Sears, Roebuck and Company

advertisement

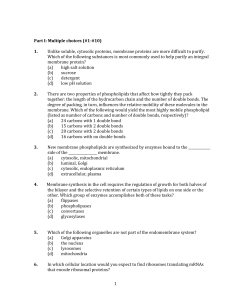

Sears, Roebuck and Company Situational Analysis Situational Analysis An assessment of the current situation in the retail industry and Sear’s operation in general. Areas of assessment – Analysis of Current Situation Market Situation Competitive Situation Marcoenvirnomental Situation Past Product Performance – Key Issues Threats Opportunities Strengths Weaknesses Analysis of Current Situation Market Situation The total market capitalization for Retail (Department & Discount) is substantial, amounting to about $341 billion. Softlines, specifically home furnishings, are growing in popularity, due to increase do-it-yourself television shows like Trading Spaces. Sear’s total share of the market place is 3% compared to WalMart’s market share of 68%. Sear’s has been around for 117 years and has strong brand name loyalty, however, strong competition from non-mall based discount retailers have eroded their market share in all product areas, specifically in the clothing products. Sear’s consumer’s have a negative perception of their shopping experience; malls, parking lots and cramped aisles. Analysis of Current Situation Competitive Situation Sear’s home appliances and hardware market share is strong but will continue to take a hit as Home Depot and Lowe’s continue to eat up market shares in the market place. Sear’s clothing line will continue to be flat until they can catch up to the marketing strategies of Target and Kohl’s. Sear’s will continue to have pressure from higher quality stores, such as Wal-Mart and Target and pressure from lower price stores, such as Kohl’s. Sear’s diverse product line allows them to compete in all areas of the market place however concentration in some key products, like clothing, needs to be addressed immediately. Analysis of Current Sitaution Macroenvirnomental Situaiton The current state of the economy, which is stagnant, has put pressure on Sear’s net sales, as consumers are being more frugal with their spending. Increasing number of women are tackling the tasks of home renovation and home decorating increases sale potential of tools and home appliance. Sear’s full-line stores are attractive to the time crunched consumer which is attracted to a shopping environment where they can buy everything they need in one stop. Analysis of Current Situation Past Product Performance While net revenue has increased in the last year for Sear’s, sales volume has continued to decrease due to non mall-based discount retailers competing against Sear’s. Profit Margin for Sear’s has increased even more than net revenue due to the downsizing of the employee force lowering operating costs for Sear’s. Sear’s clothing line slump has continued due to less than effective market campaigns, however, Sears has consolidated there clothing line brand in order to create a brand name. Also, Sear’s has purchased Land’s End in hopes of taking advantage their customer base. Key Issues Threats Lack of growth in all product lines, including their number one brand name product, Craftsman. This trend must be a top concern for Sear’s executives Lack of recognition in the market place in regards to their clothing line. Sear’s is behind in the industry strategy of Supply Chain Management. The inventory turnover of 8x is a threat to the company’s bottom line. Consumer’s negative perceptions of hassles with shopping at malls. Key Issues Opportunities The acquisition of Land’s End shows hopes for increase sales volume in Sear’s clothing line. Trends in the growth of the home furnishing market suggest that Sear’s brand name loyalty with Kenmore and Craftsman can potentially increase sales Key Issues Weaknesses Previous attempts to penetrate market share have failed. Previous attempts to increase sales in their clothing line have failed. Store floor plans are out of date and consumers have a negative perception of shopping because they feel lost and cramped while shopping. Mall based stores becoming a thing of the past Key Issues Strengths 117 years of experience in the market place. Number of stores across the market place is high. Brand loyalty built over the years: Craftsman, Kenmore, Land’s End, DieHard and Covington. Strong market share in home appliances. Being a “follower” in implementing an effective Supply Chain strategy will allow Sear’s a higher chance of implementing the strategy correctly because they will have access to better technology and access to “what not to do” when implementing the strategy.