What's at Stake? The CPA Profession on Federal Fiscal

advertisement

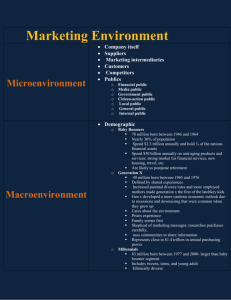

What's at Stake? The CPA Profession on Federal Fiscal Responsibility The role of CPAs • Serve as trusted advisors to a variety of organizations • Help businesses and individuals achieve strong financial standing • Protect the public interest • Explain complex financial issues Today • Overview of the federal budget • Insights into the federal financial statements • Nation’s deficit reality Federal budget Establishes the fiscal goals envisioned by Congress Measured on a cash basis Tool to help guide spending decisions Federal financial statements Record of what has actually happened Prepared on an accrual basis Provide information about longer-term implications FY 2014 financial statements Revenue = $3.0 trillion Expenses = $3.8 trillion; exceeded revenue by $0.8 trillion FY 2014 financial statements Assets= $3.1 trillion Liabilities= $20.8 trillion Accumulated deficit= $17.7 trillion U.S. financial statements differ from other organizations Most financial statements show obligations or liabilities on balance sheet U.S. government’s financial statements do not include Social Security and Medicare • Footnote disclosures • Not reflected as liabilities Reality of future obligations These future obligations equal: Additional social insurance deficit Cumulative deficit $56.7 trillion 17.7 trillion Total deficit $74.4 trillion Key data in publicly traded company’s financial statements Revenue: how much money the company is bringing in Expenses: how much money the company is spending Earnings Expenses < Revenue = Financially Healthy Company Accumulated deficit 14.8 16.1 16.9 17.7 13.5 IN TRILLIONS 11.5 2009 2010 2011 2012 2013 2014 What’s next Visit: aicpa.org/WhatsAtStake Watch What’s at Stake: The CPA Profession on Federal Financial Responsibility Citizens: read A Citizen’s Guide to the Fiscal Year 2012 Financial Report of the U.S. Government Policymakers: read the Financial Report of the U.S. Government Join the public dialogue to make the county’s fiscal health a national priority (Optional) (Add information about what you, your firm and/or your state society is doing in this area) Thank you