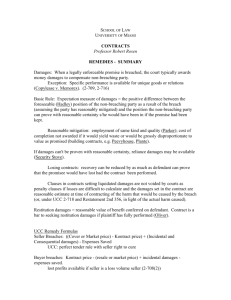

Title of CLE

advertisement

Key Contracting PrinciplesProvisions That Work & Some that Don’t Presented by: Henry A. King Timothy S. Madden Robert J. Stefani J. Grant Coleman Contractual Indemnities: Getting the Other Guy to Pay Your Legal Liability Presented by: Henry King Whether an indemnity provision is applicable involves a twopronged inquiry: 1. Is the party asserting a right to indemnification included in the definition of the indemnitee group?; and 2. Is the claim, loss, liability or expense for which indemnification is sought within the scope of risks covered by the indemnity provision? By broadly defining the “indemnified” group, the scope of persons entitled to indemnity may be increased significantly. • • Phillips v. Williams Oil Field Serv.-Gulf Coast Co., 2006 WL 1098923 (W.D.La.) Corbitt v. Diamond M. Drilling Co., 654 F.2d 329 (5th 1981) If properly drafted, an indemnity may provide reimbursement for both the direct and consequential damages suffered or incurred by an indemnitee. • Cox Communications v. Tommy Bowman Roofing, LLC, 929 So.2d 161 (La.App. 4 Cir. 3/15/06) Imprecise or narrow language in the indemnity provision may result in a court finding that a loss is not encompassed by an indemnity. • Leaming v. Century Vina, Inc., 908 So.2d 21 (La.App. 4 Cir. 6/1/05) When the indemnitee seeks indemnification against the consequences of its own negligence, the indemnity is not enforceable unless such an intention is expressed in unequivocal terms. • • Harris v. Argico Chemical Co., 570 So.2d 474 (5th Cir. 1990) Ranger Ins. Co. v. Shop Rite, Inc., 921 So.2d 1040 (5th Cir. 2006) When the indemnitee seeks indemnification against the consequences of its own negligence, the indemnity provision will be strictly construed. • Dean v. Griffin Crane & Steel, Inc., 935 So.2d 186 (La.App. 1 Cir. 5/5/06) KNOCK FOR KNOCK INDEMNITY The two policy considerations underpinning the use of “knock for knock” or reciprocal indemnity agreements are: 1. the elimination of the expense of redundant insurance coverage; and 2. a reduction in unnecessary litigation and its expense. Darty v. Transocean Offshore U.S.A., Inc., 875 So.2d 106 (La.App. 4 Cir. 2004) CONTRACTUAL INDEMNITY VS. ADDITIONAL INSURED STATUS: IS IT A BIG DEAL? Obtaining “addition insured” status is worth the effort. • Suire v. Lafayette City-Parish Consolidated Government, 907 So.2d 37 (La. 4/12/05) ADDITIONAL INSURED STATUS A contract requiring that a party be named as an additional insured can result in an extension of coverage of a CGL policy. • Jessop v. City of Alexandria, 871 So.2d 1140 (La.App. 3 Cir. 3/31/04) While some CGL policies provide exclusions for contractual liability, most policies still provide coverage where the named insured contractually assumes the tort liability of another. • Burlington Resources, Inc. v. United National Ins.Co., 2007 WL 496859 (E.D.La.) WAIVERS OF SUBROGATION A waiver of subrogation provision in a contract precludes an insurer from recovering from an otherwise negligent party in whose favor the waiver has been granted. • The Gray Ins. Co. v. Old Tyme Builders, Inc., 878 So.2d 603 (La.App. 1 Cir. 4/2/04) LOUISIANA OILFIELD ANTI-INDEMNITY ACT (“LOIA”) LA. R.S. 9:2780 In Mears v. Commercial General Liability Ins., 926 So.2d 754 (La.App. 3 Cir. 4/5/06), the court held that a contract to perform welding services in connection with the construction of an offshore platform was non-maritime, and, therefore, LOIA invalidated a contract’s defense and indemnity provisions to the extent it sought to protect the indemnitee from the consequences of its own negligence. In Hoda v. Rowan Cos., 419 F.3d 379 (5th Cir. 2005), the court held that an oil and gas services contract requiring the torquing up and down of blow-out preventer stacks from a jack-up drilling rig constituted a maritime contract and that the contract’s indemnity provision was enforceable under general maritime law. The Pitfalls of Terms of Art and Boilerplate Forms in Contract Drafting Presented by: Timothy S. Madden • THE MISUSE OF TERMS OF ART CAN LEAD YOU TO THE COURTHOUSE • AVOIDING THE PITFALLS OF INCONSISTENT CONTRACT PROVISIONS • MISUSE OF FORMS AND BOILERPLATE PROVISIONS IN CONTRACT DRAFTING LOUISIANA CIVIL CODE ON CONTRACT INTERPRETATION • 2045: Interpretation of a contract is the determination of the common intent of the parties. • 2047: The words of a contract must be given their generally prevailing meaning… • 2048: Words susceptible of different meanings must be interpreted in the meaning that best conforms to the object of the contract. • 2053: A doubtful provision must be interpreted in light of the nature of the contract, equity, usages… WHAT DO WORDS MEAN? “When I use a word,” Humpty Dumpty said, in a rather scornful tone, “it means just what I choose it to mean—neither more nor less.” “The question is,” said Alice, “whether you can make words mean so many things.” “The question is,” said Humpty Dumpty, “which is to be master – that’s all.” Through the Looking Glass(and What Alice Found There) - Lewis Carroll Louisiana Civil Code article 2047 - The words of a contract must be given their generally prevailing meaning. - Words of art and technical meaning must be given their technical meaning when the contract involves a technical matter. – In other words, words must be ascribed their generally prevailing meaning unless the words have acquired a technical meaning in a particular context. – Words of art and technical meaning often appear to be ordinary. LICENSOR v. LICENSEE ACCOUNTING TERMS OF ART IN RED • Licensee shall purchase the Products from Licensor (or its manufacturing licensee) for a price of Twenty-Seven and One-Half Percent (27.5%) more than Licensor’s or its manufacturing licensee’s cost to produce the Products where Licensor’s (or its manufacturing licensee) cost to produce the Products shall include capital depreciation of the buildings, machinery and equipment acquired for the manufacturing of the Products (the depreciation expense for capitalized expenditures to be determined in accordance with generally accepted accounting principles using the straight-line method of depreciation and the mid-point of the permissible depreciable lives of such capitalized expenditures), plant office expense, supervision and rent as well as Licensor’s labor, wages, fringe benefits, operating supplies, electricity, gas, water, utilities, plant engineering, material management, freight, royalties, raw materials, taxes (except income or other similar taxes based upon income), sanitation, hazardous waste disposal, sewer, security and any other expenses or costs associated with the production of the Products or the operation of Licensor’s or its manufacturing licensee’s manufacturing facility to manufacture the Products. LICENSOR v. LICENSEE (cont.) • The parties’ differing interpretations of this contract provision led to a protracted dispute and litigation for more than 6 years that resulted in the entry of a $16 million judgment against the Licensor, and the ultimate bankruptcy filing by the Licensor. • “Products”, “Licensor” and “Licensee” are the only capitalized and defined terms. However, this provision is filled with words of art and technical meaning. • The parties’ attempt to define “cost to produce” included terms of art that were not defined and included a circular definition. LICENSOR v. LICENSEE (cont.) • Licensor argued, unsuccessfully, that generally accepted accounting principles was not a term of art or technical term because it was not capitalized. • Licensor failed to recognize the difference between the terms “expense” and “expenditure”. – As a result, Licensor failed to distinguish between out of pocket expenditures and non-cash expenses such as depreciation, amortization of research and development expenses and amortization of good will. • Licensor’s failure to recognize the difference in treatment, under GAAP of Cost of Goods Sold; Selling, General & Administrative Expenses; and Other Expenses would result in a “double-dip” for Licensor. • The term “mid-point of depreciable lives” resulted in 2 disputes: » How to calculate the mid-point? » Is the depreciable life of an item determined based on IRS or GAAP guidelines? • All of the Licensor’s arguments were rejected by the court. Aminoil – ACCOUNTING TERMS (cont.) • Aminoil USA, Inc. v. OKC Corporation, 629 F.Supp. 647 (E.D. La. 1986) Lessor (Aminoil) brought declaratory judgment action against lessee (OKC) as to Aminoil’s net profits interest pursuant to farmout of Aminoil’s interest in mineral lease. • Farmout agreement provided: “OKC shall maintain a net profits account in accordance with the terms of this (farmout) agreement and good accounting practices…” – The purpose of this provision was to require OKC to maintain a net profits account in order to determine when “net profits” was achieved by OKC. Aminoil’s interest in production under the farmout agreement converted to a substantially more profitable net profits interest once income from production exceeded the costs and expenses of exploration and production. Aminoil – ACCOUNTING TERMS (cont.) • • The farm-out agreement further provided that “against net profits should be charged the following”: 1.) an amount equal to the costs to OKC of all direct labor, transportation and other services necessary for exploring, developing, operating and maintaining the subject lease… 2.) an amount equal to the expenses of litigation, liens, judgments and liquidated liabilities and claims incurred and paid by OKC on account of its ownership interest in the subject lease…” Terms of art and issues in dispute: • “Cost” and “expenses” – ordinary terms or terms of art? • OKC argued that under the generally prevailing meaning of the term “cost,” the $30 million interest deduction at issue represented a “cost” to OKC of labor, transportation and other services necessary for exploration and production under the farm-out agreement. • Likewise, OKC argued that its litigation with Aminoil resulted from its ownership interest in the subject lease and should also be charged against net profits under the farm-out agreement. Aminoil – ACCOUNTING TERMS (cont.) • The court disagreed with OKC’s arguments and deferred to Aminoil’s expert accountants, as well as the Court’s own appointed independent accountant, who testified that the accounting provisions in the farm-out agreement had specialized usage and meaning within the oil and gas accounting field. These usages and meaning mandated analysis of the provisions in light of generally accepted accounting and auditing principles. • Experts: • – Generally accepted accounting and auditing principles are consistently interpreted to exclude interest unless interest is specifically designated as a chargeable item. – Likewise, under accounting practices in the oil and gas industry, “expenses of litigation” never includes legal expenses related to a dispute between the contracting parties. Citing La. Civ. Code art. 2047, the Court adopted the findings of the expert accountants who interpreted the terms of the farm-out agreement in light of accepted accounting principles in the oil and gas industry rather than the “generally prevailing meaning” of the terms urged by OKC. OKC was, therefore, not permitted to charge interest deductions and legal expenses (arising from disputes between the parties) to net profits account under the farm-out agreement. Other examples… “Completion” v. “to complete”. Woolf & Magee v. Hughes, 95-863 (La.App. 3 Cir. 12/6/95) 666 So.2d 1128. – Hughes contracted to guaranty payment, on behalf of a third party, for Woolf & Magees’ (W&M’s) services in connection with the construction of an oil well. In the contract, Hughes agreed to guaranty: “The daywork charges of Woolf & Magee to complete the [well]”. – Hughes sought to limit his guaranty payment for the entirety of W&M’s services by arguing that the phrase “to complete” was synonmous with the oil and gas industry term “completion”. (“Completion” refers to the “completion phase” of well operations.) In other words, Hughes argued that his obligation terminated once W&M reached the “completion phase” of operations and did not extend until work on the well was actually completed. – Court held that the word “completion” is a technical term in the oil field industry and that if the parties, both experienced in the oil field business, intended to refer to the “completion phase” of well operations, they would have used the technical term “completion” rather than the ordinary words “to complete”. Other examples (cont.) “Drainage lines”. Patterson v. City of New Orleans, 960367 (La.App. 4 Cir. 12/18/96) 686 So.2d 87. – Consolidated cases involving personal injury claims that allegedly occurred due to slick conditions resulting from the seepage of water into the Press Drive underpass in New Orleans. The seepage occurred because a system of perforated pipes known as a “filter bed” had been installed under the roadway of the underpass. – The New Orleans Sewerage & Water Board (S&WB) had contracted with the City of New Orleans to maintain and repair “subsurface drainage”, which the contract defined as “all drainage lines less than 36” in diameter. The S&WB argued that it could not be held responsible for the dangerous conditions caused in the overpass because the term “drainage lines” in its contract with the City was a technical term that referred only to a particular type and placement of pipe which did not include the “filter bed” pipes at issue. “Drainage lines” (cont.) – Court: “Drainage line” is a technical term that refers to solid pipe that carries water from one place to another. The perforated pipes of the filter bed, though connected to the S&WB’s drainage lines, do not constitute “drainage lines.” • Significance: Contract between the City and S&WB contained definitions, but no definition of the precise term of art at issue. Carefully drafted and comprehensive definitions are the key to avoiding the pitfalls presented by terms of art in contract drafting. DEFINITIONS ARE THE KEY • Besides the obvious meticulous scrutiny required in all aspects of contract drafting, the use of a carefully drafted definitions section is the key to avoiding the pitfalls of terms of art. – Always capitalize terms of art. This forces the parties to consider the effect of their usage of a particular term and may shift the focus of contract negotiations. While this may draw out negotiations, it is more cost effective than litigating the meaning of the terms in court. – BE CONSISTENT!!! It is imperative that the definitions used in a contract are consistent with each other. The result can be disaster. • Example: Failure to draft consistent definitions in a contract can negate indemnity agreement. While not terms of art, the definitions used in the following provision were not consistent and could result in the invalidity of certain aspects of the indemnities negotiated by the parties. DEFINITIONS (cont.) • “Express negligence” rule: Contractual indemnity agreements protecting an indemnitee from its own negligence are enforceable under maritime law provided the language is clear and unambiguous. Hardy v. Gulf Oil Corp., 949 F.2d 826, 834 (5th Cir. 1992). – Master Services Agreement provides in part: • Contractor agrees to release, protect, defend, indemnify and hold COMPANY and COMPANY’S AFFILIATES …harmless from and against any and all claims, demands and causes of action of every kind and character arising in connection with the presence of personnel or the placement of property of a CONTRACTOR INDEMNITEE and/or its GROUP on a COMPANY RIG, or the performance of work or providing of products by a CONTRACTOR INDEMNITEE and/or its GROUP on a COMPANY RIG, on account of personal or bodily injury to or death of personnel of a CONTRACTOR INDEMNITEE and/or its GROUP,… regardless of the CAUSE (including any CAUSE of CONTRACTOR GROUP and/or COMPANY GROUP or any other person or entity) of such injury, death, damage… BOILERPLATE CONTRACTS/CLAUSES • Preprinted contracts or contract provisions that are often printed in small type-face and are utilized repeatedly without change in the text. • Boilerplate provisions are enforceable - BE CAREFUL WHAT YOU ASK FOR. • Review all boilerplate provisions anew with each use of the contract to ensure that the boilerplate provisions are applicable to the contract at issue as intended by the parties. • Beware of “cutting and pasting” boilerplate forms and provisions from different contracts. Warranties & Remedies Presented by: Robert Stefani WARRANTIES Sale • Obligations of Seller – Deliver the thing sold – Warrant: - Peaceful possession - Absence of hidden defects - Fit for intended use • Redhibition – Warranty against redhibitory defects or vices » » Useless or so inconvenient; presumed buyer would not have purchased Usefulness or value diminished; presumed buyer would have purchased at lesser price – Exclusion or limitation of warranty by agreement » » » » » Clear & unambiguous; brought to buyer’s attention Buyer not bound if seller declared thing had quality he knew it did not have Buyer subrogated to seller’s rights in warranty against others even when warranty excluded Seller liable for redhibitory defect has action against the manufacturer if defect existed at time of delivery Berney v. Roundrtee Olds-Cadillac, Inc., 763 So.2d 799 (La.App.2 Cir. 6/21/00) • Redhibition (cont.) – Fit for ordinary use » When seller knows or has reason to know of intended use or purpose and buyer relying on seller’s skill or judgment in selecting, must be fit for buyer’s intended use or his particular purpose – Kind and quality specified • Eviction – Eviction = loss of, or danger of losing, all or part of the thing because of third person’s right existing at time of sale – Covers encumbrances not declared at time of sale » Apparent servitudes and natural and legal nonapparent servitudes need not be declared – May transfer whatever rights he may then have without warranting existence of such rights » “quitclaim deed” or “assignment of rights without warranty” • Eviction (cont.) – Modification or exclusion of warranty against eviction » Warranty implied » Parties may increase or limit warranty » Parties may suppress or exclude warranty » Even if warranty excluded, seller must return purchase price unless: -Buyer was aware of danger of eviction; -Buyer declared he was buying at his peril and risk; or -Obligation to return purchase price expressly excluded » In any event, seller liable for eviction occasioned by own act -Agreement to the contrary is null » Buyer subrogated to seller’s rights in warranty against others, even when warranty excluded • Eviction (cont.) – Warranty against eviction extends to proceeds from thing sold » Examples: fruits and products – Buyer threatened with eviction must give timely notice to seller » Calling upon seller to defend amounts to notice » Warranty may be forfeited upon failure to give timely notice Conventional Obligations or Contracts • • • Contracts have effect of law between parties and must be performed in good faith Party may demand security be given – When ability to perform endangered » Demand in writing » Upon failure to give security, party may withhold or discontinue performance May include real security, personal security, or assurance that obligor has secured or will secure means of performance REMEDIES Conventional Obligations or Contracts • Obligee has right to: – Enforce performance by obligor – Enforce performance by causing it to be rendered by another at obligor’s expense – Recover damages » Failure to perform, defective performance, or delayed performance Specific Performance • • • Upon failure to perform, court shall grant specific performance plus damages for delay if obligee demands If specific performance impracticable, court may award damages Obligor may be restrained from doing anything in violation of obligation not to do Putting in Default • • • Damages for delay in performance owed from time obligor put in default Other damages owed from time obligor failed to perform Putting in default – – – – – Arrival of term Written request for performance Oral request for performance; two witnesses Filing suit Contractual provision Damages • • Nonperformance, defective performance, or delayed performance Measured by loss sustained and profits deprived – • Rapheal v. Raphael, 929 So.2d 825 (La.App.3 Cir. 5/3/06); Scenicland Construction Co., LLC v. St. Francis Medical Center, Inc., 936 So.2d 247 (La.App. 2 Cir. 7/26/06); Simpson v. Restructure Petroleum Marketing Services, Inc., 830 So.2d 480 (La.App. 2 Cir. 10/23/02) Good faith obligor liable for foreseeable damages – Foreseeable/unforeseeable factors: » Nature of contract » Nature of business » Prior dealings of parties » Other circumstances related to contract and known to obligor – Andry, et al. v. Murphy Oil, USA, et al., 935 So.2d 239 (La.App. 4 Cir. 6/14/06); Simpson v. Restructure Petroleum Marketing Services, Inc., 830 So.2d 480 (La.App. 2 Cir. 10/23/02) Damages (cont.) • • • Bad faith obligor liable for all damages, foreseeable or not, that are direct consequence of failure to perform When performance is money, measured by interest – Damages for delay measured by interest on that sum from time due » Rate agreed upon by parties » In absence of agreement, rate fixed by La R.S. 9:3500 Parties may, by written contract, expressly agree that obligor also liable for attorney’s fees in a fixed or determinable amount Damages (cont.) • Advance exclusion or limitation of liability for intentional or gross fault that causes damage or physical injury to other party is null – Does not govern indemnity clauses, hold harmless agreements, or other agreements where parties allocate between themselves risk of potential liability towards third persons • May stipulate damages – Secondary obligation – Nullity of principal obligation nullifies stipulated damages clause, but nullity of stipulated damages clause does not nullify principal obligation – Keiser v. Catholic Diocese of Shreveport, Inc., 880 So.2d 230 (La.App.2 Cir. 8/18/04) Damages (cont.) • • • • • Either stipulated damages or performance Both if damages stipulated for mere delay For stipulated damages, obligee need not prove actual damage Reduce stipulated damages in proportion to benefit derived from partial performance Stipulated damages not modified by court unless so manifestly unreasonable as to be contrary to public policy – Carney v. Boles, 643 So.2d 339 (La.App. 2 Cir. 9/21/94) Dissolution • May be granted additional time to perform – Case-by-case determination • Damages upon judicial dissolution – In some instances, regarded as dissolved before judicial declaration • • When delayed performance of no value or when evident obligor will not perform, regarded as dissolved without notice to obligor Agreement that contract shall be dissolved for failure to perform a particular obligation – Dissolved at time contract provides – In absence of such a provision, dissolved at time obligee gives notice that he avails himself of dissolution clause Sale • Obligations of Seller – Specific performance – Dissolution of sale – Damages – Upon recission of contract, purchase price returned and expenses of sale reimbursed Sale • Eviction – Purchase price, value of fruits returned to third person, and other damages sustained » Absent special agreement, attorney’s fees not recoverable – Return full purchase price even if, at time of eviction, value of thing diminished – If buyer benefited from diminution by own act, amount of benefit deducted Eviction (cont.) • Reimburse costs of useful improvements • Reimburse costs of all improvements if knew thing belonged to a third person • Recission of sale or reduction of price for partial eviction – Rescission of sale if would not have purchased – If sale not rescinded, entitled to proportional diminution of price Redhibition • Depends on nature of breach – Useless or so inconvenient – recission of sale – Not useless but diminished in usefulness or value - reduction of price – Not reasonably fit for ordinary use – dissolution, damages, or both – Not of kind or quality specified or represented by seller – dissolution, damages, or both Redhibition (cont.) Knowledge of defect or false declaration – Return of purchase price with interest from time paid; – Reimbursement of reasonable expenses occasioned by sale; – Reimbursement of reasonable expenses incurred for preservation; – Damages; and – Attorney fees » Use of thing or fruits yielded therefrom may lead to a credit • Seller charged with knowledge of defect when he is manufacturer of thing Redhibition (cont.) • No knowledge of defect – Repair, remedy, or correct defect • If unable to repair, remedy, or correct, bound to: – Return purchase price with interest from time paid; – Reimburse reasonable expenses occasioned by sale; – Reimburse reasonable expenses incurred for preservation » Use of thing or fruits yielded therefrom may lead to a credit Tax Concerns & Pitfalls in Contract Drafting Presented by: Grant Coleman GENERAL TAX ISSUES • Tax language is not “boilerplate” and should be reviewed by tax experts – Classic example is tax language in LLC Operating Agreement • Tax reporting requirements – W-9 – 1099 • Tax advice notice EXAMPLE OF TAX ADVICE NOTICE • NOTICE REQUIRED BY IRS RULES OF PRACTICE. U.S. federal tax regulations provide that, for the purpose of avoiding certain penalties under the Internal Revenue Code, taxpayers may rely only on formal opinions of counsel which meet specific in this writing or any attachment hereto does not constitute a formal opinion that meets the requirements of the regulations. Accordingly, we are required to advise you that (1) any tax advice contained in this communication was not intended or written to be used, and may not be used, for the purpose of avoiding such penalties and (2) no one, without express prior written permission, may use any part of this communication in promoting, marketing or recommending an arrangement relating to any Federal tax matter to any person or entity. SERVICE CONTRACTS – Status as independent contractor – Establish responsibility for contractor taxes SAMPLE PROVISION IN SERVICE CONTRACT CONTRACTOR agrees to pay all taxes, licenses, and fees levied or assessed on CONTRACTOR in connection with or incident to the performance of this Agreement by any governmental agency and will pay unemployment compensation insurance, old age benefits, social security, or any other taxes upon the wages of CONTRACTOR, its agents, employees, and representatives. CONTRACTOR agrees to reimburse OWNER on demand for all such taxes or governmental charges, State or Federal, which OWNER may be required or deem it necessary to pay on account of employees of CONTRACTOR or its subcontractors. CONTRACTOR agrees to furnish OWNER with the information required to enable it to make the necessary reports and to pay such taxes or charges. At its election, OWNER is authorized to deduct all sums so paid for such taxes and governmental charges from such amounts as may be or become due to CONTRACTOR hereunder. ACQUISITIONS/DISPOSITIONS OF ASSETS (OTHER THAN ENTIRE BUSINESS) • Sales taxes – Who is responsible? – Statutory rules/exemptions – Exemption certificates • Property taxes – Allocation for year of sale SAMPLE SALES TAX PROVISION • All transfer, documentary, sales, use, stamp, registration and other such Taxes and fees (including any penalties and interest) incurred in connection with this Agreement, shall be paid by Buyer when due, and Buyer will, at its own expense, file all necessary Tax Returns and other documentation with respect to all such transfer, documentary, stamp, registration and other Taxes and fees, and, if required by applicable law, the Seller will join in the execution of any such Tax Returns and other documentation. SAMPLE PROPERTY TAX PROVISION • Taxes for the current year have not yet been paid by Seller and have been prorated between Purchaser and Seller, and Purchaser assumes responsibility for all future tax payments. All future tax notices, bills and assessments should be mailed to: ______________________________ ______________________________ PURCHASE OF BUSINESS • Asset purchase – Or • Stock purchase ISSUES RELATED TO ASSET PURCHASE – Sales/property tax issues • May be casual sale exemption. – Allocation of consideration among assets SAMPLE ASSET PURCHASE PROVISION • The parties hereto agree that the consideration set forth in Section ____ hereof shall be allocated as stated in Exhibit ____. Purchaser and Seller each agrees to file its federal income tax returns and its other tax returns (including any forms or reports required to be filed pursuant to Section 1060 of the Code, the regulations promulgated thereunder or any provisions of state and local law (“1060 Forms”)) reflecting such allocation and to take no position contrary thereto unless required to do so pursuant to a determination (as defined in Section 1313(a) of the Code). The parties agree further to cooperate in the preparation of any 1060 Forms and to file such 1060 Forms in the manner required by applicable law. ISSUES RELATED TO STOCK PURCHASE – Franchise tax allocation for year of sale – Allocation of income tax for year of sale • Flow through entity issues SAMPLE PROVISIONS – STOCK PURCHASE The following provisions shall govern the allocation of responsibility as between the Buyer and Sellers for certain tax matters following the Closing Date: • Tax Periods Ending on or Before the Closing Date. The Company has prepared and filed all Federal and state income Tax Returns for the Company and its Subsidiaries for the tax year ended December 31, 200__. • Tax Periods Beginning Before and Ending After the Closing Date. The Buyer shall prepare or cause to be prepared and file or cause to be filed any Tax Returns of the Company and its Subsidiaries for Tax periods which begin before the Closing Date and end after the Closing Date. An amount equal to the portion of such Taxes which relates to the portion of such Taxable period ending on the Closing Date to the extent such Taxes are not reflected in the Final Tax Accrual shall be considered Damages to the Buyer Group under Section 7.2(a) and shall be subject to Section 7.2(h). SAMPLE PROVISIONS – STOCK PURCHASE (cont.) • Refunds and Tax Benefits. Any Tax refunds that are received by the Buyer or the Company and its Subsidiaries, and any amounts credited against Tax to which the Buyer or the Company and its Subsidiaries become entitled, that relate to Tax periods or portions thereof ending on or before the Closing Date shall be for the account of the Sellers except to the extent any such payment or credit against Tax is reflected as an asset for purposes of Closing Date Working Capital. • Cooperation on Tax Matters. The Buyer, the Company and its Subsidiaries and Sellers shall cooperate fully, as and to the extent reasonably requested by the other party, in connection with the filing of Tax Returns pursuant to this Section and any audit, litigation or other proceeding with respect to Taxes. SAMPLE PROVISION – Tax Representation • The Company and each of its Subsidiaries (A) have timely paid all Taxes required to be paid by them (including any Taxes shown due on any Tax Return) and (B) have filed or caused to be filed in a timely manner (within any applicable extension periods) all Tax Returns required to be filed by them with the appropriate Governmental Entities in all jurisdictions in which such Tax Returns are required to be filed, and all such Tax Returns are true and complete in all material respects. No claim has ever been made by an authority in a jurisdiction where the Company or any of its Subsidiaries does not file Tax Returns that the Company or any of its Subsidiaries is or may be subject to taxation by that jurisdiction. STOCK SALES WHICH ARE TAX ASSET SALES • Disregarded entities • Deemed asset sales Thank You King, Leblanc & Bland P.L.L.C 201 Saint Charles Avenue, 45th Floor New Orleans, LA 70170 6363 Woodway, Suite 750 Houston, TX 77057 Henry A. King was born in New London, Connecticut. After graduation from Vanderbilt University with a B.A. in 1974 and Louisiana State University with a Juris Doctorate degree in 1977, he was admitted to the Louisiana Bar in 1978 and the Texas Bar in 1992. Henry was a co-founder of King, LeBlanc & Bland, P.L.L.C. which was formed with five attorneys in October 1985. Henry’s principal areas of practice include admiralty law, complex commercial litigation, construction law and oil and gas disputes. He has litigated or arbitrated commercial and casualty matters in many jurisdictions including Saudi Arabia, India, England and throughout the United States. Henry also has considerable experience representing clients in corporate and banking related matters, particularly in the maritime and energy-related fields. Henry is a member of the U.S. Fifth, Eleventh and Federal Appellate Circuits. He is currently a member of the Louisiana, Texas and American Bar Associations, as well as the Louisiana Banker’s Association, the Maritime Law Association of the United States (Marine Finance Committee, 1985 - ) and the Southeastern Admiralty Law Institute (New Orleans Port Directors 2000 - ). He is a member of the LSU Law School Board of Trustees and a fellow in the Louisiana Bar Foundation. 201 St. Charles Ave., 45th Floor New Orleans, LA 70170 6363 Woodway, Suite 750 Houston, TX 77057 J. Grant Coleman was born in Lynchburg, Virginia. He received a Bachelor of Arts in History from the University of New Orleans in 1971, a Juris Doctorate from Tulane University in 1974 and a Master of Laws in Taxation from the University of Miami in 1977. He has been a Board Certified Specialist in Taxation since the inception of the Louisiana Specialization Program in 1985. He was chair of the Louisiana State Bar Association Section on Taxation in 1992 and served on the Louisiana State Bar Association Specialization Board for Taxation from 1993-1996. He is past chair of the New Orleans Bar Association Tax Committee. He is a member of the Partnership Committee of the American Bar Association Section on Taxation. He is a Fellow of the American College of Trust and Estate Counsel. He served on the adjunct tax faculty at Louisiana State University Law School in 1999 and currently is an Adjunct Associate Professor at Tulane Law School where he has taught courses in tax law since 1995. His practice has focused primarily on taxation and business law and he has been a frequent author and lecturer on taxation and business law matters. His practice experience includes planning, compliance and controversy in virtually every area of federal, state and local taxation. He is admitted to practice before all Louisiana federal and state courts and the United States Tax Court. He is also admitted to practice in the District of Columbia. Timothy S. Madden was born in New Orleans, Louisiana. He graduated summa cum laude from Loyola University with a B.B.A in accounting with a secondary concentration in computer science in 1987. Prior to entering law school, Tim worked for three years as a Certified Public Accountant for Ernst & Whinney. In 1992, he received his juris doctorate degree from Loyola University, graduating magna cum laude. During law school, he served as a member of the Loyola Law Review. Upon graduation, he served as a judicial law clerk to the Honorable Chief Justice Pascal F. Calogero of the Louisiana Supreme Court for one year. He works primarily in the fields of commercial litigation and maritime personal injury defense. Tim also serves on the Law School Liaison committee for the Young Lawyers Section of the Louisiana State Bar Association. 201 St. Charles Ave., 45th Floor New Orleans, LA 70170 6363 Woodway, Suite 750 Houston, TX 77057 Robert J. Stefani, Jr. was born in Irvington, New Jersey. Bob was admitted to the bars of the States of Louisiana and New York in 1988 and the bar of the District of Columbia in 1989. Prior to joining King, LeBlanc & Bland, P.L.L.C. in March of 1998, Bob was a partner with Robins, Kaplan, Miller & Ciresi in Washington, D.C. He received a Bachelor of Arts, cum laude, from Brandeis University in 1983 and a Juris Doctorate, cum laude, from Tulane University in 1987. Bob practices primarily in the fields of commercial and financial transactions and commercial and insurance litigation, with emphasis on matters pertaining to the oil and gas and marine industries. He has extensive experience in the fields of marine pollution, ship finance, shipping and port regulation and government contracting, and in dealing with the Maritime Administration, Coast Guard, Federal Maritime Commission and the Congress. He is a member of the Maritime Law Association of the United States and the Maritime Administrative Bar Association.