Asset Management - Southeast Mortgagee Advisory Council

advertisement

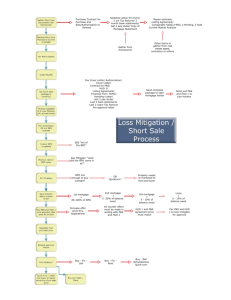

Southeast Mortgagee Advisory Council (SMAC) May 29-May 31 Downs Spitler, III, Moderator – Senior Vice President – HFC Funding Corporation, Ridgeland, MS. Mark Van Kirk – Director of Asset Management – U.S. Department of Housing & Urban Development,Washington, DC. Jan W. Haber, Esq. – U.S. Department of Housing & Urban Development, Atlanta, Georgia Jim Reed – Senior Vice President – Asset Management – Oppenheimer Multifamily Housing & Healthcare Finance, Inc., North Wales, PA John Vihstadt, Esq. – Krooth & Altman LLP, Washington, D.C. 2 Downs is Senior Vice President of Originations for HFC Funding Corporation located in Ridgeland, MS. He began his career with Wachovia Bank & Trust in North Carolina followed by a brief stay in New York where he worked with the joint venture between Nations Bank and Dean Witter, and later SunTrust Bank in Tampa. His career includes work in Commercial & Industrial Lending as well as Commercial Real Estate. Downs graduated from Barton College. 3 Marie Head, the U.S. Department of Housing and Urban Development (HUD) deputy assistant secretary of multifamily housing, recently announced the appointment of Mark B. Van Kirk as the new director of asset management. The Office of Asset Management is responsible for the oversight of all multifamily project assets, subsidized and insured, after the development phase. It develops policy for and oversees field office asset management operations. The office is also responsible for oversight of regulated property ownership and management, routine mortgage servicing, default servicing, acquisition and disposition of loans (mortgage notes) and properties, and management of properties where the secretary is owner or mortgagee-in-possession. Marilyn Edge had been serving as acting director for more than the last year and will be returning to her role as deputy director of asset management. About Mark Van Kirk Before joining HUD, Mark was the Chief Operating Officer of Pillar Multifamily, LLC, a Fannie Mae DUS Lender. Mark co-started the business in 2005 as a de novo DUS Lender. Mark was also with Fannie Mae for almost 10 years in the multifamily division focused on multifamily credit, asset and portfolio management before starting a Pillar Multifamily, LLC. By: Nancy Libson Published On: Mar 20, 2012 leadingage.org 4 Jan W. Haber has worked as an Attorney-Advisor in HUD’s Atlanta the Office of Counsel since 1990. During that time, she has worked in the legal areas of fair housing, litigation and program services. Currently, Ms. Haber has responsibility for advising HUD staff and HUD’s industry partners on issues relating to property disposition, multifamily housing (development and asset management), public housing and community planning and development (CPD). Ms. Haber holds a Bachelor of Arts degree from the University of California at Los Angeles and a Juris Doctor degree from Southwestern School of Law. She is married and has two children. 5 Jim Reed has been the Senior Vice President of Permanent Loan Servicing and Asset Management at Oppenheimer Multifamily Housing and Healthcare Finance since November of 2011. Jim has been in the Mortgage Banking industry since 2001 spending a large part of this time as Vice President of Servicing Acquisitions at Berkadia (f/k/a GMAC Commercial Mortgage and Caprmark Finance Inc.) where his supervisory role was largely related to the valuation of acquired CMBS servicing rights. Prior to his current position at Oppenheimer Multifamily, Jim spent several years at GMAC ResCap/Ally Bank in various roles including Risk Manager of ResCap’s Servicing Valuation and Analytics team. At Oppenheimer Multifamily Jim is charged with oversight of the firm’s FHA/GNMA loan servicing operation as well as asset management functions that include Default Modifications, TPAs, and Financial Statement Analyses. Jim received his BA from Penn State University and his MBA in Operations Management from Temple University. 6 John E. Vihstadt is a partner with the Washington, D.C. law firm of Krooth & Altman LLP (www.krooth.com). Mr. Vihstadt concentrates in lender representation in HUD insured multifamily housing and healthcare financing transactions nationwide. His practice also includes government and legislative affairs as K&A is counsel to the Committee on Healthcare Financing, a trade association specializing in HUD Section 232 (assisted living/nursing facility) and 242 (hospital) issues. Prior to joining K&A in 1989, Mr. Vihstadt served as Executive Assistant to the President of Ginnie Mae and was Republican Counsel to the Select Committee on Aging, U. S. House of Representatives. Mr. Vihstadt received his B.A. degree and J.D. degree from the University of Nebraska. One of John’s primary career goals is to dine at every federal building cafeteria across the country that includes a multifamily HUD office. 7 Primary handbook used by Field Office and Headquarters Multifamily Housing staff in carrying out their asset management and loan servicing responsibilities Directed to and used by owners, lender, tenants, and other program participants Handbook has not been substantially revised since 1992 Extensive HUD/MBA dialogue on revisions HUD’s Audrey Hinton & Eric Ramsey taking HUD lead MBA’s Eileen Grey and Walker & Dunlop’s Sharon Walker leading industry comments 8 Unit I…….Introduction Unit II……Getting Started Unit III…...Emergency and Disaster Assistance Unit IV……Enforcement Unit V…….HUD-Held Servicing Unit VI……Preservation Unit VII…...Project Monitoring Unit VIII…..Property Disposition Unit IX…….Reserves and Escrows Unit X……..Servicing Troubled Projects Unit XI…….Subordinate Debt 9 Introduction A. Organization of Handbook B. Goals, Responsibilities and Relationships C. Changing Concepts 4350.1 Draft TOC (4-13) 10 Getting Started A. Basic Document Files B. Initial Servicing C. Mortgagor Structures D. Previous Participation E. Record Keeping Systems F. GNMA – It’s Role and Organization 4350.1 Draft TOC (4-13) 11 Emergency and Disaster Assistance A. Relocation B. Section 8 Pass-Through Leases C. Multifamily Emergency/Disaster Guidance (Ch. 38 of 4350.1) 4350.1 Draft TOC (4-13) 12 Enforcement A. Audits (I.G., GAO) B. Department Enforcement Center (DEC) C. Civil Rights – Related Requirements D. Mortgagor Requirements E. Tools – LDP, Informal Reviews, Debarments, etc. 4350.1 Draft TOC (4-13) 13 HUD-Held Servicing A. Assignment of Mortgage B. Foreclosures C. Mortgage Sales D. Workouts 4350.1 Draft TOC (4-13) 14 Preservation A. Combining Section 8 Contracts B. Decoupling C. Emergency Low-Income Housing Preservation Act (ELIHPA) and Low-Income Housing Preservation and Resident Homeownership Act of 1991(LIHPRHA) D. Flexible Subsidy E. Mark-to-Market (M2M) F. Nonprofit Proceeds Notice G. Partial Release of Security 4350.1 Draft TOC (4-13) 15 Preservation (cont.) H. Prepayments, Lockouts, and Penalties I. Section 8 HAP Assignment J. Surplus Cash Analysis K. Tax Credits and Subsidy Layering L. Section 8(bb) M. Section 212 N. Use Agreements O. Releases and Satisfactions 4350.1 Draft TOC (4-13) 16 Project Monitoring A. Financial Statements/FASS B. Monthly Accounting Reports C. Commercial and Ground Leases D. Infestations E. Insurance and Loss Drafts F. Management and Operating Review G. Physical Inspections/PASS/Reverse Auctions 4350.1 Draft TOC (4-13) 17 Project Monitoring (cont.) H. Preventing Defaults I. Preventing Mortgage Assignments J. Updating iREMS K. Multifamily Delinquency and Default Reporting System (MDDR) L. Environmental 4350.1 Draft TOC (4-13) 18 Property Disposition A. Pre-Foreclosure/Troubled Project Consultation B. Relocation 1. HAP Abatement 2. Vouchers 3. PD Responsibilities 4. FO/Hub Responsibilities C. Property Management 1. MIP 2. HUD-Owned (Deed-in-lieu) 4350.1 Draft TOC (4-13) 19 Property Disposition (cont.) D. Sales 1. Foreclosures A. Types of Default B. Bankruptcy C. One Time Right To Cure D. The Foreclosure Recommendation E. The Use Agreement 2. Unit of Local Government (HUD-Owned) Sales A. Reverter Deeds B. Equity Participation C. The Special Warranty Deed 3. Terms and Conditions of Sales 4. How the PD Center Advertises Sales and Listserv 4350.1 Draft TOC (4-13) 20 Property Disposition (cont.) E. Post-Sale Monitoring 1. FO responsibilities 2. PD responsibilities a. Repairs b. Up-Front Grant (UFG) 3. Post-Sale Requests a. Conveyance b. Sale/Refi c. LIHTC – pass-through leases d. The equity review 4350.1 Draft TOC (4-13) 21 Reserves and Escrows A. General Operating Reserves B. Reserve for Replacements C. Residual Receipts D. Section 202 Debt Service Reserves E. Special Escrows – Pre – and Post Final Endorsement F. LIHTC Reserves G. New Projects with Special Escrows 4350.1 Draft TOC (4-13) 22 Servicing Troubled Projects A. Mortgage Modifications B. Partial Payment of Claims C. Risk Management/Watch List/MROC D. Refunding Tax-Exempt Bonds E. 1-10 Scoring F. The Ginnie Mae Security 4350.1 Draft TOC (4-13) 23 Subordinate Debt A. Conventional Loans B. Liens C. Operating Loss Loans D. Subordination of Section 202 Loans E. Supplemental Loans F. Tax Credits and Subsidy Layering 4350.1 Draft TOC (4-13) 24 QUESTIONS? THANK YOU! 25