Using accounting Information

advertisement

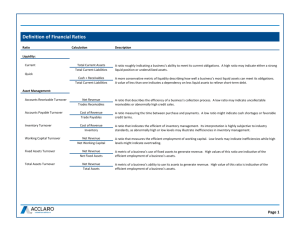

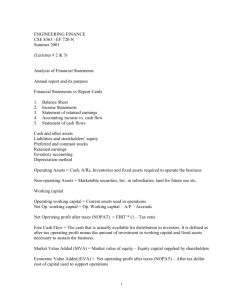

USING ACCOUNTING INFORMATION By Udayanga & Habeeb Why is Accounting information important? Definition for accounting: “A process of systematically collecting, analyzing and reporting financial information.” Managers, employees, lenders, suppliers, stockholders, and the government agencies all rely on the information contained in the three financial statements. There are •Balance sheet •Income statement •Statement of cash flows http://www.articlesbase.com/careers-articles/why-is-accounting-so-important-796991.html Why is Accounting information important? (cont’d) The firms accounting system provides information that can be complied for the entire firm; for each product; for each division and department and generally in a way that will help those who manage the organization. The people who use accounting information •The primary uses of accounting information are the managers. They use these information to make their decisions as well as set goals to the organization. •Lenders also use the accounting information to see the firms financial side to lend either short time or long time loans. •Suppliers also need the accounting information before they supply the raw materials. This is to see whether they will extend credit to the firm. The people who use accounting information (cont’d) •Stockholders are provided with a summary of the firms financial position annually. •Government agencies need the accounting information in order to prepare the tax amount. Careers in accounting There are many jobs available in the accounting area. Many different jobs. Some of them are; 1) Private accountant; they are employed by a specific organization. Medium or larger firms employee one or more private accountants. Their job is normally to design its accounting information system, manage its accounting department, and provide managers with advise and assistance. http://www.careers-in-accounting.com/ Careers in accounting (cont’d) They also perform the following to their employers. i. General accounting- recording business transactions and prepare financial statements. ii. Budgeting- helping manager to prepare the budget for sales and various expenses. iii. Cost accounting- determining the cost for a specific product or service. iv. Tax accounting- planning ax strategies and producing tax returns to the firm. v. Internal auditing- reviewing the companies financial status and determine whether they have achieved their goals. Careers in accounting (cont’d) 2) Public accountant- they work on a fee basis for clients and may be self employed or be the employee of an accounting firm. CPA- certified public accountants. And experience individuals who has met state requirements for accounting education. This is a well paid job. In USA a CPA’s income range of an hour is $50 to $300. this is a very hard job. They are always up to the current situation in the business field. Only a CPA can audit the financial statements in a corporation's annual repot and express an opinion. They are always consulted with business firms troubled financially or in management of the firm. Accounting Process Information is defined as data presented in a form useful for a specific purpose. Accounting system transforms raw data in to useful financial information. The accounting equation; Assets = liabilities + owners equity Accounting Process (cont’d) Let us learn some accounting equations terms; •Assets; these are resources owned by the business. Eg- cash, inventory, real estate. •Liabilities; firms long term and short term debts (what is owned by others). •Owner equity: the share owned by the founder or the father of the business. The Accounting life cycle The accounting life cycle contains 5 stages. a) Analyzing Source Documents b) Recording Transactions c) Posting Transactions d) Preparing the Trial Balance e) Preparing the Financial statements and Closing the Books Double Entry Books This is a system in which each financial transaction is recorded as two separate accounting entries to maintain the balance in the accounting system. (assets = liabilities + owners equity) The Balance Sheet A financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. These three balance sheet segments give investors an idea as to what the company owns and owes, as well as the amount invested by the shareholders. The balance sheet must follow the following formula: Assets = Liabilities + Shareholders' Equity http://www.investopedia.com/terms/b/balancesheet.asp Assets Asset as we know is all the belonging of the firm. When stating on the balance sheet we must state it according to the most liquid to the least liquid. Liquidity means assets converting into money. There are three types of assets. They are ; i) Current Assets ii) Fixed Assets iii) Intangible Assets Current Assets A balance sheet account that represents the value of all assets that are reasonably expected to be converted into cash within one year in the normal course of business. Current assets include cash, accounts receivable, inventory, marketable securities, prepaid expenses and other liquid assets that can be readily converted to cash. In the United Kingdom, current assets are also known as "current accounts". http://www.investorwords.com/1245/current_assets.html Fixed Assets Land, buildings, equipment, machinery, vehicles, leasehold improvements, and other such items. Fixed assets are not consumed or sold during the normal course of a business but their owner uses them to carry on its operations. In accounting, 'fixed' does not necessarily mean 'immovable;' any asset expected to last, or be in use for, more than one year is considered a fixed asset. On a balance sheet, these assets are shown at their book value (purchase price less depreciation). http://www.businessdictionary.com/definition/fixed-asset.html#ixzz10sbobnI7 Intangible Assets Something of value that cannot be physically touched, such as a brand, franchise, trademark, or patent. opposite of tangible asset. http://www.investorwords.com/2525/intangible_asset.html#ixzz10sdtHaXM Liabilities An obligation that legally binds an individual or company to settle a debt. When one is liable for a debt, they are responsible for paying the debt or settling a wrongful act they may have committed. http://www.investorwords.com/2792/liability.html#ixzz10seXa2j3 Owner’s Equity Owner's Equity—along with liabilities—can be thought of as a source of the company's assets. Owner's equity is sometimes referred to as the book value of the company, because owner's equity is equal to the reported asset amounts minus the reported liability amounts. Owner’s Equity (cont’d) Owner's equity may also be referred to as the residual of assets minus liabilities. These references make sense if you think of the basic accounting equation: Assets = Liabilities + Owner's Equity and just rearrange the terms: Owner's Equity = Assets – Liabilities The Income Statement An income statement is a summary of a firms revenue and expenses during a specific accounting period – one month, three months, six months, or a year Show if the company is making a profit or a loss. Sometimes called Profit and Loss account (PnL) Measuring Income Some important terms Revenues – Dollar amount earned by selling good and services Cost of Goods Sold (COGS) – Total cost of merchandise sold. Dollar amount equal to: Beginning Inventory + Net purchases – Ending Inventory Gross Profit – Sales revenue less COGS Operating Expenses – All business costs other than Cost of Goods Sold Net Income – The profit earned during a period after all expenses have been deducted from revenues Sample Income Statement Statement of Cash Flows A statement that shows how the operating, investing, and financing activities of a company affect cash during an accounting period – one month, three months, six months, or a year. Shows cash receipts and cash payment Organized around 3 activities: Operations, Investing, Financing Sources of Cash Flows Cash Flows from Operating activities Cash Flows from Investing activities Cash Flows from Financing activities Usefulness of the Statement of Cash flows Ability to generate future cash flows. Ability to pay dividends and meet obligations. Reasons for the difference between net income and net cash provided (used) by operating activities. Cash invested and financing transactions during the period. Types of Cash inflow and outflow Sample Cash Flow Statement Evaluating Financial Health Three characteristics of a company: 1) liquidity 2) profitability 3) solvency In order to obtain information as to whether the amount: 1) represents an increase over earlier years or 2) is adequate in relation to the company’s need for cash, or 3) the amount of cash must be compared with other financial statement data. Financial Ratio classifications Comparing Accounting Data Financial Ratios Ratio analysis expresses the relationship among selected items of financial statement data. A ratio expresses the mathematical relationship between one quantity and another. Profitability Ratios Short-term financial Ratios Activity Ratios Debt-to-owner’s equity Ratios Profitability Ratios Earning Per Share (EPS) Earnings per share (EPS) is a measure of net income earned on each share of common stock. EARNINGS PER SHARE NET INCOME = ———————————-———-————————— WEIGHTED AVERAGE COMMON SHARES OUTSTANDING Profit Margin The profit margin ratio is a measure of the percentage of each dollar of sales that results in net income. PROFIT MARGIN ON SALES = NET INCOME —————— NET SALES Short-term financial ratios Current Ratio The current ratio (working capital ratio) is a widely used measure for evaluating a company’s liquidity and shortterm debt-paying ability. CURRENT RATIO = CURRENT ASSETS ——————————— CURRENT LIABILITIES Acid-test ratio The acid-test ratio (quick ratio) is a measure of a company’s short-term liquidity. CASH + MARKETABLE SECURITIES + RECEIVABLES (NET) ACID-TEST RATIO = ———————————————————————— CURRENT LIABILITIES Activity Ratio Two activity ratios permit managers to measure how many times each year a company collects its accounts receivables or sells inventory Accounts Receivable Turnover The receivables turnover ratio is used to assess the liquidity of the receivables. It measures the number of times, on average, receivables are collected during the period NET CREDIT SALES RECEIVABLES TURNOVER = —————————————AVERAGE NET RECEIVABLES Activity Ratio Inventory Turnover The inventory turnover ratio measures the number of times, on average, the inventory is sold during the period. Its purpose is to measure the liquidity of the inventory. INVENTORY TURNOVER = COST OF GOODS SOLD ———————————— AVERAGE INVENTORY Debt-to-owner’s equity Ratios Used to determine whether a firm has too much debt. The higher the ratio, the riskier the situation is for lenders. A high ratio may make borrowing money difficult TOTAL LIABILITIES DEBT-TO-OWNER’S EQUITY RATIO = ————----------——----------------OWNER’S EQUITY Thank You Udayanga Wijesekara & Mohamed Habeeb