Georgia Real Estate, 8e - PowerPoint for Ch 09

advertisement

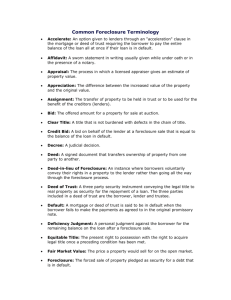

Chapter 9 Georgia Real Estate An Introduction to the Profession Eighth Edition Chapter 9 Notes and Security Documents Key Terms • • • • • • • • • • acceleration clause • mortgagor alienation clause • naked title beneficiary • power of sale deed of trust • promissory note deficiency judgment • reconveyance deed defeasance clause • second mortgage first mortgage • security deed foreclosure • subordination junior mortgage • trustee mortgagee • trustor © 2015 OnCourse Learning Overview There are two documents used in a typical real estate loan. The first is the promissory note and the second is the security document. Most states use a mortgage as the security document, some use a deed of trust. Georgia uses a security deed. © 2015 OnCourse Learning Promissory Note The promissory note is a contract between a borrower and a lender. If there is no note, there is no debt. A note is a negotiable instrument in that it creates a debt. The debt created can be conveyed to a third party. © 2015 OnCourse Learning Promissory Note A note must be: • in writing • between a borrower and a lender • state certain sum of money • show the terms of payment • by signed by the borrower • voluntarily delivered by the borrower and accepted by the lender © 2015 OnCourse Learning Interest Conveyance Interest in real estate loans is almost always computed as simple interest. Interest is paid in arrears. © 2015 OnCourse Learning Prepayment Rights All VA-guaranteed and FHA-insured loans allow prepayment. Most conventional loans do not have a prepayment penalty, legally they can. © 2015 OnCourse Learning Default In the event of a late payment, the note will provide for a penalty. In the event the payments are not made, there will be a provision for acceleration. © 2015 OnCourse Learning Security Virtually all notes are secured, via a mortgage, trust deed or security deed. The note will tie defaults to the security as a default to the note. © 2015 OnCourse Learning The Mortgage Instrument The mortgage is a separate agreement from the promissory note. The mortgage provides security that the lender can sell if the note is not paid. Hypothecation means the borrower retains the right to possess and use the property while it serves as collateral. © 2015 OnCourse Learning The Mortgage Instrument The mortgagor is the person giving the mortgage. The mortgagor is the borrower. The lender is receiving the security, so they are the mortgagee. A loan is given by the lender; the mortgage is given by the borrower. © 2015 OnCourse Learning Deed of Trust A trust deed or deed of trust is a three-party arrangement consisting of the borrower (trustor), the lender (beneficiary) and a neutral third party (trustee). The borrower executes a deed to the trustee instead of the lender. © 2015 OnCourse Learning Deed of Trust Real property is used as security for a debt. If the debt is not repaid, the property is sold and the proceeds are applied to the balance owed. © 2015 OnCourse Learning Parties to a Deed of Trust The borrower conveys title to the trustee, to be held in trust until the note is paid in full. The deed of trust is recorded in the county where the property is located. © 2015 OnCourse Learning Parties to a Deed of Trust The title that the borrower grants to the trustee is referred to as a naked title or bare title. The borrower still retains the right to occupy and use the property. © 2015 OnCourse Learning Parties to a Deed of Trust As long as the note is not in default, the trustee’s title lies dormant. The lender does not receive title, only a right that allows the lender to request the trustee to act. © 2015 OnCourse Learning Reconveyance When the note is paid in full, the lender sends to the trustee a request for reconveyance. The trustee cancels the note and issues the borrower a reconveyance deed. © 2015 OnCourse Learning Default If a borrower defaults under a deed of trust, the lender instructs the trustee to sell the property and pay the balance due on the note. © 2015 OnCourse Learning Default The power of sale clause found in the deed of trust is designed to give the trustee the authority to sell the property without having to go through a court-ordered foreclosure proceeding. © 2015 OnCourse Learning Trustee The trustee is expected to be neutral and fair to both the borrower and the lender. Mortgages are legal in Georgia, but they are not commonly used. © 2015 OnCourse Learning Security Deed A security deed provides security for the note in Georgia. The security deed conveys legal title to the lender. This allows the lender to foreclose in a non-judicial process. © 2015 OnCourse Learning Security Deed The borrower is giving the deed; the borrower is the grantor. The lender is receiving the deed; the lender is the grantee. © 2015 OnCourse Learning Provisions of the Security Deed The alienation clause is also known as the due on sale clause. If the borrower sells or conveys any interest in the property to another without the lender’s prior written consent, such transfer is considered a default. © 2015 OnCourse Learning Provisions of the Security Deed The lender has the right to call the entire loan balance due and payable. This clause keeps most conventional loans from being assumed. © 2015 OnCourse Learning Provisions of the Security Deed Equitable redemption is the borrower’s right to reinstate a defaulted loan after acceleration but before foreclosure. When a borrower has the right to reinstate ownership of the property after the foreclosure sale, the right is known as statutory redemption. © 2015 OnCourse Learning Provisions of the Security Deed Georgia does not recognize statutory redemption on a loan foreclosure. © 2015 OnCourse Learning Provisions of the Security Deed If the borrower defaults, the acceleration clause allows the lender to demand an immediate payment of the debt and invoke the power of sale. The sale is publicly advertised, then sold on the courthouse steps. © 2015 OnCourse Learning Provisions of the Security Deed The defeasance clause requires the lender to cancel the security instrument upon full payment. The lender must provide recorded proof that the debt has been paid. © 2015 OnCourse Learning Satisfaction of the Security Deed When a borrower creates a debt against a property, the security deed is recorded. Upon payoff of the note, the lender has the obligation to record a “Cancellation of Deed to Secure Debt” showing that the debt is paid. © 2015 OnCourse Learning Foreclosure on a Security Deed The primary reason that a security deed is used in Georgia rather than a mortgage is the foreclosure process. By using a security deed, the foreclosure process becomes non-judicial. The security deed transfer title to the lender. © 2015 OnCourse Learning Foreclosure on a Security Deed The security deed contains an acceleration clause which allows the lender to call the debt due upon the occurrence of an event, commonly a default on the payments. © 2015 OnCourse Learning Foreclosure on a Security Deed The property would be advertised for four consecutive weeks and then put up at public auction on the county courthouse steps on the first Tuesday of each month. Any party wishing to bid must come with cash (typically a letter of credit from a financial institution). © 2015 OnCourse Learning Foreclosure on a Security Deed The lender will typically bid the amount of the debt and costs. They are essentially bidding on the note. © 2015 OnCourse Learning Foreclosure on a Security Deed On a loan foreclosure in Georgia, the borrower has the legal right to pay off the loan any time before the sale and reclaim the property. This is known as equitable redemption. © 2015 OnCourse Learning Foreclosure on a Security Deed Once the sale is final, some states allow the borrower to reimburse the investor from the sale. This is known as statutory redemption. Georgia does not recognize statutory redemption. The foreclosure against debt is final. © 2015 OnCourse Learning “Subject To” If an existing mortgage on a property does not contain a due-on-sale clause, the seller can pass the benefits of that financing along to the buyer. The buyer can purchase the property subject to the existing loan. © 2015 OnCourse Learning “Subject To” The buyer takes no personal responsibility for the loan and the mortgage. The buyer pays the remaining loan payments as they come due, but the seller is still personally liable to the lender for the loan. © 2015 OnCourse Learning “Subject To” If the buyer stops making payments before the loan is fully paid, the seller is totally liable. Properties are seldom sold “subject to debt.” © 2015 OnCourse Learning Assumption Under an assumption, the buyer promises in writing to the seller to pay the loan, becoming personally obligated to the seller. The seller’s name is still on the original promissory note, but the seller has recourse against the buyer. © 2015 OnCourse Learning Assumption with a release of liability The safest arrangement for the seller is to ask the lender to substitute the buyer’s liability for his. This is an assumption with a release of liability through novation. © 2015 OnCourse Learning Assumption with a release of liability Novation releases the seller from the personal obligation created by the promissory note. The lender will require the buyer to prove financial capability to repay. © 2015 OnCourse Learning Estoppel An estoppel certificate is used when the holder of a loan sells the loan to another investor. The borrower is asked to verify the amount still owed and the rate of interest. © 2015 OnCourse Learning Debt Priorities When a default occurs and the price the property brings at its foreclosure sales does not cover all the loans against it, the debt with the highest priority is satisfied first, then the next highest debt is satisfied, until the sale proceeds are exhausted or all debts are satisfied. © 2015 OnCourse Learning First and Second Mortgages A lender will want to be in the most senior position possible. The first lender to record holds the first mortgage. If the same property is used to secure another note before the first is fully satisfied, the new mortgage is a second mortgage. © 2015 OnCourse Learning First and Second Mortgages Any mortgage with a lower priority is known as a junior mortgage. This can only be determined by searching the public records for mortgages recorded against the property. © 2015 OnCourse Learning Subordination Subordination allows a junior loan to move up in priority. Many homeowners have home equity loans that are seconds. If they wish to refinance the first to reduce the interest rate, this would push the equity loan into first position. © 2015 OnCourse Learning Subordination Refinancing lenders would never allow themselves to be second to a home equity loan. Home equity lenders are asked to subordinate to the new loan. © 2015 OnCourse Learning Chattel Liens A chattel mortgage is a mortgage secured by personal property. © 2015 OnCourse Learning The Foreclosure Process To foreclose means to cut off. © 2015 OnCourse Learning Delinquent Loan Foreclosure occurs because the note is not being repaid on time. When a borrower runs behind in payments, the loan is said to be a delinquent loan. A lender considers foreclosure to be a last resort. © 2015 OnCourse Learning Delinquent Loan The lender would much rather have the borrower make regular payments. If a borrower cannot make payments, cannot find a buyer for the property, and the lender sees no further sense in stretching the payment schedule, the acceleration clause will be invoked and foreclosure will begin. © 2015 OnCourse Learning Foreclosure Routes Judicial foreclosure means taking the matter to court in the form of a lawsuit. It is costly and time-consuming. Non-judicial foreclosure is conducted by the lender in accordance with the mortgage and the state law. It is faster, simpler and cheaper. © 2015 OnCourse Learning Foreclosure Routes Non-judicial foreclosure is preferred by the lender when the case is simple and straightforward. © 2015 OnCourse Learning Judicial Foreclosure Judicial foreclosure process begins with a title search. The lender files a lawsuit naming the borrower as the defendants. The lender identifies the debt and the mortgage securing it. © 2015 OnCourse Learning Judicial Foreclosure The lender asks the court for a judgment directing that the defendant’s interests in the property be cut off, the property sold at public auction and the lender’s claim be paid from the proceeds of the sale. © 2015 OnCourse Learning Surplus Money Action A junior mortgage holder will file a surplus money action in the hopes that the property will sell at foreclosure for enough money to satisfy all senior claims as well as their own claim against the borrower. © 2015 OnCourse Learning Notice of Lis Pendens A notice of lis pendens informs the public that a legal action is pending against the borrower. If the borrower attempts to sell the property at this time, a prospective buyer will learn of the pending litigation from a title search. © 2015 OnCourse Learning Public Auction The foreclosure sale is usually a public auction to obtain the best possible price for the property by inviting competitive bids. © 2015 OnCourse Learning Equity of Redemption The sale is conducted by the county sheriff. The lender is usually present and is able to bid the loan. The lender can bid up to the amount of owed without having to pay cash. All other bidders must pay cash. © 2015 OnCourse Learning Equity of Redemption The foreclosure does not cut off property tax liens against the property. © 2015 OnCourse Learning Deficiency Judgment If the property sells for more than the claims against it, the borrower receives the excess. Georgia allows the lender to pursue a deficiency judgment against the borrower’s other unsecured assets. This may require the borrower to sell those assets. © 2015 OnCourse Learning Deficiency Judgment The purchaser at the foreclosure sale receives a sheriff’s deed. These are usually special warranty deeds. The purchaser may take immediate possession. The court will assist in removing anyone in possession who was cut off in the foreclosure proceedings. © 2015 OnCourse Learning Statutory Redemption In states with statutory redemption laws, the foreclosed borrower has from one month to one year after the sale to pay in full the judgment and retake title. The high bidder receives a certificate of sale entitling the bidder to a sheriff’s deed if no redemption is made. © 2015 OnCourse Learning Statutory Redemption The purchaser may or may not get possession until then. Bidders tend to offer less that what the property would be worth if title and possession could be delivered immediately after the foreclosure sale. © 2015 OnCourse Learning Statutory Redemption Georgia does not allow for a statutory redemption on a security deed foreclosure. © 2015 OnCourse Learning Strict Foreclosure Strict foreclosure is a judicial foreclosure without a judicial sale. The lender files a lawsuit requesting the borrower be given a period of time to exercise the equitable right of redemption or lose all rights to the property, with title transferring irrevocably to the lender. © 2015 OnCourse Learning Non-judicial Foreclosure The power of sale clause in the mortgage gives the lender the power to conduct the foreclosure and sell the property without taking the issue to court. © 2015 OnCourse Learning Non-judicial Foreclosure Lenders foreclosing under power of sale cannot award themselves a deficiency judgment. If there is a deficiency as a result of the sale, the lenders must go to court for it. © 2015 OnCourse Learning Non-judicial Foreclosure A junior mortgage holder will file a request for notice of default when the mortgage is originally recorded. This requires anyone holding a senior lien to notify the junior mortgagee if a default notice has been filed. © 2015 OnCourse Learning Entry and Possession Entry and possession is based on the lender giving notice to the borrower that the lender wants possession of the property. The borrower moves out and the lender takes possession. This would be witnessed and recorded in the public records. © 2015 OnCourse Learning Deed in Lieu of Foreclosure A borrower may want to voluntarily deed the mortgaged property to the lender. This relieves the lender of foreclosing and waiting for any redemption period. © 2015 OnCourse Learning Deed in Lieu of Foreclosure A deed in lieu of foreclosure is a voluntary act sometimes called a “friendly foreclosure.” This may not cut off the rights of junior mortgage holders. The lender may have to make those payments or be foreclosed by the junior mortgage holder. © 2015 OnCourse Learning Overview of Mortgage Foreclosure © 2015 OnCourse Learning