Presentation

advertisement

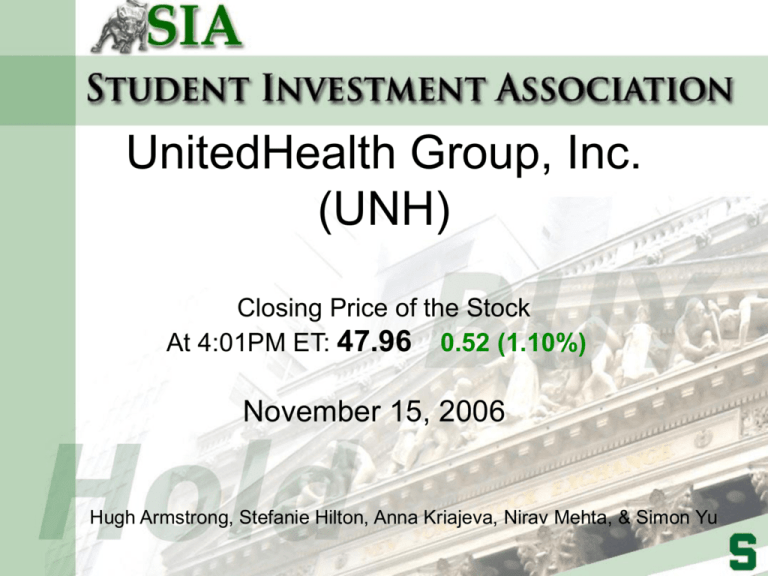

UnitedHealth Group, Inc. (UNH) Closing Price of the Stock At 4:01PM ET: 47.96 0.52 (1.10%) November 15, 2006 Hugh Armstrong, Stefanie Hilton, Anna Kriajeva, Nirav Mehta, & Simon Yu UnitedHealth Group, Inc. • • • • • • • Index: NYSE Sector: Healthcare Industry: Health Care Plans Employees: 55,000 Senior Management: 5 members Board of Directors: 10 members Serves approximately 70 million individuals Company Overview • Customer Information – Mid-sized and small employers – Individuals and families – State sponsored Medicaid – Senior Citizens (50+) Company Overview • Services Uniprise Delivers healthcare and well-being services to employers, consumers, and health care organizations Healthcare Services Provides health benefit plans and services State sponsored Medicare programs Specialized Care Services Provides employee benefit offerings Dental, vision, disease management, complex chronic illness and care facilitation Ingenix Offers database and data management services, software products, publications, & consulting services Capital Structure Debt/Total Capital Cash $Mil Total Debt $Mil Cash Flow from Operations $Mil 29.9 % 8,361 7,523 6,079 The company moderately finances its growth with debt. http://quicktake.morningstar.com UNH Key Statistics • • • • • Market Cap: 62.110 B Price/Sales: 0.97 Price/Book: 3.20 Profit Margin: 6.12% % of Shares Held by Institution: 86% • S&P Quality Ranking A+ (highest) The ratings measure how likely the firm is to default and the protection creditors have in the event of default. Balance Sheet Financing Long Term Debt Short Term Debt Other Liabilities Increasing Increasing Increasing % of Assets Intangibles Current Assets Long Term Assets 2005 4.80% 25.72% 21.68% 2004 4.30% 30% 28% 2003 1% 35% 38% % of Debt Current Liabilities Long Term Liabilities 2005 70.40% 16.29% 2004 66% 19.50% 2003 70% 14% Cash and Cash Equivalents Significant Changes Goodwill Increase Other Assets Increase Assets Overall Increase Current Liabilities Increase Retained Earnings Increase Total Equity Increase Turnover Ratios A/R Turnover A/P Turnover Inventory Turnover $5,421,000 $3,991,000 $2,262,000 $9,470,000 $76,000 $27,879,000 $11,329,000 $7,616,000 $10,717,000 to to to to to to $16,206,000 $1,890,000 $41,374,000 $16,644,000 $10,789,000 $17,733,000 10.7807 4.0947 18.1907 33.8 days 89.1 days Income Statement • Total Revenue $45.365 B • Cost of Goods Sold $32.725 B • Gross Profit $12.64 B • Earnings Before Interest and Taxes $5.373 B • Net Income $3.3 B Liquidity • Times Interest Earned (TIE) Ratio 22.29 • Total Debt 7.35B • Current Ratio .835 • Quick Ratio .66 • Debt to Equity .375 What do ratios mean: • Current ratio measures a company's ability to pay short-term obligations. UNH .835 • measures company's ability to meet its short-term obligations with its most liquid assets. The higher the ratio, the better the position of the company (usually around 1). Quick ratio UNH .66 • Times interest earned ratio used to measure the ability of a company to meet its debt obligations, indicates how many times a company can cover it's interest charges on a pretax basis since failure to meet these obligations could force a company into bankruptcy. UNH 22.29 • http://www.investopedia.com Beta 0.18 • Beta measures stock's volatility in relation to the market as a whole. • The higher the beta, the more the stock goes up when the market heads up and drops when the market heads down (S&P 500) UNH- low beta stock: less volatile than the stock market as a whole. holds its value even when the market plunges low risk stable performance Stock Performance Orangeindustry Red- UNH GreenS&P 500 • http://quicktake.morningstar.com Mergers and Acquisitions • • • • • 2006 – Acquired NWH, Inc. through subsidiary Ingenix – Reached an agreement to buy the assets of Student Resources, an operating division of The MEGA Life and Health Insurance Company, from HealthMarkets 2005 – $9.2 Billion acquisition of Pacificare – Acquisition of John Deere Health Care through subsidiary UnitedHealthcare 2004 – Acquired Mid Atlantic Medical Services, Inc., through subsidiary UnitedHealthcare – $4.9 Billion acquisition of Oxford Health Plans – Acquired Definity Health Corporation 2002 – Acquired AmeriChoice 2000 – UnitedHealth Group Inc. merged with United Healthcare Corporation Competitors Private Companies • Centers for Medicare & Medicaid Services • Blue Cross and Blue Shield Association • Medco Health Solutions Public Companies • Caremark Rx, Inc. • HCA, Inc. • WellPoint, Inc. • Aetna, Inc Largest Competitors WellPoint, Inc. • Market Cap: $45.19B • Employees: 42,000 • Revenue: $54.28B • Quarterly Revenue Growth: 29.30% Aetna, Inc. • Market Cap: $21.01B • Employees: 28,200 • Revenue: $24.65B • Quarterly Revenue Growth: 10.50% Blue Cross Blue Shield •Private Company •Employees: 150,000+ •Revenue: $238.9 B Positive news • Democrats taking over the Congress… Democrats favoring Medicaid and Medicare programs • United Health Inks deals with Walmart, HAC – place kiosk in Walmart stores to inform people about Medicare advantage and drug plans – new agreement giving its members access to HAC hospitals (150+ hospitals nationwide) In The News Concern: UnitedHealth Group, Inc. • Former CEO Group is expected to face charges by SEC for backdating, William McGuire stepped down last month • New executive management team • CEO and CFO has agreed to remove all personal benefits from any past option grants that was questioned in a prior report • Returning $300 million worth of stock option back to the company • UNH has to re-evaluate all their option reports from 1994 to present Discounted Cash Flow Model Conclusion UNH is a low risk stock Stable company with steady growth Great for portfolio diversification