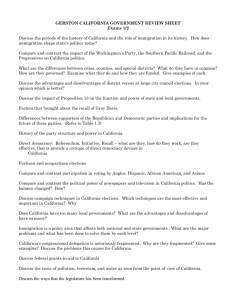

PowerPoint Slides - California State University, Long Beach

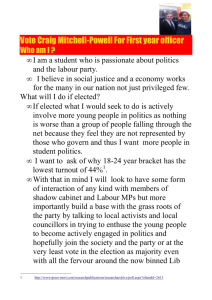

advertisement