UCC § 3-302 Who is a Holder in Due Course

advertisement

A First Look at the Transfer of Notes (text p. 446) • “Although both the note and mortgage are transferred, the note is viewed as the controlling document.” • Article 3 of the Uniform Commercial Code contains the law of notes. • A note transferee who qualifies as a holder in due course takes free of important defenses of the maker of the note. – Think of a HDC as an especially well protected BFP 1 Donald J. Weidner A First Look at the Transfer of Notes (cont’d) • To qualify as a holder in due course, the transferee must acquire a negotiable instrument in good faith and without notice of defenses against it. • The UCC (1990) states that good faith (among merchants) “means honesty in fact and the observance of reasonable commercial standards of fair dealing.” – 2001 revision comment says honesty in fact is subjective and reasonable commercial standards is objective. 2 Donald J. Weidner A Quick Overview of UCC Law of Notes (Supplement pp. 50-52) • Caveat about the Smith & Lubell statement at text p. 566: “Since the note is evidence of a debt and is a negotiable instrument, only one copy of it should be signed by the borrower.” – Under the Uniform Commercial Code, not all notes qualify as negotiable instruments – The “holder” must take a negotiable instrument to be a “holder in due course.” 3 Donald J. Weidner Rights of Holder in Due Course • Rights of a holder in due course (UCC 3305) – In general, a holder in due course takes free of “personal defenses” but takes subject to “real defenses” (see next slide) – Breach of warranty is a personal defense from which the HDC takes free 4 Donald J. Weidner UCC § 3-305 DEFENSES AND CLAIMS IN RECOUPMENT A holder in due course is not subject to “personal defenses” (such as breach of warranty). A holder in due course is subject only to the following “real” defenses: ”(1) a defense of the obligor based on (i) infancy of the obligor to the extent it is a defense to a simple contract, (ii) duress, lack of legal capacity, or illegality of the transaction which, under other law, nullifies the obligation of the obligor, (iii) fraud that induced the obligor to sign the instrument with neither knowledge nor reasonable opportunity to learn of its character or its essential terms, or (iv) discharge of the obligor in insolvency proceedings;” 5 Donald J. Weidner Official Comment to Revised UCC 3-305 • The Official Comment to the revised UCC 305 states that the holder in due course doctrine: – “applies only to cases in which more than two parties are involved. Its essence is that the holder in due course does not have to suffer the consequences of a defense of the obligor on the instrument that arose from an occurrence with a third party.” • The big issue is usually who qualifies as a holder in due course. – See UCC 3-302, 3-104, 3-106. 6 Donald J. Weidner UCC § 3-302 Who is a Holder in Due Course ”(a) [With very limited qualification], ‘holder in due course’ means the holder of an instrument if: (1) the instrument when issued or negotiated to the holder does not bear such apparent evidence of forgery or alteration or is not otherwise so irregular or incomplete as to call into question its authenticity; and (2) the holder took the instrument (i) for value, (ii) in good faith, (iii) without notice that the instrument is overdue or has been dishonored . . . , (iv) without notice that the instrument contains an unauthorized signature or has been altered, (v) without notice of any claim to the instrument . . . , and (vi) without notice that any party has a defense or claim in recoupment . . . .” - § 3-104 (b) provides: “Instrument means a negotiable instrument.” 7 Donald J. Weidner Notice • Consider that a HDC is one who takes without “notice” that the instrument is overdue or of a defense against it. • “Notice” does not require actual knowledge because it is defined in terms of “reason to know.” – A person has notice of a fact if the person, “from all the facts and circumstances known to the person at the time in question, has reason to know that it exists.” UCC 1-202(a). 8 Donald J. Weidner UCC § 3-104 When Instrument is Negotiable ”(a) [With minor exceptions], ‘negotiable instrument’ means an unconditional promise or order to pay a fixed amount* of money, with or without interest or other charges . . . if it: (1) is payable to bearer or to order . . . ; (2) is payable on demand or at a definite time; and (3) does not state any other undertaking . . . to do any act in addition to the payment of money, but the promise or order may contain (i) an undertaking or power to give, maintain, or protect collateral to secure payment . . . . * The old language requiring a “sum certain” was removed. New Section 3-112(b) was added. 9 Donald J. Weidner New UCC Section 3-112(b) and “Fixed Amount” • UCC Section 3-112(b) now provides: – “(b) [i] Interest may be stated in an instrument as a fixed or variable amount of money or it may be expressed as a fixed or variable rate or rates. [ii] The amount or rate of interest may be stated or described in the instrument in any manner and may require reference to information not contained in the instrument.” • This language was added in 1990 to dispel any doubts about the negotiability of variable interest rate notes. • Furthermore, the entire amount due need not be calculable from what is written in the note itself. 10 Donald J. Weidner UCC § 3-106 When Promise or Order Unconditional “(a) [With minor exception], for the purposes of Section 3-104(a), a promise or order is unconditional unless it states (i) an express condition to payment, (ii) that the promise or order is subject to or governed by another record, or (iii) that rights or obligations with respect to the promise or order are stated in another record. A reference to another record does not of itself make the promise or order conditional. (b) A promise or order is not made conditional (i) by a reference to another record for a statement of rights with respect to collateral, prepayment, or acceleration, or (ii) because payment is limited to resort to a particular fund or source.” 11 Donald J. Weidner More on Whether a Note Fails the “Unconditional Obligation” Requirement to be a Negotiable Instrument What result in a 1975 Florida case: the note stated it was “secured by a mortgage on real estate . . . The terms of said mortgage are by this reference made a part hereof.” - See Holly Hill Acres, LTD. V. Charter Bank of Gainsville, 314 So. 2d 209 (Fl. App. 1975) (text p. 448). 12 Donald J. Weidner UCC § 3-203 Transfer of Instrument; Rights Acquired by Transfer (a) An instrument is transferred when it is delivered by a person other than its issuer for the purpose of giving to the person receiving delivery the right to enforce the instrument. --Transfer of the right to enforce it (b) Transfer of an instrument . . . vests in the transferee any right of the transferor to enforce the instrument, including any right as a holder in due course, but the transferee cannot acquire rights of a holder in due course by a transfer, directly or indirectly, from a holder in due course if the transferee engaged in fraud or illegality affecting the instrument. 13 Donald J. Weidner UCC § 3-203 Official Comment 2. . . . Under subsection (b) a holder in due course that transfers an instrument transfers those rights as a holder in due course to the purchaser. The policy is to assure the holder in due course a free market for the instrument. There is one exception to this rule stated in the concluding clause of subsection (b). A person who is party to fraud or illegality affecting the instrument is not permitted to wash the instrument clean by passing it into the hands of a holder in due course and then repurchasing it. 14 Donald J. Weidner UCC § 3-203 Official Comment (Cont’d) 4. The operation of Section 3-203 is illustrated by the following cases. In each case Payee, by fraud, induced Maker to issue a note to Payee. The fraud is a defense to the obligation of Maker to pay the note under Section 3305(a)(2). Case #1. Payee negotiated the note to X who took as a holder in due course. After the instrument became overdue X negotiated the note to Y who had notice of the fraud. Y succeeds to X's rights as a holder in due course and takes free of Maker's defense of fraud. In other words, an originator of a subprime note and mortgage may have engaged in consumer fraud. The originator can transfer the note to someone who takes as a HDC. That HDC can sell its right to HDC status even to someone who buys with notice of the originator’s fraud. 15 Donald J. Weidner UCC § 3-203 Official Comment (Cont’d) There is an exception in the case of a fraudulent originator who subsequently reacquires the note: Case #2. Payee (who induced the maker by fraud) negotiated the note to X who took as a holder in due course. Payee then repurchased the note from X. Payee does not succeed to X's rights as a holder in due course and is subject to Maker's defense of fraud. 16 Donald J. Weidner Giorgi v. Pioneer Title Insurance Co. (Text p. 437) • Two couples (“Makers”) executed a Note and D/T. Note was payable to payeees H, W. – Payees recorded D/T. • Note was delivered to Pioneer, Trustee under the D/T, to hold note in escrow for collection. – The D/T (as usual) directed the Trustee to collect on the note, disburse the proceeds to the payee named in the note and reconvey the property to the maker. • Payee H died, his interest passed to Payee W • Payee W assigned all her interest in the note and D/T to Giorgi before the note became due. 17 Donald J. Weidner Giorgi v. Pioneer Title Insurance Co. (cont’d) • However, Payee W did not physically transfer the note or the D/T to her assignee, Giorgi, telling Giorgi that she had lost both. • Georgi recorded the Assignment to him of the Note and D/T with the mortgages (and Ds/T) • Nevada statute said that recordation of an assignment of a beneficial interest under a D/T is constructive notice to all persons. • Giorgi gave Makers of the note notice that he was the assignee • However, neither Giorgi nor the Makers gave the Trustee actual notice of the assignment. 18 Donald J. Weidner Giorgi v. Pioneer Title Insurance Co. (cont’d) • Makers continued to make Note payments to the Trustee – Even though Giorgi had told Makers he was the assignee of the note • Trustee continued to follow the trust instructions and: 1. disbursed the money to original payee W (who accepted the money even though she had assigned the note to Giorgi!) and 2. reconveyed the property to Makers after the note payments were completed. 19 Donald J. Weidner Giorgi v. Pioneer Title Insurance Co. (cont’d) • Giorgi sued both original Payee-Assignor W [a clear wrongdoer] and the Trustee [who never had actual notice of the assignment (but not the Makers, who made all the payments required of them although they continued to pay the Trustee rather than to the Payee’s assignee)] – The suit against original Payee-Assignor W was successful. – But the suit against the Trustee was NOT successful. 20 Donald J. Weidner Giorgi v. Pioneer Title Insurance Co. (cont’d) • Giorgi Argued: the Nevada statute says a recorded assignment of a D/T is constructive notice to the world, and the Trustee is part of the world. Court Rejected this argument. • #1. General Rule: When there is a negotiable instrument secured by a D/T (or mortgage), the law of negotiable instruments prevails over mortgage law. • #2. Rule: The Maker is supposed to pay the Holder – Assignee Giorgi never got physical possession of the note—never became its “holder” 21 Donald J. Weidner Giorgi v. Pioneer Title Insurance Co. (cont’d) – In other words: • “[T]he maker of a negotiable note secured by a mortgage or deed of trust cannot discharge his liability by payment to one not the holder or one not authorized by the holder to receive payment.” • Stated differently: “And a debtor is not justified as against an assignee of the security in making payments to a mortgagee or a beneficiary named in a deed of trust who does not have possession of the instrument.” – Many F/C proceedings have been halted when the debtor challenged the party seeking foreclosure to produce the note. 22 Donald J. Weidner Giorgi v. Pioneer Title Insurance Co. (cont’d) • Rule # 3. Decisions in this area should be informed by the strong policy in favor of a market in debt instruments. – Granted, it is hard to rationalize the law of notes with the law of mortgages. The law of mortgages should not be applied to interfere with “the mobility of the debt” and the mortgage is “a mere incident of the debt.” • Point #4. As a practical matter, Trustees (or title companies) should not be required to keep searching the title before disbursing the payments they receive on the notes they hold for collection – Trustees can continue to pass along the maker’s payments to the trust beneficiary 23 Donald J. Weidner Doyle v. Resolution Trust Corp. (Text p. 439) • Doyle, maker of the note, sued Trinity S & L for breach of contract and for fraud in connection with an adjustable rate note he signed. – Resolution Trust (The “RTC”) in 1990 became the receiver that got Trinity’s interest • par for the course in the “S & L crisis” • Doyle later added assignee FNMA, who purchased the note and mortgage, as a defendant. • The “gist” of Doyle’s complaint was that Trinity, without his consent, increased the interest rate on his note from 11% to 15% and forged his initials on the change. 24 Donald J. Weidner Doyle v. Resolution Trust Corp. (cont’d) • At trial, Doyle initially recovered both [1] actual and punitive damages against wrongdoer Trinity S & L and [2] cancellation of the note and mortgage held by FNMA. • The case has a long and tortured history. In short, this appeal is about whether FNMA qualifies as a holder in due course (who takes free from the maker’s “real” defenses). • Court initially concluded that this particular note was not a negotiable instrument (and that therefore FNMA could not qualify as a HDC). 25 Donald J. Weidner Doyle v. Resolution Trust Corp. (cont’d) • An Oklahoma intermediate appellate court had said that the note was not a negotiable instrument: It was not for a “sum certain” because an external index, rather than the instrument itself, had to be consulted to determine the precise amount payable. • The Oklahoma S. Ct. reversed. Its reversal reflects current law of the U.C.C.: – The old “sum certain” requirement has been replaced by the “fixed amount” requirement • And external indices may be consulted to determine the fixed amount. • Therefore, because the note was negotiable, a subsequent holder could be a HDC if it took the note for value, in good faith with no notice of its defect (the unauthorized and admittedly significant alteration). 26 Donald J. Weidner Doyle v. Resolution Trust Corp. (cont’d) The question then became whether FNMA had notice of the defect. • Under the U.C.C., one has notice of a fact when one has; • a) actual knowledge of it; • b) received a notification of it; or • c) reason to know it exists. • Unless there was a finding FNMA had notice of an unauthorized alteration, FNMA “could enforce the note, as originally executed, free from any claims or defenses Doyle might have against Trinity.” 27 Donald J. Weidner Doyle v. Resolution Trust Corp. (cont’d) • FNMA had knowledge that the interest rate was altered. • However, it had no knowledge that the alteration was unauthorized. • FNMA frequently purchased notes with altered interest rates, provided the maker’s initials appeared alongside the alteration. • FNMA was not required to dig further unless other factors called the alteration to FNMA’s attention (Trinity “had a fine reputation”) 28 Donald J. Weidner Doyle v. Resolution Trust Corp. (cont’d) • Doyle also reflects the strong policy in favor of the marketability of debt instruments. • Court focused on U.C.C. 3-304(1): – “The purchaser has notice of a claim or defense if (a) the instrument is so incomplete, bears such visible evidence of forgery or alteration, or is otherwise so irregular as to call into question its validity, terms or ownership or to create an ambiguity as to the party to pay.” 29 Donald J. Weidner Doyle v. Resolution Trust Corp. (cont’d) • 10th Circuit upheld the District Court determination that FNMA took without notice (reason to know): ---Whereas there is a subjective test to determine whether a holder takes in “good faith” ---There is an objective test to determine whether a holder has “notice of defenses”—the question is what a reasonable person in the holder’s position would know ---The District Court’s finding that FNMA took without notice is not clearly erroneous. • As a result: FNMA was a HDC of Doyle’s note “and could enforce [it], as originally executed, free from any claims or defenses Doyle might have against Trinity.” 30 Donald J. Weidner Doyle v. Resolution Trust Corp. (cont’d) • The lower court also said – The originating lender was not FNMA’s agent (and therefore FNMA was not bound as a principal for an agent’s bad acts); and – There was no other “close connectedness” between assignee FNMA and the assignor/originating lender that would have put FNMA on notice of any bad practices of the originating lender . • See the apparent split in the cases (text p. 447) about whether the holder’s notice of the transferor’s shoddy business practices constitutes reason to know with respect to the transferred note. 31 Donald J. Weidner Note on Mortgage Electronic Recording System (Text p. 445) • The federal government helped private sector mortgage lenders and others to create “Mortgage Electronic Registration System, Inc.” • Lenders, banks, insurance companies and title companies become members of MERS and pay an annual fee. • They appoint MERS as their agent to act on all mortgages that they register on the new electronic system. 32 Donald J. Weidner MERS (cont’d) • A MERS mortgage is recorded with the county land records with the MERS Corporation named “as the lender’s nominee or mortgagee of record” on the mortgage. • The MERS member owning the beneficial interest may assign the ownership rights or the servicing rights to another MERS member. • The assignments are not part of the public record. • Rather, they are tracked electronically on MERS’s private records. – One objection was that MERS makes it more difficult for borrowers to identify a lender with whom to negotiate? – Another one was: the MERS system makes it harder to study the operation of markets. 33 Donald J. Weidner MERS (cont’d) • Mortgagors are notified of transfers of servicing rights • But were not notified of transfers of beneficial ownership. • Text discusses the facilitation of “an efficient secondary market in mortgages” – bemoaning pesky judicial decisions questioning MERS – while noting “legitimate concern if unrecorded mortgage assignments in secondary market transactions are not placed on the public record.” • New Federal Reserve rule responds to the initial concern and requires the assignee of a loan to notify the borrower within 30 days of note assignment (not just of change in servicer) (Text 449). 34 Donald J. Weidner Associates Home Equity Services, Inc. v. Troup (Text p. 390) • Classic type of civil rights case. This in N.J. in 2001. • Elderly, minority, inner-city resident Troup, signed contract to pay for repairs on their home. • Home improvement company steered her to defendant originating lender to finance their contract. • In 1996, originating lender provide her a loan: – $46,500 amount – 11.6% interest (plus 4 points at closing) – 15 yr. length – $41,600 balloon (due at end of 15 years) • Originating lender sold her note and mortgage to defendant Associates Home Equity, who paid a premium for it because of its high interest rate. 35 Donald J. Weidner Associates Home Equity (cont’d) • Borrower defaulted on the note. • Notepurchaser Associates (assignee of note and mortgage) filed an action to foreclose • Borrower asserted defenses against the foreclosure and counterclaimed on the basis of various statutes, including: – CFA, the Consumer Fraud Act – TILA, the Truth in Lending Act – FHA, the Fair Housing Act – CRA, the Civil Rights Act Sec. 1982 – LAD, the Law Against Discrimination (New Jersey) 36 Donald J. Weidner Associates Home Equity (cont’d) • In short, the court allowed the case to move forward to the discovery stage. • Borrower is permitted to raise overlapping defenses to establish “equitable recoupment” in the foreclosure proceeding even if its claims would be time-barred as an independent matter. • Borrower asserted a. predatory lending, b. discriminatory lending and c. unconscionability. • Borrower asserted that notepurchaser either acted in concert with the originating lender or controlled its conduct. 37 Donald J. Weidner Associates Home Equity (cont’d) • Predatory lending was defined in terms of loans that are not suitable for the borrowers: – “In essence, the loan does not fit the borrower, either because [1] the borrower’s underlying needs for the loan are not being met or [2] the terms of the loan are so disadvantageous to that particular borrower that there is little likelihood that the borrower has the capacity to repay the loan.” 38 Donald J. Weidner Associates Home Equity (cont’d) • The allegation of discriminatory lending was essentially that the loan originator and notepurchaser engaged in “reverse redlining”: – Recall that “redlining” refers to withholding financing from neighborhoods a lender disfavors • “Reverse redlining is the practice of extending credit on unfair terms” to specific geographic areas due to the income, race or ethnicity of the residents. – The focus is on communities that lack access to traditional lending institutions. • Reverse redlining has been held to violate the FHA (Federal Housing Act), the CRA (Civil Rights Act) and the LAD (New Jersey law against discrimination). 39 Donald J. Weidner Associates Home Equity (cont’d) • Disparate impact may be sufficient to establish a claim of in reverse redlining: – A plaintiff may establish a colorable claim of reverse redlining by demonstrating that “defendants’ lending practices and loan terms were ‘unfair’ and ‘predatory,’ and that the defendants either intentionally targeted on the basis or race or that there is a disparate impact on the basis of race.” • Further discovery in this case may reveal that notepurchaser’s guidelines are discriminatory. • Noting a study that emphasizes home improvement loans and that in predominately minority areas subprime lenders control nearly two thirds of the home improvement market. 40 Donald J. Weidner Associates Home Equity (cont’d) • Court rejected notepurchaser’s argument that recoupment is inapplicable because the foreclosure proceeding is not one to collect a debt. • A foreclosure action “is a quasi in rem procedure to determine not only the right to foreclose, but also the amount due on the mortgage.” – Borrower seeks to reduce the amount due to the assignee on foreclosure, said the court – First, on the theory that the assignee was a wrongdoer – Next, on the theory that, under the FTC’s “holder rule,” the assignee took subject to the defenses the borrower had against the originator. • Held: facts needed to be developed to determine whether the FTC’s “holder rule” applies. 41 Donald J. Weidner Associates Home Equity (cont’d) • The FTC says that sellers who receive proceeds of any “purchase money loan” under any “consumer credit contract” must include the following language in the contract: “Notice – ANY HOLDER OF THIS CONSUMER CREDIT CONTRACT IS SUBJECT TO ALL CLAIMS AND DEFENSES WHICH THE DEBTOR COULD ASSERT AGAINST THE SELLER . . . .” • This holder rule “strips the ultimate holder of the paper of its traditional status as a holder-in-due-course and subjects it to any potential defenses which the purchaser might have against the seller.” • A business may not so structure a consumer credit transaction to separate the consumer’s duty to pay from the seller’s duty to perform. 42 Donald J. Weidner Associates Home Equity (cont’d) • There was an issue whether the originator’s loan was a purchase money loan. • Under the FTC rule, a purchase money loan is a cash advance received be a consumer to purchase goods or services from a seller who: – 1. refers consumers to the creditor or – 2. is affiliated with the creditor by common control, contract or business arrangement. • There was also an issue whether the notepurchaser was affiliated with the originating lender or designated from the outset to be the notepurchaser. 43 Donald J. Weidner Associates Home Equity (cont’d) • The borrow also argued that the note was unconsciouable. • As to “unconscionability,” the court seems to say the test is the UCC test for good faith in the case of a merchant (honesty in fact plus the observance of fair dealing in the trade), applied with particular scrutiny “for those most subject to exploitation.” 44 Donald J. Weidner Note 1 to Associates Home Equity • Nelson and Whitman, Real Estate Finance Law Sec. 5.30 (5th ed. 2007): – The FTC’s rule makes it an unfair trade practice for a seller of goods or services to finance a sale without including language that makes the lender subject to the consumer’s claims and defenses. – In the case of third-party financing, “the loan must have been made in connection with a sale of goods or services and a type of ‘close connectedness’ criterion must be satisfied” • “but it is much simpler and looser than the UCC’s.” 45 Donald J. Weidner Note 1 to Associates Home Equity (cont’d) • “The lender is brought within the rule’s ambit if the seller of the goods or services [1] refers consumers to the lender or [2] is affiliated with the creditor by [any] business arrangement.” • The FTC rule does not apply to financings or sales of interests in real estate—it only applies to sales of goods and services. • As of 2007, it only applied to purchases of $25,000 or less. • If the seller does not include the FTC notice in a note, its purchaser may qualify as a HDC. – Although Associates suggests that an assignee may be liable for a failure to include the required language. 46 Donald J. Weidner Note 4 to Associates Home Equity • TILA, the Truth in Lending Act, subjects creditors to liability for violating its disclosure standards. • In certain loan transactions, debtors have a right of rescission. • Debtors may rescind by midnight of the third business day after the transaction for any reason. • The three-day “cooling off” period is extended if the creditor does not give the required disclosures. 47 Donald J. Weidner Inroads into rights of holders (cont’d) (p. 447) • The Home Ownership and Equity Protection Act of 1994 amended TILA to address “high cost” home equity mortgage loans (ex., more than 10% above a Treasury obligation of the same length. – Defenses that could be raised against the originator can be raised against the assignee of these high cost mortgages – Special disclosures must be given – Certain terms are prohibited (negative amortization, certain balloons, etc.) – Certain conditions must be met to have a valid prepayment penalty • Act does not apply to “residential mortgage transaction,” that is, a purchase money loan that enables a consumer to purchase a residence. • This is also an area of concern for the new Consumer Financial Protection Bureau. 48 Donald J. Weidner West’s F.S.A. § 701.04. Cancellation of mortgages, liens, and judgments Effective: October 1, 2007 (1) Within 14 days after receipt of the written request of a mortgagor, the holder of a mortgage shall deliver to the mortgagor… an estoppel letter setting forth the unpaid balance of the loan secured by the mortgage, including principal, interest, and any other charges properly due under or secured by the mortgage . . . . Whenever the amount of money due on any mortgage, lien, or judgment shall be fully paid to the person or party entitled to the payment thereof, the mortgagee, creditor, or assignee… to whom such payment shall have been made, shall execute in writing an instrument acknowledging satisfaction of said mortgage, lien, or judgment and have the same . . . duly entered of record in the… proper county. Within 60 days of the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage . . . shall send . . . the recorded satisfaction to the person who has made the full payment.

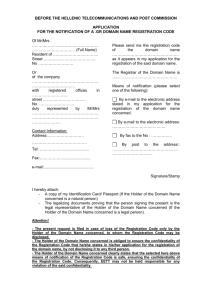

![[#SWF-809] Add support for on bind and on validate](http://s3.studylib.net/store/data/007337359_1-f9f0d6750e6a494ec2c19e8544db36bc-300x300.png)