Accounting Review Questions: Merchandising Companies

advertisement

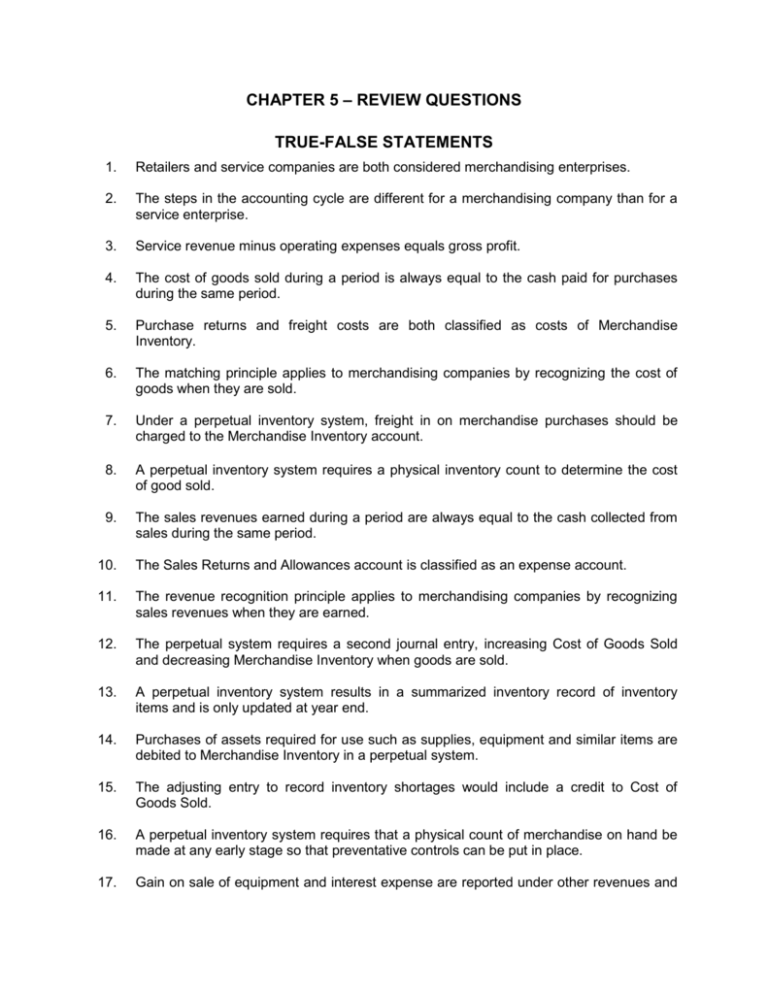

CHAPTER 5 – REVIEW QUESTIONS TRUE-FALSE STATEMENTS 1. Retailers and service companies are both considered merchandising enterprises. 2. The steps in the accounting cycle are different for a merchandising company than for a service enterprise. 3. Service revenue minus operating expenses equals gross profit. 4. The cost of goods sold during a period is always equal to the cash paid for purchases during the same period. 5. Purchase returns and freight costs are both classified as costs of Merchandise Inventory. 6. The matching principle applies to merchandising companies by recognizing the cost of goods when they are sold. 7. Under a perpetual inventory system, freight in on merchandise purchases should be charged to the Merchandise Inventory account. 8. A perpetual inventory system requires a physical inventory count to determine the cost of good sold. 9. The sales revenues earned during a period are always equal to the cash collected from sales during the same period. 10. The Sales Returns and Allowances account is classified as an expense account. 11. The revenue recognition principle applies to merchandising companies by recognizing sales revenues when they are earned. 12. The perpetual system requires a second journal entry, increasing Cost of Goods Sold and decreasing Merchandise Inventory when goods are sold. 13. A perpetual inventory system results in a summarized inventory record of inventory items and is only updated at year end. 14. Purchases of assets required for use such as supplies, equipment and similar items are debited to Merchandise Inventory in a perpetual system. 15. The adjusting entry to record inventory shortages would include a credit to Cost of Goods Sold. 16. A perpetual inventory system requires that a physical count of merchandise on hand be made at any early stage so that preventative controls can be put in place. 17. Gain on sale of equipment and interest expense are reported under other revenues and gains in a multiple-step income statement. 18. The gross profit section for a merchandising company appears on both the multiple-step and single-step forms of an income statement. 19. In a multiple-step income statement, income from operations excludes other revenues and gains and other expenses and losses. 20. A single-step income statement reports all revenues, both operating and other revenues and gains, at the top of the statement. 21. If net sales are $1,000,000 and cost of goods sold is $800,000, the gross profit margin is 20%. 22. Gross profit represents the merchandising profit of a company. 23. Gross profit is a measure of the overall profitability of a company. 24. Gross profit is calculated by dividing cost of goods sold by net sales. 25. Sales revenues, cost of goods sold, and gross profit are sections of a merchandising company's income statement not commonly found on the income statement of a service company. 26. In a trial balance of a merchandising company, all income statement accounts with debit balances are expenses. 27. Non-operating activities exclude revenues and expenses that result from secondary or auxiliary operations. 28. Inventory turnover indicates how rapidly inventory is bought. 29. Days sales in inventory indicates the age of the inventory. 30. Inventory turnover ratio indicates the number of times the inventory is counted. *31. GST is a single stage tax collected from final consumers on goods and services. *32. PST is a multi-stage tax of 7%, imposed each time a good or service is sold. *33. In a work sheet, beginning merchandise inventory will be shown in the trial balance (Dr.), adjusted trial balance (Dr.) and income statement (Dr.) columns. *34. Ending merchandise inventory is classified as a current asset in a classified balance sheet. *35. A major difference between preparing the income statement of a service company and a merchandising company is the need to present the cost of goods sold. Answers to True-False Statements Item 1. 2. 3. 4. 5. Ans. F F F F T Item 6. 7. 8. 9. 10. Ans. T T F F F Item 11. 12. 13. 14. 15. Ans. T T F F F Item 16. 17. 18. 19. 20. Ans. Item T F F T T Ans. 21. 22. 23. 24. 25. T T F F T Item 26. 27. 28. 29. 30. Ans. Item Ans. F F F T F *31. *32. *33. *34. *35. F F T T T MULTIPLE CHOICE QUESTIONS 36. An enterprise which sells goods to customers is known as a a. proprietorship. b. corporation. c. retailer. d. service firm. 37. Which of the following would not be considered a merchandising operation? a. Retailer b. Wholesaler c. Service firm d. Trading concern 38. A merchandiser differs from a service type business in that it a. makes, buys, or sells goods to customers. b. is more profitable. c. has greater cash flow. d. requires more government regulation. 39. Two categories of expenses in merchandising companies are a. cost of goods sold and financing expenses. b. operating expenses and financing expenses. c. cost of goods sold and operating expenses. d. sales and cost of goods sold. 40. The primary source of revenue for a service company is a. investment income. b. service revenue. c. the sale of merchandise. d. the sale of capital assets the company owns. 41. Service revenue less operating expenses is called a. gross profit. b. net profit. c. net income. d. marginal income. 42. The operating cycle of a service company differs from that of a merchandising company in that it a. is usually longer in days. b. is usually shorter in days. c. involves the purchase of inventory. d. involves the sale of merchandise. 43. Which of the following expressions is incorrect? a. Gross profit – operating expenses = net income b. Sales – cost of goods sold – operating expenses = net income c. Net income + operating expenses = gross profit d. Operating expenses – cost of goods sold = gross profit 44. With respect to the income statement, a. contra-revenue accounts do not appear on the income statement. b. quantity discounts increase the dollar value of sales. c. contra-revenue accounts increase the amount of operating expenses. d. cost of goods sold reduces gross profit. 45. The journal entry to record a return of merchandise purchased on account under a perpetual inventory system would credit a. Accounts Payable. b. Purchase Returns and Allowances. c. Sales. d. Merchandise Inventory. 46. Under a perpetual inventory system, acquisition of merchandise for resale is debited to the a. Merchandise Inventory account. b. Cost of Goods Sold account. c. Supplies account. d. Purchases account. 47. In a perpetual inventory system, cost of good sold is recorded a. on a daily basis. b. on a monthly basis. c. on an annual basis. d. with each sale. 48. Under a perpetual inventory system, the following entry would be made to record the purchase of inventory on account: a. Merchandise Inventory ....................................................... 500 Accounts Payable ................................................... 500 b. Purchases .......................................................................... 500 Accounts Payable ................................................... 500 c. Cost of Goods Sold............................................................. 500 Accounts Payable ................................................... 500 d. Merchandise Inventory ....................................................... 500 Cost of Goods Sold ................................................. 500 49. Under a perpetual inventory system, the following entry would be made to record the return of merchandise purchased on account: a. Accounts Payable ............................................................... 500 Purchases ............................................................... 500 b. Accounts Payable ............................................................... 500 Merchandise Inventory ............................................ 500 c. Accounts Payable ............................................................... 500 Purchase Returns and Allowances .......................... 500 d. Accounts Payable ............................................................... 500 Cost of Goods Sold ................................................. 500 50. If Sarajevo's Video Store's accounting records show, using a perpetual inventory system, an ending inventory balance of $25,000 and a physical count shows a balance of $23,000, it is important to a. debit your inventory records. b. purchase additional inventory. c. remove the nonexistent inventory from your records. d. credit Cost of Goods Sold. 51. Detailed records of goods held for resale are not maintained under a a. perpetual inventory system. b. periodic inventory system. c. double-entry accounting system. d. single-entry accounting system. 52. the Under a periodic inventory system, acquisition of merchandise for resale is debited to a. b. c. d. Merchandise Inventory account. Purchases account. Supplies account. Cost of Goods Sold account. 53. Using a periodic inventory system, cost of goods sold is determined a. at the end of every month. b. after every transaction is recorded. c. at the time of every sale. d. at the end of the accounting period. 54. Purchases of items held for use in the business should be debited to the a. Merchandise Inventory account. b. Cost of Goods Sold account. c. Purchases account. d. Supplies account. 55. The entry to record the purchase of merchandise inventory on account would require a a. debit to the Merchandise Inventory account and a credit to the Accounts Payable account. b. debit to the Accounts Payable account and a credit to the Merchandise Inventory account. c. debit to the Merchandise Inventory account and a credit to the Cash account. d. credit to the Merchandise Inventory account and a debit to the Cost of Goods Sold account. 56. Brown Company purchased merchandise from Drabek Company with freight terms of FOB shipping point. The freight costs will be paid by the a. seller. b. buyer. c. transportation company. d. buyer and the seller. 57. Using a perpetual inventory system, Freight in a. increases the cost of merchandise inventory. b. is contra to the Purchases account. c. is a permanent account. d. reflects the cost of delivering goods to customers. 58. Wright Company recently made a purchase of $10,000 from a major supplier. Shipping costs were $200, terms FOB shipping point. To record this purchase, Wright Company will need to debit the a. Merchandise Inventory account for $10,000. b. Cost of Goods Sold account for $200. c. Merchandise Inventory account for $10,200. d. Cost of Goods Sold account for $10,200. 59. Benedict Shoe Store had a beginning merchandise inventory of $18,000. During the period, Purchases were $70,000; Purchase Returns, $3,000; and Freight in $6,000. A physical count of inventory at the end of the period revealed that $12,000 was still on hand. Using a perpetual inventory system, the cost of goods sold was a. $88,000. b. $79,000. c. $91,000. d. $85,000. 60. Cost of goods sold, in a perpetual inventory system, is calculated as a. beginning inventory – cost of goods purchased + ending inventory. b. sales – cost of goods purchased + beginning inventory – ending inventory. c. sales + gross profit – ending inventory + beginning inventory. d. beginning inventory + cost of goods purchased – ending inventory. 61. If a company determines cost of goods sold each time a sale occurs, it a. must have a computer accounting system. b. uses a combination of the perpetual and periodic inventory systems. c. uses a periodic inventory system. d. uses a perpetual inventory system. 62. The Sales Returns and Allowances account is classified as a. an asset account. b. a contra asset account. c. an expense account. d. a contra revenue account. 63. As an incentive for customers to purchase a large number of items at one time, a business may offer its customers a. a sales discount. b. free delivery. c. a sales allowance. d. a quantity discount. 64. As an incentive for customers to pay their accounts promptly, a business, in certain industries, may offer its customers a. a sales discount. b. free delivery. c. a sales allowance. d. a quantity discount. 65. A credit memorandum is prepared when a. an employee does a good job. b. goods are sold on credit. c. goods that were sold on credit are returned. d. customers refuse to pay their accounts. 66. Sales revenues are usually considered earned when a. cash is received from credit sales. b. an order is received. c. goods have been transferred from the seller to the buyer. d. adjusting entries are made. 67. A sales invoice is a source document that a. provides support for goods purchased for resale. b. provides evidence of incurred operating expenses. c. provides evidence of credit sales. d. serves only as a customer receipt. 68. The journal entry to record a shortage of inventory at the end of the accounting period is a. Cost of Goods Sold Inventory b. Inventory Service Revenue c. Accounts Receivable Service Revenue d. Accounts Receivable Inventory 69. Sales revenue a. may be recorded before cash is collected. b. will always equal cash collections in a month. c. only results from credit sales. d. is only recorded after cash is collected. 70. A Sales Returns and Allowances account is not debited if a customer a. returns defective merchandise. b. receives a credit for merchandise of inferior quality. c. utilizes a prompt payment incentive. 71. d. returns goods that are not in accordance with specifications. If a customer agrees to keep merchandise that is defective because the seller is willing to reduce the selling price, this transaction is known as a sales a. discount. b. return. c. contra asset. d. allowance. 72. A credit memorandum is used as documentation for a journal entry that requires a debit to a. Sales and a credit to Cash. b. Sales Returns and Allowances and a credit to Accounts Receivable. c. Accounts Receivable and a credit to a contra-revenue account. d. Cash and a credit to Sales Returns and Allowances. 73. When goods are returned that relate to a prior cash sale, a. the Sales Returns and Allowances account should not be used. b. the Cash account will be credited. c. Sales Returns and Allowances will be credited. d. Accounts Receivable will be credited. 74. The Sales Returns and Allowances account does not provide information to management about a. possible inferior merchandise. b. the percentage of credit sales versus cash sales. c. inefficiencies in filling orders. d. errors in overbilling customers. 75. A quantity discount is a. an incentive for customers to pay quickly. b. recorded as a contra revenue account. c. considered to be a sales allowance. d. a cash savings to the purchaser. 76. Tokyo Company sells merchandise on account for $1,200 to Thomas Company. Thomas Company returns $400 (cost $250) of merchandise that was damaged, along with a cheque to settle the account. What entry does Tokyo Company make upon receipt of the cheque? a. Cash ................................................................................ 800 Accounts Receivable ............................................... 800 b. Cash ................................................................................ 784 Sales Returns and Allowances ........................................... 416 Accounts Receivable ............................................... 1,200 c. Cash ................................................................................ 800 Sales Returns and Allowances ........................................... 400 Inventory............................................................................. 250 Accounts Receivable ............................................... 1,200 Cost of Goods Sold ................................................. 250 d. Cash ................................................................................ 1,200 Sales Returns and Allowances ................................ 400 Accounts Receivable ............................................... 800 77. Which of the following would be classified as a contra account? a. Sales b. Sales Returns and Allowances c. Merchandise Inventory d. Supplies Expense 78. Which of the following accounts has a normal credit balance? a. Sales Returns and Allowances b. Delivery Expense c. Sales d. Selling Expense 79. If a purchaser returns goods purchased on account to the supplier under a perpetual inventory system, the purchaser would debit a. Cost of Goods Sold. b. Accounts Payable. c. Inventory. d. Purchase Returns. 80. A perpetual inventory system would likely be used by a(n) a. automobile dealership. b. hardware store. c. drugstore. d. convenience store. 81. A periodic inventory system would likely be used by a(n) a. import car dealership. b. home appliance store. c. art gallery. d. drugstore. 82. Which of the following is a true statement about inventory systems? a. Periodic inventory systems require more detailed inventory records. b. Perpetual inventory systems require more detailed inventory records. c. A periodic system requires cost of goods sold be determined after each sale. d. A perpetual system is specifically designed for companies that sell low unit-value items. 83. A physical inventory should be taken a. after every purchase of merchandise. b. after every sale. c. at or near the balance sheet date. d. only if a manual accounting system is used. 84. Northend Electric returned to Southerby Inc. 5 damaged fuses. Southerby accepted the return and refunded the $200 Northend had paid for the order. To record this return, Southerby’s accountant must a. debit Cash and credit Sales for $200. b. debit Sales and credit Cash for $200. c. debit Sales Returns and Allowances and credit Cash for $200. d. debit Sales Returns and Allowances and credit Accounts Receivable for $200. 85. In a perpetual inventory system, the Merchandise Inventory account should equal the actual merchandise on hand a. at all times b. only after the physical inventory account has occurred. c. only at the beginning of the accounting period. d. only at the end of the accounting period. 86. Taking a physical inventory count involves all of the following except a. counting the units on hand. b. applying unit costs to the total inventory on hand for each item of inventory. c. evaluating whether inventory needs to be written off as obsolete. d. totalling the cost of each item of inventory to determine the total cost of goods on hand. 87. When a seller issues a credit memorandum, the account that is credited is a. Sales. b. Sales Returns and Allowances. c. Purchase Returns and Allowances. d. Accounts Receivable. 88. If a purchaser using a perpetual system agrees to freight terms of FOB shipping point, then the a. Merchandise Inventory account will be increased. b. Merchandise Inventory account will not be affected. c. seller will bear the freight cost. d. carrier will bear the freight cost. 89. Freight costs paid by a seller on merchandise sold to customers will cause an increase a. in the selling expense of the buyer. b. in operating expenses for the seller. c. to the cost of goods sold of the seller. d. to a contra-revenue account of the seller. 90. Using a perpetual inventory system, the respective normal account balances of Merchandise Inventory, Sales Returns and Allowances, and Cost of Goods Sold are a. credit, credit, credit. b. debit, debit, debit. c. debit, credit, credit. d. debit, debit, credit. 91. The sales revenue section of an income statement for a retailer would not include a. Sales returns and allowances. b. Sales. c. Net sales. d. Cost of goods sold. 92. The operating expense section of an income statement for a wholesaler would not include a. shipping expense. b. utilities expense. c. cost of goods sold. d. insurance expense. 93. Income from operations will result if a. the cost of goods sold exceeds operating expenses. b. revenues exceed cost of goods sold. c. revenues exceed operating expenses. d. gross profit exceeds operating expenses. 94. Gross profit for a merchandising concern is net sales minus a. operating expenses. b. cost of goods sold. c. sales returns and allowances. d. cost of goods available for sale. 95. If a company has net sales of $500,000 and cost of goods sold of $350,000, the gross profit margin is a. 70%. b. 30%. c. 15%. d. 100%. 96. A company shows the following balances: Sales Sales Returns and Allowances Cost of Goods Sold $1,000,000 250,000 600,000 What is the gross profit margin? a. 60% b. 80% c. 40% d. 20% 97. Indicate which one of the following would appear on the income statement of both a merchandising enterprise and a service enterprise. a. Gross profit b. Operating expenses c. Sales revenues d. Cost of goods sold 98. Which of the following is not needed to calculate the gross profit margin? a. Sales b. Sales Returns and Allowances c. Cost of Goods Sold d. Operating Expenses 99. Gross profit does not appear a. on a multiple-step income statement. b. on a single-step income statement. c. to be relevant in analysing the operation of a merchandising company. d. on the income statement if the periodic inventory system is used because it cannot be calculated. 100. Which of the following is not a true statement about a multiple-step income statement? a. Operating expenses are often classified as selling and administrative expenses. b. There may be a section for non-operating activities. c. There may be a section for operating assets. d. There is a section for cost of goods sold. 101. Karr Company has a beginning merchandise inventory of $17,000, an ending merchandise inventory of $20,000, and a cost of goods sold of $200,000. Inventory turnover is calculated to be a. 12.1 b. 11.5 c. 10.8 d. 9.5 102. Inventory turnover measures the number of times inventory is a. purchased. b. sold. c. returned. d. paid for. 103. The operating cycle of a merchandising company is a. always one year in length. b. generally longer than it is for a service company. c. about the same as for a service company. d. generally shorter than it is for a service company. 104. In preparing closing entries for a merchandising company, the Owner’s Capital account will be debited for the balance of the a. Sales Revenue account. b. Cost of Goods Sold account. c. Ending Inventory account. d. Cash account. 105. The Merchandise Inventory account balance appearing in an unadjusted trial balance under a perpetual inventory system represents the a. ending inventory. b. beginning inventory. c. cost of merchandise purchased. d. cost of merchandise sold. 106. On a classified balance sheet, merchandise inventory is classified as a a. current liability. b. capital asset. c. current asset. d. long-term investment. 107. The Cost of Goods Sold account a. is a temporary account. b. is a permanent account. c. appears on the balance sheet as an asset. d. appears on the income statement as an operating expense. 108. When using a perpetual inventory system, the adjusting entry required when merchandise inventory records do not agree with the physical count a. has an effect on calculation of Cost of Goods Sold. b. has no effect on Cost of Goods Sold. c. requires reporting a loss when actual is higher than records. d. requires reporting a gain when actual is lower than records. *109. GST is a. a tax on corporate profits. b. not collected in the Atlantic provinces. c. a multi-stage tax collected every time a taxable good or service is provided. d. a single-stage tax collected from final consumers only. *110. PST is a. a tax on personal income. b. not collected in Ontario. c. a multi-stage tax collected every time a taxable good or service is provided. d. a single-stage tax collected from final consumers only. *111. PST is not charged on a. taxable goods and services purchased for resale. b. office supplies used in a retail store. c. goods sold to consumers. d. household purchases. *112. Assume that Joe's Candy Store pays $2,000 cash to replenish its office supplies. PST of 8% and GST of 7% are collected by the retailer, Grand & Toy, for later remittance to the government. The journal entry to record the purchase is a. Office Supplies ................................................................... GST Payable ...................................................................... PST Payable....................................................................... Cash ....................................................................... 2,000 140 160 b. Office Supplies ................................................................... GST Payable ........................................................... PST Payable ........................................................... Cash ....................................................................... 2,300 c. Office Supplies ................................................................... GST Recoverable ............................................................... Cash ....................................................................... 2,160 140 d. Office Supplies ................................................................... GST Recoverable ............................................................... PST Recoverable................................................................ Cash ....................................................................... 2,000 140 160 2,300 140 160 2,000 2,300 2,300 *113. Assume that 7% GST of $266 is due on sales of $3,800. PST is $304. Including tax, the total invoice due is $4,370 ($3,800 + $266 + $304). The following entry would be made to record the credit sale: a. Accounts Receivable .......................................................... GST Recoverable ............................................................... Sales ....................................................................... GST Payable ........................................................... b. Accounts Receivable .......................................................... GST Payable ........................................................... PST Payable ........................................................... Sales ....................................................................... c. Accounts Receivable .......................................................... GST Payable ........................................................... Sales ....................................................................... d. Accounts Receivable .......................................................... Sales ....................................................................... 3,800 266 3,800 266 4,370 266 304 3,800 4,066 266 3,800 3,800 3,800 *114. If a $300 sales return and allowance (plus $21 GST and $24 PST) is granted, the seller's entry to record the credit memorandum will require the following entry: a. Sales Returns and Allowances ........................................... GST Payable ...................................................................... PST Payable....................................................................... Accounts Receivable ............................................... b. Sales ................................................................................ Accounts Receivable ............................................... c. Sales Returns and Allowances ........................................... Accounts Receivable ............................................... d. Sales Returns and Allowances ........................................... GST Payable ........................................................... PST Payable ........................................................... Accounts Receivable ............................................... 300 21 24 345 345 345 300 300 345 21 24 300 *115. Assume that a retail store purchases, on credit, $3,800 of goods and services, plus GST of $266. A perpetual inventory system is used. The following entry would be made to record the purchase: a. Merchandise Inventory ....................................................... GST Recoverable ............................................................... Accounts Payable ................................................... b. Merchandise Inventory ....................................................... Accounts Payable ................................................... GST Recoverable.................................................... 3,800 266 c. Merchandise Inventory ....................................................... Accounts Payable ................................................... 4,066 d. Merchandise Inventory ....................................................... Accounts Payable ................................................... 3,800 4,066 4,066 3,800 266 4,066 3,800 *116. The entry for a retail store, using a perpetual inventory system, to record $300 of inventory returned (including PST), plus $21 GST is a. Accounts Receivable .......................................................... GST Recoverable.................................................... Merchandise Inventory ............................................ b. Accounts Payable ............................................................... Merchandise Inventory ............................................ c. Accounts Payable ............................................................... GST Recoverable.................................................... Merchandise Inventory ............................................ 321 d. Accounts Payable ............................................................... GST Recoverable.................................................... Sales Returns and Allowances ................................ 321 21 300 321 321 321 21 300 21 300 *117. The entry for a retail store, using a perpetual system, to record $300 of merchandise returned by a customer is a. GST Payable ...................................................................... Sales Returns and Allowances ........................................... Cash ....................................................................... 21 300 b. Cash ................................................................................... Merchandise Inventory ............................................ GST Payable ........................................................... 321 c. Cash ................................................................................... Sales Returns and Allowances ................................ GST Payable ........................................................... 321 d. Accounts Receivable .......................................................... GST Receivable ...................................................... Merchandise Inventory ............................................ 321 321 300 21 300 21 21 300 *118. When merchandise is purchased for resale a. GST paid by a business does not form part of the inventory cost. b. PST paid by a business does not form part of the inventory cost. c. the company will receive from the government, reimbursement for GST Recoverable (paid on purchases) and remit separately to the government GST Payable (collected on sales). d. GST and PST paid by a business form part of the inventory cost. *119. A debit in the income statement column of a work sheet of a merchandising company could not represent a(n) a. expense. b. beginning inventory amount. c. contra-revenue amount. d. contra-purchases amount. 120. When recording a credit sale, all of the following accounts are affected except a. Sales Revenue. b. Accounts Receivable. c. Merchandise Inventory. d. Cash. 121. Toby Co. purchased $10,000 in merchandise and sold it six months later for $18,000. At the time of the sale, Toby will a. debit the Cost of Goods Sold account for $18,000. b. debit the Cost of Goods Sold account for $10,000. c. credit the Cost of Goods Sold account for $18,000. d. credit the Cost of Goods Sold account for $10,000. 122. A company uses the Sales Returns and Allowances account to record a. a discount offered for a large quantity purchase. b. a discount received from a supplier to encourage prompt payment. c. returns of inventory to suppliers. d. customer returns of prior sales. 123. Freight costs incurred by a seller on outgoing merchandise are debited to a. the Cost of Goods Sold account. b. the Sales Revenue account. c. an operating expense account. d. the Sales Returns and Allowances account. 124. In a perpetual inventory system, a separate account is maintained for each separate inventory item. These separate accounts are referred to as a. contra accounts. b. subsidiary accounts. c. control accounts. d. purchase accounts. Answers to Multiple Choice Questions Item 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. Ans. c c a c b c b d d d a d a Item 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. Ans. b c b b d d a b a c b d d Item 62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. Ans. d d a c c c a a c d b b b Item 75. 76. 77. 78. 79. 80. 81. 82. 83. 84. 85. 86. 87. Ans. Item Ans. Item Ans. d c b c b a d b c c a c d 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99. 100. a b b d c d b b d b d b c 101. 102. 103. 104. 105. 106. 107. 108. 109. 110. 111. 112. 113. c b b b a c a a c d a c b Item 114. 115. 116. 117. 118. 119. 120. 121. 122. 123. 124. Ans. a a c a a d d b d c b