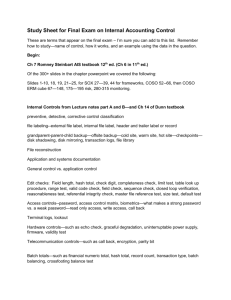

Handout

advertisement

Pharmaceutical Liability The Growing Storm Product Withdrawals • 15 product withdrawals between 1997 and 2005 – 14 Prescription Drugs, 1 Vaccine – Combined peak sales potential of these drugs is greater than $13 Bn • In 26 years prior to 1997, there were only 8 product withdrawals 1 Complaints Filed Against Investigators Complaints filed per Investigator Annual Complaints Received by FDA Annual Complaints Received by FDA 150 131 118 106 75 11 9 13 11 8 15 9 0 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 Source: FDA FDA Office of Compliance, Source: Office of Compliance,CenterWatch CenterWatch 2 Pooled Data Losses 21 20 # of Losses • Gathered in 2002 from 14 major pharmaceutical companies • 30 Claims with Incurred > $20 Million • Minimum = $20.8 Million • Maximum = $3 Billion • Since this data was collected, 2 of the losses in the 20-100 category have moved into the 300+ category (actually both north of $1bn). 25 15 10 4 3 2 5 0 20-100 101-200 201-300 301+ $ in millions 3 Vioxx • COX-2 selective inhibitor NSAID marketed by Merck • Used in the treatment of osteoarthritis, acute pain conditions and dysmenorrhoea • Worldwide, over 80 million people have been prescribed Vioxx • Withdrawn in 2004 because of concerns about increased risk of heart attack and stroke 4 Vioxx (cont) • Merck had Vioxx sales of $2.5B in the year prior to withdrawal • There are currently over 10,000 cases and 190 class actions filed against Merck due to Vioxx • Merck has vowed to fight every claim • Merck currently has 3 wins & 3 losses 5 Other Publicized Events • Ambien – Reports of sleepwalking, sleep driving & sleep eating • Bausch & Lomb – Renu contact solution possibly causing eye infections • Pfizer’s Viagra – May cause blindness • Merck’s osteoporosis drug Fosamex – May cause rare disorder that causes patient’s jawbone to rot and die • Zocor / Crestor – May cause muscular degeneration 6 Why the increase in Issues? • More complex drugs • Rush to be first to get a product to market • Patent expiration on existing drugs • Information on side effects are known much faster • Lawyers are more organized and able to use information on side effects much faster 7 Problems Pharmaceuticals face in court • Pharmaceutical companies are seen as deep pockets – This makes them an attractive target for lawsuits • Many people view pharmaceutical companies as more concerned with profits than people – In court, perception can be more important than fact • The Plaintiff bar has gotten much better organized and prepared – Currently, there are seminars on how best to prosecute Vioxx claims – The Plaintiff bar analyses wins and losses and does a better job of sharing information 8 Actuarial Issues • Insurance Pricing – Is it possible to develop a fair insurance structure that reflects the potential for loss? – Would Pharmaceutical companies buy it? – Would Insurance companies offer it? • Reserving – How do you determine reserves for these “Batch” claims due to a particular product • What is the frequency? • What is the severity? 9 Pharmaceutical Insurance • Pharmaceutical insurance tends to have $3 to $5 MM retentions for small companies and $100 to $300 MM for larger companies • Individual claims from a single product such as Vioxx would not usually exceed the retention limit • However, based on the terms of the Pharmaceutical coverage, the individual company may declare individual claims from a particular product to be a “Batch” claim 10 “Batch” Claims • Parameters established in the policy such as a dollar threshold determine at which time the insured must declare a batch. • All claims related to the product in question and occurring prior to the date the claims were declared “Batch” claims are combined • For the policy year in which a “Batch” is declared, the company’s retention is increased for “Batch” claims • Claims related to use after the product has been declared a “Batch” claim are not included in the combined “Batch” claim 11 “Batch” Claim Data • “Batch” claims represent a huge cost for Pharmaceutical companies • As many of these claims are on-going and subject to discovery, the companies’ lawyers are very hesitant to release any data to insurance markets • In general, the companies tend to be very protective about any loss data and are very hesitant to release it • Also, lawyers tend to do the claim reserving and may not even show estimates of loss reserves on their files • For actuaries, lack of data is a big problem 12 Rescission • Rescission – Rescinding the policy due to misrepresentation by the company – Full disclosure is an assumption in all contracts, but the application for insurance acts like a warranty of what the insured knows at the time of the application. The insurers like the plaintiffs claim the insured knew more than they disclosed and move to cancel the policy as if it never existed – This is an extreme action but it is being pursued or considered in several cases 13 Insurance Market Response • Retentions forced significantly higher Company Sales Market Desired Retention < $5B $25 – 100 MM $5 - 10B $100 – 300 MM > $10B $300 – 500+ MM • Market Capacity is evaporating – Current Estimate: $200-700MM range from >$1B • Coverage Restrictions 14 Market-Wide Product Restrictions • Entire market effectively working-off extensive product exclusion list • Individual insurers freely/constantly add to list • Focus on excluding substances under all applications/uses/names rather than just specific products – exclude “manufacture, distribution, sale, utilization, ingestion or inhalation of, or exposure to or existence of, as the case may be of listed substances or their generic equivalents or any other substance which is comprised of the same active ingredient(s)” – exclude “listed drugs, or any generic or other versions, or equivalent active ingredient to any of the foregoing drugs” 15 Common Product/Substance Exclusions • • • • • • • • • • • • • Accutane (Isotretinoin) Actos (Pioglitazone) Adderall Arava (Leflunomide) Avandia (Rosiglitazone) Baycol/Lipobay (Cerivastatin) Birth Control Products: Contraceptive pills, drugs or devices Blood Borne Pathogens AIDS/HIV, Hepatitis B & C Bupropion (Zyban/Wellbutrin) Calcium Channel Blocker products Celebrex Chlorofluorocarbons (CFC) Comfrey (Pyrrolizidine Alkaloids) • • • • Diethylstilbestrol or DES Dienestrol Duract (Bromfenac Sodium) Ephedrine, Ma Huang, Chinese Ephedrine, Ma Huang extract, Ephedra, Ephedrine sinica, Ephedrine extract, Ephedrine Herb Powder, Epitomic or products of any kind or nature which contain Ephedrine, Ma Huang, Chinese Ephedrine, Ma Huang extract, Ephedra, Ephedrine silica, Ephedrine extract, Ephedrine Herb Powder, Epitomic or any derivative thereof. • Enbrel (Entanercept) 16 Common Product/Substance Exclusions (cont) • All weight management drugs including, but not limited to, FenPhen/ Pondimin/ Redux (Fenfluramine Hydrochloride, Dexfenfluramine Hydrochloride)/ Phentermine • Fertility Drugs • FIAU (Fialuridine) • Halcion (Triazolam) Hormone Replacement Therapy/Drugs • Iressa/Gefitnib • Lamisil (Terbinafine Hydrochloride) • Kava, ava, ava pepper, awa, kava root, kava-kava, kawa, Piper methysticum Forst f., Piper Methysticum G. Forst, rauschpfeffer, intoxicating pepper, kava pepper, kawa-kawa, kew, Piper methysticum, sakau, tonga, wurzelstock, yangona. • Methylphenidate • Latex, Natural Rubber Latex Gloves, Condoms • Lead • L-Tryptophan • Lotronex (Alosetron Hydrochloride) • Lymerix vaccine • Meridia (sibutramine) • Oraflex (Benoxaprofen) • Oxycontin/Oxycodone (morphine) • Parlodel (Bromocriptine) 17 Common Product/Substance Exclusions (cont) • Posicor (Mibefradil Dihydrochloride) • RU486 - mifepistone/misoprostol (morning after “abortion” pill) • Selective Seritonin Reuptake Inhibitors (SSRI’s) • PPA (Phenylpropanolamine) • Serzone (Nefazodone Hydrochloride) • Paxil (Paroxetine Hydrochloride) • Polychlorinated biphenyls (PCB) • Propulsid (Cisapride) • Prozac/Sarafem (Fluoxetine) • Raplon (Rapacuronium Bromide) • Raloxifene / Evista • Remicade (Infliximab) • Silicone (implantables) • SMON (Clioquinol)/(Oxychinolin) • Sporanox (Itraconazole) • St. John’s Wort • Stadol NS (butarphanol) • Rezulin (Troglitazone) • Statins/Fibrate Combination • Ritalin (Methylphenidate) • Statins • Rotashield vaccine • Swine Flu Vaccine 18 Common Product/Substance Exclusions (cont) • Thalidomide Other Dietary Supplement Exclusions: • Trovan (Trofloxacin Mesylate) • GHB (gamma hydrozybutyric acid) • Urea Formaldehyde Foam • GBL (gamma butyrolactone) • Thimerosal -Vaccines or other products containing any form of mercury including, but not limited to, mercury, ethyl mercury. • BD (1,4 butanediol) – Vaccines/treatments for Smallpox, Anthrax, Botulism, Plague • Vioxx • Zerit (Stavudine) • Zoloft (Sertraline) • Zyban/Wellbutrin • Tetramethylene glycol • 2 (3H)-furanone di-hydro • creatine • DHEA (dehydroepiandosterone) • pregnenolene • andro • androstenedione • androstenediol • steroids • anabolic hormones 19 Company Response “Carriers and our own recognizance tell us eight of the top ten major pharmaceutical companies have stopped buying conventional products liability insurance” 20