Unit 5 Review

advertisement

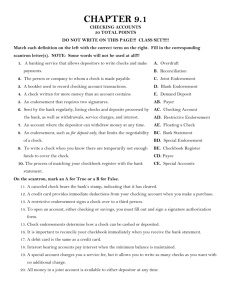

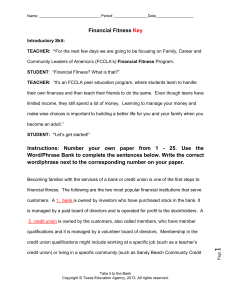

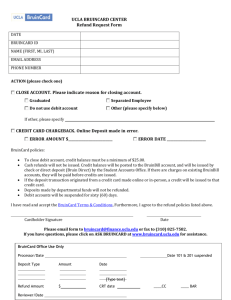

Money Matters Spring 2012 Unit 5 – Your Money: Keeping it Safe and Secure Test Review Matching: a. b. c. d. e. f. g. Debit Card EFT Bank Restrictive Endorsement ATM Fee Check Register Bank Statement h. i. j. k. l. m. n. Blank Endorsement Deposit Slip On-line Banking Checking Account Credit Union Checks Verification Number o. Identity Theft p. Automated Teller Machine q. Reconcile r. Savings Account s. Special Endorsement t. Bounced Check 1. Occurs when someone uses your name, Social Security number, credit card number, or other personal information without your permission 2. Type of endorsement where all you do is sign the back of the check 3. Legal documents that function like cash that are tied to your bank account 4. Place to record all transactions including deposits, checks, debit card purchases, additional fees, and ATM use 5. A for-profit company, owned by investors in its stock; available for anyone to open an account 6. The 3-digit code on the back of your credit card 7. View your savings and checking account activity, transfer money between accounts, and even pay bills with just a few clicks of the mouse 8. Type of endorsement where you write “pay to the order of” and the name of the person you want to transfer the check to 9. Fees charged by banks to use their ATM machines 10. Machine that allows you to withdraw cash and make deposits for your bank account, often for a fee 11. Method by which employers can deposit your paycheck directly into your bank account 12. A common financial service used by many customers that helps you to manage money and pay bills more conveniently without have to carry large amounts of cash 13. Type of endorsement where you write “for deposit only” and the account number where the money will be deposited, above the signature 14. Contains the account holders account number and allows money (cash or check) to be deposited into the correct account 15. A check that cannot be processed because the writer has insufficient funds 16. Plastic card that is electronically connected to an individual’s bank account 17. A place to deposit money you don’t plan to spend right away 18. Shows all transactions that have occurred in your bank account(s) in a specific timeline; usually a month 19. A financial institution owned by their customers, who are also called members; serves a defined segment of the population 20. The process used to balance the checkbook register each month to the balance shown on the bank statement Money Matters Spring 2012 Multiple Choice: ____ 21. The identification numbers at the bottom of a check include all of the following information EXCEPT: a. Routing Number b. Social Security Number c. Account Number d. Check Number ____ 22. What is one benefit to using a debit card that is not a benefit of using a credit card to make a purchase? a. Easy to carry b. Purchase is paid in full without adding to debt c. Able to make purchases on demand d. Transactions can be verified on a monthly statement ____ 23. You can’t find your credit card, and you think it may have been stolen. What should you do? a. Wait at least 90 days to report the card as missing or stolen in case you find the card b. Immediately apply for another card to cancel out the stolen card c. Contact your bank for a replacement d. Call the credit card company as soon as you are aware the card is missing ____ 24. A endorsement names a 3rd party who can cash the check. a. Blank Endorsement c. Special Endorsement b. Restricted Endorsement d. Specific Endorsement ____ 25. Which of the following line item does NOT appear on a check? a. Personal Information b. Memo c. Check Number d. Deposit ____ 26. You need to deposit money into an account to use all of the following services except a a. Credit card b. Debit card c. Savings account d. Checking account ____ 27. If you “bounce” a check when you make a purchase at a clothing store, what could happen? a. You will be charged a fee by the store b. You will be charged a fee by your bank c. Your credit score can be reduced d. All of these ____28 . Who is responsible for keeping track of your debit card purchases? a. The stores will send you statements after c. Your bank or credit union every purchase b. You d. The debit card company ____ 29. If you have been a victim of identity theft, what can you do to prevent someone from using your personal information? a. Stop using your accounts to see if there is c. Place a fraud alert on your credit report any activity that you did not authorize b. Get a new Social Security number d. Get a new photo ID ____ 30. Who is responsible for reporting identity fraud? a. The person who was defrauded b. Any of the 3 credit reporting agencies c. The company that accepted the stolen card d. The police Money Matters Spring 2012 True False ____ 31. Credit cards are plastic cards that are electronically connected to your bank account. ____ 32. When you use a debit card, you give your bank permission to immediately remove money from your checking account. ____ 33. You should always write your checks in blue ink to avoid problems with check washing. ____ 34. A pro of using a debit card is that it doesn’t allow for overspending. ____ 35. A check with a blank endorsement can be cashed by anyone. ____ 36. Checks are legal documents that function like cash. ____ 37. Checks, credit cards, and debit cards can be used interchangeable for most things. ____ 38. A debit card requires a PIN to confirm the user of the debit card is authorized to access the account. ____ 39. If an ATM/debit card is reported stolen within 2 business days, the cardholder is only liable for $500. _____ 40. You use an EFT machine to withdraw cash and make deposits. Project Fill in the check book and balance it against the bank statement provided. 20 points Money Matters Spring 2012 Answer Key 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. O H M F C N J S E P B K D I T A R G L Q 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. B B D C D A D B C A 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. F T F T T T T T F F 47. 48. 49. 50.