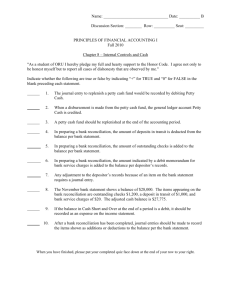

Chapter 5 PPT

advertisement

Chapter 5 Fraud, Internal Control, and Cash PowerPoint Author: Brandy Mackintosh, CA Copyright © 2016 by McGraw-Hill Education Learning Objective 5-1 Define fraud and internal control. 5-2 Fraud Fraud is generally defined as an attempt to deceive others for personal gain. Corruption Asset Misappropriation Financial Statement Fraud 5-3 Fraud 5-4 The Sarbanes-Oxley Act (SOX) 5-5 Internal Control Objectives Internal control consists of the actions taken by people at every level of an organization to achieve its objectives. Operations 5-6 Reporting Compliance Internal Control Components Most organizations use the following control components as a framework when analyzing their internal control systems. Control Environment Risk Assessment Information and Communication s 5-7 Control Activities Monitoring Activities Relationship of Control Objectives and Components 5-8 Learning Objective 5-2 Explain common principles and limitations of internal control. 5-9 Principles of Control Activities 5-10 Control Limitations Internal controls can never completely prevent and detect errors and fraud for two reasons: Benefits must exceed the costs 5-11 Human error or fraud Learning Objective 5-3 Apply internal control principles to cash receipts and payments. 5-12 Internal Control for Cash Internal controls for cash are important because the volume of cash transactions is enormous and because cash is valuable and portable and therefore poses a high risk of theft. 5-13 Controls for Cash Receipts Business can receive cash in two different ways: Receive cash in person at time of sale Receive cash through electronic transfer The primary internal control goal for cash receipts is to ensure that the business receives the appropriate amount of cash and safely deposits it in the bank. 5-14 Cash Received in Person 5-15 Cash Received in Person Cashiers rung up sales totaling $6,100 but had only $6,097 to deposit. 1 Analyze Assets Cash 2 = +$6,097 + Stockholders’ Equity Sales Revenue (+R) +$6,100 Cash Shortage (+E) -$3 Record Cash Cash Shortage Sales Revenue 5-16 Liabilities 6,097 3 6,100 Cash Received from a Remote Source 5-17 Cash Received from a Remote Source 5-18 Controls for Cash Payments Most cash payments involve writing a check or completing an electronic funds transfer (EFT). In rare cases where a company pays for purchases with dollar bills and coins, it uses a petty cash system. The primary goal of internal controls for all cash payments is to ensure that the business pays only for properly authorized transactions. 5-19 Cash Paid by Check for Purchases on Account 5-20 Cash Paid by Check for Purchases on Account 5-21 Cash Paid by Check for Purchases on Account 5-22 Cash Paid by Check for Purchases on Account 5-23 Cash Paid by Check for Purchases on Account 5-24 Cash Paid by Check for Purchases on Account 5-25 Cash Paid to Employees via Electronic Funds Transfer Most companies pay cash to their employees through EFTs, which are known by employees as direct deposits. To reduce the risk of the bank accidentally overpaying or underpaying an employee, many companies use an imprest system. 5-26 Cash Paid to Reimburse Employees (Petty Cash) A petty cash system is used to reimburse employees for small expenditures they have made on behalf of the organization. 5-27 Controls from Bank Procedures Banks provide important services that help businesses to control cash in several ways: Restricting Access Documenting Procedures Independently Verifying A bank reconciliation is an internal report prepared to verify the accuracy of both the bank statement and the cash accounts of a business or individual. 5-28 Learning Objective 5-4 Perform the key control of reconciling cash to bank statements. 5-29 Bank Statement 5-30 Bank Reconciliation 5-31 Bank Reconciliation To determine the appropriate cash balance, these balances need to be reconciled. 5-32 Bank Reconciliation Bank Reconciliation Goals 1.Identify the deposits in transit. 2.Identify the outstanding checks. 3.Record other transactions on the bank statement and correct your errors. 5-33 Bank Reconciliation 5-34 Bank Reconciliation After the reconciling entries are posted, the Cash balance matches the bank reconciliation ($11,478.40). 5-35 Learning Objective 5-5 Explain the reporting of cash. 5-36 Reporting Cash (in millions) 5-37 Supplement 5A Petty Cash Systems Copyright © 2016 by McGraw-Hill Education Learning Objective 5-S1 Describe the operations of petty cash systems. 5-39 Petty Cash Systems 1. Put money into the fund 2. Pay money out of the fund 3. Replenish the fund 1 Analyze Assets Cash Petty Cash 2 Liabilities + Stockholders’ Equity -$100 +$100 Record Petty Cash Cash 5-40 = 100 100 Petty Cash Systems 1. Put money into the fund 5-41 2. Pay money out of the fund 3. Replenish the fund Petty Cash Systems 1. Put money into the fund 2. Pay money out of the fund 3. Replenish the fund 1 Analyze Assets Cash Supplies 2 - $67 + $40 Liabilities + Stockholders’ Equity Travel Expense (+E) -$21 Office Expense (+E) -$6 Record Supplies Travel Expense Office Expense Cash 5-42 = 40 21 6 67 Chapter 5 Solved Exercises M5-3, M5-8, M5-14, M5-16, E5-5, E5-9 Copyright © 2016 by McGraw-Hill Education M5-3 Identifying Internal Control Principles Applied by a Merchandiser Identify the internal control principle represented by each point in the following diagram. Establish Responsibility Document Procedures Independent Verify Segregate Duties Document Procedures Restrict Access 5-44 M5-8 Organizing Items on the Bank Reconciliation Indicate whether the following items would be added (+) or subtracted (-) from the company’s books or the bank statement side of a bank reconciliation. + + 5-45 M5-14 Reporting Cash and Cash Equivalents Indicate (Yes or No) whether each of the following is properly included in Cash and Cash Equivalents. Yes No No Yes 5-46 M5-16 (Supplement 5A) Accounting for Petty Cash Transactions On September 30, Hector’s petty cash fund of $100 is replenished. At the time, the cash box contained $18 cash and receipts for taxi fares ($40), delivery charges ($12), and office supplies ($30). Prepare the journal entry to record the replenishment of the fund. Travel Expense .................................................................................. Delivery Expense ............................................................................... Supplies Expense .............................................................................. Cash ............................................................................. 5-47 40 12 30 82 E5-5 Preparing a Bank Reconciliation and Journal Entries, and Reporting Cash Hills Company’s June 30 bank statement and the June ledger account for cash are summarized here: Required: 1. Prepare a bank reconciliation. A comparison of the checks written with the checks that have cleared the bank shows outstanding checks of $700. Some of the checks that cleared in June were written prior to June. No deposits in transit were noted in May, but a deposit is in transit at the end of June. 5-48 E5-5 Preparing a Bank Reconciliation and Journal Entries, and Reporting Cash HILLS COMPANY Bank Reconciliation June 30 Bank Statement Company’s Books Ending balance per bank statement……………….. Ending balance per Cash account ……………….. $ 6,070 Additions: Deposit in transit……………. Additions: *1,000 7,070 Deductions: None 6,400 Deductions: Outstanding checks………... 700 Bank service charge...……... 30 Up-to-date cash balance…... $6,370 Up-to-date cash balance…... $6,370 *$19,000 - $18,000 = $1,000. 5-49 $ 6,400 E5-5 Preparing a Bank Reconciliation and Journal Entries, and Reporting Cash 2. Give any journal entries that should be made as a result of the bank reconciliation. Office Expenses Cash To record bank service charges. 30 30 3. What is the balance in the Cash account after the reconciliation entries? $6,370 ($6,400 - $30) 4. In addition to the balance in its bank account, Hills Company also has $300 of petty cash on hand. This amount is recorded in a separate T-account called Petty Cash on Hand. What is the total amount of cash that should be reported on the balance sheet at June 30? Balance sheet (June 30): Current assets: Cash ($6,370 + $300) 5-50 $6,670 E5-9 (Supplement 5A) Recording Petty Cash Transactions Sunshine Health established a $100 petty cash fund on January 1. From January 2 through 10, payments were made from the fund, as listed below. On January 12, the fund had only $10 remaining; a check was written to replenish the fund. a. January 2- Paid cash for deliveries to customers - $23. b. January 7- Paid cash for taxi fare incurred by office manager- $50. c. January 10- Paid cash for pens and other office supplies - $17. Required: 1. Prepare the journal entry, if any, required on January 1. Petty Cash Cash 5-51 100 100 E5-9 (Supplement 5A) Recording Petty Cash Transactions Required: 2. Prepare the journal entries, if any, required on January 2 through 10. No journal entries are recorded when amounts are paid out of the petty cash fund. These transactions are recorded only when the fund is replenished. 3. Prepare the journal entries, if any, required on January 12. Delivery Expense Travel Expense Supplies Cash 5-52 23 50 17 90 End of Chapter 5 5-53