How is CT computed? - Chartered Accountants Ireland

advertisement

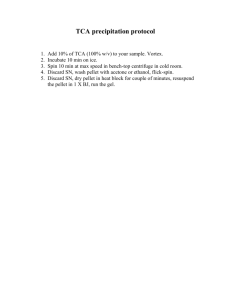

Chartered Tax Consultant Applied Tax Module 5 Corporation Tax Michael Smith 22nd & 23rd February and 1st March 2013 www.charteredaccountants.ie EDUCATING SUPPORTING REPRESENTING Learning Objectives • • • • • Scope of Irish Corporation Tax Resident and Non Resident Companies CT Framework – Rates and APs CT computations and 9 Principles CT Compliance – Tax Return filing, payments and assessments Introduction and Overview • • • • • CT legislation Income Tax and CGT Rules Irish CT policy and 12.5% rate Strict rules and tax law apply Step by step analysis of CT computation Scope of CT • Resident Cos • CT on Worldwide Income • Non Res Cos Trading • CT on Irish trading income in Ireland • Non Res Cos not trading in Ireland • No CT – IT on Irish source/CGT on SA Company Residence • Case Law – Central Management and Control • Irish Tax Law – S.23A(2) TCA 97 – general rule Irish incorporation – S.23A(3) and (4) TCA 97 – Trading and Treaty exemptions • Double Tax Agreements (CTC Integrated Tax) Central Mgt and Control • Case law established this basic concept • UK cases – De Beers Consolidated Gold Mines v Howe (5TC 198) • A co is resident “where the central management and control actually abides” • Step 1 – Determine location of central mgt and control (CMC) Where is CMC located? • Review corporate governance processes – Who decides on high level strategy? – Where are these decisions taken? • • • • Where are books and records kept? Where are accounts audited? Where are profits realised? Location of bank accounts? Case Law Tests LOCATION OF MEETINGS AND COMPANY RECORDS? Directors’ Meetings Books of account Shareholders’ Meetings Accounts prepared and examined Statutory Books and Company Seal Accounts audited Negotiation of major contracts Dividends declared Matters of important policy determined Profits realised Majority of directors resident Bank account Head Office Company Residence • No single factor determines residence • Combination of tests used to establish CMC • Company not incorporated in Ireland? Residence determined by location of CMC Residence – Irish Incorporation • S.23A TCA 97 • S.23A(2) TCA 97 – Irish incorporated companies are Irish resident • S.23B TCA 97 – Societas Europaea (SE) and European Cooperative Society (SCE) with registered office in Ireland – Treated as resident in Ireland Incorporation Test • E Ltd incorporated in • Ireland • Carries on business in • Isle of Man • • Majority of directors resident in IOM • • Board Meetings in IOM • Irish-director attends • All decisions made in IOM Where is management and control exercised? Isle of Man Where is company resident? Ireland – S.23A TCA 97 No Treaty/Trading exemption Incorporation Rule Exceptions • Treaty Exception • Place of incorporation rule does not apply where the company is resident in a Treaty country • S.23A(4) TCA 97 – DTA tie breaker clause holds • Co generally resident where CMC is located Incorporation Rule Exceptions • Treaty Exception example • Beckett Solutions Ltd is incorporated in Ireland • The co is also resident in France under French law • Tie-breaker clause in Irish/France DTA treats BSL as resident in France • S.23A(4) TCA 97 – BSL resident in France Trading Exception • S.23A(3) TCA 97 • “Relevant Company” • Does company (or related* co) carry on a trade in Ireland? – Is the company under ultimate control of >50% residents of an EU/DTA country? Or – Quoted on SE (or in >50% relationship* with QSE Co) in EU/DTA country? *related = 50% group with real and substantial relationship Trading Exception • Where S.23A(3) TCA 97 applies: – Irish incorporation test does not apply – Company is resident under central management and control test Trading Exception • S.23A(3) TCA 97 • Applies where the company is a “relevant company” • Relevant Company = Co (or related co) carrying on a trade in Ireland which is: – Under the ultimate control of EU/DTA residents or – Quoted* on recognised SE in EU/DTA country * Or in 50% relationship with quoted company Trading Exception -1 • Micro Ltd Irish • incorporated Co • • 1 Irish & 2 Bermuda dirs • All board meetings in Ber • • Micro’s trade in Bermuda • 60% Micro owned by Macro – quoted on ISE • Micro owns 55% Mega, • • an Irish trading co Relevant Co? Yes – owned by >50% EU listed co Trading condition met as Mega is >50% owned and trading in Ireland CMC test applies Micro is resident in Bermuda Trading Exception -2 • Avoir Ltd is Irish incorporated • Carrying on a trade in Argentina • CMC is in Argentina • Avoir owns 62% of Irish resident co • Avoir is owned by 4 French individuals resident in France • Is Avoir a “relevant co”? • Yes - >50% controlled by EU residents and • Meets trading condition with 62% sub • Avoir resident in Argentina – CMC rule Trading Exception -3 • Éire Ltd is Irish incorporated • Carries on a trade in Kenya • Owned by a UK res co • UK co by 2 individuals resident in Kenya • Éire owns 82% in an Irish trading company • Where is ultimate ownership? • Kenya – not EU/DTA • Trading test is met but Éire is not a “relevant co” • S.23A(2) applies • CMC displaced • Éire is resident in Ireland Trading Exception -4 • Anois Ltd is incorporated in Ireland • 2 Irish resident individuals own 100% of Anois • Anois carries on its trade in Argentina • Anois is managed and controlled exclusively in Argentina • Is Anois a “relevant co”? • No - the company does not carry on a trade in Ireland • S.23A(2) treats Anois as resident in Ireland Non Resident Companies • S.25 TCA 97 • No CT liability unless the non res co trades in Ireland through a branch/agency • S.4 TCA 97 defines branch or agency • “any factorship, agency, receivership, branch or management” • Non trading Irish branch – Income Tax • Non trading Irish branch – CGT on SA Scope of Charge Irish Branch Company resident in US with Dublin Branch Trading Profits Dublin Branch Irish Branch Deposit accounts in Dublin and New York Rental income from UK property purchased from branch profits US co Galway Rental property Irish CT - int and n/a for curr gains Irish CT - income n/a and gains Irish CT No charge US Head Office n/a Irish IT on rents Irish CGT on gain Non Resident Companies • • • • Start CT comp with Irish branch accounts Include investment assets of branch Include income from assets Assets held outside Ireland – Has Irish branch made the investment? or – Has Head Office made investment? – S Murphy v Dataproducts (ITR Vol IV p 12) How is CT computed? • • • • • Legal Framework CT Rates Trading v Passive Income Accounting Periods From Financial Statements CT comps Legal Framework • • • • S.26 TCA 97 S.26(1) – CT is on worldwide profits S.27(1) – Arising basis S.26(2) – Special situations – Where co is a beneficiary under a trust – Where co is a partner in a partnership – Winding up of company – in liquidation Legal Framework • S.26(3) TCA 97 • CT charged for each calendar year • Assessments made for Accounting Periods • S.27 TCA 97 – rules for APs • CT assessment is apportioned between relevant calendar years where CT rate changes CT Rates • • • • CT Rate set in Budget CT introduced in 1977 CT Rate 1982-88 – 50% S.21(1) TCA 97: - 2003 to date 12.5% (standard rate) • S.21(2) TCA 97 dis-applies IT to Irish res cos liable to CT • Non res cos liable to CT on branch profits CT Rates • S.21A TCA 97 higher CT rate of 25% on passive income: Sch D Case III, IV and V • S.21A(4) – 25% rate not applicable to Case I interest of certain insurance cos • S.21A(3) – 25% rate on income of an “excepted trade” – Dealing in or developing land – S.639-647 – Working minerals, turn and peat – Petroleum activities CT Rate – Mixed activities • Apportionment of receipts and expenses • Just and reasonable basis • Net income taxed @ 12.5%/25% • Builder buys land – trading stock • Builds on part of land • Profits on sale of building @12.5% • Profit on sale of undeveloped land @ 25% CT Rates Summary Nature of Income • Point Trade 1 Excepted • Point 2 Case I and II Trades • Point 3 Case III Trades • Point 4 Case III For • Point 5 Divs • Point Case IV, V6 Chargeable Gains (as adjusted) 12.5% 25% X X X X X Trading v Passive Income • Trading operation v passive income • Revenue focus on “low substance” business – “brass plate” operations • No definition of “trading” in Direct Tax Acts • Case Law • Badges of Trade • Revenue Guidance Court Cases • Examine specific facts of case • Is there an existence of common characteristics of trade? • Noddy Subsidiary Rights v IRC 43 TC 458 • Noddy Ltd found actively engaged in trade of intellectual property rights • Staff exercised skill/sought customers /made contracts Badges of Trade Subject Matter of Realisation Commodities/Manufactured Items normally = trading Length of period of ownership Trading usually short Frequency of transaction Similar transaction at same time or in succession = presumption of trading Article more marketable? Advertising? Marketing? Trading v investment status? Supplementary Work Circumstances of realisation Motive Never irrelevant – intention of seller Revenue Guidance • Tax Briefing 57 • Revenue Statement of Practice on Classification of Activities as Trading • Revenue prior ruling can be sought • Foreign companies coming to Ireland • Decisions published on “Opinions on the Classification of Activities as Trading” Revenue Guidance • • • • Factors considered by Revenue Commercial Rationale Real value added Employees in Ireland with skills needed to carry out trade Accounting Periods • Concept of AP is fundamental to CT • APs drive the CT compliance cycle • Computations, Returns, Assessments, Tax Payments • S.27 TCA 97 deals with APs • Commencement and cessation of APs • Relationship of AP with Financial Statements Commencement of AP S.27(2)(a) Co acquires a Source of Income Placing shareholder funds on deposit. Date account opened S.27(2)(a) Co becomes Resident in Ireland CMC changed to Ireland – date of board meeting S.27(2)(a) Res Co commences to carry on a /S.27(4) business Dormant co receives subscription for shares and buys land for manufacturing trade S.27(2)(a) Legislative event New liability or repeal of exemption S.27(2)(b) Cessation of another AP while co remains chargeable to CT First day of AP normally day after AP ends S.27(7) Member’s passing of windingup resolution Appt of liquidator and 12 months intervals thereafter Cessation of AP S.27(3)(a) End of 12 months from beginning of AP S.27(3)(b) S.27(3)(b) S.27(3)(c) Accounting date of company End of a period for which no accounts prepared Commencement of trading S.27(3)(c) Cessation of trading S.27(3)(c) Trade comes within charge to CT S.27(3)(d) Commencement of residence in Ireland S.27(3)(d) Cessation of residence in Ireland S.27(3)(e) Co ceases to be within charge to CT S.27(7) Appointment of liquidator and intervals of 12 mths Accounting Periods • S.27(5) – Rules for cases where different accounting dates used for different trades – Highly unusual situation • S.27(6) – Where chargeable gains/losses arise outside an AP • S.27(8) – Co can appeal Revenue’s estimate of an AP Financial Statements to CT Comp • FS are foundations of CT comp • Adjustments needed to arrive at CT liability • CT comp determines tax charge for FS • Review of FS • Tax payable for AP/Opening Balance/Payments • P/L Tax Charge and Bal Sheet Liability Financial Statements to CT Comp • Why is a consistent methodology needed? • Serves as a checklist • Material items not omitted • Computation prepared in correct order • Control procedure for review Corporation Tax Computation 1. Is Co or Branch trading? Yes (If No, see 8) 2. Adjust PBT to exclude – – – – Irish dividends Income chargeable under other Cases/Schedules Chargeable Gains “Tax Nothings” Corporation Tax Computation 3. Prepare adjusted Case I/II comp for each trade 4. Compute CA and deduct from Case I/II of each trade 5. Is the trade taxable at 12.5%? Yes (If No, see number 8) 6. Deduct losses forward from prior years from income of each related trade Corporation Tax Computation 7. Aggregate the profits of each trade Add other amounts liable @12.5% (Case IIIforeign dividends) Deduct: Relevant trading losses Relevant trading charges Corporation Tax Computation 8. Add following amounts - Income chargeable under Case III, IV,V - Trading income @ 25%, net of losses fwd Note: Includes income where No. 1 and No. 5 answer was “No” Corporation Tax Computation 9. Add adjusted chargeable gains 10. Deduct the following, in order, from total profits - Current year losses - Non trade charges - Group Relief - Loss Relief carried back 11. Compute CT @ 12.5% and 25% Corporation Tax Computation 12. Deduct the following, in order, from corporation tax - Value based charges - Value based losses 13. Compute Close Co surcharges 14. Deduct CT credits 15. Add/deduct net IT Corporation Tax Principles 1 Irish Divs received and divs/distributions made 2 Income Tax Principles apply to CT 3 Capital Allowances and CT 4 Chargeable Gains and CT 5 Charges on Income 6 Tax nothings – tax adjustments 7 Income tax borne by deduction 8 Losses 9 Deduction for CT Credits CT P1 Irish dividends Received • Sch F applies to individuals but not to companies • S.129 TCA 97 – exemption from CT for dividends from another Irish company and for amounts treated as a distribution by Chapter 2, Part 6 TCA 1997 CT P1 Irish dividends Paid • S.76(5)(a)TCA 97 • Dividends and distributions are not deductible • S.130(2)(d)(iv) TCA 97 interest to a parent co resident in a tax haven is a distribution • No deduction for interest within S.130(2)(d)(iv) TCA 1997 Irish Dividends • S.156 TCA 1997 • Franked Investment Income (FII) • Symmetrical treatment – div paid not deductible and div received not taxable CT P2 IT Principles Apply • • • • • S.76 TCA 97 – Application of IT principles Co based on APs = IT based on Years of Asst Income exempt from IT also exempt from CT Schedules C, D, E and F Know difference between “profit before tax” and “Tax adjusted profit” • Additional/modified rules for CT GAAP v IFRS • S.76A TCA 97 allows IFRS or GAAP • S.17A TCA 97 – Rules for transition from GAAP to IFRS • Group members may not “mix” GAAP and IFRS for tax advantage • S.76C(2) TCA 97 – GAAP used for tax purposes where groups prepare accounts using GAAP and IFRS Case 1 and 11 • “Realisation principle” - Case Law • Tax only arises when Profit realised • S.76B TCA 97 over rides “realisation principle” where IAS 39 used • “Fair Value” accounting includes unrealised profits and losses under IAS 39 • No adjustment to PBT Interest and R&D Capitalised • IFRS/GAAP – certain expenses capitalised as cost of asset in balance sheet • S.81(3) TCA 97 exception to general rule • Expenses capitalised relating to R&D and interest are tax deductible • Amount deductible = amount capitalised • Adjustment to CA comp and DT comp Exchange Differences • Financial Statements – functional currency • S.79 TCA 97 – tax treatment of exchange differences for trading companies • S.79(2) - Gains/Losses on Relevant Monetary Items and Hedging contracts are trading items for tax purposes Exchange Differences • S.79(3) TCA 97 • FX element of realised and unrealised gains/losses • Representing money held or hedging contracts • Excluded from CGT as taxed as income under S.79(2) TCA 97 Exchange Differences • FX for non-trading companies must be analysed from first principles • IT/CGT can arise for fully matched positions Exchange Translation • Trading companies where € is not functional currency • Translate FC tax liability @ average FX rate for AP • Non trading companies – translate each non-trading income/gain at actual FX Rate to compute € tax liability Hedge Contracts • € tax liability fixed in company’s functional currency by hedging • FX transaction • Forward purchase of € for fixed amount • Hedge contract is an asset for CGT • S.79(4) TCA 97 – CGT “ignored” • “Effective for tax purposes” • Matching of tax liability FX with hedging cancel each other What expenditure is deductible ? Income Tax principles Revenue v Capital Pre-Trading Expenditure Superannuation pension Schemes Employer Contributions to Revenue Approved Occupational Pension Schemes/PRSA Registration of Trade Marks S.82 TCA 97 S.84 TCA 97 Long Term Unemployed double deduction S.88A TCA 97 S.774(6)(b) TCA 97 S.787(2) TCA 97 Paid Basis S.86 TCA 97 What expenditure is deductible ? Repairs to Capital Assets Scientific Research Research not related to cos trade – R&D cost sharing agreements Know-how expenditure S.81(2)(d) TCA 97 Improvements and replacements NOT deductible S.764 TCA 97 S.764(2) TCA 97 S.768 TCA 97 Non Deductible Expenditure Amounts not “wholly and exclusively” incurred S.81 TCA 97 Capital employed in the trade or profession S.81(2)(f) TCA 97 Interest on late payment of tax e.g. VAT, CT, PAYE/PRSI S.1080(3) TCA 97 Expenditure involving crime S.83A TCA 97 Business Entertainment S.840 TCA 97 (Staff entertainment is allowable) Trade Interest Paid • Interest allowable on an accruals basis • S.817C TCA 97 - interest paid to a connected person if connected person is taxable on the interest as trading income (Bank, Finance Co etc) • Interest deduction on amount taxable on recipient • S.817C not applicable to interest paid to non resident cos not under control of Irish residents Case III Trades • S.18(2)(f) TCA 97 – foreign trades taxed under Sch D Case III • S.77(5) TCA 97 applies Case I rules • Foreign Trade - Taxable @ 25% • Highly unusual for trade to be carried on entirely outside Ireland • Case I trading activity needed for “trading exception” for incorporation residence rule Case III Foreign Dividends • S.77(6) TCA 97 – deduction for foreign tax • Foreign divs taxable under Case III • S.21B TCA 97 - modifies 25% rate in S.21A TCA 97 • ECJ Case - FII Group Litigation Order (GLO)(C446/04) • Freedom of Establishment principle of EC Treaty applies Case III Foreign Dividends • Cannot discriminate between tax on domestic and foreign dividends • S.21B(5) TCA 97 – 12.5% rate on divs paid out of trading profits – Co res in EU/DTA/OECD country for period of div – Public quoted cos (+75% sub) in Irl/EU/DTA • Election made by Irish recipient co • Trade undertaken in branch of EU/DTA/OECD co Case III Dividends • ≤ 5% shareholding = portfolio holding • Divs taxable at 12.5% (trade and non trade income) • > 5% shareholding – apportionment needed between trading and non trading income • Where ≥ 75% profits of paying co are trading and ≥ 75% of assets of receiving co are trading assets • divs = trading income divs 12.5% For Divs Example A Ltd Sub % Owned • B Ltd C Ltd • D Ltd • E Ltd • F Ltd • • G Ltd Point 1 100% 100%2 Point 100% Point 3 100% Point 4 100%5 Point Point 6 100% H Ltd 3% Residence Income Rate of tax on div UK Rents in UK 25% Jersey Shop in French Branch 25% France Shop in Jersey Branch 12.5% German Manufacturing and Bank interest Manufacturing and Bank interest 12.5%/25% Brazil Trade in Brazil 12.5% US Rents New York 12.5% France 12.5% Case IV and V • No special rules for CT computation • Income tax principles apply • CT calculations done using IT rules CT P3 Capital Allowances • S.307 TCA 97 – Case I CAs/Balancing Charges are treated as an expense or receipts of trade • Income chargeable to CT is net of CA • S.308(1) /(2) TCA 97 – CA/BC from other sources treated as deductible/taxable from that source CT P3 Capital Allowances • Excess non-trade capital allowances • Set against total profits of the current period • Carried back against total profits of prior period of same length • Carried forward against same source (Case IV/V) Green Capital Allowances • • • • • Qualify for accelerated CAs S.285A/ Sch 4A TCA 97 100% of cost allowed in first year Sustainable Energy Ireland – full list 10 Categories: Motors and Drivers Lighting/Controls BEMS Information & Communication Heating and Technology Alternative fuel vehicles – electric Refrigeration and cooling systems HVAC systems Electro mechanical systems Catering and hospitality machinery IP and Intangible Assets • Historic situation – limited deductions for expenditure on IP • Expenditure on Specified Intangible Assets • S.291A TCA 97 extends definition of plant in S.288 TCA 97 to include SIAs SIAs Patents/Registered designs Trademarks/Brand names Domain names/copyrights/service marks/publishing titles Applications for grant or registration of above Know-how Authorisation to sell medicines, product of designs, formula, process or invention Computer software for commercial application Goodwill relating to SIAs SIAs • Relief applies to pre trading expenditure Deduction against • income generated from exploiting SIA • income from sale of goods/services deriving greater part of value from SIAs • Company can opt to claim IP deduction on – Matching CA with depreciation per accounts or – Over 15 years – 7% for 14 yrs + 2% in yr 15 SIAs • Accounts based allowance includes impairment charge under GAAPs • 80% Relevant Profits restriction • Restriction includes funding costs • Carry forward of excess allowance against IP related profits SIAs • Anti avoidance – connected parties and bona fide transactions • No CGT “group relief” where acquirer claiming IP relief • Possible BC if sold within 10 years Patents – old regime • • • • • S.755 TCA 97 CA on purchase of patent rights 17 year write off period or remaining life Expenditure incurred for trade purposes or On acquiring patents rights for licensing – Case IV with CA • S.291A TCA 97 from 7th May 2011 Patents & Know How • Pre and Post 7th May 2011 regimes • Choice for taxpayer • Post 7th May 2011 – CA claim under S.291A TCA 97 CT P4 Chargeable Gains • Income + Gains = Total Profits • S.76(3) TCA 97 • S.21(3) TCA 97 Irish res cos not liable to CGT – exceptions • S.649 TCA 97 – CGT on development land gains • Non dev land gains chargeable to CT • Effective rate = CGT liability CT P4 Chargeable Gains • S.78 TCA 97 – conversion mechanism • Calculate capital gain/loss on each disposal in the AP • Arrive at chargeable gain, net of losses • Net gain included in CT computation is an amount, if taxed @ 12.5%, would produce same result as CGT computation • S.78(3)(b) TCA 97 – rules for rate changes in AP CT P4 Chargeable Gains • • • • • • • • 1/1/2011-6/12/2011 (339 days) 25% 7/12/2011-31/12/2011 (268 days)30% CGT Rate-S 78(3)(b) TCA 97: 25% x (339/365) = 23.22% 30% x (26/365) = 2.14% CGT Rate 2011 25.36% 25.36% applies to all gains in 2011 Contrast with individuals CT P4 Chargeable Gains Gain on Building €120,000 Loss on Land (€30,000) Net Gain €90,000 Capital Loss b/fwd (€10,000) Chargeable to tax €80,000 Include in computation €80k x 30%/12.5% CT @12.5% €192,000 €24,000 CT P5 Charges on Income • “Pure Income” receipts • No expenses incurred in generation of income • Patent Royalty • Acquisition interest – on non trading loan where loan is capable of lasting >1 year • Annuities and other annual payments CT P5 Charges on Income • S.76(5)(b) TCA 97 – no deduction against taxable income • S.243 TCA 97 – deduction allowed in year in which payment made • Note – interest on funds borrowed for trading or purchase of rental property are not a charge on income and are deductible under Case I/V rules CT P5 Charges on Income • S.243(4)-(9) TCA 97 define “charges” to include • Yearly Interest eligible for relief under S.247 TCA 97 (purchase of shares in another co) • Other S.247 interest • Annuities/annual payments • Patent Royalty expenditure – not capital CT P5 Charges on Income • S.243 TCA 97 excludes from charges • Dividends and distributions • Amounts deductible in calculating CT Profits (Case I interest, Case V interest) • Payments charged to capital • Payments not made for valuable and sufficient consideration • Payment not ultimately borne by the co Charges on Income • Two categories • Relevant trade charges – paid wholly and exclusively for 12.5% taxed trading purposes • Non-trade charges Relevant Trade Charges • Patent Royalties and Annual Payments • S.243(3) TCA 97 - Pre-trading trade charges treated as paid on date trade commences • S.243A(3)TCA 97 – trade charges deductible against – Income from trades @ 12.5% – S.21B TCA 97 dividends taxable @ 12.5% – Trading income from reinsurance Relevant Trade Charges • S.243B TCA 97 – relief for “Value Based Relief” • Tax value of trading charges exceeding 12.5% trading income reduces CT payable • No deduction for trading charges against 25% income • Excess charge value = 12.5% tax equivalent • Unutilised charges carried fwd as S.396 TCA 97 trade losses Non-Trade Charges • Charges not wholly and exclusively incurred for trade taxable at 12.5% • Patent Royalties for Case IV source • Patent Royalties paid for 25% tax mining trade • S.247 TCA 97 acquisition interest Non-Trade Charges • S.243(2)TCA 97 – deductible against total profits • Deduct after all other reliefs but before group loss relief • Choice - against 12.5% or 25% items • Gains are grossed up @12.5% • Excess non-trade charges lost if not claimed by co or group co Acquisition Interest • S.247 TCA 97 – “protected” or “acquisition” interest • Loans taken out to invest in/lend to another company • Legislation is very complex • Many anti-avoidance provisions Acquisition Interest 1. Funds applied in acquiring ord shares of or lending to: • Trading company • Rental company • Holding co of trading company • Wholly or mainly test Acquisition Interest 2. Refinancing loans qualify to extent of the amount of original loan 3. Investing company must hold >5% interest after S.247 transaction 4. ≥ 1 common director throughout loan 5. S.254 Recovery of Capital provisions - Sale of shares and repayment of loan Receipt of divs/income allowed Acquisition Interest • • • • • FA 2011 – significant changes Loans taken out on or after 21st January 2011 Certain interest excluded from qualifying as a charge Similar to intra group borrowing restrictions Detailed provisions affecting group financing structures involving non resident members. CT P6 “Tax Nothings” • Valid debits/credits in Financial Statements • Not deductible or taxable for CT purposes • PBT must be adjusted • Add back of deduct items • No deferred tax if “permanent differences” CT P 6 “Tax Nothings” Debits in P&L not deductible for tax Entertainment Expenses Impairment Provisions Credits in P&L not taxable Dividends from Irish companies Profits from Fair Value adjustment in non trading cos Loss on liabilities in non Profits on liabilities in non trading co trading co Divs and payments treated as divs CT P7 Income Tax at source • Withholding tax applies to wide range of transactions • Receipts – tax computation • S.24(2) TCA 97 – IT deducted set off against CT for the AP in which income is assessable • IT refundable only if no CT for AP • Accounting treatment = tax treatment CT P7 Income Tax at source Liable to Income Tax @ source Exceptions for annual Interest paid DIRT Interest @ 30% S.246(3)(a) TCA 97 Bank/building soc interest Professional Services PSWT S.246(3)(h) TCA 97 exemption if DTA resident S.264(2) TCA 97 annual interest S.246(3)(g) TCA 97 (non bank) Withholding tax @ Interest treated as a distrib 20% under S.437 TCA 97 S.268 TCA 97 Charges - Patent S.246(3)(bb) and S 246(5) Royalties/annuities/annual TCA 97 Interest treated as payment Withholding tax @ 20% trading e.g. Treasury SPC CT P7 Income Tax at source • • • • Treatment of payment in CT computation S.246(2) TCA 97 - annual interest S.238 TCA 97 - patent royalties, annuities S.239 TCA 97 - Rules for resident cos to pay IT • S.241 TCA 97 - Rules for non resident cos • CT Tax Return to show details CT P7 Income Tax at source • Option to net payments recd and made S.239(7) TCA 97 • IT treated as CT for payment Group Payments – Withholding Tax • S.410 TCA 97 • 51% Group • Direct or indirect ownership • S.9(5) –(10) TCA 97 • Rules to calculate lower tier companies Owner Payer Recipient Group -Payments • S.410(3) TCA 97 – 51% group conditions • Both companies Irish resident or resident in EU/EEA with DTA (Iceland and Norway) • Where ownership is indirect all companies in chain must be resident in EU, Iceland or Norway • Indirect ownership – shares in lower co ≠ share dealing co Consortium -Payments • *Other Shareholders • HC must own 90% Trading Co • ≥75% shares in HC/TC owned by ≤ 5 EEA Res Cos Each holds ≥ 5% Up to 5 consortium Members 25%* Holding Co Trading Co Group -Payments • S.410(4) TCA 97 – no need to deduct IT on: • Payments within group/consortium regime that are: – Charges on income of interest of paying co – And taxable in country of residence where non resident recipient is resident – Recipient co cannot hold shares as trading stock Group -Payments • S.891 TCA 97 – Returns to Revenue • S.891A TCA 97 – Return of interest paid gross by virtue S.246(3)(h) must also be filed CT P8 Losses • • • • Chapter 3 Part 12 TCA 97 S.396 - S.401 TCA 97 Trading Losses Other Losses CT P8 Losses Case IV • • • • • Case IV - offset against other Case IV of same AP - carry forward excess against Case IV - no claim - mandatory CT P8 Losses Case V • S.399(2)(a) TCA 97 net surplus/deficiency • Net deficiency – claim to set against Case V of prior period of equal length • Apportionment needed if prior AP not = length of current AP • S.384 TCA 97 Case V losses forward set against profits of first available year • CA (S.305(1)(a)) TCA 97 claimed in priority to loss fwd CT P8 Losses Case IV Losses Priority 1. Sideways against other Case IV 2. Forward against future Case IV Case IV Excess CA priority 1. Offset against total profits of current period 2. Carry back to offset total profits of prior period 3. Carry forward against future Case IV CT P8 Losses Case V Losses Priority Case V Excess CA priority 1. Calculate net loss 2. Carry back against Case V of prior length period* 3. Forward against future Case V – after Case V CA claim 4. Cannot be group relieved * 2 year time limit 1. Offset total profits current period 2. Carry back against total profits of prior period 3. Carry fwd against future Case V 4. Can be group relieved CT P8 Trading Losses • Categorise 12.5% trading losses and other • 25% Losses include land dealing, minerals or petroleum exploration • 12.5% trading losses = “relevant trading losses” Relevant Trading Losses • S.396A(3) TCA 97 - Order of set off • First against other 12.5% trading income of AP, foreign divs @12.5%,income from certain financial trades @12.5% • Second against income of prior period of equal length from 12.5% trade or 12.5% financial trades Relevant Trading Losses • No carry back against foreign divs @12.5% • Time limit – within 2 years of end of AP in which loss incurred • Apportionment of profits if prior AP longer than AP of loss • S.396A(4) TCA 97 – if AP of prior year is shorter, full loss allowed and any balance claimed in second last period – apportionment for remaining period Relevant Trading Losses • S.396A(4) TCA 97 timing of claims • Prior period income first reduced by trading losses fwd before setting off relevant trading losses carried back • S.396A(3) TCA 97 – relevant trading losses offset first against income of current AP and excess then carried back to prior AP • Relief under S.396A (current or future AP but not group relief) comes before deduction of current S.243A TCA 97 charges Trading Losses Example A Ltd Trading Company 2012 Financial Statements Profit/Loss before Tax (€80,000) Deposit Interest €16,000 2011 Tax Computation Case I €100,000 Case III €20,000 Trading Losses Example 2012 CT Comp Loss per A/Cs (€80,000) Deposit Interest €16,000 Case I Loss (€96,000) Carry back of loss to 2011 Case I €100,000 Loss carried back against 12.5% CT payable for 2011 reduced to (€4,000 x 12.5%)+(€20,000 x 25%) (€96,000) €4,000 Value Basis Relevant Trading Losses • S.396B TCA 97 • Applies to losses that cannot be relieved against 12.5% income under S.396A TCA 97 • Euro for euro loss relief takes precedence over value based relief • Reduction of tax payable • CT on 25% income and CT on gains Relevant Corporation Tax • Value based relief reduces “relevant corporation tax” = CT liability before: – S 239 and 241 debits and credits for income tax – Value before group relief (S.420B TCA 97) – Close co surcharges (S.440/441 TCA 97) • Allowed in year of loss and carried back to prior AP of equal length • Time limit –within 2 years of AP of loss Non Trade Charges/Mgt Expenses A Ltd Solution • A Ltd Solution Case 1 Case 111 CT @ 25% 25% €50,000 (€40,000) €10,000 €2,500 VB Loss Relief (€20,000 (€2,500) @ 12.5%) Profits Chargeable NIL Non Trade Charges/Mgt Expenses • • • • • • • • A Ltd Solution - Loss Utilisation Case I Loss €160,000 Actual loss used VB (€2,500/12.5%) (€20,000) Deemed loss used non trade charges (€40,000*25%/12.5%) (€80,000) Balance loss fwd €160k-€20k-€80k €60,000 Relevant Trading Losses • Carry forward of unrelieved trading losses • S.396(1) TCA 97 • Losses c/fwd indefinitely against same trade • Must be set against first available income from the same trade • No claim needed Excepted Trade Losses • 25% trade – Land dealing/mineral/petroleum activities • S.396(2) TCA 97 current and prior years 1. Against profits of current AP 2. Against profits of prior period* 3. Carry forward against future income of same excepted trade • * Equal length rules and 2 year time limit Summary Chart Current Period Prior Period Carry Forward € for € € for € Value € for € Value Based Based Value Based Case I @ 12.5% Case I @ 25% x x x x Case III Trade @ 25% x x x x Terminal Loss Relief • S.397 TCA 97 • Termination of trade with loss in final 12 mths trading • Carry back of loss against previous profits from the same trade for 3 years • Time apportionment for “mismatching” APs Terminal Loss Relief • S.397(3) TCA 97 - Relief for losses fwd and trade charge take precedence over TLR • TLR not allowed to extent loss could be claimed in another way • TLR can only be made when all other claims for loss relief exhausted CT P9: Deduction for CT Credits • Credit is deducted from CT liability after – Applying 12.5% and – Applying CT Principles 1-8 – R&D is the only form of CT tax credit Research and Development • Who can claim? Where must R&D be carried out? – Companies within charge to Irish CT – Branches of overseas companies included – Irish resident companies – R&D cannot be tax deductible in another country • R&D activities carried on within EEA • Co does not have to hold the intellectual property rights R& D • S.766(1) TCA 97 – qualifying activities – Basic Research – Applied Research – Experimental Development • Activities in the fields of – Natural sciences – Engineering and technology – Medical or agricultural sciences R&D • SI No 434/2004 and Revenue Guidelines • Expanded list of areas and exclusions • Routine testing, mgt studies/research ≠ R&D • Activities must aim to – Advance scientific or technical knowledge – Resolve scientific or technological uncertainty R&D • Commercialism of technology or investigations on commercial viability of an idea ≠ R&D • Once scientific or technological uncertainty is resolved, expenditure beyond that point does not qualify R&D • Exclusions – Expenditure financed by grants – Tax exempt royalties – Royalties in excess of arm’s length rate – Interest • “Double Deduction” effect – Deduction and credit R&D Example: X Ltd Qualifying R&D of €40,000 Sales €100,000 R&D Expenses (€40,000) Taxable Profits €60,000 CT @ 12.5% €7,500 Credit for R&D €40,000 @ 25% (€10,000) CT Liability NIL Excess R&D Credit c/fwd €2,500 Value of Credit = 37.5% 12.5% + 25% R&D • 100% claim for expenditure on R&D plant and machinery purchased in period as part of incremental expenditure • Capital allowances on same capital items also allowed • SIAs qualifying for S.291A TCA 97 CA are excluded R&D • Pooled costs on R&D qualify for the credit • Subcontracting can mean no R&D credit • R&D credit allowed where subcontractor is – A university or 3rd level institution in EEA. Costs up to 5% or €100,000 can qualify – Others – costs up to 10% or €100,000 can qualify – Subcontractor cannot claim R&D on same expenditure or be connected with contractor Incremental Expenditure • • • • • Companies formed before 2003 Base year = cos AP ending in 2003 Identify qualifying R&D in 2003 base year Identify qualifying R&D in current AP If current year > 2003 excess available for R&D credit • Cos formed after 2003 – all R&D incremental Calculation of R&D Credit • Current Rate 25% of qualifying incremental expenditure (20% up to 2008) • S.766(2) TCA 97 • Credit first set against current period’s CT • S.766(4A) TCA 97 • Unused excess set back to offset CT of preceding period of equal length • Excess still left after setting back can be claimed for Revenue refund Calculation of R&D Credit • Refund of excess R&D Credit repaid in 3 instalments over 33 month period from end of AP in which expenditure incurred • First instalment is 33% of excess – payable by filing date of AP of expenditure • Remaining balance used to – Reduce CT of next AP – 50% of any remaining excess repaid after due date for filing of next CT Return after original claim CT Return Calculation of R&D Credit • Claim for R&D credit made in respect of AP 31st December 2012 • 50% refunded after filing of 31st December 2012 return • Filing date for 2012 Return is 21st/23rd September 2013 • Refund made after 21st/23rd September 2013 Calculation of R&D Credit • Further excess reduces CT of following AP • S.766(4B) TCA 97 - remaining excess paid as 3rd installment after filling of 2nd CT Return after CT Return giving rise to original R&D claim • Above example – after 21st/23rd September 2014 Maximum Amounts • S.766B TCA 97 – applies cap • Maximum amounts that can be paid to co is greater of – CT payable in 10 years prior to AP of claim – Payroll liabilities (PAYE/PRSI/USC) for Relevant payroll period • “Relevant payroll period” extended • Includes payroll for current and prior AP Maximum Amounts FA 2011 • Increase to payroll cap restricted where: – Co got refund for excess credits by reference to CT in earlier period – Co got refund for excess credits by reference to CT in earlier period • Payroll costs usually dominant R&D • Companies with NIL CT entitled to relief • Excess credits c/fwd if no claim made Expenditure on Buildings • S.766A TCA 97 • R&D credit for 25% of 100% cost of certain buildings • Building must qualify for IBAA • S.766 TCA – no base year or incremental expenditure all expenditure qualifies • Site cost and grants excluded Expenditure on Buildings • 35% of building must be used for R&D activities carried out in EU/EEA country in a 4 year period S.766A(1)(a) TCA 97 • 4 year period starts when building bought or refurbished • Clawback provisions S.766A(3) TCA 97 • Case IV assmnts if building ceased to be used/sold within 10 years or ceases to be used for same trade within 4 years Clawback Exception • From 1st January 2012 • Company makes claim for R&D • Another company commences to carry on the trade • R&D building is transferred to that company • Successor Co claim unused R&D • Both companies must be members of same group Employee R&D Relief • S.472D TCA 1997 • From 1st January 2012 • Surrender by Co of R&D credit to key employees • Transfer of company’s credit to employees • Max credit = CT liability of company • Reduced IT of employee – not USC/PRSI • Employee IT rate cannot be < 23% Employee R&D Relief • • • • • Key Employee Cannot be a director No material interest – 5% Not connected 75% duties in conception or creation of new knowledge, products, processes, methods or systems • 75% of emoluments qualify as R&D R&D Administration • S.766(5) TCA 97 - Claim within 12 mths of end of AP • S.766(1)(b)(vi) TCA 97 - claim for pre trading expenditure – within 12 mths of end of AP when trading commenced • Records for R&D must be maintained R&D Administration • S.766(7) and (8) TCA 97 – Revenue may consult with outside experts • Co may object and appeal against choice of expert CT Compliance Process • Part 41 TCA 97 – Self assessment • S.951(1)(b) TCA 97 – requirement to file Form CT1 • S.884 TCA 97 – specifies the data to be provided CT Compliance Process Profits chargeable to CT Income - Cases and Schedules Chargeable gains and allowable losses Charges exempt from IT Distributions from Irish resident companies Annual payments on which IT deducted S.238 TCA 97 IT on loans to participators S.438 TCA 97 Chargeable gains rolled over under reorg reliefs S.584 TCA 97 Income tax deducted from company’s income Mgt expenses, capital allowances and balancing charges Mandatory e Filing • • • • • Phased basis since January 2009 S.917EA TCA 97 Use of ROS compulsory Phase 1 = LCD cases Phase 2 = Companies with turnover >€7.3m and > 50 employees Mandatory e Filing • Phase 3A 1st June 2011 – All companies, trusts, partnerships, CIUs, EEIGs and Public Bodies • Exclusions – rare for companies • If Revenue happy no capacity to e File • Insufficient access to internet Mandatory e Filing • Penalties for non compliance • €1,520 under S.917EA(7) TCA 97 • Applies for non e-filing and non epayment • Surcharge 5% under S.1084 TCA 97 Mandatory e Filing • Advisor is an “approved person” where filing – S.917G TCA 97 • Employee is an “authorised person” • Autorisation to file – S.951(5) TCA 97 Treated as filed by taxpayer • Risk Management – tax consultant should get written approval of client before Tax Return is submitted Expression of Doubt • S.955(4) TCA 97 • Where taxpayer has doubt about application of law or tax treatment of item • Disclose uncertainty on Tax Return • Full and true disclosure – protects against penalties. • Genuine doubt not motivated by tax avoidance or evasion Due date for Filing CT 1 • Electronic Filing – 9 mths after end of AP • No later than 23rd of month in which 9 mth period ends • Liquidation of co – any return due >3 mths after liquidation commences is due at the end of 3 mths or on 21st/23rd of 3rd month • Manual filing – 21st of month Due date for Filing CT 1 • A Ltd (prior to Mandatory eFiling) • AP 31st December 2010 • Manual CT Return filed • BA Ltd • AP 31st December 2012 • Electronic CT Return filed • CT1 due 21st September 2011 • CT1 due 23rd September 2013 Late Filing • S.1084 TCA 97 – late filing surcharge • 5% of tax – max €12,695 – Returns filed within 2 months of deadline • 10% of tax – max €63,485 – Returns filed more than 2 months late • S.1085 TCA 97 – restrictions on loss relief Loss Restrictions Loss Relief provision S.308(4) Excess CIV or V CA S.396(2) Current and C/Back exc trade S.396A(3) Current and C/Back rel trade S.396B(2) Rel trade VB Current and C/Back S.399(2) Case V C/Back and Fwd Return ≤ 2 mths late 25% Return > 2 mths late 50% 25% 50% 25% 50% 25% 50% 25% 50% Loss Restrictions Loss Relief provision S.411 Group Relief S.420 Group Relief – Excepted Trade, Excess Case IV/V CA, Excess Mgt Exps/non trade charges S.420A(3) Group Relief relevant trading losses and excess trade charges S.420B(2) Group Relief VB relevant trading losses and excess trade charges S.1085 Max Restriction Return ≤ 2 Return > 2 mths late mths late 25% 50% 25% 50% 25% 50% 25% 50% €31,740 €158,715 CT Assessments • S.954 TCA 97 • Inspector makes assessment after CT1 filed • If CT1 is late – inspector may make estimated assessment • Assessment based on CT1 • Check that assessment reflects data on CT1 CT Assessments • Taxpayer may request an assessment • Useful to show entitlement to tax credits for Irish tax by non resident shareholder • S.955 TCA 97 – 4 year time limit for Inspector to amend assessment • Within 4 years after chargeable period in which CT1 due for filing CT Assessments • 4 Year time limit does not apply where – Full and True disclosure not made – Appeal determined by Courts or Appeal Commissioners – Event occurs after filing of CT1 – Error in calculation – Mistake of fact – asst does not reflect fact disclosed • S.955(3) TCA 97 Right to appeal CT Payments • S.958 TCA 97 – corporation tax payments • Extremely complex due to amendments • New small companies – total liability of €200,000 or less – reduced where AP < 1 year • No Preliminary Tax due • CT liability payable on CT 1 filing date CT Start Up Exemption • S.486C TCA 97 – 3 year exemption • Company incorporated on or after 14th October 2008 • Commence a new trade in 2009 - 2014 • Income taxable @ 12.5% • Trade not carried on previously • Cannot be liable to close co service surcharge CT Start Up Exemption • Full exemption if CT on income and gains ≤ €40,000 • Marginal relief where CT between €40,000 - €60,000 • Profits or adjusted chargeable gains up to €320,000 fully relieved CT Start Up Exemption • Restrictions for APs commencing on or after 1st January 2011 • Ceiling based on the Employer PRSI paid in AP • Maximum €5,000 PRSI per employee • Include ER PRSI that would have been paid if exempt under Job Incentive Scheme CT Start Up Exemption • Maximum relief thus is €5,000 per employee subject to the overall limit of €40,000. • “Qualifying Trade” amended FA 2011 • Excludes activities of a company if same carried on in associated company Small Companies • CT liability in previous AP of ≤ €200,000 • Due dates for tax follow same rules as CT Returns • Preliminary Tax Due: 23rd(21st) day of month 11 of AP • Balance of Tax Due: 23rd (21st) day of month 9 after AP • PT must be at least the 90% of current period or 100% of prior period Small Companies • • • • • • • In determining €200,000 CT limit Can exclude income tax S.239 TCA1997 Rev eBrief 28/2008 Rev eBrief 28/3008 Income tax due when PT due Treat IT as CT S.239(5) TCA 1997 Large Companies • CT liability in previous AP of > €200,000 • Due dates for tax follow same rules as CT Returns • 1st instalment Preliminary Tax Due: 23rd(21st) month 6 of AP • 2nd instalment Preliminary Tax Due: 23rd(21st) month 11 of AP • Balance of Tax Due: 23rd(21st) month 9 after AP Large Companies • Level of payment required • PT 1st Instalment: Lesser of 45% of current period liability or 50% of liability of prior year • PT 2nd Instalment: Amount to bring total payment to 90% of current year liability • Balance of liability due on CT1 filing date Large Companies – CGT • • • • • • Chargeable Gain in last month of AP Tax payable due 21 days after AP AP ended 31st December 2012 Chargeable Gain in December 2012 Tax payable by 23rd December 2012 Applies also to small company opting to pay PT based on 90% current year CT PT Example X Ltd Year Ended 31/12 Current Year CT €350 Prior Year CT €300 PT1 Lower of €350*45% = €157.5k €300*50% = €150k Paid €150k Due Date 23rd June PT2 €350*90% = €315k Payable €315k-€150k =€165k Due Date 23rd Nov Balance €35k 23rd Sept CT1 Filing Date CT and Short APs • APs shorter than 1 mth +1 day – due date for PT is last day of the period or 23rd of month if period ends between 23rd day and end of the month • AP of large co longer than above, but shorter than 7 mths, small co rules apply • One PT payment in penultimate month Failure to pay Correct Amt • S.958(4) TCA 97 – interest on underpayment from due date • Risk management as penalty for wrong payment is disproportionate to quantum of error • Prior Year CT €100 and Current Year CT = €1m • If €100 paid after 23rd/21st of 11th mth Interest on €999k from due date Group Companies – Offset PT • S.958(11) TCA 97 • Group co which is not a “small co” • If PT<90% a group co can surrender any excess>90% PT • Cos must have same APs • Joint election to Collector General on or before filing date • Claimant co must pay all liability by filing date Other Returns to File • Other information returns are due for filing at the same time as CT1 • S.889 TCA 97 - Form 46G • S.894 TCA 97 – 46G is a Self Assessment Return • Payments for services >€6,000 where no tax deducted • Detail needed of name, PPSN, Address and nature of services provided • Mandatory e-Filing applies Other Returns to File • S.891 TCA 97 – Return of interest paid gross • S.894 TCA 97 self assessment • Banking and trading cos paying interest on trade borrowings • Payment > €65 • Name, address and amount of interest Other Returns to File • S.891A TCA 97 • Return of interest paid without deduction of tax under S.246(3)(h) TCA 97* • Companies trading in Ireland that have been financed by foreign borrowings • Name, address, amount paid and country of residence • *Interest can be paid gross if paid for trading purposes by a co to another co res in EU/DTA country Professional Skills for CT • • • • • • • • Research Skills and Risk management What are the sources of research for CT? Engagement of 3rd parties Firm’s risk management procedures Shareholder and director details SEC and other restrictions Group structure Mandatory e-Filing Professional Skills for CT • • • • • Close Company Issues Year end and length of AP Cos sources of income and CT rates Changes in ownership Effect on residence Report Writing/Communication • • • • Writing style appropriate to reader Build rapport Aim to be main contact person for client Are you communicating with person who has required authority Professional Obligations/Ethics • Have you followed Standard of Professional Conduct? • Check for conflict of interest in Code of Ethics • Is your practice over reliant on one client? Money Laundering • When were the last checks carried out? • Is an up to date co search needed? • Was there a change in ownership since last ML checks done? • Have you checked current ML law and CCABI Guidelines? • Consult CAI website on ML Professional Skills and CT • Do not rely on familiarity with client • Example of query on sale of London office block • Always use Tax legislation and check basics • S.23A TCA 97 was not consulted • Incorrect advice may have been given CT Round Up • Company Residence • Incorporation Rule and Case Law • Trading and Treaty exceptions to incorporation rule • Irish resident companies liable on worldwide income • Non Resident Cos liable on trading branches CT Round Up • • • • • • Calculation of Corporation Tax CT Rates Trading v Passive Income Case Law and Badges of Trade Revenue Guidance on trading v passive Accounting Periods – linked to the CT compliance process CT Round Up • • • • • • • • From FS to CT comp Steps in preparation of CT comp 9 CT Principles GAAP/IFRS Foreign Trades Foreign dividends and 12.5% rate Capital Allowances Chargeable Gains CT Round Up • • • • Losses Value based relief Charges Offset Rules for losses CT Round Up • • • • • • Research & Development CT Compliance Process Tax Filing deadlines Tax payment dates Small and large companies Start Up Exemption CT Round Up • • • • Professional Skills for CT Report writing and communication Professional Obligations/Ethical Values Money Laundering Learning Outcome • • • • • • Scope of charge to CT Apply correct CT rate Commencement and cessation of AP Treatment of dividends CT Rate for foreign dividends CGT rebasing for CT computation Learning Outcome • Use of losses and charges • Relevant and non relevant trade charges deductions • Losses on € for € and Value basis claims Learning Outcome • Identify and calculate R&D Credit • Advise on compliance issues and obligations for companies • Apply accounting for tax principles to CT principles • Use professional skills for CT engagements