AICPA_Are you ready

advertisement

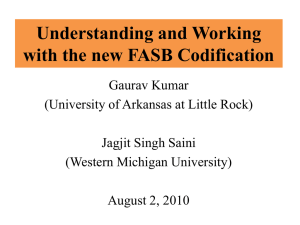

ARE YOU READY FOR THE NEW FASB CODIFICATION? This presentation has not been approved, disapproved, or otherwise acted upon by any senior technical committees of the AICPA, nor does it represent the views or an official position of the AICPA. This presentation is not intended as legal, accounting, or other professional advice and should not be relied upon as such. © 2009 The American Institute of Certified Public Accountants What is the Codification? What is the Codification? The source of authoritative US GAAP recognized by FASB to be applied by all nongovernmental entities An effort to reduce the complexity of accounting standards and to facilitate international convergence. The effort resulted in a major restructuring of accounting and reporting standards. Level A–D: U.S. GAAP (previously issued by a standard setter) was codified into a topically organized format (approximately 90 topics). Goals of the Codification Simplify user access to all authoritative U.S. GAAP -Reduce the amount of time and effort required to solve an accounting research issue -Mitigate the risk of noncompliance with standards through improved usability of the literature -Provide accurate information with real-time updates as new standards are released Goals of the Codification (cont.) Assist FASB with the research and international convergence efforts required during the standardsetting process Become the authoritative source of literature for the completed eXtensible business reporting language (XBRL) taxonomy Clarify that guidance not contained in the Codification is not authoritative See the FASB’s Codification Notice to Constituents for a full discussion on the goals of the Codification. Why Codify U.S. GAAP? Constituent concern was that U.S. GAAP was overly confusing and difficult to research. Multiple types of standards, multiple standard setters, multiple indexing schemes, and different levels of authority made it difficult to ensure completeness of all relevant guidance and accuracy of its application to an accounting issue. Codification Content Codification Content Includes authoritative guidance (for example, standards sections, implementation guidance, and so on) Excludes content deemed redundant or nonauthoritative (for example, much of basis for conclusions) Codification Content (cont.) The following literature is included in the Codification: FASB Statements, Interpretations, Technical Bulletins, Staff Positions, Staff Implementation Guides, and Statement No. 138 Examples EITF Abstracts and Topic D Derivative Implementation Group Issues Accounting Principles Board Opinions Accounting Research Bulletins FASB Accounting Interpretations AICPA Accounting Statements of Position, Practice Bulletins, incremental accounting guidance from Audit and Accounting Guides, and Technical Inquiry Service questions and answers (for Software Revenue Recognition only) Select SEC guidance SEC Content in the Codification SEC content is the domain of the SEC. SEC content is included in Codification topics but in separate SEC sections. SEC guidance is required only for SEC registrants. An “S” precedes any SEC guidance in the Codification. SEC material sections include the full text of the relevant guidance. SEC sections do not contain the entire population of SEC rules, regulations, interpretive releases, and staff guidance. Codification Structure How is the Codification Structured? Areas (Not Cited) Topics Subtopics Sections Paragraph How is the Codification Structured? (cont.) Areas—groupings of topics General Principles Presentation Assets Liabilities Equity Revenue Expenses Broad Transactions Industry How is the Codification Structured? (cont.) Topics Broadest categorization of related content (for example, FASB ASC 405, Liabilities) Correlate with IFRS / IAS standards Subtopics Represent subsets of a topic (for example, FASB ASC 405-20, which discusses the extinguishment of liabilities) Generally distinguished by type or scope How is the Codification Structured? (cont.) Sections Represent the nature of the content in a subtopic. Examples are recognition, disclosure, and subsequent measurement. Correlate with IFRS / IAS sections. How is the Codification Structured? (cont.) Subsections Allow further segregation and navigation of content. Occur in a limited number of cases. Unlike sections, subsections are not numbered. Codification Structure Example Leases Topic Subtopics Sections Operating Leases Overall Scope Lessees Disclosure Lessees Scope Lessees Capital Leases Disclosure Lessees Scope Lessees Disclosure Lessees Subsections Lessors Lessors Lessors Lessors Lessors Lessors Note: This is for illustration only and does not include all Topics, Subtopics, Sections, and Subsections. A Look at the Codification How is the Codification Structured? (cont.) Example of referencing FASB Accounting Standards Codification (ASC) Topic-Subtopic-Section-Paragraph FASB ASC 310-10-55-1: ???????????????? A Look at the Cross Reference Tool A Look at the Cross Reference Tool (cont.) Cross Reference Search by Standard Type AAG AIN APB ARB CFRR DIG EITF FAS FIN AICPA Audit and Accounting Guide AICPA Interpretations APB Opinions Accounting Research Bulletins Codification of Financial Reporting Releases FASB Derivative Implementation Group Issues Emerging Issues Task Force FASB Statements FASB Interpretations A Look at the Cross Reference Tool (cont.) Cross Reference Search by Standard Type (continued) FSP FTB IR PB QA SAB SOP SX TIS FASB Staff Positions FASB Technical Bulletins SEC Interpretive Release AICPA Practice Bulletins FASB Staff Implementation Guides SEC Staff Accounting Bulletin AICPA Accounting Statement of Position SEC Regulation S-X AICPA Technical Inquiry Service (only for software revenue recognition 5100, pars. 38-76) Resources Web sites Codification site is available at FASB’s site www.fasb.org AICPA resources related to the Codification can be found at http://www.aicpa.org/Professional+Resources/Acc ounting+and+Auditing/GAAP+Codification/.