Fare Study EcoPass Recommendation from RTD

FARE STUDY

ECOPASS RECOMMENDATION

Operations & Customer Service Committee

September 8, 2015

Fare Study Process

• Summer 2014: Fare Study Initiated

– First phase was focused on fare structure

– Pricing was incorporated as part of the recommendations for public hearings

• Spring 2015: Public Hearings

– Included price increase for EcoPass consistent with the general fare increase

• May 2015: Board Action on Structure & Level

– Title VI concerns were identified for Business

EcoPass as part of the equity analysis

– Board action did not include EcoPass pricing

• September 2015: Recommendation for 2016

EcoPass pricing that reduces Title VI risk

2

Stakeholder Outreach

• 36 Commuting Solutions

• City of Arvada

• AARP

• Arapahoe County LCC

•

Douglas County

• Downtown Denver Partnership

• DRCOG

• eGo Car Share

• Arc of Aurora

• Boulder Chamber of Commerce

• Boulder County

• City of Boulder •

•

•

• FRESC/AFTF

Jeffco LLC

City of Louisville

Livable Places Consulting

• Colorado Coalition for the Homeless • Mi Casa Resource Center

• Colorado Cross Disability Coalition • Mile High Connects

• CU Boulder • Servicios de la raza

• CWEE

• City and County of Denver

• Denver South EDP

•

•

•

Stapleton Foundation

City of Thornton

US 36 Mayors/Commissioners Coalition

3

Stakeholder Feedback

• Recognition that EcoPass is a good program coupled with concern that increasing the price will result in fewer participating neighborhoods and businesses

• Frustration that tap data are not available

• Concern that there has not been enough outreach and stakeholder involvement in developing the recommendations

• Questions about the data and math that were used to develop the recommendations

• Concern that companies have not budgeted for an 18 percent increase

4

Stakeholder Feedback (cont)

• Desire for an addition to the Business EcoPass matrix to allow for a master contract for lowwage businesses

• Opportunities to include changes to the

Neighborhood EcoPass program as part of the continued affordable fares discussions

• The entire fare study seems like a complicated process that was broken into individual pieces

– A summary of all of the fare policies and how they fit together would be helpful when the process is complete

5

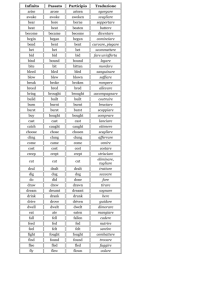

Recommendation for 2016

Business EcoPass Contracts

• Increase Business EcoPass contracts by 18.3 percent

– Results in a projected average fare for EcoPass passengers that is equivalent to the overall average fare projected for 2016

– EcoPass riders will not be more heavily subsidized than other passengers

• Eliminate $2.50 upgrade charge for trips to and from DIA

• No changes to SLA boundaries to incorporate new lines until 2017 contracts

6

Recommended 2016 Contract

Prices for Business EcoPass

PRICE PER EMPLOYEE PER YEAR

Service

Level

Area Employees

Contract

M inimum Per

Year

1-24 employees

25-249 employees

250-999 employees

1,000-1,999 employees old new old new old new old new old new

A

B

C

D

2,000+ employees old new

1-10

11-20

21+

$ 972 $ 1,150

$ 1,944 $ 2,299

$ 2,915 $ 3,448

$ 83 $ 98 $ 72 $ 85 $ 63 $ 75 $ 54 $ 64 $ 51 $ 60

1-10

11-20

21+

$ 1,782 $ 2,108

$ 3,563 $ 4,215

$ 5,344 $ 6,321

$ 177 $ 209 $ 160 $ 189 $ 146 $ 173 $ 135 $ 160 $ 128 $ 151

1-10

11-20

21+

$ 2,429 $ 2,873

$ 4,859 $ 5,747

$ 7,287 $ 8,619

$ 450 $ 532 $ 417 $ 493 $ 397 $ 470 $ 388 $ 459 $ 367 $ 434

1-10

11-20

21+

$ 2,429 $ 2,873

$ 4,859 $ 5,747

$ 7,287 $ 8,619

$ 460 $ 544 $ 441 $ 522 $ 408 $ 483 $ 397 $ 470 $ 376 $ 445

7

Detail Regarding EcoPass Prices

• EcoPass contract prices have not gone up since 2011

• The per employee price of an annual

EcoPass in the Downtown area is comparable to providing a parking pass for

2 – 5 months

• Maximum EcoPass price well below the federal limit of $1,560 per year per employee transit pass tax exclusion of the

IRS Commuter Benefits program

8

Contract Payment Options

• Currently contracts are paid in full at the beginning of the year

• Add two new contract payment options for

2016:

– Quarterly payments with an administrative processing fee of 1%

– Semiannual payments with no additional administrative processing fee

9

Recommendation for 2016

Neighborhood EcoPass Contracts

• Increase Neighborhood EcoPass contracts by 13.3 percent consistent with the general fare increase

• Eliminate $2.50 upgrade charge for trips to and from DIA

• Make a minor update to the survey for new neighborhoods

– Modify survey so pricing incorporates all participants eligible for half fare discount

10

Title VI Equity Analysis

• A review of the fare equity analysis in May of

2015 revealed Title VI risks for the Business

EcoPass program

• This recommendation was developed considering those risks

• Per FTA requirements and RTD Board Policy, this EcoPass recommendation was analyzed for any disproportionate adverse effect on minority and low-income riders

• The analysis of this recommendation does not reveal a disproportionate adverse effect

11

Recommendation for Future

EcoPass Pricing

• Begin pricing EcoPass contracts with utilization data as soon as adequate smart card data are available

• Re-evaluate the 2009 Board Policy for utilization pricing as part of a Pass

Program Working Group that will include stakeholders from across the district

• Goal for future pricing: average EcoPass fare should be equivalent to the overall average fare

12

Revenue Impact

• Fare policies adopted in May included an assumption that EcoPass contracts would increase by 13.3 percent

• Additional increase in Business EcoPass contracts would result in approximately $1 million of additional fare revenue per year

13

Next Steps

• Send out 2016 contracts with new pricing

– Include payment options

• 2016: Convene RTD and Stakeholder

Pass Program Working Group to develop recommendations for future pricing

– Define goals for pass programs

– Reevaluate 2009 Board Policy for utilization pricing incorporating the new fare structure and average fare analysis

– Coordinated effort with the Affordable Fares

Task Force discussions

14