town would gain revenue of $24 per person,

but it would not offset the drop in consumer surplus. Therefore, there would be a deadweight

loss.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Figure 9

e. In the real world, it is unlikely that all residents have the same demand. Thus, an admission

price would push more of the cost on those who would use the museum.

7. a. A monopolist always produces a quantity at which demand is elastic. If the firm produced a

quantity for which demand was inelastic and the firm raised its price, quantity would fall by a

smaller percentage than the rise in price, so revenue would increase. Because costs would

decrease at a lower quantity, the firm would have higher revenue and lower costs, so profit

would be higher. Thus the firm should keep raising its price until profits are maximized, which

must happen on an elastic portion of the demand curve.

b. As Figure 10 shows, another way to see this is to note that on an inelastic portion of the

demand curve, marginal revenue is negative. Increasing quantity requires a greater

percentage reduction in price, so revenue declines. Because a firm maximizes profit where

marginal cost equals marginal revenue, and marginal cost is never negative, the

profit-maximizing quantity can never occur where marginal revenue is negative. Thus, it can

never be on the inelastic portion of the demand curve. Total revenue is maximized where

marginal revenue is equal to zero (QTR on Figure 10).

Figure 10

8. a. The profit-maximizing outcome is the same as maximizing total revenue in this case because

there are no variable costs. The total revenue from selling to each type of consumer is

shown in the following tables:

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Price

10

9

8

7

6

5

4

3

2

1

0

Price

10

9

8

7

6

5

4

3

2

1

0

Quantity of Adult

Tickets

0

100

200

300

300

300

300

300

300

300

300

Quantity of Child

Tickets

0

0

0

0

0

100

200

200

200

200

200

Total Revenue from Sale

of Adult Tickets

0

900

1,600

2,100

1,800

1,500

1,200

900

600

300

0

Total Revenue from Sale

of Child Tickets

0

0

0

0

0

500

800

600

400

200

0

To maximize profit, you should charge adults $7 and sell 300 tickets. You should

charge children $4 and sell 200 tickets. Total revenue will be $2,100 + $800 =

$2,900. Because total cost is $2,000, profit will be $900.

b. If price discrimination were not allowed, you would want to set a price of $7 for the tickets.

You would sell 300 tickets and profit would be $100.

c.

The children who were willing to pay $4 but will not see the show now that the price is $7 will

be worse off. The producer is worse off because profit is lower. Total surplus is lower. There

is no one that is better off.

d. In (a) total profit would be $400. In (b), there would be a $400 loss. There would be no

change in (c).

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

9 a. The monopolist would set marginal revenue equal to marginal cost and then

substitute the profit-maximizing quantity into the demand curve:

10 – 2Q = 1 + Q

9 = 3Q

Q=3

P = 10 – Q = $7

Total revenue = P Q = ($7)(3) = $21

Total cost = 3 + 3 + 0.5(9) = $10.5

Profit = $21 – $10.5 = $10.5

b. The firm becomes a price taker at a price of $6 and no longer has monopoly power.

In a competitive equilibrium, the price equals marginal cost so,

10 - Q = 1 + Q

10 = 1 + 2Q

9 = 2Q

Q = 4.5

P = 5.5

The firm will export soccer balls because the world price is greater than the

domestic price (in the absence of monopoly power). As Figure 11 shows, domestic

production will rise to 5 soccer balls, domestic consumption will rise to 4, and

exports will be 1.

Figure 11

c. The price actually falls even though Wiknam will now export soccer balls. Once

trade begins, the firm no longer has monopoly power and must become a price

taker. However, the world price of $6 is greater than the competitive equilibrium

price ($5.50) so the country exports soccer balls.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

d. Yes. The country would still export balls at a world price of $7. The firm is a price

taker and no longer is facing a downward-sloping demand curve. Thus, it is now

possible to sell more without reducing price.

10. a. Figure 12 shows the firm’s demand, marginal revenue, and marginal cost curves. The firm’s

profit is maximized at the output where marginal revenue is equal to marginal cost.

Therefore, setting the two equations equal, we get:

1,000 – 20Q = 100 + 10Q

900 = 30Q

Q = 30

The monopoly price is P = 1,000 – 10Q = 700 Ectenian dollars.

Figure 12

b. Social welfare is maximized where price is equal to marginal cost:

1,000 – 10Q = 100 + 10Q

900 = 20Q

Q = 45

At an output level of 45, the price would be 550 Ectenian dollars.

c.

The deadweight loss would be equal to (0.5)(15)(300) = 2,250 Ectenian dollars.

d. i.

A flat fee of 2000 Ectenian dollars would not alter the profit-maximizing price or

quantity. The deadweight loss would be unaffected.

ii.

A fee of 50 percent of the profits would not alter the profit-maximizing price

or quantity. The deadweight loss would be unaffected.

iii.

The marginal cost of production would rise by 150 Ectenian dollars if the

director was paid that amount for every unit sold. The new marginal cost

would be 100 + 10Q + 150. The new profit-maximizing output would be 25,

the marginal cost at that level would be 500, and the price would rise to 750.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

The deadweight loss would be smaller. With the new marginal cost

function, the quantity at which social welfare is maximized changes. Now,

price is equal to marginal cost when Q = 37.5:

1,000 - 10Q = 250 + 10Q

750 = 20Q

Q = 37.5

As a result, the deadweight loss would be equal to (0.5)(37.5-25)(750-500) =

1,562.50 Ectenian dollars rather than 2,250 Ectenian dollars.

iv.

If the director is paid 50 percent of the revenue, then total revenue is

500Q – 5Q2. Marginal revenue becomes 500 – 10Q. The profit-maximizing

output level will be 20 and the price will be 800 Ectenian dollars. The

deadweight loss will be greater.

11. a. Figure 13 shows the cost, demand, and marginal-revenue curves for the monopolist. Without

price discrimination, the monopolist would charge price PM and produce quantity QM.

Figure 13

b. The monopolist's profit consists of the two areas labeled X, consumer surplus is the two areas

labeled Y, and the deadweight loss is the area labeled Z.

c.

If the monopolist can perfectly price discriminate, it produces quantity QC, and has profit

equal to X + Y + Z.

d. The monopolist's profit increases from X to X + Y + Z, an increase in the amount Y + Z. The

change in total surplus is area Z. The rise in the monopolist's profit is greater than the change

in total surplus, because the monopolist's profit increases both by the amount of deadweight

loss (Z) and by the transfer from consumers to the monopolist (Y).

e. A monopolist would pay the fixed cost that allows it to discriminate as long as Y + Z (the

increase in profits) exceeds C (the fixed cost).

f.

A benevolent social planner who cared about maximizing total surplus would want the

monopolist to price discriminate only if Z (the deadweight loss from monopoly) exceeded C

(the fixed cost) because total surplus rises by Z – C.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

g. The monopolist has a greater incentive to price discriminate (it will do so if Y + Z > C) than

the social planner (she would allow it only if Z > C). Thus if Z < C but

Y + Z > C, the monopolist will price discriminate even though it is not in society's best

interest.

ch16

Quick Quizzes

1. Oligopoly is a market structure in which only a few sellers offer similar or identical products.

Examples include the market for breakfast cereals and the world market for crude oil.

Monopolistic competition is a market structure in which many firms sell products that are similar

but not identical. Examples include the markets for novels, movies, restaurant meals, and

computer games.

2. The three key attributes of monopolistic competition are: (1) there are many sellers; (2) each firm

produces a slightly different product; and (3) firms can enter or exit the market freely.

Figure 1 shows the long-run equilibrium in a monopolistically competitive market. This equilibrium

differs from that in a perfectly competitive market because price exceeds marginal cost and the

firm does not produce at the minimum point of average total cost but instead produces at less

than the efficient scale.

Figure 1

3. Advertising may make markets less competitive if it manipulates people’s tastes rather than being

informative. Advertising may give consumers the perception that there is a greater difference

between two products than really exists. That makes the demand curve for a product more

inelastic, so the firms can then charge greater markups over marginal cost. However, some

advertising could make markets more competitive because it sometimes provides useful

information to consumers, allowing them to take advantage of price differences more easily.

Advertising also facilitates entry because it can be used to inform consumers about a new

product. In addition, expensive advertising can be a signal of quality.

Brand names may be beneficial because they provide information to consumers about the quality

of goods. They also give firms an incentive to maintain high quality, since their reputations are

important. But brand names may be criticized because they may simply differentiate products

that are not really different, as in the case of drugs that are identical with the brand-name drug

selling at a much higher price than the generic drug.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Questions for Review

1. The three attributes of monopolistic competition are: (1) there are many sellers; (2) each seller

produces a slightly different product; and (3) firms can enter or exit the market without

restriction. Monopolistic competition is like monopoly because firms face a downward-sloping

demand curve, so price exceeds marginal cost. Monopolistic competition is like perfect

competition because, in the long run, price equals average total cost, as free entry and exit drive

economic profit to zero.

2. In Figure 2, a firm has demand curve D1 and marginal-revenue curve MR1. The firm is making

profits because at quantity Q1, price (P1) is above average total cost (ATC). Those profits induce

other firms to enter the industry, causing the demand curve to shift to D2 and the

marginal-revenue curve to shift to MR2. The result is a decline in quantity to Q2, at which point the

price (P2) equals average total cost (ATC), so profits are now zero.

Figure 2

3. Figure 3 shows the long-run equilibrium in a monopolistically competitive market. Price equals

average total cost. Price is above marginal cost.

Figure 3

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

4. Because, in equilibrium, price is above marginal cost, a monopolistic competitor produces too

little output. But this is a hard problem to solve because: (1) the administrative burden of

regulating the large number of monopolistically competitive firms would be high; and (2) the

firms are earning zero economic profits, so forcing them to price at marginal cost means that

firms would lose money unless the government subsidized them.

5. Advertising might reduce economic well-being because it manipulates people's tastes and

impedes competition by making products appear more different than they really are. But

advertising might increase economic well-being by providing useful information to consumers and

fostering competition.

6. Advertising with no apparent informational content might convey information to consumers if it

provides a signal of quality. A firm will not be willing to spend much money advertising a

low-quality good, but may be willing to spend significantly more to advertise a high-quality good.

7. The two benefits that might arise from the existence of brand names are: (1) brand names

provide consumers information about quality when quality cannot be easily judged in advance;

and (2) brand names give firms an incentive to maintain high quality to maintain the reputation of

their brand names.

Quick Check Multiple Choice

1. b

2. d

3. a

4. d

5. a

6. c

Problems and Applications

1. a. Tap water is a monopoly because there is a single seller of tap water to a household .

b. Bottled water is a monopolistically competitive market. There are many sellers of bottled

water, but each firm tries to differentiate its own brand from the rest.

c.

The cola market is an oligopoly. There are only a few firms that control a large portion of the

market.

d. The beer market is an oligopoly. There are only a few firms that control a large portion of the

market.

2. a. The market for wooden #2 pencils is perfectly competitive because pencils by any

manufacturer are identical and there are a large number of manufacturers.

b. The market for copper is perfectly competitive, because all copper is identical and there are a

large number of producers.

c.

The market for local electricity service is monopolistic because it is a natural monopoly—it is

cheaper for one firm to supply all the output.

d. The market for peanut butter is monopolistically competitive because different brand names

exist with different quality characteristics.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

e. The market for lipstick is monopolistically competitive because lipstick from different firms

differs slightly, but there are a large number of firms that can enter or exit without restriction.

3. a. A firm in monopolistic competition sells a differentiated product from its competitors.

b. A firm in monopolistic competition has marginal revenue less than price.

c.

Neither a firm in monopolistic competition nor in perfect competition earns economic profit in

the long run.

d. A firm in perfect competition produces at the minimum average total cost in the long run.

e. Both a firm in monopolistic competition and a firm in perfect competition equate marginal

revenue and marginal cost.

f.

A firm in monopolistic competition charges a price above marginal cost.

4. a. Both a firm in monopolistic competition and a monopoly firm face a downward-sloping

demand curve.

b. Both a firm in monopolistic competition and a monopoly firm have marginal revenue that is

less than price.

c.

A firm in monopolistic competition faces the entry of new firms selling similar products.

d. A monopoly firm earns economic profit in the long run.

e. Both a firm in monopolistic competition and a monopoly firm equate marginal revenue and

marginal cost.

f.

Neither a firm in monopolistic competition nor a monopoly firm produces the socially efficient

quantity of output.

5. a. The firm is not maximizing profit. For a firm in monopolistic competition, price is greater than

marginal revenue. If price is below marginal cost, marginal revenue must be less than

marginal cost. Thus, the firm should reduce its output to increase its profit.

b. The firm may be maximizing profit if marginal revenue is equal to marginal cost. However,

the firm is not in long-run equilibrium because price is less than average total cost. In this

case, firms will exit the industry and the demand facing the remaining firms will rise until

economic profit is zero.

c.

The firm is not maximizing profit. For a firm in monopolistic competition, price is greater than

marginal revenue. If price is equal to marginal cost, marginal revenue must be less than

marginal cost. Thus, the firm should reduce its output to increase its profit.

d. The firm could be maximizing profit if marginal revenue is equal to marginal cost. The firm is

in long-run equilibrium because price is equal to average total cost. Therefore, the firm is

earning zero economic profit.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

6. a. Figure 4 illustrates the market for Sparkle toothpaste in long-run equilibrium. The

profit-maximizing level of output is QM and the price is PM.

Figure 4

b. Sparkle's profit is zero, because at quantity QM, price equals average total cost.

c.

The consumer surplus from the purchase of Sparkle toothpaste is areas A + B. The efficient

level of output occurs where the demand curve intersects the marginal-cost curve, at QC. The

deadweight loss is area C, the area above marginal cost and below demand, from QM to QC.

d. If the government forced Sparkle to produce the efficient level of output, the firm would lose

money because average total cost would exceed price, so the firm would shut down. If that

happened, Sparkle's customers would earn no consumer surplus.

7. a. As N rises, the demand for each firm’s product falls. As a result, each firm’s demand curve will

shift left.

b. The firm will produce where MR = MC:

100/N – 2Q = 2Q

Q = 25/N

c.

25/N = 100/N – P

P = 75/N

d. Total revenue = P Q = 75/N 25/N = 1875/N2

Total cost = 50 + Q2 = 50 + (25/N)2 = 50 + 625/N2

Profit = 1875/N2 – 625/N2 – 50 = 1250/N2 – 50

e. In the long run, profit will be zero. Thus:

1250/N2 – 50 = 0

1250/N2 = 50

N=5

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

8. Figure 5 shows the cost, marginal revenue and demand curves for the firm under both conditions.

Figure 5

a. The price will fall from PMC to the minimum average total cost (PC) when the market becomes

perfectly competitive.

b. The quantity produced by a typical firm will rise to QC, which is at the efficient scale of output.

c.

Average total cost will fall as the firm increases its output to the efficient scale.

d. Marginal cost will rise as output rises. Marginal cost is now equal to price.

e. Profit will not change. In either case, the market will move to long-run equilibrium where all

firms will earn zero economic profit.

9. a. A family-owned restaurant would be more likely to advertise than a family-owned farm

because the output of the farm is sold in a perfectly competitive market, in which there is no

reason to advertise, while the output of the restaurant is sold in a monopolistically

competitive market.

b. A manufacturer of cars is more likely to advertise than a manufacturer of forklifts because

there is little difference between different brands of industrial products like forklifts, while

there are greater perceived differences between consumer products like cars. The possible

return to advertising is greater in the case of cars than in the case of forklifts.

c.

A company that invented a very comfortable razor is likely to advertise more than a company

that invented a less comfortable razor that costs the same amount to make because the

company with the very comfortable razor will get many repeat sales over time to cover the

cost of the advertising, while the company with the less comfortable razor will not.

10. a. Figure 6 shows Sleek’s demand, marginal-revenue, marginal-cost, and average-total-cost

curves. The firm will maximize profit at an output level of Q * and a price of P *. The shaded

are shows the firm’s profits.

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Figure 6

b. In the long run, firms will enter, shifting the demand for Sleek’s product to the left. Its price

and output will fall. Firms will enter until profits are equal to zero (as shown in Figure 7).

Figure 7

c.

As consumers become more focused on the stylistic differences in brands, they will be less

focused on price. This will make the demand for each firm’s products more price inelastic.

The demand curves may become relatively steeper, allowing Sleek to charge a higher price.

If these stylistic features cannot be copied, they may serve as a barrier to entry and allow

Sleek to earn profit in the long run.

d. A firm in monopolistic competition produces where marginal revenue is greater than zero.

This means that firm must be operating on the elastic portion of its demand curve.

ch17

Quick Quizzes

1. If the members of an oligopoly could agree on a total quantity to produce, they would choose to

produce the monopoly quantity, acting in collusion as if they were a monopoly.

If the members of the oligopoly make production decisions individually, self-interest induces them

to produce a greater quantity than the monopoly quantity.

2. The prisoners’ dilemma is the story of two criminals suspected of committing a crime, in which the

sentence that each receives depends both on his or her decision to confess or remain silent and

on the decision made by the other. The following table shows the prisoners’ choices:

© 2012 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from

the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part.

Bonnie’s Decision

Confess

Clyde’s

Decision

Confess Bonnie gets eight years

Clyde gets eight years

Remain Bonnie goes free

Silent Clyde gets 20 years

Remain Silent

Bonnie gets 20 years

Clyde goes free

Bonnie gets one year

Clyde gets one year

The likely outcome is that both will confess, since that is a dominant strategy for both.

The prisoners’ dilemma teaches us that oligopolies have trouble maintaining the

cooperative outcome of low production, high prices, and monopoly profits because

each oligopolist has an incentive to cheat.

3. It is illegal for businesses to make an agreement about reducing output or raising prices.

Antitrust laws are controversial because some business practices may appear

anti-competitive while in fact having legitimate business purposes. An example is

resale price maintenance.

Questions for Review

1. If a group of sellers could form a cartel, they would try to set quantity and price like a monopolist.

They would set quantity at the point where marginal revenue equals marginal cost, and set price

at the corresponding point on the demand curve.

2. Firms in an oligopoly produce a quantity of output that is greater than the level produced by

monopoly. They sell the product at a price that is lower than the monopoly price.

3. Firms in an oligopoly produce a quantity of output that is less than the level produced by a

competitive market. They sell the product at a price that is greater than the competitive price.

4. As the number of sellers in an oligopoly grows larger, an oligopolistic market looks more and more

like a competitive market. The price approaches marginal cost, and the quantity produced

approaches the socially efficient level.

5. The prisoners’ dilemma is a game between two people or firms that illustrates why it is difficult for