Classification of Costs

advertisement

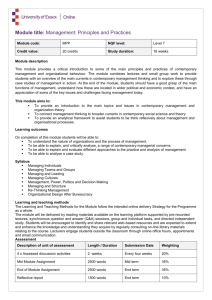

Classification of Costs Lecture No. 29 Chapter 8 Contemporary Engineering Economics Copyright © 2006 Contemporary Engineering Economics, 4th edition, © 2007 Chapter Opening Story – High Hopes for Plastic Beer Bottles What is the least expensive way to make a 0.5L PET barrier beer bottle? Types of Production Method Capital investment (20,000 bottles/hr) Direct Mfg Cost (per 1,000 units) Comments 5-layer 3-layer Internal coating External coating $10.8M $9.9M $9.2M $7.5M $59.35 $66.57 $46.90 $55.34 Need a bottle that provides shelf life of over 120 days with less than 15% loss of CO2 and admittance of no more than 1 ppm of oxygen Contemporary Engineering Economics, 4th edition, © 2007 General Cost Terms Manufacturing Costs Direct Raw Materials Direct Labor Manufacturing Overhead Nonmanufacturing Costs Overhead Marketing Administrative Functions Contemporary Engineering Economics, 4th edition, © 2007 Various Types of Manufacturing Costs Contemporary Engineering Economics, 4th edition, © 2007 Classifying Costs for Financial Statements Matching Concept: The costs incurred to generate particular revenue should be recognized as expenses in the same period that the revenue is recognized. Period Costs: Those costs that are matched against revenues on a time period basis Product Costs: Those costs that are matched against revenues on a product basis. Contemporary Engineering Economics, 4th edition, © 2007 Example Period Costs: General and administrative expenses Marketing expenses Insurance premiums Income taxes Nonmanufacturing costs Product Costs: Direct material costs Direct labor costs Manufacturing overhead Contemporary Engineering Economics, 4th edition, © 2007 How the Period Costs and Product Costs Flow Through Financial Statement Contemporary Engineering Economics, 4th edition, © 2007 Cost Flows and Classifications in a Manufacturing Company Contemporary Engineering Economics, 4th edition, © 2007 Example 8.1 Classifying Costs for Uptown Ice Cream Shop Product Cost Period Cost Unit Price of an Ice Cream Ice cream (cream, sugar, milk, and milk solids) $0.65 Cone 0.05 Rent 0.61 Wages 0.25 Payroll taxes 0.25 Sales taxes 0.23 Business taxes 0.08 Debt service 0.23 Supplies 0.09 Utilities 0.08 Other (insurance, advertising,professional fees) 0.05 Profit 0.13 $2.50 Contemporary Engineering Economics, 4th edition, © 2007 Cost Classification for Predicting Cost Behavior Volume index Cost Behaviors Fixed costs Variable costs Mixed costs Average unit costs Contemporary Engineering Economics, 4th edition, © 2007 Volume Index Def: The unit measure used to define “volume” Examples: Automobile – “miles” driven Generating plant – “kWh” produced Stamping machine – “parts” stamped Contemporary Engineering Economics, 4th edition, © 2007 Fixed Costs Def: The costs of providing a company’s basic operating capacity Cost behavior: Remain constant over the relevant range Contemporary Engineering Economics, 4th edition, © 2007 Variable Costs Def: Costs that vary depending on the level of production or sales Cost behavior: Increase or decrease proportionally according to the level of volume Contemporary Engineering Economics, 4th edition, © 2007 Mixed Costs Def: Costs are fixed for a set level of production or consumption, becoming variable after the level exceeded. Cost behavior: Increase or decrease after maintaining a fixed level of expense Mixed cost behavior Depreciation Expenses ($) 6000 5000 4000 3000 2000 1000 0 5 15 25 Miles Driven (Unit: 1,000) Contemporary Engineering Economics, 4th edition, © 2007 Average Unit Cost Def: activity cost per unit basis Cost Behaviors: Fixed cost per unit varies with changes in volume. Variable cost per unit of volume is a constant. Mixed cost per unit of volume contains both the constant and variable elements Contemporary Engineering Economics, 4th edition, © 2007 Practice Problem You have 3000 units to produce. Total labor cost = $20,000 Total material cost = $25,000 Total overhead cost = $15,000 Total fixed cost = $40,000 What is the average cost per unit? Average cost = ($100,000)/3,000 = $33.33/unit Contemporary Engineering Economics, 4th edition, © 2007 Future Costs for Business Decisions Differential (Incremental) cost Opportunity cost Sunk cost Marginal cost Contemporary Engineering Economics, 4th edition, © 2007 Differential (Incremental) Costs Def: Costs that represent the differences in total costs, which results from selecting one alternative instead of other Cost behavior: Increase or decrease with the overall change that a company experiences by producing one additional unit of good Contemporary Engineering Economics, 4th edition, © 2007 Opportunity Costs Def: The potential benefit that is given up as you seek an alternative course of action Example: When you decide to pursue a college degree, your opportunity cost would include a 4-year’s potential earnings foregone. Contemporary Engineering Economics, 4th edition, © 2007 Sunk Costs Def:Cost that has already been incurred by past actions Economic Implications: Not relevant to future decisions Example: $500 spent to replace brakes last year— not relevant in making a selling decision in the future Contemporary Engineering Economics, 4th edition, © 2007 Marginal Costs Def: Added costs that result from increasing rates of outputs, usually by single unit Example: Cost of electricity— decreasing marginal rate Contemporary Engineering Economics, 4th edition, © 2007